About The Fund

The Quantum Multi Asset Allocation Fund aims to diversify your portfolio across three major asset classes i.e. Equity, Debt and Gold to reduce dependence on a single asset class & deliver better risk-adjusted returns over the long run. While Equity investments have the potential to generate capital appreciation over time, Debt investments add stability to your portfolio & Gold plays the role of a strategic diversifier as it generally has an inverse correlation with Equities. This Fund helps combine the benefits of 3 asset classes with 1 single investment to achieve your long-term goals with peace of mind.

Enjoy the benefits of having a Fund Manager who periodically rebalances the portfolio to capitalize on opportunities across market cycles. Investors who do not have the time or the expertise to manage a diversified portfolio on their own can take advantage of this actively managed fund.

5 Reasons to Invest in Quantum Multi Asset Allocation Fund

-

1. Dynamic research backed asset allocation.

-

2. Smarter option to a Bank Fixed Deposit.

-

3. Periodic rebalancing to buy low and sell high.

-

4. Tax efficient rebalancing and indexation benefits.

-

5. Potential for good risk adjusted returns.

To know more about the Post Budget Tax Implications on this fund - Click Here

Fund Features

Investment Objective

The investment objective of the Scheme is to generate long term capital appreciation/income by investing in a diversified portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments.

Benchmark

Tier I: NIFTY 50 TRI (40%) + CRISIL Short Term Bond Fund AII Index (45%) + Domestic Price of Gold (15%)

Type of Scheme

An Open-Ended Scheme Investing in Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments

Plans Available

The Scheme offers two Plans - Direct Plan & Regular Plan – Investment Through Distributor. Each plan offers – Growth Option

Minimum Application Amount

500 / SIP - 100 (Daily) & 500 (Weekly, Fortnightly, Monthly & Quarterly)

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

Funds Managed:

Qualification:

- B.Com Degree, CA Inter, Pursuing CFA

Qualification:

- B.Com Degree, CA (Institute of Chartered Accountants of India)

Portfolio

Product Label

-

Name of the Scheme and Benchmark

Quantum Multi Asset Allocation Fund

(An Open-Ended Scheme Investing in Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments)

Tier I Benchmark: NIFTY 50 TRI (40%) + CRISIL Short Term Bond Fund All Index (45%) + Domestic Price of Gold (15%) -

This product is suitable for investors who are seeking*

• Long term capital appreciation and current income

• Investment in a Diversified Portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments

