- Quantum Multi Asset Allocation Fund

- Quantum Small Cap Fund

- Quantum Long Term Equity Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Equity Fund of Funds

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Fund of Funds

- Why Quantum

-

Investment Solutions

- Quantum Multi Asset Fund of Funds

- Quantum Small Cap Fund

- Quantum Long Term Equity Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Equity Fund of Funds

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Allocation Fund

- Partner Corner

- Learning Lab

Notice

Dear Investor,

Pursuant to SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings, irrespective of the amount of investment, under all mutual fund schemes.

1) To know more about payment modes available :

• Lump Sum Investments and their efficiency in the hierarchy of best to worst Click Here

• SIP Investments and their efficiency in the hierarchy of best to worst Click Here

2) Bank efficiencies in terms of providing credit to mutual funds on the same day before cut-off timings on which investors’ account is debited

i. NPCI (National Payments Corporation of India) Click Here

ii. Payment Aggregators (for e.g. Google Pay, Amazon Pay, PayTM)

We request Investors who have not submitted their PAN details and/or are Non KYC compliant to submit their PAN details & fulfill their KYC at the earliest. You may contact our [email protected] or call our toll free number 1800 - 209 - 3863 / 1800 - 22- 3863 for any queries or assistance.

Non-Business Day - November 01, 2024, Diwali -Laxmi Pujan (All Schemes)

Due to Diwali - Laxmi Pujan, November 01, 2024 (Friday) will be a non-business day for all schemes of Quantum Mutual Fund. Redemption payouts under all schemes, scheduled for this date, will be deferred to the next business day i.e., November 04, 2024 (Monday).

Liquidity Window - Quantum Gold Fund (ETF): The Liquidity Window under Quantum Gold Fund is Open. Investors of Quantum Gold Fund can submit their redemption request upto Rs.25 Crores at the Official Point of Acceptance of the AMC. You may also redeem by sending the application via email from your registered Email Id to our Transact Id - [email protected].

SEBI’s Important Update on Folios without PAN / PEKRN: Click here for PAN / PEKRN related intimation.

Important Update on PAN & Aadhaar Seeding: As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 30th June 2023 failing which the unlinked PAN shall become inoperative. Please visit https://www.incometax.gov.in/iec/foportal/ and click on ‘Link Aadhaar option’ under the ‘Quick Links’ section to link your PAN with Aadhaar.

Equity Asset Class Outlook

Equity Mutual Funds in India

Quantum Long Term Equity Value Fund

The investment objective of the scheme is to achieve long-term capital appreciation by investing primarily in shares of companies that will typically be included in the S&P BSE 200 Index and are in a position to benefit from the anticipated growth and development of the Indian economy and its markets.

Know More

Quantum ELSS Tax Saver Fund

The investment objective of the scheme is to achieve long-term capital appreciation by investing primarily in shares of companies that will typically be included in the S&P BSE 200 Index and are in a position to benefit from the anticipated growth and development of the Indian economy and its markets.

Know More

Quantum Nifty 50 ETF

The investment objective of the scheme is to invest in stocks of companies comprising CNX Nifty Index and endeavor to achieve returns equivalent to the Nifty by “passive” investment. The scheme will be managed by replicating the Index in the same weightage as in the CNX Nifty Index.....

Know More

Quantum ESG Best In Class Strategy Fund

The Investment Objective of the scheme is to achieve long-term capital appreciation by investing in share of companies that meet Quantum’s Environment, Social and Governance (ESG) criteria.

Know More

Quantum Small Cap Fund

An open Ended Equity Scheme predominantly investing In equity and equity-related instruments of small-cap companies. The investment objective of the Scheme to generate capital appreciation by investing predominantly in Small Cap Stocks.

Know More

Quantum Multi Asset Allocation Fund

The investment objective of the Scheme is to generate long term capital appreciation/income by investing in a diversified portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments.

Know MoreMonthly Equity Outlook

-

Equity Monthly View for September 2024

Posted On Monday, Oct 07, 2024

Indian markets continued to well in September. There are some signs of weakness in the mid/small cap pockets

Read More -

Equity Monthly View for August 2024

Posted On Thursday, Sep 05, 2024

After the recent run up, Indian markets remained range bound in August; BSE Sensex registered a growth of ~1%. BSE Midcap Index advanced by 1.0% & BSE Small cap Index advanced by 1.4%.

