Is there a link between green investing & long-term returns?

Posted On Tuesday, Jun 06, 2023

ESG investing refers to the integration of Environmental, Social, and Governance factors into investment decision-making processes. It is a way of equity investing that filters and invests in companies based on the following parameters:

Though Environment Day is over, now is a good opportunity as any to further decode ESG investing & its significance in translating to the potential for returns as well as safeguarding the future. It is an investment approach that not only offers you exposure to equity markets & impacts financial performance but also impacts society and the environment.

In recent years, ESG investing has gained significant traction as investors recognise the importance of sustainability and responsible business practices go hand in hand. Despite this, there are several myths and misconceptions surrounding ESG investments. In this blog, we will bust 5 myths associated with ESG investing and shed light on the realities of this strategy.

Myth 1: ESG strategies do not offer good returns

Reality: On the contrary, evidence suggests that ESG strategies have the potential to deliver better risk-adjusted returns compared to conventional strategies. While there may be variations in short-term performance, numerous studies have demonstrated the long-term outperformance of ESG-focused investments. Talk about QESG returns.

Research from leading institutions, such as Morgan Stanley and Harvard Business School, has shown that companies with strong ESG performance tend to exhibit better financial performance over the long term. These companies are often better equipped to manage risks, adapt to changing market dynamics, and seize opportunities, which can contribute to their overall financial success.

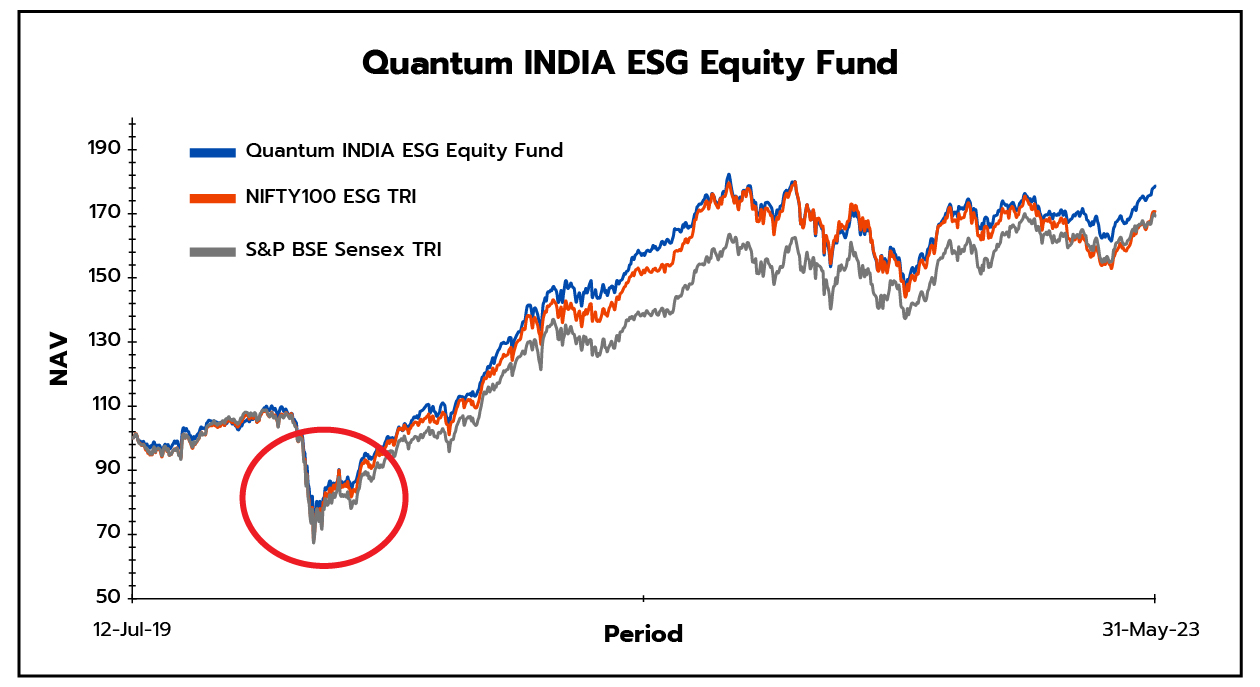

ESG factors can help identify potential risks that may not be adequately captured by traditional financial analysis. This risk-aware approach may lead to more resilient portfolios and better risk-adjusted returns. As historical trend shows, ESG index has not only outperformed the traditional Equity index over the long term, but it has also protected downside risk better. This was well observed during the pandemic as represented in the chart as depicted below. Quantum India ESG Equity Fund – one of the first ESG -themed mutual funds has performed well during this period.