-

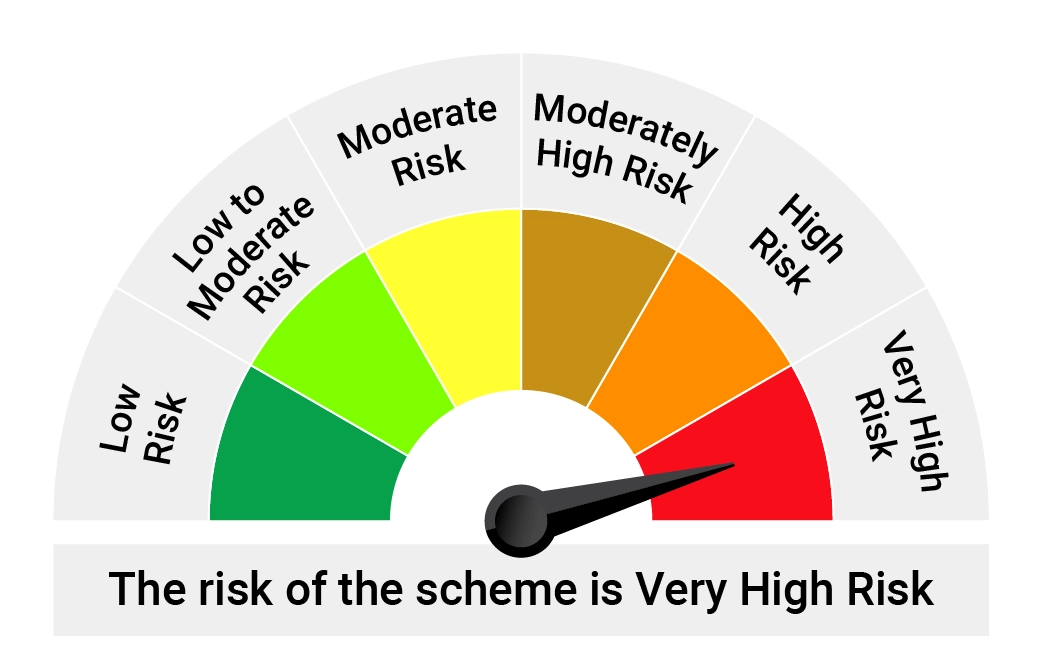

Risk-o-meter of Scheme

-

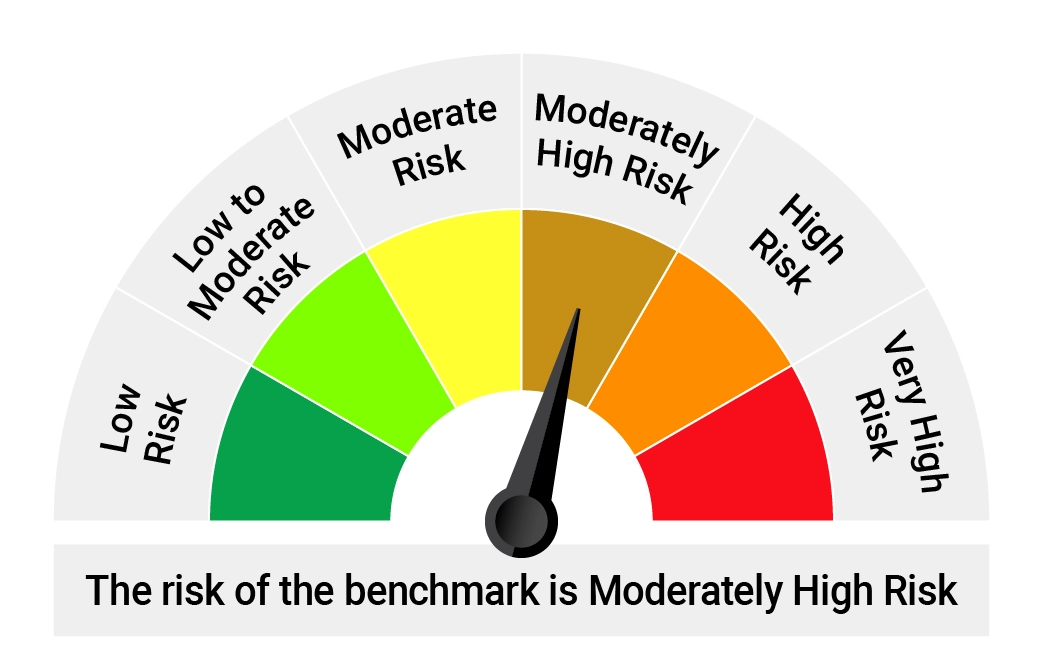

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Frequently Asked Questions

A Multi-Asset Allocation fund is a type of mutual fund that invests in a variety of asset classes, such as equities, fixed income and gold. Equities offer potentially high returns but with higher volatility. Fixed income provides steadier income and lower volatility.

Gold can offer diversification and safeguard against certain market conditions.

The goal of these funds is to provide investors with a diversified portfolio that can help to reduce risk. Generate good risk adjusted returns and achieve long-term investment goals.

Multi-Asset Allocation fund can be suitable for a wide range of investors, including:

a) Balance risk & reward: Those seeking downside protection and a balanced approach with lower volatility than pure equity investments without compromising on the growth potential may benefit from this fund.

b) Retirement Savers: Individuals saving for retirement may appreciate the risk management and inflation-beating features of Multi-Asset Allocation fund, especially as they approach retirement age and seek to preserve capital.

c) Novice Investors: Those who are new to investing may find this fund attractive due to the professional management and measured exposure to equities that they offer.

d) Investors Seeking Diversification: Investors looking to diversify their portfolios beyond traditional equity and fixed-income investments can benefit from the dynamic Asset Allocation diversification provided by Multi-Asset Allocation fund.

e) Individuals with Limited Time or Expertise: Investors who lack the time, knowledge, or expertise to construct and manage a diversified investment portfolio on their own may find this fund convenient and effective.

f) Option to an FD: Investors looking to cope with inflation better than traditional Bank Fixed Deposits along with indexation benefits at time of taxation may find Multi-Asset Allocation funds suitable for achieving these objectives.