Read More -

Equity Monthly View for July 2024

Posted On Tuesday, Aug 06, 2024

Indian markets continued to well in July; BSE Sensex advanced by 3.5%.

Read More

Related Webinars

-

What Is the Status of Index Valuation in Relation to Its Long-Term Average & Its Way Ahead?

Date & Time : 06th December, 2023 (06:00 PM)

Speaker : George Thomas

Designation : Equity (2022)

Description : Index valuation mostly moves around its long-term average. 🚀⚖️ Balancing act in the world of finance – where the present meets the past? Find out more on your equity investments & what should do you next to safeguard your investment portfolio?

Read More -

Changes in SEBI Guidelines – Impact on AMC's Explained by Christy

Date & Time : 08th June, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Christy Mathai Equity (2022)

Description : SEBI has changes the guidelines for Mutual Funds and Investors. Understand evolving guidelines & its impact on AMC’s, investments etc.

Read More -

Is India Amidst Rising Economic Boom or Is It Bubble?

Date & Time : 08th June, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Christy Mathai Equity (2022)

Description : Get answer to this key question about India‘s economy & more. If you have missed our #webinar, then view this snippet to resolve your doubts, from our investment experts.

Read More -

How Can Inflation Moderation Ease RBI Pressure and Impact Bond Risk Premiums?

Date & Time : 06th December, 2023 (06:00 PM)

Speaker : Pankaj Pathak

Designation : Fixed Income (2013)

Description : Unlocking a financial silver lining! 🌟 Moderating inflation not only eases the pressure on RBI but signals a potential shrink in risk premiums on bonds. 💹💼 Smart moves in finance pave the way for a brighter economic horizon.

Read More -

Elections Behind Us, Budget Ahead: The Way Forward for Investors

Date & Time : 21st June, 2024 (06:00 PM)

Speaker : Christy Mathai

Designation : Christy Mathai Equity (2022)

Speaker : Pankaj Pathak

Designation : Fixed Income (2013)

Description : Catch our recorded webinar on ‘Elections Behind Us, Budget Ahead: The Way Forward for Investors. 'Dive into the post-election analysis, expectations from the upcoming Budget and its potential impact on the markets.

Read More -

Is ESG true to its label

Date & Time : 13th July, 2023 (06:00 PM)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Description : ind out what our investment expert Chirag Mehta speaks about India ‘s roadmap on #ESGinvesting, why are market leaders optimistic about India, #FPI’s outlook about top emerging countries etc.

Read More -

Webinar: Navigating Small-Cap Success: Market Insights & Strategies.

Date & Time : 16th October, 2023 (06:09 PM)

Speaker : Ajit Dayal

Designation : Ajit Dayal - Founder Quantum Advisors Pvt Ltd

Speaker : Chirag Mehta

Designation : Quantum AMC Pvt Ltd

Description : Given the flows small-cap funds have seen over the last year, the speakers share valuable insights into the growing opportunities in the Small Cap investing landscape & how to overcome the challenges.

Read More -

Webinar: Navigating Small-Cap Success: Market Insights & Strategies.

Date & Time : 16th October, 2023 (06:09 PM)

Speaker : Ajit Dayal

Designation : Ajit Dayal - Founder Quantum Advisors Pvt Ltd

Speaker : Chirag Mehta

Designation : Quantum AMC Pvt Ltd

Description : Given the flows small-cap funds have seen over the last year, the speakers share valuable insights into the growing opportunities in the Small Cap investing landscape & how to overcome the challenges.

Read More -

Webinar: Seize the Moment - Small Caps, Big Opportunities.

Date & Time : 18th October, 2023 (06:00 PM)

Speaker : Ajit Dayal

Designation : Ajit Dayal - Founder Quantum Advisors Pvt Ltd

Speaker : Chirag Mehta

Designation : Quantum AMC Pvt Ltd

Description : Get ready to dive into the world of Small Cap investments & opportunities, uncover the Quantum Small Cap NFO details, and learn how to address the challenges to build lasting Small Cap potential.

