Equity monthly view for July 2022

Posted On Thursday, Aug 11, 2022

Equity Markets managed a splendid recovery in the month of July-22. S&P BSE SENSEX moved up by 8.71 % on a total return basis in the month. It has been a global rally with S&P 500 & MSCI World Index moving up by 9.2% and 7.9% respectively. The MSCI EM Index was however a drag with a negative return of -0.17% due to the underperformance of Chinese stock. The broader market has been strong too. S&P BSE Midcap Index moved up by 10.9% for the month & S&P BSE Small cap Index increased by 9.3%. Capital goods & consumer durables were the best performing sector with both the sectoral indices moving up by more than 14%.

After relentless selling in the first half of the calendar year 2022, the FPIs have turned positive for the month of July-22 with a net inflow of US$ 600 mn. Domestic institutional investors (Mutual Funds & Insurance put together) have also been net buyers for the month of July 2022 to the tune of US$ 1.3 bn.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 8.05% in its NAV in the month of July 2022. This compares to a 9.74% increase in its Tier I benchmark S&P BSE 500 & 9.79% increase in its Tier II Benchmark S&P BSE 200. Cash in the scheme stood at approximately 2.5% at the end of the month. The portfolio is attractively valued at 14.2x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 19x FY24E consensus earnings.

Sectors referred above are for illustrative and not recommendation of Quantum Mutual Fund/AMC. The Fund may or may not have any present or future positions in these sectors.

The above information of sectors which is already available in publicly access media for information and illustrative purpose only and not an endorsement / views / opinion of Quantum Mutual Fund /AMC.

The above information should not be constructed as research report or recommendation to buy or sell of any stocks from any sector.

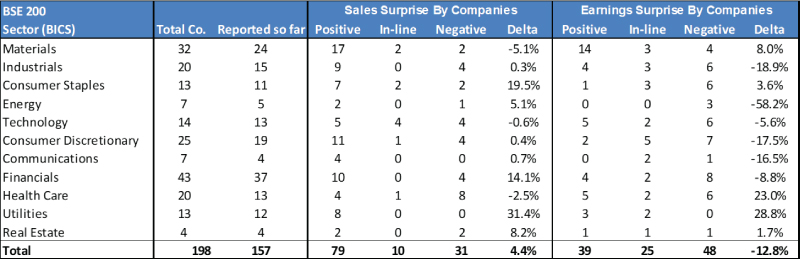

Corporate India has shown remarkable resilience to inflationary pressures in the April -June 2022 quarter as reflected by results declared by 157 of the BSE 200 companies so far. The top line growth has positively surprised the consensus estimates by 4.4% on an aggregate basis. The strongest performers have been Staples, Financials & Utilities. However, the PAT growth has been lower than estimated due to input cost pressure weighing on operating margins. Energy, Industrials & consumer discretionary have seen the biggest miss on earnings amongst the BSE 200 companies. However, with softening commodity prices and a likely pick up in rural demand the pressure on the profit growth is likely to reduce. Companies have gradually passed on the cost increase to ensure margins are protected. Despite some impact of higher prices on consumer discretionary spends, feedback from companies remains optimistic.

Monsoons will be an important near-term trigger for demand. Till the end of July, Southwest Monsoon is 6% above long-term average across the country. However, the distribution has been rather uneven. While the Western & Southern India has received excess rainfall some of the highly populated and large states like Uttar Pradesh, Bihar, Jharkhand & West Bengal states are seeing deficient rains. There could be a near term demand impact in these states due to deficient rains.

Past performance may or may not be sustained in the future

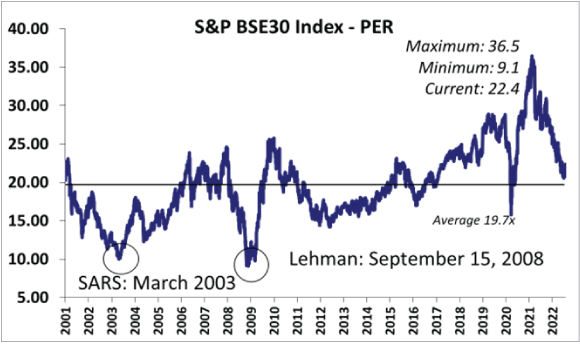

The valuation over the last six-seven months have become a lot more comfortable both for Sensex & the broader markets. In fact, the PE (price to earning) ratio for Sensex is very close to its long-term average of 19.7x. This is despite a stupendous rally in the month of July.

Geopolitical challenges, inflation. rising interest rates & social media hullabaloo on a possible U.S recession next year can make investors nervous to sell into the current rally. However, these are times for investors to stay the course in their investment journey to achieve their long-term financial goals. Equity investors should stagger their allocation to equity over a period & move the asset allocation to the optimum level as defined by their asset allocation plan.

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II Benchmark |

Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on July 31, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on July 31, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Turn your Values into Wealth with our latest NFO

Posted On Thursday, Nov 21, 2024

When the Greek king Midas was granted a wish, he got greedy and asked for everything he touched to turn to gold.

Read More -

Equity Monthly View for October 2024

Posted On Friday, Nov 08, 2024

Indian markets declined in the month of October to the tune of 5.7%.

Read More -

Equity Monthly View for September 2024

Posted On Monday, Oct 07, 2024

Indian markets continued to well in September. There are some signs of weakness in the mid/small cap pockets

Read More