Data as of May 31, 2023. Past performance may or may not be sustained in the future. The above performance graph is to be read in conjunction with the complete fund performance below

Myth 2: ESG investing only involves screening out "sin" stocks.

Reality: ESG investing does not solely mean screening out "sin" stocks, which are companies involved in controversial or harmful activities like tobacco, weapons, or fossil fuels. While negative screening is one approach within ESG investing, it is just one component of a broader strategy.

ESG investing encompasses a more comprehensive and proactive approach. Rather than solely avoiding certain companies or industries, it seeks to identify and invest in companies that demonstrate strong ESG practices and sustainability efforts. This means actively selecting companies with positive ESG attributes rather than solely excluding negative ones.

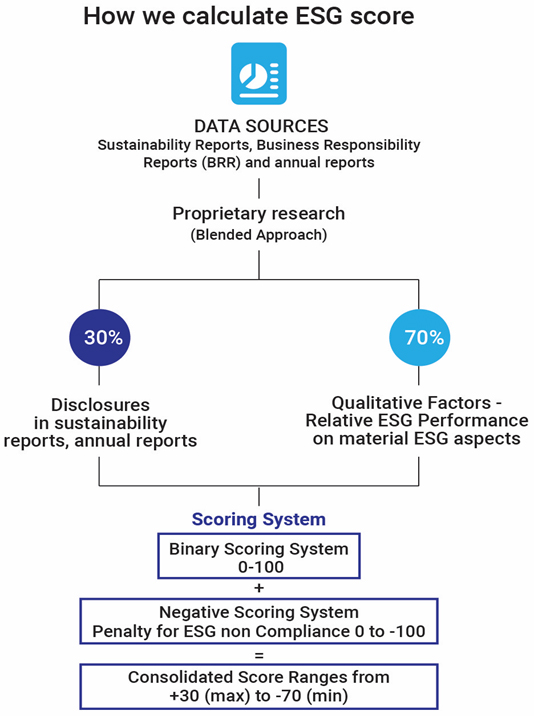

The Quantum India ESG Equity Fund subjectively evaluates more than 200 parameters across the Environment, Social, and Governance domains. Based on this research, we assign a score of -70 to +30 and rank based on their ESG performance relative to their peers. Companies with an ESG score of > 0 qualify for inclusion in the portfolio. Finally, you get a diversified basket of ESG-compliant companies with the potential to outperform conventional market indices.

Myth or Fact? 3: ESG investing is merely greenwashing

Reality: ESG investing is not necessarily greenwashing, while there are instances of companies that have lured investors in the pretext of following ESG norms on paper and not on the ground – referred to as greenwashing. As per AMFI data in April 2023, the combined assets under management of existing ESG funds in India are at Rs. 9,516 crores. Since the introduction of ESG in India, more ESG funds have entered the field, with the category now making up 0.6% of total equity AUM, as per Bloomberg.

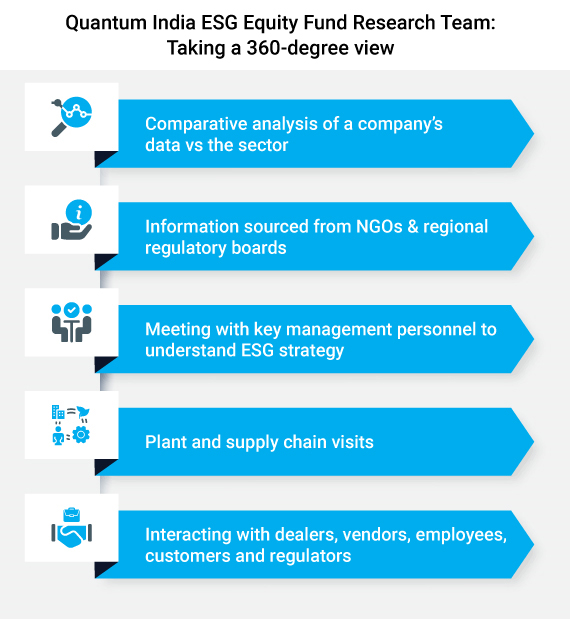

Quantum India ESG Equity Fund has taken the right direction forward by going beyond desk research and encompasses a 360 approach to ESG metrics. You can benefit from our approach to years of research in the ESG space. We believe ESG credentials still warrants a detective’s lens, and therefore, you cannot rely solely on funds that filter stocks based on self-disclosures. Apart from company disclosures, we also use source information from NGOs & regional regulatory boards, gather data from plant & supply visits, and interact with key management personnel, dealers, vendors, customers & regulatory among others.

ESG investing has experienced an increase in demand from various types of investors, including institutional investors, asset managers, and individual investors. This demand is driven by a growing awareness of sustainability challenges, social issues, and the need for responsible investment practices.

Quantum India ESG Equity Fund has been true to label since inception. The fund has performed well since inception offering a return of 16.09% since inception outperforming its benchmark return of 14.74%.

The above performance is to be read in conjunction with the complete fund performance below.

Myth 4: Only millennials and women invest in ESG

Reality: Although millennials and women have demonstrated a strong interest in ESG investing, the attractiveness of sustainable and ethical investment strategies transcends these groups. ESG factors are becoming more important to investors of all ages, especially Gen X and baby boomers. Cross-generational alignment of investments with long-term sustainability and personal values is a goal.

ESG investing has gained traction among institutional investors, such as pension funds, insurance companies, and sovereign wealth funds across the globe. These large-scale investors are incorporating ESG considerations into their investment strategies due to the recognition of the potential financial risks associated with ESG issues and the need to fulfill their fiduciary duty.

ESG investing has been adopted within the mainstream financial industry, with asset managers, banks, and financial advisors integrating ESG considerations into their product offerings.

Regulatory bodies are promoting ESG investing by implementing disclosure requirements and integrating ESG considerations into their frameworks.

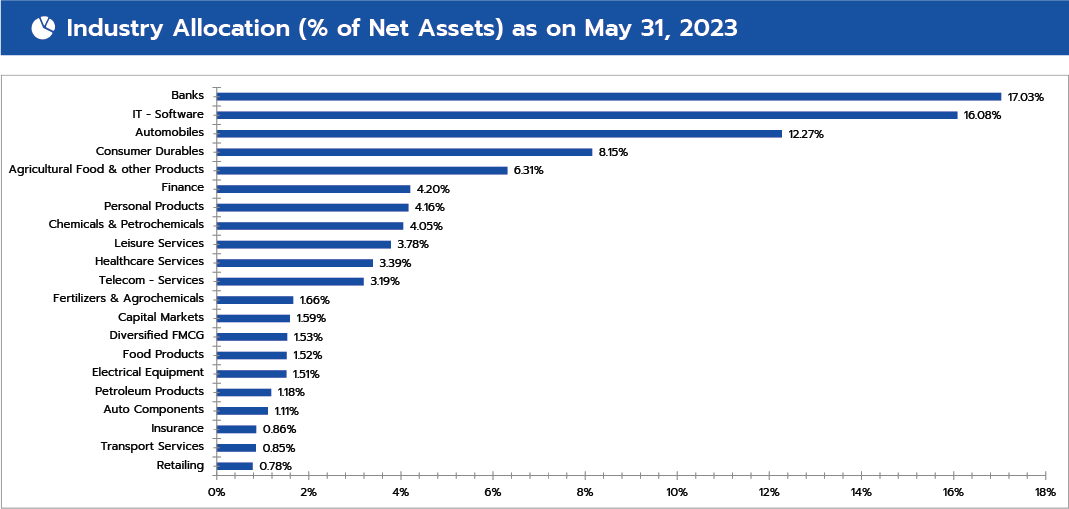

Myth 5: ESG investing is limited to a particular sector.