Read More -

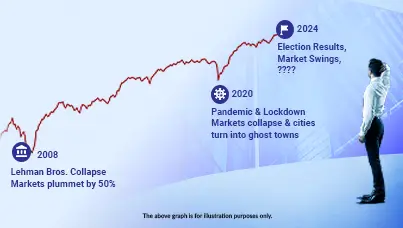

Certainty in an Uncertain World - Elections, Economy & Returns - Ajit Dayal Founder of QAMC

Date & Time : 26th March, 2024 (06:00 PM)

Speaker : Ajit Dayal

Designation : Ajit Dayal - Founder Quantum Advisors Pvt Ltd

Description : Ajit Dayal, founder of Quantum Asset Management Company, discusses the principles of value investing and Quantum's approach to predicting certainty in an unpredictable investment landscape. We have demonstrated our ability to navigate through turbulent market conditions, including crises like the collapse of Lehman Brothers, the challenges posed by the Covid pandemic and elections.

Read More -

Riding the Bull: Risk Management in Richly Valued Markets

Date & Time : 17th May, 2024 (06:00 PM)

Speaker : George Thomas

Designation : Equity (2022)

Description : Introducing our monthly webinar series tailored to enhance investor learning in investments and financial planning.

Read More -

Small Caps, Big Opportunities: Navigating Obstacles

Date & Time : 19th April, 2024 (06:00 PM)

Speaker : Abhilasha Satale

Designation : Alternative Investment (2023)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Description :

Read MoreSmall cap investments offer tremendous growth potential, but they also come with their fair share of challenges...

-

Navigating Markets in 2024: Fund Managers' Year-End Perspective

Date & Time : 06th December, 2023 (06:00 PM)

Speaker : George Thomas

Designation : Equity (2022)

Speaker : Pankaj Pathak

Designation : Fixed Income (2013)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Description : Watch this mega webinar with our team of investment experts, where they decode the trends, unveil strategies, and chart the course for financial success.

Read More -

Navigating Small-Cap Success: Market Insights & Strategies.

Date & Time : 16th October, 2023 (04:30 PM)

Speaker : Ajit Dayal

Designation : Ajit Dayal - Founder Quantum Advisors Pvt Ltd

Speaker : Chirag Mehta

Designation : Quantum AMC Pvt Ltd

Description : Given the flows small-cap funds have seen over the last year, the speakers share valuable insights into the growing opportunities in the Small Cap investing landscape & how to overcome the challenges.

Read More -

Navigating the Path to Success with Small Cap Fund

Date & Time : 13th October, 2023 (06:00 PM)

Speaker : Abhilasha Satale

Designation : Alternative Investment (2023)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Description : Given the inflows Small Cap Fund have seen over the last year, one should be mindful of the risks & challenges posed by investments in Small Cap Funds.

Read More -

Navigating the Market Rally: Strategies for Equity Investing.

Date & Time : 30th June, 2023 (06:00 PM)

Speaker : George Thomas

Designation : Equity (2022)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Description : Discover winning strategies to thrive in the market rally! Learn how to navigate equity investing with expert insights and stay ahead. Don't miss out! Watch NOW.

Read More -

Riding the Big Wave - How to Build a Winning Investment Portfolio for India's Economic Boom

Date & Time : 26th May, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Christy Mathai Equity (2022)

Speaker : Pankaj Pathak

Designation : Fixed Income (2013)

Description : Did you miss tuning into our exclusive #webinar on “Riding The Big Wave” & creating an impactful portfolio? Hosted by our Fund Managers.

Read More

Watch the video to know more!

-

Are Market Dynamics Supporting Value Investing?

Date & Time : 12th April, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Christy Mathai Equity (2022)

Description : In this video, we explore whether the current market dynamics are favorable for value investing, a long-term investment strategy that seeks to identify undervalued stocks and hold them until their true value is realized. We discuss the factors that influence market dynamics and how they impact the performance of value investing.

Read More -

Mega Webinar: Equity Markets Poised For Growth - Is Your Portfolio?

Date & Time : 22nd July, 2022 (06:00 PM)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Speaker : Hitendra Parekh

Designation : Equity (2004)

Description : In our mega webinar, our Fund Manager Hitendra Parekh and CIO Chirag Mehta discussed how you can ride the India growth story with ease.

Read More -

Webinar - How is India Placed Amidst Global Uncertainty?

