Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face fluctuations, influenced by global and domestic factors. Economic and policy analysts anticipate that the US Federal Reserve may begin its rate-cut cycle this month. Historically, such rate-cut cycles have had mixed results on equity markets.

Investors must be mindful that market cycles are an inevitable part of investing. Whether it is the bull market’s euphoria or the bear market’s gloom, these cycles are a reminder that market fluctuations are part of the investment journey.

While market fluctuations may be disconcerting, they are a natural aspect of investing and present both challenges and opportunities. To overcome market uncertainties, a strategic and calibrated approach to investing may be adapted.

The Multi-Asset Approach - A Solution?

In times of uncertainty, having a multi-asset approach becomes essential as it offers exposure to multiple asset classes, each moving through its own cycles.

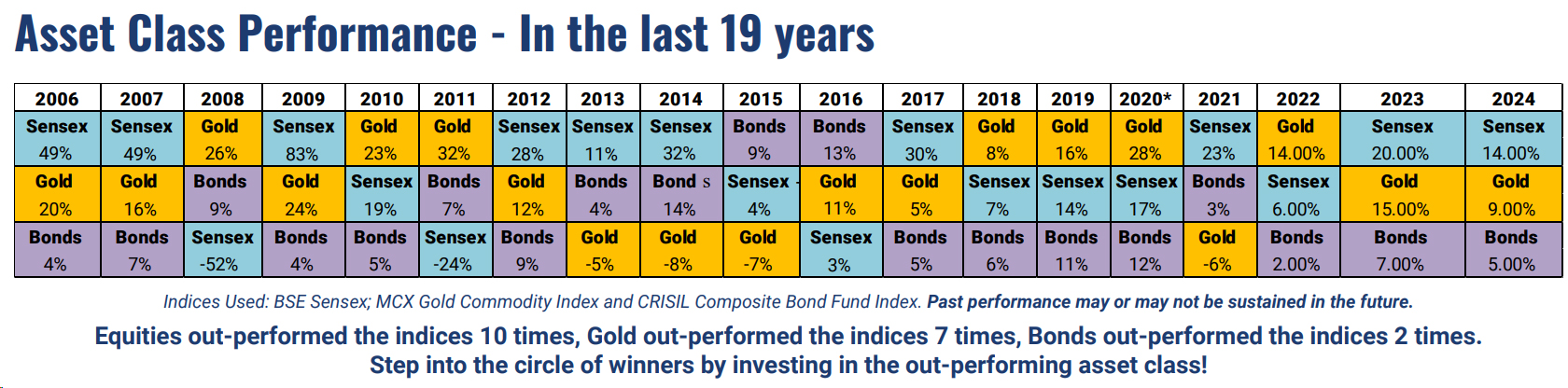

Historically, different asset classes have succeeded in different years: equities during strong market run, bonds during periods of uncertainty, and gold during market turmoil. Because these asset classes move through their own cycles, their peaks and troughs rarely align.

The chart ranks the best to worst performing indexes per calendar year from top to bottom

Past performance may or may not be sustained in future.

Indices Used: BSE Sensex Total Return Index, MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

Lower Drawdown with a Multi-Asset Approach

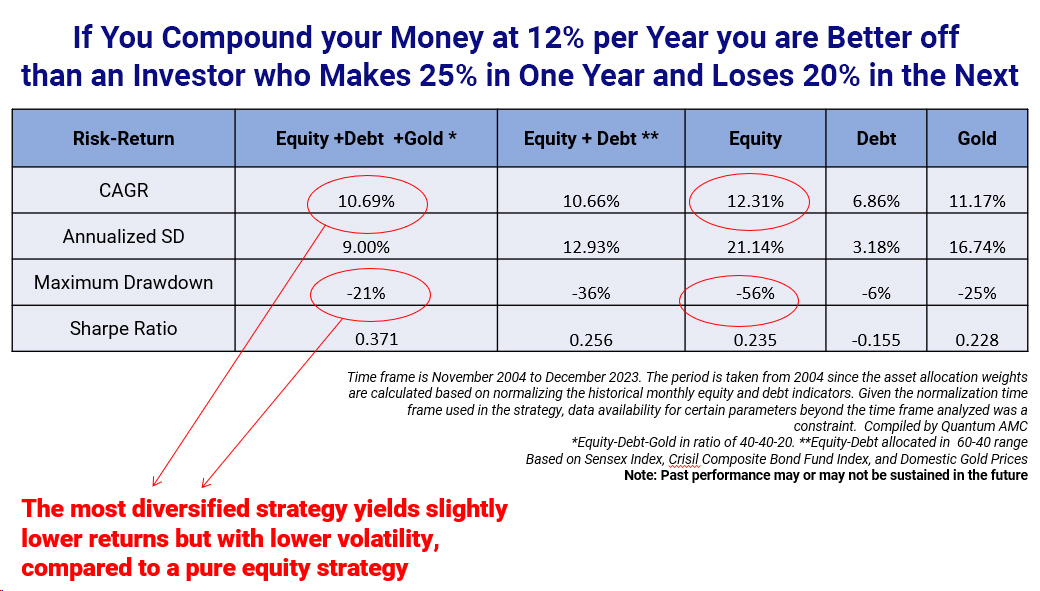

When it comes to investing, equities might be a long-term approach to create wealth over time and beat inflation. But equity investments also have drawdowns. These can be defined as a decline in value from a stock’s maximum point up to its lowest point before recovering.

