Invest in Financial Freedom with This Multi Asset Fund

Posted On Tuesday, Aug 13, 2024

Just as India’s freedom was marked by resilience, strategic planning, and unity, the journey to financial independence requires thoughtful investment choices that secure long-term prosperity.

A Wealth of Opportunity

A multi-asset investment embodies this spirit of financial freedom, offering a diversified investment approach that mirrors the strength found in unity. By pooling investments across various asset classes, such as equity, debt, and gold, a multi-asset investment provides a balanced and resilient strategy, much like the unity in diversity of our nation.

A Diverse Tapestry

Financial markets, like India's cultural tapestry, have a dynamic interplay. The markets sway between growth and recessionary phases. This necessitates a diversified investment approach. Asset classes within a portfolio demonstrate divergent performance trajectories. No single asset class can predictably outperform across all market conditions. Equities, bonds, and gold each possess unique risk-return profiles. Consequently, a well-diversified portfolio, has a harmonious blend of these asset classes. A strategic Multi Asset investment approach, much like India's cultural diversity, fosters resilience and adaptability in the face of changing economic landscapes.

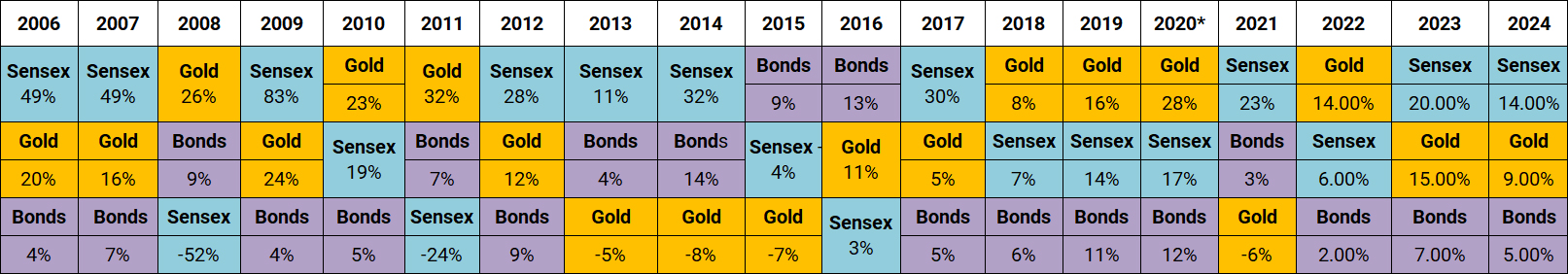

The chart ranks the best to worst performing indexes per calendar year from top to bottom

Past performance may or may not be sustained in future.

Indices Used: BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

Equities outperformed the indices 10 times,

Gold outperformed the indices 7 times,

Bonds outperformed the indices 2 times.

Step into the circle of winners by investing in the top performing asset class with a Multi-Asset approach!

Quantum Multi Asset Fund of Funds

The Quantum Multi Asset Fund of Funds is a dynamic, based on research backed asset allocation. The Fund invests across multiple asset classes predominantly in the schemes of Quantum Mutual Fund whose underlying investments are in equity, debt, money market instruments, and gold. The Quantum Multi Asset Fund of Funds is:

- A model that takes into account various economic factors and valuations.

- With a Fund manager who strategically positions the portfolio to generate risk-adjusted returns.

- Periodically rebalanceed to buy low and sell high.

Limit your downside risk by investing in this truly balanced Fund.

More Dynamic and Resilient Option than FD’s

In today’s dynamic financial landscape, traditional investment options like fixed deposits (FDs) in banks, while considered safe, often fall short in delivering inflation adjusted returns. Fixed deposits offer a guaranteed returns but not linked with the market linked return which, when adjusted for inflation, often results in lesser real growth of investments.