Date & Time : 23rd September, 2022 (06:00 PM)

Speaker : George Thomas

Designation : Equity (2022)

Description : In this webinar, our Fund Managers Ghazal Jain and George Thomas discussed how is India placed amidst Global Uncertainty.

Read More -

Could Equities be a Game Changer in 2021?

Date & Time : 23rd December, 2020 (12:00 AM)

Speaker : I.V.Subramaniam

Designation : MD & Group Head (Equities) of Quantum Advisors (1996)

Description : Could Equities be a Game Changer in 2021?

Read More -

Investing in a Bull Run - Where to from here

Date & Time : 20th August, 2021 (06:00 PM)

Speaker : Nilesh Shetty

Designation : Co Fund Manager - Equity

Description : Watch Mr. Nilesh Shetty, Fund Manager - Equity, Quantum MF, share his insights on the recent bull run. He discusses whether reacting to this rally is the right move for long-term investors.

Read More -

Equity Investing Simplified

Date & Time : 06th November, 2020 (06:00 PM)

Speaker : Chirag Mehta

Designation : Chief Investment Officer (2006)

Description :

Read MoreEquity Investing Simplified

Related Quantum Directs

Our weekly newsletter of curated content to keep you updated on industry trends

-

Overcome Market Uncertainties: The Power of Multi-Asset Investing

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

From Transactions to Trust: Building Enduring Relationships in Mutual Fund Distribution

In the dynamic world of mutual fund distribution, building lasting relationships with clients is paramount.

Read More -

Maximising Client Returns: A Mutual Fund Distributor's Playbook

In the competitive and dynamic world of mutual funds, the role of a distributor is not merely to sell products but to act as a trusted distributors who helps clients maximise their returns potential.

Read More -

Quantum Mutual Fund - Riding the Market Rollercoaster? Strap in with Downside Protection

India with impressive economic growth, demographic dividend, and increasing influence on the political scale, the world’s hope remains with India.

Read More -

Invest in Financial Freedom with This Multi Asset Fund

Just as India’s freedom was marked by resilience, strategic planning, and unity, the journey to financial independence requires thoughtful investment choices that secure long-term prosperity.

Read More -

Be Good. Do Good: The Quantum Way

In the business environment, good corporate governance is paramount to the success and sustainability of organisations.

Read More -

Navigating the New Taxation Rules for Quantum Investors

The Union Budget announced on 24 July, 2024 brought in controversial changes such as removal of indexation benefits and changes in tax rates.

Read More -

Ballots Cast, Budgets Await: Market Reactions in the Post-Election Economy

As India emerges from a dynamic election cycle, the investing landscape finds itself at a crossroads. While the newly formed Coalition government settles in, pre-budget expectations are shaping market sentiment.

Read More -

The Governance Feature in this ESG Fund

In the realm of sustainable investing, the governance aspect of an ESG (Environment, Social, and Governance) fund holds paramount importance.

Read More -

Experience the Quantum Difference: Investor Success with Integrity

In the evolving landscape of mutual funds, Quantum stands out as a beacon of integrity, transparency, and investor-centric operations.

Read More -

Skip the Coffee, SIP It Instead

We all know the joy of starting the day with a cup of our favourite coffee brew. But what if we told you that your daily Rs. 300 coffee habit

Read More -

Balancing Act: The Coalition Government and Markets in India

Let's explore how the current coalition government may impact your investments. The Indian stock market is a barometer of the country's economic health and is shaped by the prevailing political environment.

Read More -

Polls to Portfolios: A Robust Portfolio with Quantum in Post-Election India

The election season may be over, but the journey for your investments is ongoing.

Read More -

-

Are You Looking for Stability and Growth in Your Portfolio? Read This

Although the Indian equity markets have scaled new highs, the last couple of months have been rather volatile.

Read More -

World Health Day: Build a Healthier Portfolio with Quantum ESG Best-in Class Strategy Fund

As we celebrate World Health Day on April 7th, it's a timely reminder of the importance of wellness in all spheres of our lives.

Read More -

Worried How the Indian Equity Markets Would Do Around Elections?

In the last couple of months of the calendar year 2024, the Indian equity market has been on a rollercoaster ride or rather volatile.

