About The Fund

The Quantum Gold Fund (QGF) invests in Physical Gold. It offers investors an innovative and cost-efficient way to invest in gold any making charges or storage hassles. Each unit of the QGF will be approximately equal to price of 1/100th of 1 gram of Gold. QGF provides investors with an excellent way to diversify their portfolio and adopt prudent asset allocation, by holding units of smaller denominations at minimal cost

Please note that you need a demat trading account to invest in QGF.

5 Reasons to invest in the Quantum Gold Fund

1. Affordable: Only Gold ETF where 1 unit represents 1/100th of 1 gram of gold.

2. Pure: Backed by gold of 0.995 finesse.

3. Convenient: Call your broker to buy ‘QGOLDHALF’ (S&P BSE & NSE code) like an equity share through your trading account.

4. Value: Trades like an equity share on the exchange - in tandem with the domestic gold price.

5. Protection: Gold is stored in a secured vault and insured.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

Click here to view Tracking Error and Tracking Difference

Click here to view Norms for Market Making Framework

How To Invest

Since the scheme is listed on Stock Exchange (BSE and NSE), please contact your Demat Service Provider/Stock Broker for Investing . Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Gold Fund ETF

(An Open Ended Scheme Replicating / Tracking Gold)

Tier I Benchmark : Domestic Price of physical gold -

This product is suitable for investors who are seeking*

• Long term returns

• Investments in physical gold

-

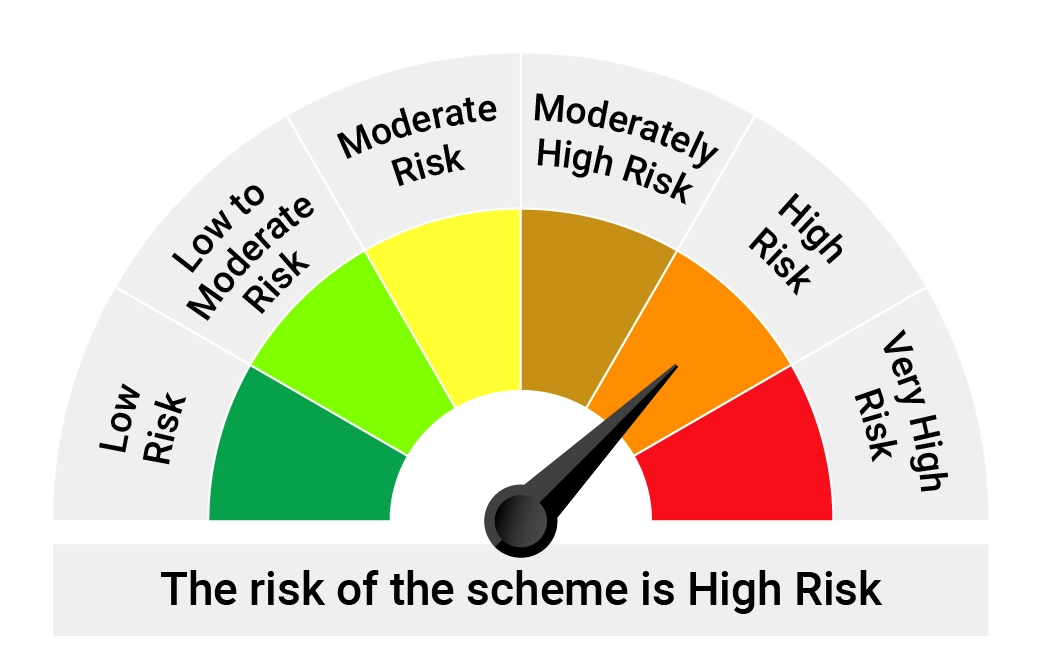

Risk-o-meter of Scheme

-

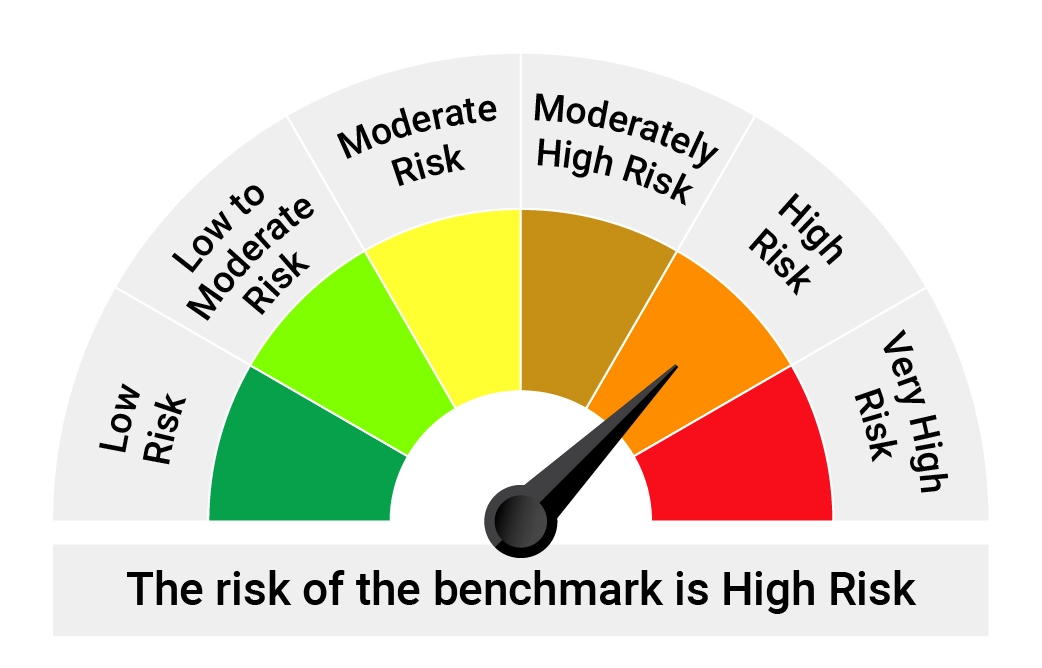

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Sep 30, 2025

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on Sep 30, 2025

Frequently Asked Questions

Gold ETFs are Investment vehicles that invest in physical gold. They aim to track the price of gold and generate returns in line with the returns of physical gold subject to expenses and tracking error.

Investors looking to invest in gold and diversify their portfolios can consider investing in Gold ETFs. As one of the most price efficient, secure, liquid, regulated and accessible gold investment avenues available today, gold ETFs can be a good choice to build a 10-15% gold allocation. Those who do not wish to open a DEMAT account or to time the markets, can opt for gold mutual funds which invest in Gold ETFs and use the SIP option.

Gold ETFs combine the flexibility of stock investment and the simplicity of gold investments. Gold ETF units are listed and traded on stock exchanges. You can buy and sell gold ETF units using a DEMAT account just as you would trade in stocks.

• Accessible and pure: Each unit of the Gold ETF represents 0.01 grams of 24 carat physical gold.

• Price efficient and liquid: Investors in Gold ETFs do not bear any making charges or high premiums associated with physical gold. Gold ETFs are traded on the exchange close to the prevailing market price of physical gold.

• Secure and convenient: Underlying gold is stored in a secured vault and insured. Investors can buy or sell Gold ETF units through a DEMAT account