Decoding the Intersection of Elections, Economy & Equity Investments

Posted On Friday, Dec 01, 2023

India has the largest democracy and elections are an integral part which can influence the country’s sentiment and macroeconomic outlook. Election results can create short-term volatility and uncertainty in the market and it’s difficult to predict the performance. As the political landscape heats up, it is natural to be concerned about the potential impact on your equity investments. You may be having certain questions:

• How have stock markets performed during election results in the past?

• Should you use a wait-and-watch approach?

• Should you be taking any action on your investments?

Let’s understand how to navigate the upcoming election period with confidence and manage your portfolio for long-term success.

What historical returns from equity pre & post-Election results?

As evidenced by historical trends, the equity market's performance pre and post the election results may not be consistent.

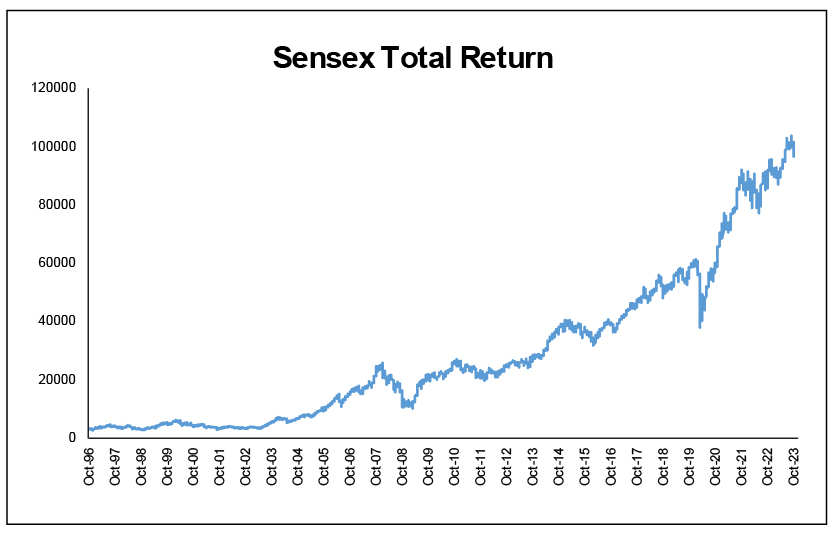

For example, in the month following the 2004 Lok Sabha elections, the BSE Sensex, the benchmark index of the Indian stock market, saw declines but saw a sharp rally for the next three years. Despite market skepticism, long term returns turned out well.

Similarly, during the 2009 Lok Sabha elections, the market saw a marginal decline, in the month after the elections but gained in the longer period after the election results. As long as structural reforms continue to be rolled out, by whichever government is in power, markets shall do well in the long run.

Returns | 1999 | 2004 | 2009 | 2014 | 2019 |

1 month after election | -2.10% | -9.90% | 0.20% | 5.00% | 1.30% |

6 month before elections to 6 month after elections | 40.20% | 23.10% | 92.70% | 39.60% | 16.70% |

3 Years after elections | -34.00% | 169.70% | 17.90% | 32.50% | 44.60% |

Source: Bloomberg; Sensex Total Return is considered. Past performance may or may not be sustained in the future. Returns are absolute for 12 months before & after election results, 1 month after & 3 years after election results

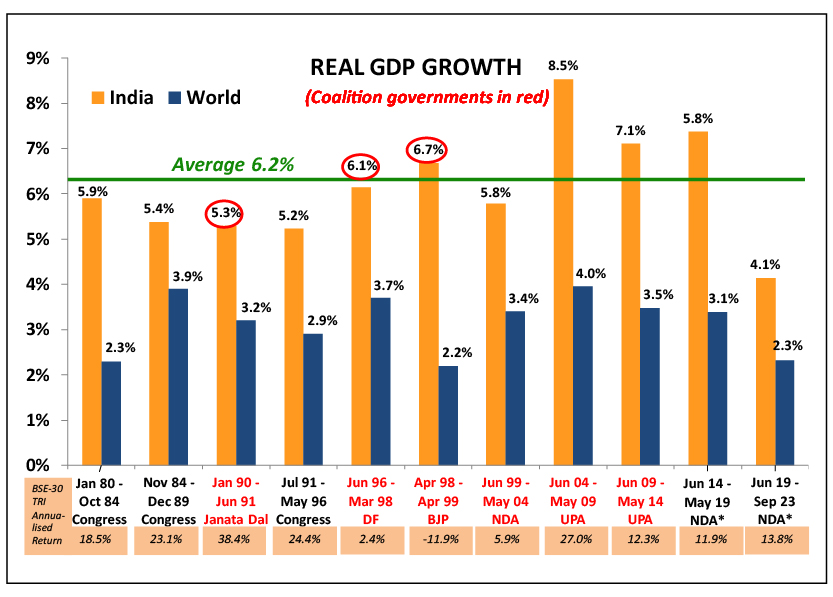

India's GDP growth across different governments

Note: The number in the red rectangle is from a changed data series starting Jan 2015. While a “superior” series, there is no comparable number to equate the “New” with the “Old”. Most economists deduct 0% to 1.5% from the “New” to equate to the “Old”; therefore, under Modi, the GDP has been at 5.9% at best matching the 5.6% under the BJP-led coalition government of Vajpayee resulting in a rout for the BJP at the time of the next election in 2004.* Please note that data used for World GDP for 2021 & 2022 is a median Estimate since World Bank data is not yet available and India GDP data is the government's third advance estimate released at the end of August 2023.

Source: RBI and www.parliamentofindia.nic.in; data as of Sept 2023.

As seen in the graph above, irrespective of which political party is in power, the Indian GDP is growing at 6-6.5% across 10 governments over the past 40 years and in nominal terms (including inflation) between 11%-12%. This annual nominal economic growth has a correlation on market returns over the long term. Over a longer period, India’s GDP growth gets reflected in the equity markets.

Equity strategy to navigate the volatility

Market sentiment can go both ways – positive or negative. If the market sentiment is positive, it offers the opportunity to participate in potential market rallies that may follow. However, if the election results are unexpected or if there is a hung parliament, the market sentiment may be negative following the elections, and can lead to a market decline.

However, the loss applies only if you resort to panic selling. It’s important to recognize that the market sentiment be it positive or negative may be temporary. If equity forms the largest component of your portfolio, a sound investing strategy is needed to help navigate the volatility with confidence.

Diversification is Key:

In certain years, equities have performed well. However, during times of macroeconomic uncertainty, equities can encounter headwinds.

Source: Bloomberg; Data as of 31-Oct-2023. Past performance may or may not be sustained in the future.

The impact of the market cycles is not consistent across equity investments; hence advisable to avoid concentrating your investment portfolio. Diversifying the portfolio across market caps, investing styles and asset classes is crucial to mitigate the impact of any fluctuations arising during the election period. For instance, large-cap funds generally may fall lesser when markets are bearish. On the other hand, when the sentiment is positive, investing in a small cap fund can offer opportunities to participate in any market upswings.

What matters is focusing on the underlying fundamentals of your equity portfolio and the true intrinsic value of the investments. Adding a mutual fund schemes that invests in companies with earnings growth and reasonable valuations are likely to weather any market swings.

An anchor for your investment portfolio – Add a Value Fund: Holding or adding on to a value fund that is focused on finding companies that are available at a discount to its intrinsic value makes sense during this time. Value fund provides a margin of safety helping to absorb impact of any negative shocks arising in the equity market due to unfavourable election outcomes. The Quantum Long Term Equity Value Fund, a true-to-label value fund can form as the foundation of your portfolio. The fund has a 17-year track record of identifying undervalued companies with strong fundamentals and integrity using its bottom-up stock selection approach.

To add spark and accelerate you Equity portfolio potential: Add Small Cap Fund. Even within small cap space, there are pockets of value and several bottom-up stories that can translate into an upside for the portfolio. Hence, allocating 10-15% to Quantum Small Cap Fund that has a high-conviction portfolio of quality small cap stocks fits within your diversified equity strategy.

To invest more responsibly and for the good of our planet: Add an ESG Fund. Considering the environmental and macroeconomic challenges that we face, it makes sense to invest in an equity fund that offers growth potential along with focus on ESG parameters (Environmental, Social & Governance) with Quantum India ESG Equity Fund.

Apart from diversification within equities, it is also important to have exposure to other asset classes – following an asset allocation approach with exposure to equity, debt, and gold can smoothen your investing ride. You can make use of our 12|20:80 Asset Allocation Strategy to help you allocate between asset classes and diversify within your equity basket. Visit our Asset Allocation Calculator for helping you with this allocation.

While it’s difficult to predict the outcome of the elections, what can be controlled is to avoid making any knee jerk reaction and stick to a portfolio of strong fundamentals. The key to weathering election-related volatility lies in adopting a diversified equity strategy. Maintain a long-term investment horizon to ride out any short-term volatility and benefit from the long-term growth potential of the Indian economy. In uncertain times, the steadiness of a diversified, disciplined, and patient investment approach remains a beacon for long-term wealth creation.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria |  Investors understand that their principal will be at Very High Risk |

Quantum Small Cap Fund An Open-Ended Equity Scheme Predominantly Investing in Small Cap Stocks | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Planning your Taxes with ELSS? Choose a Predictable Approach to Navigate High Valuations

Posted On Tuesday, Jan 16, 2024

We are in tax planning season. It is also a time when your employer asks you to submit investment

Read More -

Look Beyond Ratings and Returns - Think S.M.A.R.T.

Posted On Wednesday, Dec 06, 2023

Investment decisions based on past returns may not be prudent as it may not be indicative of the potential or future

Read More -

Decoding the Intersection of Elections, Economy & Equity Investments

Posted On Friday, Dec 01, 2023

Elections tend to create short-term volatility and uncertainty in the financial space where it becomes difficult to predict market movements.

Read More