Retirement Planning - Navigate your Portfolio Today for a Better Tomorrow

Posted On Monday, Nov 07, 2022

You work hard and build a life for yourself and your family - one full of dreams, achievements, and happiness. As a thoughtful investor, you do not want to compromise on this life, especially after retirement. You may want to spend more quality time with your loved ones or travel the world. You may also want to fulfil commitments like your child’s higher education or wedding. While we do know how important retirement planning is, it has often been an overlooked aspect of financial planning. According to a survey conducted by Nielson, 51% of respondents stated that they hadn’t started investing for their retirement.

It’s important to plan your investment portfolio today so that you continue to meet all your goals and dreams independently.

After all, you may have very specific ideas on how you want to spend your retired life. You retire from work, not life. At the same time, you may also want to maintain your day-to-day lifestyle without worrying about inflation / expenses.

Retirement Planning requires you to rely on a well-defined Asset Allocation strategy to have a peaceful night’s sleep.

Some investors who decide to build a nest egg for their retirement still resort to conventional investments such as PPFs, FDs, gold, real estate, pension plans, etc. However, these solutions can be challenging to liquidate immediately in case of emergencies. Another challenge to tackle is inflation which continues to rise over time and may put a strain on your retirement corpus.

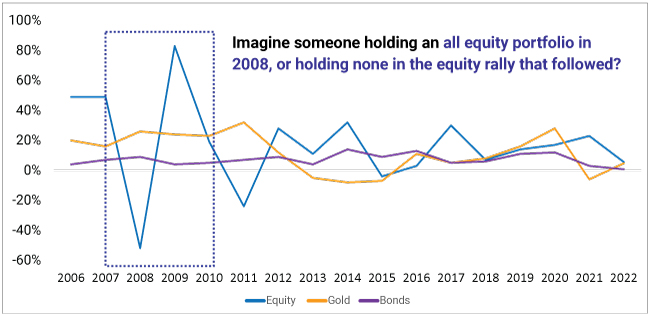

The way to address liquidity and keep inflation from eating into your retirement corpus is to invest in mutual funds such as equity investments that have the potential to generate inflation-beating returns over the long term. However, equity investments are cyclical. For instance, imagine someone holding an all-equity portfolio in the downmarket of 2008 or 2020, or holding none in the equity rally that followed.

Source – Bloomberg. Data as on Oct 31, 2022

Past performance may or may not sustain in future

While no one can predict the future, it’s important to remember that not all asset classes move in one direction. Diversification is the key to help reduce portfolio risk. Even when building your equity basket, care must be taken to not be biased to any market cap or investment style to maintain a risk-return balance.

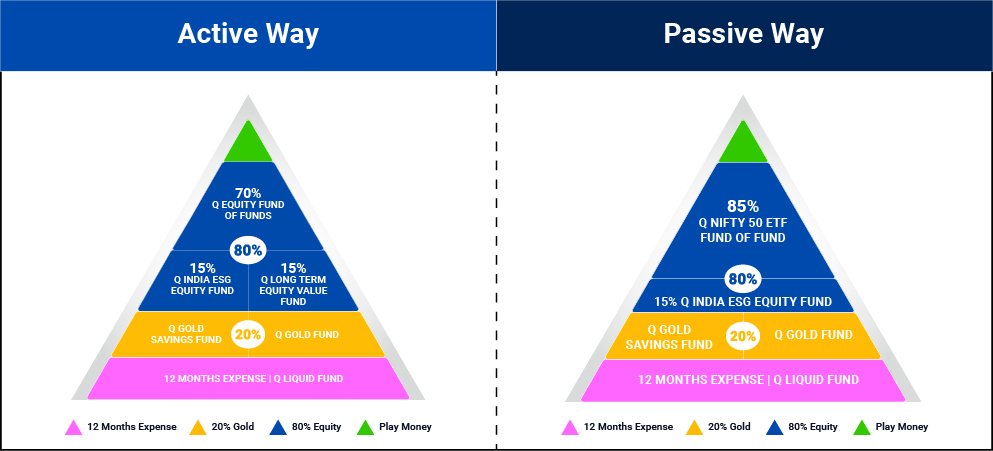

Quantum’s 12:20:80 - A solid home offering a one-stop shop for your investment needs for building a secure tomorrow

