India's True Independence Shines Amid Global Economic Shifts

Posted On Friday, Aug 11, 2023

In today's rapidly evolving world, where economic dynamics are constantly undergoing seismic changes, India emerges as a resolute beacon of resilience and growth. Despite recent global developments, including the US debt downgrade, which led to a momentary decline in the equity market, India's economic strength remains unwavering. The country’s economic indicators have retained their stability, showcasing resilience and independence.

Embracing India's Growth Story with Equity Investments

India's growth narrative continues to surpass expectations, propelling it onto the global stage.

Though benchmark indices Nifty 50 and Sensex had a minor setback due to the sentiments of global markets, the broader markets performed well.

Indicators in favour of India’s growth narrative:

- Inflation within tolerance level: Though temporarily inflation may inch higher due to high food prices such as tomatoes and cereals, the average is still likely to be within RBI’s target range.

- Strong Flows: While FIIs were net buyers to the tune of Rs. 13,922.01 crores in the month of July, till date as of Aug 9th, they have sold shares worth Rs. 4804.47 crorers. However, DIIs have supported the domestic markets and have bought shares worth net Rs. 4149.49 crores. Even though FIIs can be quite volatile, India’s enduring economic resilience and policy stability in contrast to other EMs will continue to remain robust, thereby attracting FII flows in the medium term.

- Services growth: Indian Services PMI experienced a remarkable upswing, reaching to a 13-year high in July.

- Decreasing Unemployment: Unemployment rate decreased to 7.95% in July, down from the June figure of 8.45%, due to the increased demand in agricultural sectors after the good progress in monsoon.

- Growing GST collection: The government GST collection continues to be robust in July, surpassing Rs.1.65 trillion mark, 11% higher as compared to the same period last year.

Take advantage by investing in a diversified portfolio of equity investments and gold, particularly within India's current economic climate where growth on an ascendant trajectory.

Diversified Equity Portfolio: A mix of Value and Growth

Equity market tends to go through cycles. While Value investing tend to invest in matured companies that offer relative stability, growth style invests in companies that are geared for growth sooner rather than later. By investing in a mix of value and growth style of investing, you can have the potential to generate risk adjusted returns over the long term. Quantum Mutual Fund has a winning combination of equity funds to help strengthen your portfolio.

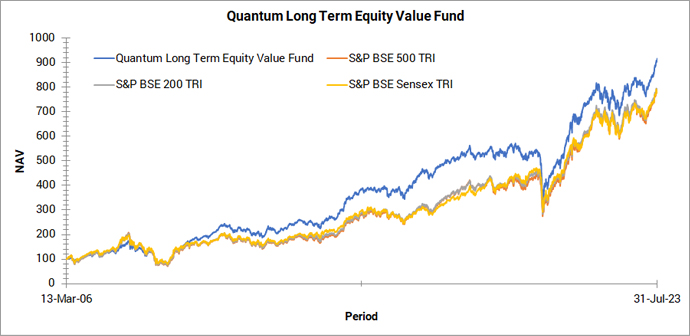

Invest in Quantum Long Term Equity Value Fund that has outpaced both tier-1 & tier 2 benchmarks: QLTEVF offers a return of 13.58% CAGR since inception versus its benchmark S&P BSE 500 of 12.57% & S&P BSE 200 (12.64%) and Sensex (12.54%).**

Data as of July 31 2023. Past performance may or may not be sustained in the future. The above table is to be read in conjunction with complete performance given below.

Further strengthen your equity portfolio with Quantum India ESG Equity Fund, one of India’s first ESG themed equity fund generating risk adjusted returns over the long run. Quantum India ESG Equity Fund has delivered CAGR Returns – 17.24% CAGR since inception (Benchmark Nifty 100 ESG TRI (15.81%) and Sensex (15.65%).**

Gold: A Path to Financial Freedom

Incorporating gold into your investment portfolio can augment its resilience and contribute to long-term stability, fortifying your portfolio. Gold generally has a negative correlation with equities and helps safeguard your portfolio from the equity market stress during uncertain times.

Key Takeaways

We believe Fitch’s downgrade of US rating would have only a limited impact on India’s real economy.

India's capacity to withstand such challenges stands as a testament to its unwavering economic framework.

Be a part of India's unwavering trajectory and make your way towards sustainable growth with Quantum Mutual Fund. Visit our Asset Allocation Calculator to know how to balance your investments as per Quantum’s tried and tested 12|20:80 Asset Allocation Strategy

|

|

**The above performance to be read in conjunction with the complete fund performance below.

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Direct Plan - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark # Returns (%) | Tier 2 - Benchmark ## Returns (%) | Additional Benchmark ### Returns (%) | Scheme Returns(₹) | Tier 1 - Benchmark # Returns (Rs.) | Tier 2 - Benchmark ## Returns (Rs.) | Additional Benchmark ### Returns (Rs.) |

| Since Inception (13th Mar 2006) | 13.58% | 12.57% | 12.64% | 12.54% | 91,650 | 78,491 | 79,364 | 78,073 |

| July 31, 2013 to July 31, 2023 (10 years) | 14.58% | 15.98% | 15.69% | 14.60% | 39,017 | 44,084 | 42,995 | 39,099 |

| July 29, 2016 to July 31, 2023 (7 years) | 11.03% | 14.29% | 14.20% | 14.47% | 20,825 | 25,505 | 25,357 | 25,787 |

| July 31, 2018 to July 31, 2023 (5 years) | 11.24% | 13.49% | 13.38% | 13.42% | 17,035 | 18,837 | 18,743 | 18,773 |

| July 31, 2020 to July 31, 2023 (3 years) | 24.35% | 25.15% | 24.13% | 22.38% | 19,230 | 19,602 | 19,125 | 18,329 |

| July 29, 2022 to July 31, 2023 (1 year) | 18.65% | 17.31% | 16.09% | 16.93% | 11,876 | 11,741 | 11,618 | 11,703 |

Data as on July 31, 2023.

# S&P BSE 500 TRI ## S&P BSE 200 TRI ### S&P BSE Sensex TRI. Past performance may or may not be sustained in the future.

Load is not taken into consideration in Scheme returns calculation.

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier I benchmark has been updated as S&P BSE 500 TRI.

As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006. ##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Scheme is co-managed by Mr. George Thomas & Mr. Christy Mathai. Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022. Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022. For other Schemes Managed by Mr. George Thomas & Mr. Christy Mathai please click here

| Performance of the Scheme | Direct Plan | |||||

| Quantum India ESG Equity Fund - Direct Plan | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (12th Jul 2019) | 17.24% | 15.81% | 15.65% | 19,070 | 18,139 | 18,036 |

| July 31, 2020 to July 31, 2023 (3 years) | 22.52% | 20.82% | 22.38% | 18,390 | 17,637 | 18,329 |

| July 29, 2022 to July 31, 2023 (1 year) | 15.69% | 10.04% | 16.93% | 11,579 | 11,009 | 11,703 |

Data as on July 31, 2023.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI. Past performance may or may not be sustained in the future.

Load is not taken into consideration in Scheme returns calculation. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The Scheme is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta is the Fund Manager and Ms. Sneha Joshi is the Associate Fund Manager managing the scheme since July 12, 2019.

For other Schemes Managed by Mr. Chirag Mehta please click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Benchmark |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More