How to Structure Your Portfolio Given an Imminent Global Economic Slowdown

Posted On Tuesday, Feb 21, 2023

The Indian equity markets, as you may have experienced, have been quite volatile of late. The bears seem to be tightening their grip given the global economic uncertainty. The World Bank and the International Monetary Fund (IMF) have forewarned of a global recession (a significant global economic slowdown).

“Given fragile economic conditions, any new adverse development—such as higher-than-expected inflation, abrupt rises in interest rates to contain it, a resurgence of the COVID-19 pandemic, or escalating geopolitical tensions—could push the global economy into recession” states the World Bank in the press release of its latest Global Economic Prospects report. The global economy is projected to grow by 1.7% in 2023 and 2.7% in 2024, as per the World Bank.

What are the economic trends to watch and where is the market headed? Get answers to these questions and learn how you should safeguard your portfolio.

Global slowdown and implication for India

With regards to the emerging market and developing economies (EMDEs) excluding China (which is estimated to grow at 4.3% in 2023, 0.9% lower than the previous forecast), growth is expected to decelerate from 3.8% in 2022 to 2.7% in 2023, reflecting significant weaker demand compounded by high inflation, currency depreciation, tighter financing conditions, and other domestic headwinds, according to the World Bank.

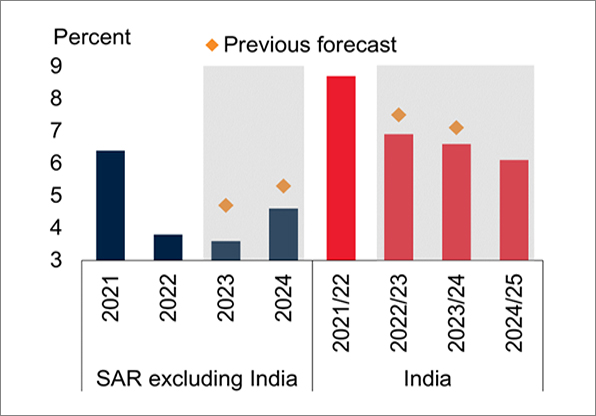

Graph 1: GDP Growth: South Asia Region excluding India, and India

Note: “Pre-pandemic” based on the January 2020 Global Economic Prospects report. “Previous forecast” reflects June 2022 Global Economic Prospects report.

(Source: World Bank)

India in a relatively better position

But India (which accounts for three-fourth of the South Asian Region’s output and is estimated to grow at 6.6% in FY23 before falling back towards its potential GDP rate of just above 6%) is in a better position and likely to see a limited impact of the projected global economic slowdown, states the World Bank. India is expected to be the fastest-growing economy of the seven largest EMDEs.

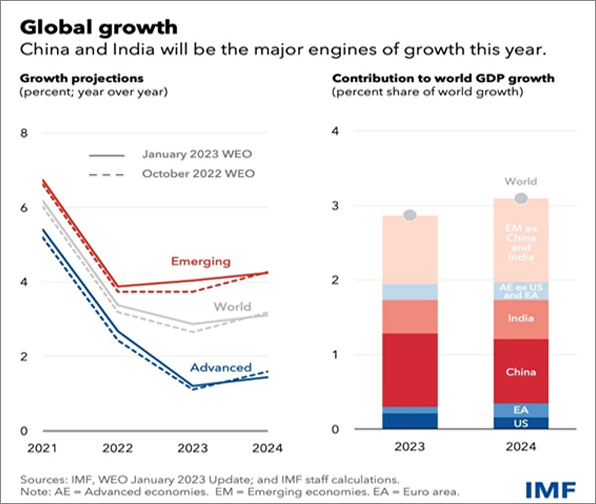

Even the IMF, sees India as a “bright spot”. Together with China (which is likely to benefit from sudden re-opening after months of COVID-19 restrictions) it will account for half of the global growth this year, versus just a tenth for the US and Euro area combined.

Graph 2: IMF’s projection of global economic growth

(Source: IMF)

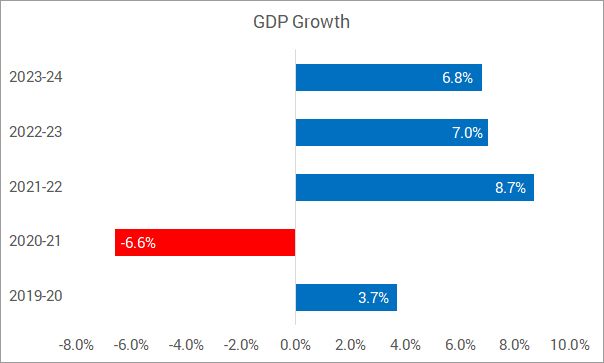

India’s GDP Projected to grow at 6.5% in real terms in FY 24

Even India’s Economic Survey 2022-23 has forecasted India’s GDP to grow around 6.0% to 6.8% in FY24, depending on the trajectory of economic and political developments globally. This year, i.e., FY23, GDP is estimated to grow at 7.0% (in real terms), while in FY24 at a baseline of 6.5% in real terms (broadly in line with World Bank and IMF’s estimates) as credit disbursals and capital investment cycle is expected to unfold in India with strengthening of balance sheets of corporates and banking sector.