You can use the 12:20:80(Baarah, Bees aur Assi) Asset Allocation Starategy as a solid, time-teste d retirement planning solution. This strategy allows you to create the right mix of Debt, Gold and Equity (Value, Growth) helping you to diversify. By investing in Quantum’s 11 funds as building blocks to this solution, you get a balance between risks and return in your portfolio thus enabling you to achieve your goals.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

As part of this strategy, equity forms the largest component of your portfolio. It comprises 80% of the investable surplus serving as the Growth building block of your portfolio. The larger allocation to Equity helps you cope with inflation and stay on course to benefit from India’s long-term growth potential.

You can also make use of our well-researched Asset Allocation calculator which provides you with a convenient and simple way to diversify your investment portfolio.

With this strategy, you do not have to worry about fluctuations in the equity market movements.

Years | Asset Allocation Returns (20:80) | BSE Sensex | Difference |

1 | 1.14% | 2.43% | -1.28% |

3 | 13.87% | 14.82% | -0.95% |

5 | 9.74% | 12.83% | -3.09% |

7 | 11.23% | 12.49% | -1.25% |

10 | 12.68% | 12.62% | 0.06% |

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Data as of Oct 31, 2022. Past performance may or may not be sustained in the future. (QGSF20%)+ (QEFOF+QLTEVF+QESG- 80% for 1 & 3 year period and (QEFOF+QLTEVF- 80%)+(QGSF20%) for 5, 7 & 10 year period) The above table is to be read in conjunction with the complete performance given below.

As you can see in the example above, the diversified allocation using an active allocation strategy for the period ended Oct 2022, has helped lower the risk of a downside, especially over the long term.

As a thoughtful investor, don’t let the market fluctuations of the near term deter your investment journey.

In the short term, equity markets can go through fluctuations and it’s difficult to assess returns. However, to anchor your expectations from an equity standpoint, assess how India has grown from a longer-term perspective.

Indian Equity | |

GDP, real GDP | +6.5% |

+Inflation | +5.0% |

= GDP, nominal | +11.5% |

If GDP = Revenues (Revenues of Typical Companies) | +11.5% |

Profit Growth of Typical Companies | +11.5% |

Companies, listed and in an index > Typical Company | +13.5% |

An Intelligent Portfolio | +15.0% |

FX, INR 75-80 | -2% |

Disclaimer: “An intelligent portfolio” mentioned above refers to a portfolio constructed by an investment manager following an active approach to investing with an appropriate research and investment process in selecting stocks. The above table is for illustrative purposes only. These growth rates may or may not be achieved. Past performance does not guarantee future results and future performance may be lower or higher than the data given above.

For those of you who have just received your Diwali bonuses, it might serve as a good opportunity to secure your future and support your lifestyle during your retirement, when there is no stable source of income.

Retirement works best when you start planning for it from the beginning. Your retirement portfolio should aim to help you lead a stress-free life. That life is uncertain is known to all of us but by investing with Quantum using the Baarah, Bees aur Assi you can ward off uncertainties to secure your future even after you retire.

|

|

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Tier 2 - Benchmark## Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Tier 2 - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (13th Mar 2006) | 13.36% | 12.45% | 12.59% | 12.46% | 80,720 | 70,576 | 72,050 | 70,602 |

| October 31, 2012 to October 31, 2022 (10 years) | 12.93% | 14.69% | 14.70% | 14.11% | 33,760 | 39,400 | 39,451 | 37,460 |

| October 30, 2015 to October 31, 2022 (7 years) | 11.32% | 14.07% | 14.12% | 13.86% | 21,203 | 25,158 | 25,236 | 24,836 |

| October 31, 2017 to October 31, 2022 (5 years) | 8.75% | 12.56% | 13.00% | 14.15% | 15,213 | 18,072 | 18,428 | 19,391 |

| October 31, 2019 to October 31, 2022 (3 years) | 14.76% | 18.38% | 17.85% | 16.13% | 15,119 | 16,599 | 16,374 | 15,668 |

| October 29, 2021 to October 31, 2022 (1 year) | 2.59% | 3.89% | 4.22% | 3.70% | 10,261 | 10,391 | 10,424 | 10,372 |

