Equity monthly view for August 2022

Posted On Thursday, Sep 08, 2022

S&P BSE SENSEX advanced by 3.6% on a total return basis in the month of Aug 2022. It has outperformed developed market indices like S&P 500 (-4.1%) and Dow Jones Industrial Average Index (-3.7%). S&P BSE SENSEX has also outperformed MSCI Emerging Market Index (0.4%). The rally was broad-based S&P BSE Midcap Index & S&P BSE Small cap Index advanced by 5.8% and 6.1% respectively. Stable domestic macros and corporate earnings, moderation in commodity prices, and hope of a slowdown in the pace of rate hikes across the globe triggered the rally. But the hawkish commentary by Jerome Powell at the Jackson Hole conference tempered the hopes of slow rate hikes. Global macro headwinds translating to a potential slowdown in IT spends led to underperformance of the IT sector during the month. Barring BSE IT & BSE Teck, all sectoral indices advanced during the month. Early signs of a potential revival in private CAPEX and a pickup in consumption with the advent of the festive season were reflected in the strong performance of Capital Goods and Consumer Durable indices.

FPIs continued to be net buyers in August at US$ 6.4 bn. Domestic institutional investors (Mutual Funds & Insurance put together) turned sellers to the tune of $825 mn in August. FPIs cumulatively recorded a net outflow of USD 21.4 bn since Jan 2022. In the same timeframe, DIIs recorded a net inflow of USD 31 bn.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 3.3% in its NAV in the month of Aug 2022. This compares to a 4.8% increase in its Tier I benchmark S&P BSE 500 & 4.7% increase in its Tier II Benchmark S&P BSE 200. The relative underperformance of our holdings in energy, industrials, and utilities compared to sector peers resulted in underperformance. Auto and healthcare stocks in the portfolio performed better than their sector peers. Cash in the scheme stood at approximately 4.6% at the end of the month. The portfolio is valued at 13.0x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 18.8x FY24E consensus earnings.

Macros largely look stable

Despite global headwinds, Indian macros appear to be relatively stable. India’s GDP grew by 13.5% in 1QFY23. Quarterly GDP surpassed the pre-covid level by 3.3%. Though the GDP growth was below estimates, a revival in domestic demand was visible in strong growth in private consumption (59.9% of GDP) at 9.1% compared to the pre-pandemic level (Q1, FY20). Gross Fixed Capital Formation (34.7% of GDP) recorded a growth of 3.6% in the same period.

GST collection remained above INR 1.4 trillion for the sixth consecutive month in August. Improved compliance, consumption, and elevated inflation contributed to the robust GST collection. Direct tax collection during April - Aug 2022 recorded a growth in excess of 30%. Robust tax collection would enable Government to pursue infrastructure projects despite elevated crude prices.

Monsoon is vital in India as more than half of the country’s farmland doesn’t have irrigation. India received 6% more rainfall than average in the first three months of June-Sep monsoon season. But there is a deficit in states such as UP and Bihar. Despite this, the sowing of all crops (pan-India) is just lower by 1.3% compared to 2021 (Data as of Sep 2, 2022). Among major crops, the acreage of rice is 5.6% lower compared to the prior year while pulses (+0.4%), coarse cereals (+4.3%), and cotton (+6.8%) recorded growth in cultivation compared to past years.

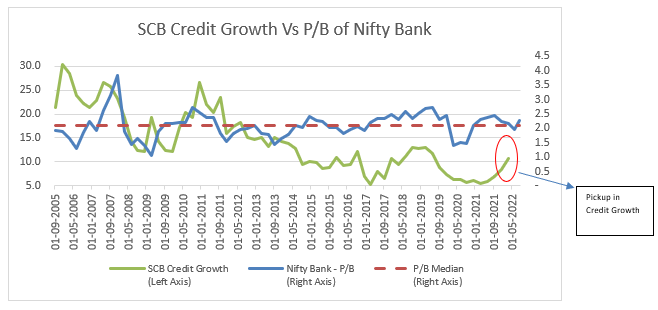

Credit Growth continues to strengthen

Pick up in credit growth despite the rising interest rates depict the strength of the ongoing economic recovery. As per the RBI release, Non-Food Credit grew by a healthy 15.1% on a yearly basis, retail loans grew at a robust 18.8% supported by growth across secured and unsecured segments. Growth in industry loans gained pace to 10.5%. (Data as of July 2022). Though part of the loan growth is inflation-led, steady improvement in capacity utilisation of the manufacturing sector to 75.3% in Q4FY22 (Source: RBI Survey) augurs well for CAPEX led corporate loan demand.

Banks: Improving Credit Demand amid Reasonable Valuation

Source: Bloomberg, Data as of Aug 31, 2022 | Past performance may or may not be sustained in the future

As of August 31, 2022, the fund holds an outsized position in the financial sector. We believe Indian banks are in one of the best positions to fund the revival in credit demand. Capital Adequacy Ratio of SCB (Scheduled Commercial Banks) rose to a new high of 16.7% as of Mar-2022 against the regulatory requirement of 9%. The bad loans indicated by the gross non-performing assets (GNPA) ratio for Scheduled Commercial Bank (SCB) fell to a seven-year low of 5.9% as of Mar-2022. This would further augment the banks’ capability to lend as low provisioning requirements would boost the profitability. Despite the pandemic, corporate balance sheets have strengthened over the past two years. Reasonable valuation along with improving credit demand outlook and stable asset quality make banks a compelling investment from a medium-term perspective.

Rising global macro uncertainties and global interest rates could impact exports and foreign flows in the near term. Notwithstanding the near-term noise, Indian markets are better positioned relative to their global peers. Reasonably stable macros, domestically driven demand, a strong banking system, and manageable inflation would help India to stay on course. We recommend investors continue with their SIP and stay invested in equities with a long-term horizon.

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II Benchmark |

Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on Aug 31, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on Aug 31, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More