Read More -

ISEC Merger with ICICI Bank, Why Quantum voted against the Resolution

Since its Inception in March 2006, Quantum Long Term Equity Value Fund has been focused on generating sensible

Read More -

Navigating the Financial Seas: The Crucial Role of Partners in Mutual Fund Distribution Space

In the vast ocean of investment opportunities, mutual funds stand out as a beacon of hope for many investors seeking to grow their wealth steadily over time.

Read More -

Did Your New Car Come Without a Steering Wheel?

Everything that is produced, as you know, follows a particular process and has certain capacity constraints.

Read More -

Mastering Mutual Fund Selection: The 4 Ps Guide for Distributors

In the ever-evolving landscape of mutual funds, when it comes to selecting the right mutual fund for your clients

Read More -

Small Cap, Big Difference: Staying Ahead with Liquidity & other Risk Controls

Amid a build-up of “froth” in the small cap and midcap space in terms of valuation

Read More -

-

Multi-Asset Allocation Fund: Navigating Choppy Waters When Equity Seas Get Rough

Indian equities are scaling new heights, reaching lifetime highs where Sensex crossed the 73,000 and Nifty crossed 22,000 mark for the first time ever on January 15, 2024.

Read More -

Valentine’s Day Special: A Perfect Match for Certainty in an Uncertain world

As Valentine's Day approaches, it is a great time for creating and nurturing relationships.

Read More -

Interim Budget 2024-25: A Quantum Perspective

Fiscal prudence, continued capex spending, green growth and status quo on direct and indirect taxes were the key highlights of the Interim Budget FY 2024.

Read More -

The rise of Robo-advisors: What does it mean for MF distributors?

In the ever-evolving landscape of Mutual funds, technological advancements have played

Read More -

This Republic Day, build a Strong Foundation for your Equity Portfolio

India will be celebrating its 75th Republic Day tomorrow.

Read More -

Dynamic Bond Fund stands to benefit from Fiscal Consolidation: Fixed Income Perspective from Pankaj Pathak

The interim union budget for 2024-25 will be presented on February 1, 2024 As has been the custom, the government may not announce any major policy changes in the interim budget ahead of Union elections.

Read More -

Tax Saving Season with a Predictable Approach

Instead of a short-term tax-saving exercise, take a holistic approach - a new lens of building wealth alongside tax saving by knowing what you can expect from your investments.

Read More -

Planning your Taxes with ELSS? Choose a Predictable Approach to Navigate High Valuations

We are in tax planning season. It is also a time when your employer asks you to submit investment

Read More -

Target Equity Growth with a more Predictable Approach

While markets will always remain uncertain and unpredictable, what if we told you could rely on a fund that offers you more predictability?

Read More -

Portfolio Released: A Sneak Peek into Our Small Cap Portfolio!

We believe that within the realm of small caps lie opportunities that can generate remarkable returns

Read More -

Look Beyond Ratings and Returns - Think S.M.A.R.T.

Investment decisions based on past returns may not be prudent as it may not be indicative of the potential or future

Read More -

Decoding the Intersection of Elections, Economy & Equity Investments

Elections tend to create short-term volatility and uncertainty in the financial space where it becomes difficult to predict market movements.

Read More -

Sail through Market Cycles with a Diversified Equity Portfolio

Mutual Funds needs close observation, realistic assessment and an open mind...

Read More -

Usher in Wealth & Good Fortune This Dhanteras with a Smart Gold Investment

Dhanteras, is fast approaching on the 10th of November and it marks the first day of the grand Diwali celebration, a time when homes across India are lit up with the warm glow of diyas.

Read More -

Opportunities & Challenges in the Small Cap Space: Interview with Chirag Mehta, CIO & Fund Manager

The Small Cap universe is very vast and has showcased good growth potential.

Read More -

Small-Caps, Big Difference: The Unexplored Opportunity Amid Sensex Rise

Worried that the Indian equity markets are near the peak?

Read More -

Small Cap, Big Difference to your Portfolio - NFO Launched Today on Oct 16!

Equity market goes through cycles. If you were to see the relative valuation of small caps vs Sensex, it is trading close to long term averages.

Read More -

Small-Caps Still Hold Potential but be Cognizant of Risks for a Rewarding Experience

The Indian equity market has had a run in the last couple of years, driven by a broad-based market rally. In the last one year, the S&P BSE Sensex generated an absolute return of 13% (as of October 05, 2023).

