- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Allocation Fund

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Active FOF

- Why Quantum

-

Investment Solutions

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Active FOF

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Allocation Fund

- Partner Corner

- Learning Lab

Notice

Dear Investor,

Pursuant to SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings, irrespective of the amount of investment, under all mutual fund schemes.

1) To know more about payment modes available :

• Lump Sum Investments and their efficiency in the hierarchy of best to worst Click Here

• SIP Investments and their efficiency in the hierarchy of best to worst Click Here

2) Bank efficiencies in terms of providing credit to mutual funds on the same day before cut-off timings on which investors’ account is debited

i. NPCI (National Payments Corporation of India) Click Here

ii. Payment Aggregators (for e.g. Google Pay, Amazon Pay, PayTM)

We request Investors who have not submitted their PAN details and/or are Non KYC compliant to submit their PAN details & fulfill their KYC at the earliest. You may contact our [email protected] or call our toll free number 1800 - 209 - 3863 / 1800 - 22- 3863 for any queries or assistance.

Non-Business Day – October 02, 2025, Mahatma Gandhi Jayanti/Dussehra (All Schemes)

Due to Mahatma Gandhi Jayanti/Dussehra, October 02, 2025 (Thursday) will be a non-business day for all schemes of Quantum Mutual Fund. Redemption payouts under all schemes, scheduled for this date, will be deferred to the next business day i.e., October 03, 2025 (Friday).

Liquidity Window - Quantum Gold Fund (ETF): The Liquidity Window under Quantum Gold Fund is Open. Investors of Quantum Gold Fund can submit their redemption request upto Rs.25 Crores at the Official Point of Acceptance of the AMC. You may also redeem by sending the application via email from your registered Email Id to our Transact Id - [email protected].

SEBI’s Important Update on Folios without PAN / PEKRN: Click here for PAN / PEKRN related intimation.

Important Update on PAN & Aadhaar Seeding: As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 30th June 2023 failing which the unlinked PAN shall become inoperative. Please visit https://www.incometax.gov.in/iec/foportal/ and click on ‘Link Aadhaar option’ under the ‘Quick Links’ section to link your PAN with Aadhaar.

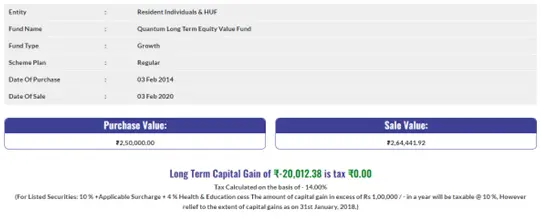

Mutual Fund Tax Calculator Online

Mutual Fund Calculator

As an investor, if you are willing to earn market-linked returns that potentially counter inflation and help accomplish the envisioned financial goals, then mutual funds are a potent investment avenue for you provided you are willing to take some calculated risk.

“In this world nothing is certain but death and taxes” – Benjamin FranklinTo compute what is the tax impact of investing in mutual funds, using a tax calculator serves very handy.

The mutual fund tax calculator is an online tool that facilitates you to know the tax impact whether it is dividends (now known as Income Distribution cum Capital Withdrawal or IDCW) and/or the capital gains you have earned (Long Term or Short Term, depending on the holding period) from a mutual fund.

How to use the Mutual Fund Tax Calculator?

Well, being an online tool, it is very easy and convenient to use. All you got to do is select the plan you opted for (Direct or Regular), the name of the mutual fund scheme, the option (Growth or Dividend), the amount invested, the date of investment, and the date of sale of the units.

Once all these details are entered, the online calculator at the backend performs the calculations and in a matter of few seconds shows the results, i.e. your tax liability (if any), as under:

The 5 benefits of using the online Mutual Fund Tax Calculator are:

- 1) Simple to use

- 2) Convenient

- 3) Helps plan your investment better

- 4) Saves you the trouble of performing complex and lengthy income-tax calculations

- 5) Saves your precious time (and instead helps you focus on spotting wealth-creating opportunities)

Frequently Asked Questions (FAQs)

How is the Capital Gain on Mutual Funds Taxed?

As regards the capital gains tax on mutual funds is concerned, whether it would be treated as Short Term Capital Gains (STCG) Tax or Long Term Capital Gains (LTCG) Tax will depend on the holding period and type of scheme.

-

Capital gains on Equity-oriented Funds

If the realised gains in the case of an equity-oriented fund are made in less than 12 months of the holding period, it is called Short Term Capital Gains and is taxed at a flat rate of 15%.

But if your holding period is more than 12 months or more in an equity-oriented fund, then it shall be referred to as Long Term Capital Gains and taxed at 10% if the realised gains are over Rs 1 lakh in the financial year. In other words, realised LTCG of equity-oriented funds will not be taxed if the sum is less than Rs 1 lakh in the respective financial year. -

Capital gains on Non-equity Funds

In the case of non-equity funds (or debt-oriented funds), if the holding period is less than 36 months it will be termed as Short Term Capital Gains and the realised capital gains will be added to your Gross Total Income and taxed as per your applicable income-tax slab rate.

But when the holding period is 36 months or more for non-equity or debt-oriented funds, the realised capital gains will be taxed at 20% Long Term Capital Gain tax with indexation benefit.

Indexation (based on cost on inflation index under Section 48 of the Income Tax Act, 1961) is the adjustment in the purchase price of an investment to reflect the inflation impact on the purchase value. With indexation benefit, you lower the long-term capital gains and bear lesser tax liabilities.

Type of Mutual Fund Short-Term Capital Gains STCG Tax Long-Term Capital Gains LTCG Tax Equity-oriented Less than 12 months 15% 12 months and above 10% (for realized gains above Rs 1 lakh) Non-equity-oriented (Debt-oriented) Less than 36 months As per your tax slab 36 months and above 20% (with indexation benefit)

Note, gold ETFs and gold saving funds are also classified as ‘non-equity’ funds and thus the aforementioned capital gains tax rule applies to them.

Further, keep in mind that if you are an NRI the capital gains on mutual funds will be subject to Tax Deduction at Source (TDS) at the rate of 15% in the case of STCG and 20% for LTCG (with the indexation benefit available).

How Are the Dividends Received from Mutual Funds Taxed?

The income in the form of dividends from mutual funds (now called IDCW) will be taxed as ‘Income from Other Sources’ as per your income tax slab rate.

If the dividend amount is above Rs 5,000 dividend will be subject to TDS as per Section 194K @10% for resident individuals, but if the PAN is not provided then @20%.

In the case of an NRI (Non-Resident Indian), the TDS rate will be as per section 195 @20% tax plus the applicable surcharge and cess.

How Do I Avoid Taxes on Mutual Fund Gains and Income Distribution?

Taxes on your mutual fund investment are not wholly tax-free. But by engaging in thoughtful investment planning, perhaps you can lower the tax impact. If equity mutual funds units are held for the long term and the LTCG is below Rs 1 lakh in the financial year, there will be no tax.

Similarly, if you opt for the growth option -- which ideally should be your preferred option -- there will be no question of paying tax on the income distribution and cash withdrawal. So, what is necessary on your part as an investor is prudent planning.

Can I Save Tax by Investing in Mutual Funds?

Yes, that is possible. To save tax (and at the same time grow your money) consider investing in Equity Linked Savings Scheme (ELSS)––also known as a tax-saving mutual fund.

They are equity-oriented mutual funds that come with a mandatory 3 years lock-in period. In other words, your money invested in an ELSS cannot be withdrawn for three years.

The investment in ELSS can help you avail of a deduction of up to Rs 1.50 lakh (from the Gross Total Income) under Section 80C of the Income Tax Act, 1961 in the financial year in which the investment is made.

Add To Cart

| Total of Lumpsum Amount |

|---|

Broker Details

-

ARN CodeARN -

-

Sub Broker Code

-

EUIN CodeE -

-

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker.