While Chasing Market Rally, Take Cognizance of Risks

Posted On Wednesday, Jul 19, 2023

We are halfway through 2023 and after overcoming challenges such as skyrocketing inflation and aggressive rate hikes in the initial part of this year, Nifty 50 & Sensex broke into new lifetime highs in June (19000 & 64500 levels respectively). The lure of a market rally and the prospect of earning significant returns can be enticing. However, you may have certain questions or concerns for participating in the equity rally:

- Does it make sense to enter equity markets at these levels?

- Should you invest in mid & small cap indices since they have moved up higher than the Sensex?

- Is there more fuel left to the rally or are the markets headed towards a correction?

Through this article, let’s address these concerns & explore the current market scenario and finally delve into steps for strengthening your equity portfolio to arrest downsides in case of a market correction in the future.

1. Be Market Aware

Though markets have moved up, the rally is supported by strong FPI flows of Rs 47,148 crore as per NSDL as of Jun end, cooling inflation (CPI of 4.5% as of May end) and a pause in rate hikes, you must avoid timing the market at this time as predicting market movements may not be easy. History has shown that the equity market is dynamic thereby causing significant changes in stock prices. Market downturns can erode investment portfolios if not managed properly.

Therefore, as equity markets are volatile by nature, going ahead, you need to be vigilant of certain risks as listed below that could negatively affect the financial markets and your investments:

• Frothy valuations: Though S&P BSE midcap and small cap index have move up higher than BSE Sensex, you need to exercise caution when skewing your portfolio to these companies as the valuations have moved up higher. If certain expensive stocks in various sectors fail to meet expectations during the quarterly results, it may lead to a correction.

| Index | MTD (Month-to-date) | PE (Trailing) |

|---|---|---|

| S&P BSE Sensex | 3.60% | 23.92 |

| S&P BSE Midcap | 6.40% | 24.87 |

| S&P BSE Smallcap | 6.90% | 26.06 |

S&P BSE factsheet Data as of June 30, 2023. Past performance may or may not be sustained in the future.

• Possibility of Recession in the US: If there is a recession in the US, it may hurt the export and capex outlook eventually lowering demand. This can slowdown India’s economic growth, the profitability of companies and return on your investments.

• Probability of shortfall in Monsoon: Monsoons are an important factor to keep an eye on which can impact domestic inflation as well as rural demand. Inadequate or unfavourable monsoons can lead to higher inflation, lowering consumption in rural areas. This will negatively impact the overall economy.

• Interest rates Hikes: Going ahead, the prospect of further interest rate hikes cannot be ruled out. Whether the pause will be short-lived or extended is “data dependent. Further rate hikes will weigh on corporate profitability with high price-to-earnings (P/E) multiples, compared to low P/E or value stocks.

2. Strategise to navigate market downturns

Though there are risks facing the global economy and Indian financial markets today, by taking proactive measures to balance the risk-reward dynamics, you can build resilience into your investments.

Adopting a sound investment strategy helps you take advantage of the opportunities, avoid emotional or irrational decision-making and lower downside risks. This can be achieved by diversifying across market caps, investing styles and sectors.

As you may be aware, value and growth are the two dominant styles of investing. Markets are cyclical. Styles come in and out of favour depending on the prevailing macroeconomic indicators. While Value investing has staged a rebound for over two years, it is a wise decision to have a mix of both value and growth oriented investments in your portfolio for risk adjusted returns across market cycles.

A well-diversified equity portfolio is better positioned to weather market downturns as losses in one area may be offset by gains in another.

Value Fund: A steady approach to equity investing that focuses on seeking good quality companies at a bargain. Staying invested in a value fund helps lower the impact of market downturns & capture the opportunities in line with India’s long-term growth. In a current market characterised by broad based economic growth and cooling inflation, value fund have potential to perform well.

Quantum Long Term Equity Value Fund (QLTEVF) with a well-researched & diversified portfolio helps to make investments in rightly valued companies offering room to grow risk-adjusted returns over the long run. It offers a portfolio of quality companies that are discounted below their intrinsic value, providing a margin of safety and hence has a buffer to absorb downward pressure even if the assumptions while buying the stock doesn’t materialise. It holds cash when stocks are overvalued and buys stocks at reasonable valuations relative to their peers and long term average.

ESG Funds: ESG investing has given equity investments a whole new meaning by filtering out companies based on Environmental, Social and Governance factors eventually leading to higher potential for profitability while safeguarding the planet at the same time. Invest in one of India’s first ESG-themed Equity mutual fund – Quantum India ESG Equity Fund with a proprietary ESG scoring model that filters out companies based on 200 parameters of ESG compliance.

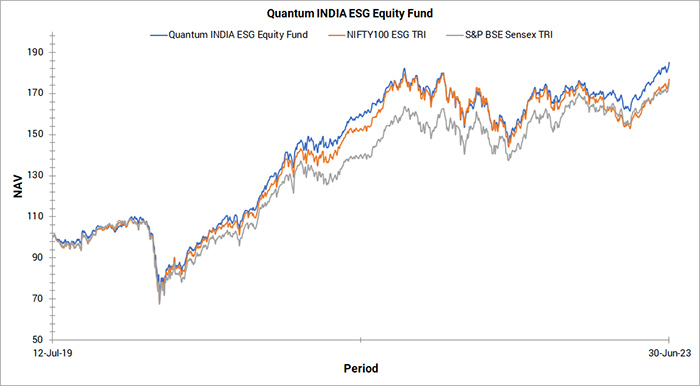

As seen in the graph below, Quantum India ESG Equity Fund with returns of 16.76% CAGR^ since inception is outperforming its benchmark (15.74%) & BSE Sensex TRI (15.17%). Considering the push the Government has placed on sustainability initiatives as outlined in the last budget, this form of equity investing is set to evolved the equity investing landscape and delivered risk adjusted returns over the long term.

Quantum India ESG Equity Fund vs Benchmark

Data as of June 30, 2023. Past performance may or may not be sustained in the future.

The above performance graph to be read in conjunction with the complete fund performance below.

3. SIP to build equity allocation

While participating in the current market rally is an idea worth considering, you can stagger your investments with an SIP to avoid negative impact of any near-term corrections on your investments. SIP helps inculcate financial discipline, prevent emotional decision-making and avoid the temptation to time the markets

Though participating a market rally can be tempting, it is crucial to take cognizance of the risks involved. Navigate the dynamic equity market with greater confidence by adding a diversified portfolio devised using Quantum’s prudent 12|20:80 Asset Allocation Strategy. For more guidance on how to use this Strategy, please explore the Asset Allocation Calculator. A well thought out equity investing strategy, complemented with an SIP, can help build wealth over the long term while mitigating the impact of market downturns.

|

|

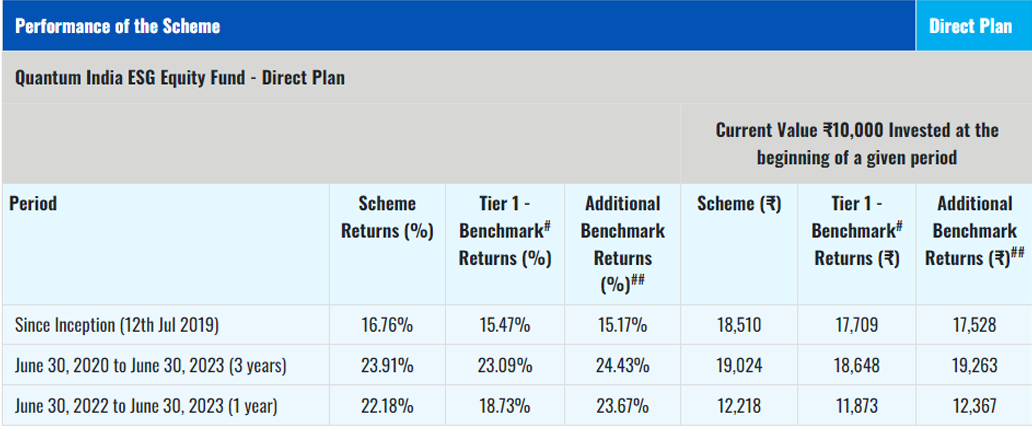

^the above performance to be read in conjunction with the complete performance given below.

Data as on June 30, 2023.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI. Past performance may or may not be sustained in the future.

Load is not taken into consideration in Scheme returns calculation. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The Scheme is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta is the Fund Manager and Ms. Sneha Joshi is the Associate Fund Manager managing the scheme since July 12, 2019.

For other Schemes Managed by Mr. Chirag Mehta please click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Benchmark |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More