Read More -

Exploring the Shared Principles of Classrooms and Markets

From imparting knowledge, instilling good values and guiding you towards the right path, a teacher's contribution to one’s life is unmatched.

Read More -

Raksha Bandhan: Karo #PlanetKiRaksha with this Mutual Fund

Just as you've vowed to protect your sister, it's time to make a commitment to act towards #PlanetKiRaksha.

Read More -

India's True Independence Shines Amid Global Economic Shifts

In today's rapidly evolving world, where economic dynamics are constantly undergoing seismic changes, India emerges as a resolute beacon of resilience and growth.

Read More -

Sustainable Growth or Bubble? What Sets the Current Equity Rally Apart from the Pre-Covid Rally?

The Indian equity market has witnessed several upswings in recent years, but the current rally is particularly noteworthy for its strength and breadth.

Read More -

While Chasing Market Rally, Take Cognizance of Risks

We are halfway through 2023 and after overcoming challenges such as skyrocketing inflation and aggressive rate hikes in the initial part of this year, Nifty 50 & Sensex broke into new lifetime highs in June (19000 & 64500 levels respectively).

Read More -

India Story Turns Positive Again: How to Position Your Portfolio

In recent times, the Indian economy has shown promising signs of a positive turnaround.

Read More -

Market Fundamentals in Favour of Value

Value investing is a proven equity investing strategy propagated by legendary investors like Warren Buffett and Benjamin Graham that focuses on investing in undervalued stocks that are priced lower than their intrinsic value.

Read More -

Is there a link between green investing & long-term returns?

ESG investing refers to the integration of Environmental, Social, and Governance factors into investment decision-making processes.

Read More -

Take the Early Ride to Maximize Your Tax Saving & Wealth Building Potential with an SIP in ELSS

Generally, many of us start scrambling toward the end of the financial year to make last-minute tax-saving investments.

Read More -

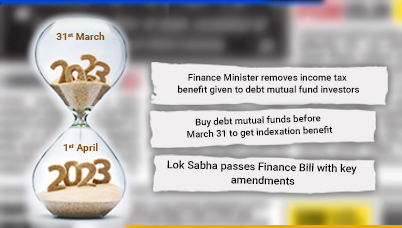

How do you Benefit from Indexation before Mar 31

What is the impact of indexation benefit withdrawal & how do you respond?

Read More -

India is Gearing Towards Sustainability. Is your Portfolio?

The Government has identified Green growth as one of the seven top priorities of the Union Budget this year.

Read More -

How to Structure Your Portfolio Given an Imminent Global Economic Slowdown

The Indian equity markets, as you may have experienced, have been quite volatile of late.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More -

Planning your taxes? Consider an option that can Save Tax AND Grow Wealth

It’s February and we are pretty much in the tax planning season. If you are a high-risk taker, looking to get two birds with one stone

Read More -

Here’s Why Invest in ELSS for Tax Benefit

‘A penny saved is a penny earned’, so goes a famous saying.

Read More -

Top 10 Highlights of the Indian Union Budget 2023-24 and Takeaways

Union Finance Minister Nirmala Sitharaman has presented the Union Budget 2023 heralded as the first budget in Amrit Kaal.

Read More -

What is a Tax-Saving Fund And Why Does It Make Sense for the Risk-takers to Invest in It?

We all aim to maximise our savings, isn’t it? In this respect, along with prudent budgeting and wise use of hard-earned money, saving tax is important.

Read More -

Kickstart the New Year with a 12:20:80 Mutual Fund Portfolio Review

As the year draws to a close, it is a good time take a closer look at your investment portfolio.

Read More -

Equity Year End Wrap-up & Outlook - 2023

2022 was an eventful year when the global economy witnessed the cons of easy money flow (Quantitative Easing).

Read More -

Your Anchor in a Storm - Grow your Wealth with a Value + Tax Advantage

The financial markets have been through a bumpy ride the past year – the Russia-Ukraine war has led to a global energy crisis and led to rising inflation and subsequent interest rate hikes.

Read More -

Is your MF Portfolio Designed to Ride India’s Long Term Growth Story?

You probably have these and more questions and concerns about the future of India and its impact on your investment portfolio.