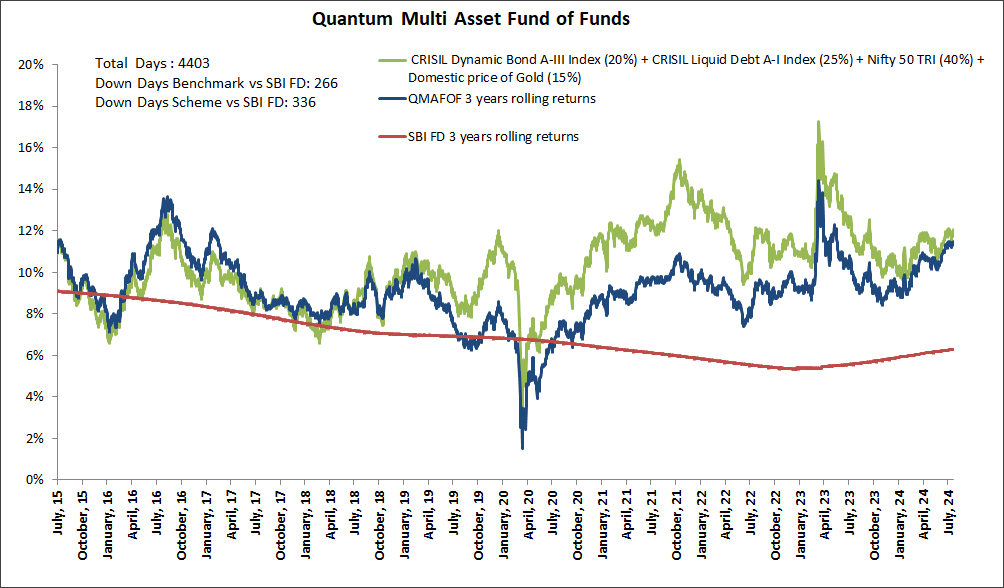

Consider investing in a diversified Mutual Fund - Quantum Multi Asset Fund of Funds (QMAFOF) which has a 12 year track record of skilfully navigating market uncertainty by diversifying across the three asset classes of equity, debt and gold. It has been observed that QMAFOF has historically given better returns than FDs over the long term (3 years and above). As you can see in the charts below, the fund has performed better than the 3 year rolling FD return.

Unlike Fixed Deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds. Investments in Quantum Multi Asset Fund of Funds as compared to Fixed Deposit carry “moderately” high risk and is subject to market risk. This graph / performance to read in conjunction with the detailed performance of the scheme provided below.

Quantum Multi Asset Fund of Funds are actively managed, with fund managers making strategic adjustments to the asset allocation in response to economic shifts, interest rate changes, and market trends. This proactive management helps to optimise returns and reduce risks, ensuring that the portfolio remains aligned with the investor's financial goals.

So, if you’re looking for an option for better risk-reward potential than a 3-year FD, start investing in the Quantum Multi Asset Fund of Funds, today.

The Quantum Multi Asset Fund of Funds should again start attracting investors who want to look out for a better option to Fixed Deposits which have been a losing proposition and hampered due to tax changes earlier. Instead of getting distracted by the short-term market uncertainty it would be better for the investors to focus on the fundamentals.

Wrapping up,

In essence, the Multi Asset Fund of Funds is more than just an investment vehicle; it is a reflection of multi assets strength through diversity, making it an ideal choice for those who wish to secure their financial future through diversification.

|

|

| Quantum Multi Asset Fund of Funds | as on July 31, 2024 | |||||||

| Quantum Multi Asset Fund of Funds - Direct Plan - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## | ||

| Since Inception (11th Jul 2012) | 10.06% | 10.88% | 15.15% | 31,767 | 34,740 | 54,802 | ||

| 10 years | 9.47% | 10.58% | 13.58% | 24,736 | 27,365 | 35,777 | ||

| 7 years | 9.69% | 11.31% | 15.43% | 19,113 | 21,182 | 27,327 | ||

| 5 years | 11.35% | 12.82% | 18.26% | 17,128 | 18,286 | 23,147 | ||

| 3 years | 11.34% | 11.88% | 17.24% | 13,812 | 14,013 | 16,131 | ||

| 1 year | 17.83% | 16.94% | 24.38% | 11,788 | 11,699 | 12,445 | ||

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%). w.e.f. April 3, 2023, benchmark of the scheme has been changed.

It is a customized index and it is rebalanced daily. ##BSE Sensex TRI

Click here for other schemes managed by Chirag Mehta Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund Tier I Benchmark : CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold |  Investors understand that their principal will be at High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The investors of Quantum Multi Asset Fund of Funds will bear the Scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment (subject to regulatory limits).

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More