Reality: While ESG investing is classified as a thematic fund, it is sector agnostic and not limited to particular sectors or market caps. Quantum India ESG Equity Fund has a well-diversified equity investment portfolio that follows a structured and disciplined investment process in portfolio selection. The advantage of diversifying your investments is to reduce dependency on a single basket of equities to generate risk-adjusted returns.

Within the investment community, ESG investing has gained popularity and acceptability. As investors increasingly prioritise ESG factors, the momentum behind ESG investing is expected to continue. ESG represents a fundamental shift in the equity investment landscape that is likely to continue and grow in importance.

Take the opportunity of this World Environment Day to gain a better understanding of the benefits of including ESG elements in investment decision-making by busting these myths. It is clear that ESG investing may produce both monetary gains and benefit society and the environment.

Quantum India ESG Equity Fund offers you a well-diversified ESG fund. If you would have invested Rs. 10,000 as an SIP 3 years ago on May 29, 2020, your portfolio would have grown to Rs. 4,52,302 in three years as of May 31, 2023 compared to the benchmark of Rs. 4,47,006

|

|

| Performance of the Scheme | Direct Plan | |||||

| Quantum India ESG Equity Fund - Direct Plan | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (12th Jul 2019) | 16.09% | 14.74% | 14.48% | 17,870 | 17,074 | 16,921 |

| May 29, 2020 to May 31, 2023 (3 years) | 25.50% | 24.65% | 26.02% | 19,790 | 19,392 | 20,037 |

| May 31, 2022 to May 31, 2023 (1 year) | 12.25% | 8.13% | 14.05% | 11,225 | 10,813 | 11,405 |

Data as on May 31, 2023.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI. Past performance may or may not be sustained in the future.

Load is not taken into consideration in Scheme returns calculation. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The Scheme is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta is the Fund Manager and Ms. Sneha Joshi is the Associate Fund Manager managing the scheme since July 12, 2019.

For other Schemes Managed by Mr. Chirag Mehta please click here.

| SIP Performance | |||||||

| Total Amount Invested (₹‘000) | Mkt Value as on May 31, 23 (₹‘000) | Tier I - Benchmark# Returns (₹‘000) | Additional Benchmark Returns (₹‘000)## | Returns (XIRR*) (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | |

| SIP Since Inception | 460 | 617 | 601 | 622 | 15.55% | 14.16% | 15.97% |

| 3 Years SIP | 360 | 434 | 424 | 445 | 12.69% | 11.07% | 14.46% |

| 1 Year SIP | 120 | 128 | 125 | 128 | 12.83% | 8.65% | 13.18% |

Data as on May 31, 2023.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI. Past performance may or may not be sustained in the future.

The above SIP performance is for Quantum India ESG Equity Fund - Direct plan - Growth option. Load is not taken into consideration using applicable NAV on the SIP day (5th of every month). Return on SIP and Benchmark are annualized and compounded investment return for cash flows resulting out of uniform and regular monthly subscriptions as on 5th day of every month (in case 5th is a non-Business Day, then the next Business Day) and have been worked out using the Excel spreadsheet function known as XIRR. XIRR calculates the internal rate of return for series of cash flow. Assuming ₹10,000 invested every month on 5th day of every month (in case 5th is a non-Business Day, then the next Business Day), and since inception returns from SIP are annualized and compounded investment return computed on the assumption that SIP installments were received across the time periods from the start date of SIP.

Returns are net of total expenses

*XIRR - XIRR calculates the internal rate of return to measure and compare the profitability of series of investments.

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Benchmark |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme Tier 1 - Benchmark NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Debt Monthly View for February 2025

Posted On Friday, Mar 07, 2025

February 2025 kicked off with two key events in Indian bond markets: the Union Budget and RBI's Monetary Policy.

Read More