India is Gearing Towards Sustainability. Is your Portfolio?

Posted On Wednesday, Apr 26, 2023

We celebrated World Earth Day last Saturday. It’s time to take meaningful conversations beyond the confines of one day and convert them to sustainable actions. Take this opportunity to assess whether your portfolio is geared towards sustainability. The Government has identified Green growth as one of the seven top priorities of the Union Budget this year. India is incrementally making strides toward its climate pledge of net-zero carbon emissions by 2070. This is considering the accelerated pace of extreme weather events and challenges facing India – Climate change, deforestation, pollution, etc., are a few of the most significant environmental challenges of our time. Though the government seems to be doing some heavy lifting, the allocation falls short of what India requires for the green push.

Environment & Social Budget Breakup -

| Expenditures | Actuals | Budgeted | Estimated | |

| FY'20 | FY'21 | FY'22 | FY'23 | |

| Expenditure towards Environmental Activites (in Billion) | 154 | 225 | 570 | 744 |

| as % of GDP | 0.08% | 0.10% | 0.25% | 0.29% |

| Expenditure towards Social Activites (in Billion) | 1,421 | 2,784 | 2,759 | 2,679 |

| as % of GDP | 0.70% | 1.20% | 1.19% | 1.04% |

Source: www.Indiabudget.gov.in

To achieve the ambitious goal of a cleaner, greener India, Corporate India must be participating. The Union Budget also underlines the urgency for corporates to adopt responsible and sustainable business practices. This shift presents new opportunities for long-term investment strategies with a sustainability focus.

It is expected that the sustainable initiatives will bring the nation a step closer to its goals spelled out at COP 26.

Why ESG is the future of investing?

ESG investing assesses quality companies on the ESG matrix (environmental, social and corporate governance criteria) and aims to achieve the triple bottom line that is good for people, the planet and profits. It identifies potential opportunities and unearths risks hidden beneath a company's business activities by measuring sustainability.

As thoughtful investors, it’s time to relook at your investments. and evaluate whether the companies underlying your investments are responsibly addressing environmental concerns among other key criteria. You have the power to demand businesses do the right thing by investing in companies that are sustainable, and avoiding those which are not.

This can help to reduce the negative impact on the environment and promote sustainable growth.

Opportunity to strengthen Equity Investments with an ESG focus

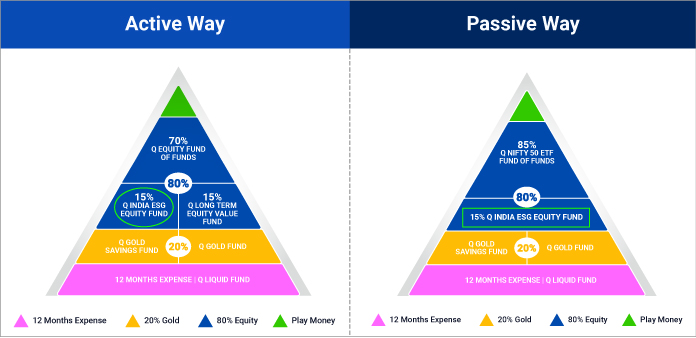

In this light, it is the right time to strengthen equity investments by adding ESG investing as part of your diversified equity strategy to help contribute towards a more sustainable future. Irrespective of which style you prefer, be it active or passive investing, Quantum India ESG Equity Fund remains a key component of our 12|20:80 Asset Allocation Strategy. Explore Quantum’s handy Asset Allocation calculator to assess how much you need to invest in ESG investments.

ESG – An Integral Component

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Companies with ESG are better equipped to grow over the long term

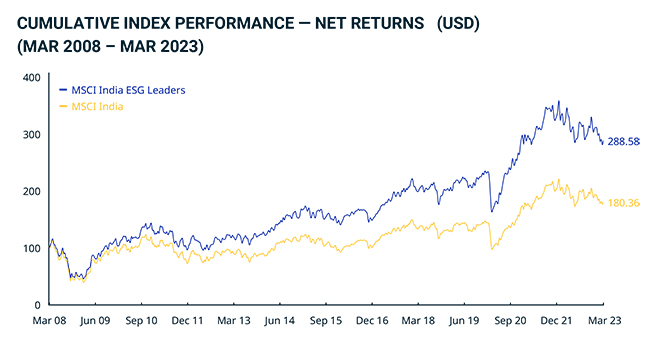

We believe that in the long term, ESG funds can deliver good long-term risk-adjusted returns. As historical trend shows, the ESG index has protected downside risk better than traditional equity funds during down markets. This was well observed during the pandemic.

Data Source: MSCI Indexes supplied by MSCI Inc, and MSCI ESG Indexes supplied by MSCI ESG Research Inc, a subsidiary of MSCI Inc. Data as of Mar 31, 2022. Past performance may or may not be sustained in the future.

Consider a mutual fund that can identify companies better positioned to navigate future ESG challenges and mitigate risks.

It’s time to invest in a true-to-label ESG fund that goes beyond the desk to give a more holistic 360-degree research backed by quantitative and qualitative criteria.

Quantum India ESG Equity Fund is one of the first ESG funds in India. At Quantum, you can rely on proprietary research developed from our years of experience in selecting stocks. Our focus has been on enhancing transparency through disclosures, as well as reducing carbon footprint.

Reasons to invest in Quantum India ESG Equity Fund

As India is gearing up in response to the increasing environmental challenges, a portfolio that encompasses ESG investments may be better positioned for risk-adjusted returns over the long term. As responsible investors, it’s time to do your part and prioritize a sustainable future by investing in Quantum India ESG Equity Fund as part of your diversified 12|20:80 portfolio. Start allocating 15% of your equity portfolio to Quantum India ESG Equity Fund.

|

|

Related Articles

Invest in The Triple Bottom Line with ESG

Sustainable Investing With ESG

ESG Investing: Good for the Planet, Good for your Portfolio

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open ended Fund of Fund Scheme investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF - Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The investors of Quantum Equity Fund of Funds, Quantum Gold Savings Fund, Quantum Nifty 50 ETF Fund of Fund will bear the Scheme expenses in addition to the expenses of other schemes in which Fund of Funds scheme makes investment (subject to regulatory limits).

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More