As a matter of fact, markets move in cycles, so no asset class always wins. When equities underperform, debt and gold often step in to provide stability and support the portfolio.

Therefore, a well-diversified strategy that includes a mix of equities, stable debt, and gold allocation. Which can achieve comparable returns with controlled fluctuations than a pure equity approach.

In general, multi-asset approaches (like combining equity, debt, and gold) tend to have lower drawdowns compared to pure equity investments. Thus, it reduces the portfolio’s overall risk and enhances the returns.

Another important point to note is that different asset classes in a multi-asset approach, - when one asset class is not performing well, the others may perform better, which helps in reducing the overall impact of underperformance of one asset class.

Thus, the benefits of a diversified approach become particularly evident during periods of market fluctuations, as when equities face fluctuations, bonds or gold can offer a stabilising effect.

The main reason for using a diversified strategy is that it is nearly impossible to predict which asset class will perform best next or to time the market perfectly, especially since the economic landscape is always changing. Instead, a good asset allocation approach helps avoid trying to time the market and keeps investment portfolios well-checked.

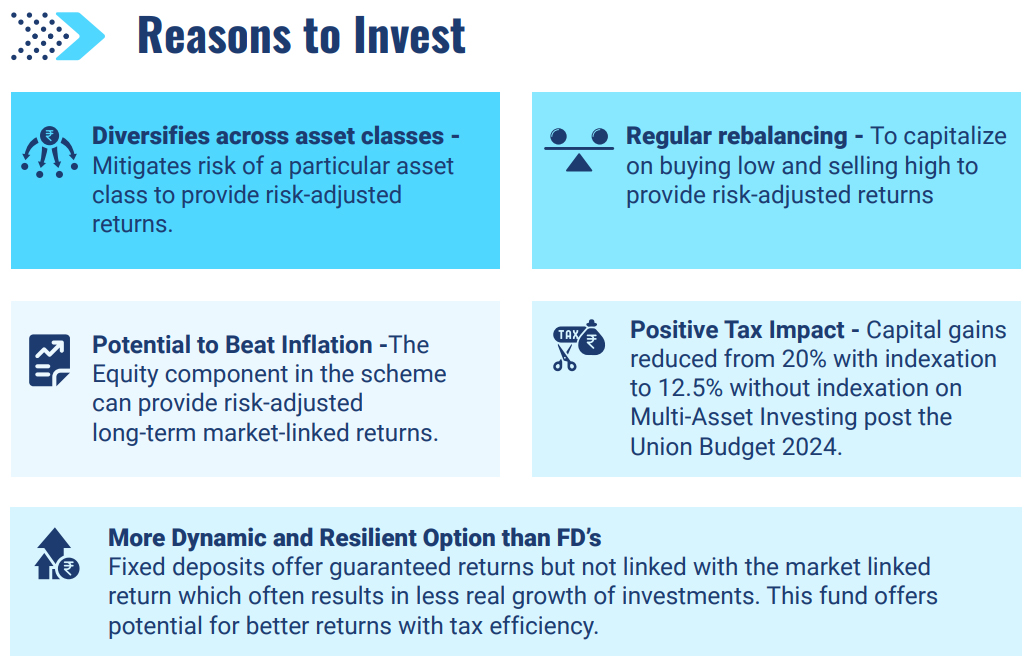

One can certainly implement a multi-asset approach on their own. But, analysing, making investment decisions, and regularly rebalancing can be cumbersome. For those who prefer a simpler solution with professional management and less hassle, a Readymade Solution like the Multi-Asset Fund of Funds could be an option.

Quantum Multi Asset Fund of Funds: A Smart Choice in Uncertain Times

Explore a single investment with the power of 3 - Equity, Debt and Gold.

Quantum Multi Asset Fund of Funds (QMAFOF) has a 12-year track record of skilfully navigating market uncertainty by diversifying across the three asset classes of equity, debt and gold. QMAFOF seeks to have an effective asset allocation among these three asset classes. It seeks to achieve better returns over longer periods. Downturns of one asset class are generally balanced with the upturns of another asset class: this principle gives the fund an opportunity to provide a more stable investment experience.

The fund’s management uses a proprietary model that takes economic indicators and valuations as input and dynamically changes the portfolio to maximise returns and minimise risk.

Through regular rebalancing, the fund takes advantage of the market swings to buy low and sell high, thus increasing risk-adjusted returns and limiting the downside risk.

Invest smartly in these uncertain times with Quantum Multi Asset Fund of Funds!

Despite equities being the most preferred asset class, it is equally important to understand the advantages of other asset types. There is a season for each of the asset classes to be utilised, hence ensuring that there is stability and growth in a well-diversified portfolio. By rationally participating in a variety of asset classes according to your risk profile, you can reap the advantages of a balanced Multi Asset Investing strategy.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund Tier I Benchmark : CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold |  Investors understand that their principal will be at High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More