Multi-Asset Allocation fund offer several advantages for investors:

a) Diversification: One of the primary benefits of Multi-Asset Allocation fund is diversification. By investing across Multiple asset classes such as stocks, bonds, and gold, the fund spread risk and reduce exposure to any single asset class. This diversification can help mitigate the impact of market volatility and potentially enhance risk-adjusted returns.

b) Risk Management: Multi-Asset Allocation fund is designed to manage risk effectively. By investing in a mix of assets with different risk profiles, fund managers aim to create portfolios that balance risk and return. Additionally, this fund may employ risk management techniques to safeguard investors during market downturns.

c) Asset Allocation Expertise: Fund managers of Multi-Asset Allocation fund have expertise in strategic Asset Allocation. They continuously monitor market conditions, economic trends, and other factors to adjust the fund's Asset Allocation strategy accordingly. This active management approach allows investors to benefit from dynamic Asset Allocation decisions aimed at optimizing risk-adjusted returns over time.

d) Simplicity and convenience: Multi-Asset Allocation fund simplify the investment process for investors by offering a single investment vehicle that provides exposure to Multiple asset classes instead of them having to select and manage individual investments across various asset classes. This convenience can be particularly appealing for investors who prefer a hands-off approach to managing their portfolios or those who do not have the time or expertise to build and maintain diversified portfolios on their own.

e) Tax efficiency: Since rebalancing is a major part of an Asset Allocation strategy, an individual ends up paying taxes every time they rebalance. Multi-Asset Allocation fund on the other hand do not pay any tax when they switch between asset classes. This keeps the gains invested and better compounds the gains which are eventually passed on to the investor.

Overall, Multi-Asset Allocation fund can be an attractive option for investors seeking diversification, convenience, and the potential for more stable returns in their investment portfolios. However, it's essential for investors to carefully consider their investment objectives, risk tolerance, and investment time horizon before investing in this fund.

This fund is generally suitable for over 3 years to benefit from indexation benefit along with the potential for good returns over the long run.

The returns from Multi-Asset Allocation fund can vary depending on factors such as the c fund's investment strategy, market conditions, Asset Allocation Generally, this fund aim to provide a balance between risk and return, seeking to deliver competitive returns over the long term while managing volatility.

Historically, Multi-Asset Allocation have offered returns that are typically higher than those of conservative investments like fixed deposit but lower than those of pure equity allocation. The actual returns can vary widely, ranging from moderate to potentially significant, depending on the fund's investment approach and the performance of the underlying assets.

Quantum Multi Asset Allocation Fund invests in a diversified portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments.

The fund's Asset Allocation strategy includes deploying 35-65% corpus in equity and equity-related securities, 25-55 % towards debt and money market instruments, 10-20% in gold ETF The Fund will predominantly invest in securities of Nifty 50 index and other large cap stocks for its equity component, sovereign and PSU debt securities across durations for its fixed income allocation and Quantum Gold ETF. for its Gold component.

The investment objective of the Quantum Multi-Asset Allocation Fund is to generate modest capital appreciation while trying to reduce risk (by diversifying risks across asset classes) from a combined portfolio of equity, debt/money markets and gold investments.

Portfolio allocation between the units of equity, debt/ money markets and gold broadly depends on the relative valuations between the asset classes. Relative valuations are determined by evaluation of various influencing factors. Some of the factors include:

• Price/Earnings Ratio relative to historical averages;

• The relationship between Earnings Yield to Bond Yield relative to historical averages;

• Macroeconomic factors prevailing globally, and within India.

After determining the optimal Asset Allocation, the Portfolio/ Investment Team determines the allocation to specific equity, debt / money markets and gold instruments within the Asset Allocation. The allocations would be regularly reviewed and necessary portfolio changes would be carried out based on the analysis suggested by various influencing factors

Depending on the holding period and your tax bracket, capital gains are subject to taxation.

Short term capital gains for a duration less than 3 years is subject to taxation as per marginal tax rates.

While long term capital gains for a duration greater than 3 years are eligible for taxation at 20% with indexation benefit. You thus get the potential to save more tax than conventional investments such as bank fixed deposits where returns are taxed as per your income tax slab. This translates to a better return on investment, especially for investors in the highest income tax bracket.

While both funds aim to generate modest capital appreciation while trying to reduce risk by diversifying across asset classes, the Quantum Multi Asset Allocation Fund invests directly in stocks, bonds and Gold ETF and the Quantum Multi Asset Fund of Funds invests in schemes of Quantum Mutual Fund which invests in Stocks, Bonds and Gold.

Minimum allocation to equities in Quantum Multi Asset Allocation Fund will be 35%. Minimum allocation to equities in Quantum Multi Asset Fund of Funds will be 25%.

For a holding period of 3 years or more, gains from the Quantum Multi Asset Allocation Fund will be subject to 20% tax with indexation benefits compared to marginal tax rate for Quantum Multi Asset Fund of Funds (which is classified as Debt fund for taxation purpose).