Graph 3: India’s GDP growth as per Economic Survey 2022-23

(Source: Economic Survey 2022-23)

That being said, there are certain risks or challenges as warned by the forecasters emanating from:

1. Loss in exports on account of slowing economic growth

2. The elevated headline and core CPI inflation globally

3. Potential supply chain disruptions that could push commodity prices higher

4. Likelihood of further increase in policy interest rates by central banks, particularly the U.S.

5. Higher borrowing costs

6. Depreciating Indian rupee (INR) against the U.S. Dollar (USD)

7. Widening of Current Account Deficit (due to higher commodity prices and vulnerable INR)

8. Historically high debt-to-GDP ratio

9. Future waves of coronavirus

10. Rise in social unrest and geopolitical tensions in many parts of the world [Persisting Russia-Ukraine conflict, Strained relations between China-Taiwan relations aren’t good; India-China are at the loggerhead at the Line of Actual Control (LAC); North Korea is provocative with its missile launches (plus the gulf has its internal conflicts]

In such times, the re-pricing of risk in global financial markets is high and Indian equity markets may remain vulnerable. The impact of all this could be seen on the earnings of companies, plus end up upsetting business and consumer confidence, among other things.

What should be your investment strategy?

To mitigate the potential risk involved, follow a sensible asset allocation.

Asset allocation - which refers to parking your investible surplus in equity, debt, and gold or even holding cash-and-cash equivalents for that matter - will serve to be the cornerstone of investing and shall play a pivotal role in the year 2023 (and beyond).

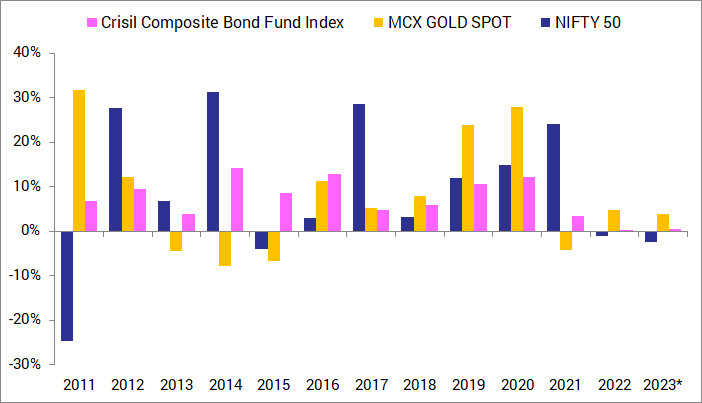

Graph 4: Performance of equity, debt, and gold

Data as of January 31, 2023

(Source: ACE MF, MCX).

The returns are expressed in ‘absolute’ terms for respective calendar year.

Past performance may or may not be sustained in the future.

As depicted by the graph above, there have been years when equities have rewarded investors with stellar returns and at times, disappointed investors - like in the years 2011, 2015, and 2018. Given the challenges of 2023, it is difficult to estimate what kind of returns equities would generate this year, and hence tactical asset allocation makes sense.

For tactical asset allocation, you may consider investing in a Multi-Asset Fund. Under this type of fund, your money is invested mainly in three asset classes: equity, debt, and gold, depending on how the fund manager perceives the outlook for these asset classes. So, in a way, it saves you the trouble of rebalancing at your end and makes portfolio tracking easy. But you ought to have a moderately high risk and an investment time horizon of 3 to 5 years before investing in a Multi-Asset Fund.

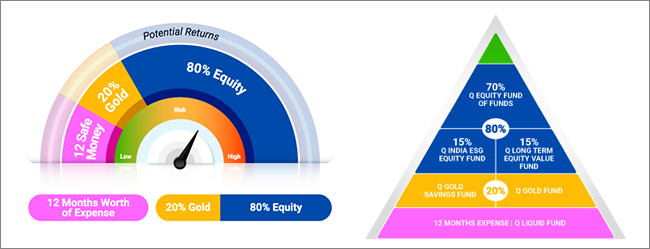

Image: 12|20:80 Asset Allocation

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Alternatively, you can follow our tried and tested 12| 20:80 Asset Allocation Strategy (Barah Bees Aur Assi). using active or passive funds to help you reach your financial goals and reduce risk of downside.

Explore our handy Asset Allocation Calculator based on this Strategy. This tool allows you to create a diversified investment basket across three asset classes of Equity, Debt and Gold offering the mix of protection, diversification and growth in just a few clicks!

Be a thoughtful investor and safeguard your portfolio to stay ahead of global recessionary pressures.

Happy Investing!

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

How to Structure Your Portfolio Given an Imminent Global Economic Slowdown

Posted On Tuesday, Feb 21, 2023

The Indian equity markets, as you may have experienced, have been quite volatile of late.

Read More