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of October 31, 2022.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Sorbh Gupta and George Thomas. Sorbh Gupta has been managing the fund since December 1, 2020. George Thomas has been managing the fund since April 1, 2022.

Click here to view other funds managed by them.

| Performance of the Scheme | Direct Plan | |||||

| Quantum Equity Fund Of Funds - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (20th Jul 2009) | 13.68% | 13.02% | 12.51% | 54,987 | 50,908 | 47,930 |

| October 31, 2012 to October 31, 2022 (10 years) | 14.47% | 14.70% | 14.11% | 38,644 | 39,451 | 37,460 |

| October 30, 2015 to October 31, 2022 (7 years) | 12.03% | 14.12% | 13.86% | 22,173 | 25,236 | 24,836 |

| October 31, 2017 to October 31, 2022 (5 years) | 9.83% | 13.00% | 14.15% | 15,983 | 18,428 | 19,391 |

| October 31, 2019 to October 31, 2022 (3 years) | 14.74% | 17.85% | 16.13% | 15,113 | 16,374 | 15,668 |

| October 29, 2021 to October 31, 2022 (1 year) | 0.03% | 4.22% | 3.70% | 10,003 | 10,424 | 10,372 |

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as of October 31, 2022.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR). The fund is managed by

Chirag Mehta since Nov 1, 2013. Chirag Mehta manages 5 Schemes of Quantum Mutual Fund.

For other schemes managed by him, please Click here.

| Performance of the Scheme | Direct Plan | |||||

| Quantum India ESG Equity Fund - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (12th Jul 2019) | 17.99% | 17.37% | 15.93% | 17,290 | 16,989 | 16,310 |

| October 31, 2019 to October 31, 2022 (3 years) | 17.85% | 17.82% | 16.13% | 16,373 | 16,364 | 15,668 |

| October 29, 2021 to October 31, 2022 (1 year) | 0.29% | -0.80% | 3.70% | 10,029 | 9,920 | 10,372 |

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as of October 31, 2022.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Chirag Mehta manages 5 Schemes and Sneha Joshi manages 1 scheme of the Quantum Mutual Fund. For performance of other funds managed by Chirag Mehta, please Click here.

| Performance of the Scheme | Direct Plan | |||||

| Quantum Gold Savings Fund - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (19th May 2011) | 6.18% | 7.41% | 6.36% | 19,895 | 22,691 | 20,269 |

| October 31, 2012 to October 31, 2022 (10 years) | 3.68% | 4.75% | 6.23% | 14,354 | 15,911 | 18,302 |

| October 30, 2015 to October 31, 2022 (7 years) | 8.24% | 9.26% | 5.70% | 17,423 | 18,597 | 14,746 |

| October 31, 2017 to October 31, 2022 (5 years) | 10.22% | 11.30% | 4.59% | 16,269 | 17,086 | 12,517 |

| October 31, 2019 to October 31, 2022 (3 years) | 7.98% | 8.91% | 3.10% | 12,592 | 12,922 | 10,961 |

| October 29, 2021 to October 31, 2022 (1 year) | 3.87% | 4.58% | -0.96% | 10,389 | 10,460 | 9,904 |

#Domestic Price of Physical Gold.

Data as of October 31, 2022.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure.

The fund is managed by Mr. Chirag Mehta. Chirag Mehta is handing the fund since May 19, 2011. For other funds managed by Chirag Mehta, please Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark and Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Benchmark |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |  |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on September 30, 2022

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More