Read More -

Tax Planning Season is Coming - Don’t Wait Till the Last Moment

It is around the time when companies start requesting investment proofs for tax planning.

Read More -

Retirement Planning - Navigate your Portfolio Today for a Better Tomorrow

You work hard and build a life for yourself and your family - one full of dreams, achievements, and happiness.

Read More -

Equity monthly view for September 2022

The S&P BSE SENSEX declined by 3.5% on a total return basis in the month of Sep 2022

Read More -

Equity monthly view for August 2022

S&P BSE SENSEX advanced by 3.6% on a total return basis in the month of Aug 2022.

Read More -

Getting Financial Freedom on Track

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More -

Equity monthly view for July 2022

Equity Markets managed a splendid recovery in the month of July-22. S&P BSE SENSEX moved up by 8.71 % on a total return basis in the month.

Read More -

How Can ESG Investing Safeguard Your Future?

Three waves of the pandemic, the Russia-Ukraine war, record-high inflation - the last three years have been challenging...

Read More -

Equity monthly view for June 2022

S&P BSE SENSEX declined by -4.47 % on a total return basis in the month of 2022.

Read More -

Now, A Diversified Portfolio at your FingerTips

In the interest of continuing our investor first approach, we have made the Asset Allocation Approach easy and simple for you to adopt, either using an active or a passive approach.

Read More -

Build a Weatherproof Portfolio Passively - With Our Upcoming NFO

Has the recent decline in the stock markets resulted in losses...

Read More -

Gear up for Growth - The Active or Passive Way

If you are worried about the present downturns in the equity market and are looking for ease of investing, here’s a new opportunity for you.

Read More -

Balancing Emotions While Investing

Emotions are an essential part of what makes us human but when it comes to investing, emotions can either make or break your goals.

Read More -

Beating Inflation: Time To Move Beyond Conventional Avenues

Inflation is when your hard-earned money loses value.

Read More -

Equity monthly view for May 2022

It has underperformed developed market indices like S&P 500 (+0.18%) and Dow Jones Industrial Average Index (+0.32%).

Read More -

Equity monthly view for April 2022

S&P BSE SENSEX declined by -2.5% on a total return basis in the month of April 2022.

Read More

Our Fund Managers

Have Questions? Reach out directly to our experienced fund managers and start a conversation today!

-

Chirag Mehta

Chief Investment Officer (2006)

Chirag Mehta has been elevated to the position of Chief Investment Officer of Quantum Asset Management Company with effect from April 01, 2022. Chirag has been serving as Senior Manager, Alternative Investments. He joined Quantum in 2006 and has more than 18 years of cumulative experience in managing commodities and specializing in the field of alternative investment strategies. He has been the fund manager of Quantum Gold Savings Fund, Quantum Gold Fund, Quantum Equity Fund of Funds, Quantum Multi Asset Fund of Funds, and Quantum India ESG Equity Fund. Chirag has been formerly ranked as the 4th best Fund Manager in the world under the age of 40 by Citywire in 2017. He is a qualified CAIA (Chartered Alternative Investment Analyst) and has also completed his Master’s in Management Studies in Finance.

-

George Thomas

Equity (2022)

Over 6 years work experience in equity research across multiple sectors.

Joined Quantum Asset Management Company Private Limited in 2016. His prior work experiences include stints at Wipro Technologies and Robert Bosch Engineering & Business Solutions.

Manages - Quantum Long Term Equity Value Fund and Quantum Tax Saving Fund

Holds a Post-Graduate Diploma in Management (Finance) - IMT -

Hitendra Parekh

Equity (2004)

Over 3 decades of work experience in the financial services industry.

Joined Quantum Asset Management Company Private Limited in 2004 prior to which he was associated with Unit Trust of India and UTI Securities Ltd.

Manages - Quantum Nifty 50 Fund ETF & Quantum Nifty 50 Fund or Fund

A B. Com graduate & holds a Master’s degree in Financial Management from Narsee Munsee Institute of Management Studies

Reach out directly to our experienced fund managers and start a conversation today!

Add To Cart

| Total of Lumpsum Amount |

|---|

Broker Details

-

ARN CodeARN -

-

Sub Broker Code

-

EUIN CodeE -

-

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker.