heading

About The Fund

Quantum brings to you an easy way to ride India’s growth story with a fund that provides exposure to the Nifty 50 Index. It is a critical block in our suite of products that gives investors a one-stop-shop solution to diversity their investments in passive funds according to our tried and tested 12|20:80 Asset Allocation Strategy.

The Quantum Nifty 50 ETF Fund of Fund is a first of its kind wrapper fund that invests in units of the Quantum Nifty 50 ETF, offering the efficiency of an ETF with the convenience of an Index Fund. The underlying Quantum Nifty 50 ETF tracks/ replicates India’s Nifty 50 companies and has a proven track record of 14 years and counting.

5 Reasons to invest in the Quantum Nifty 50 ETF Fund of Fund

1. First of its kind Nifty 50 ETF wrapper fund .

2. Low tracking error of underlying fund.

3. No Demat Account required.

4. Diversified portfolio across top Nifty 50 in different sectors.

5. Invest with as low as Rs.500.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- B.com Graduate and Masters in Financial Management.

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Nifty 50 ETF Fund of Fund

(An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF)

Tier I Benchmark : Nifty 50 TRI -

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund -

Risk-o-meter of Scheme

-

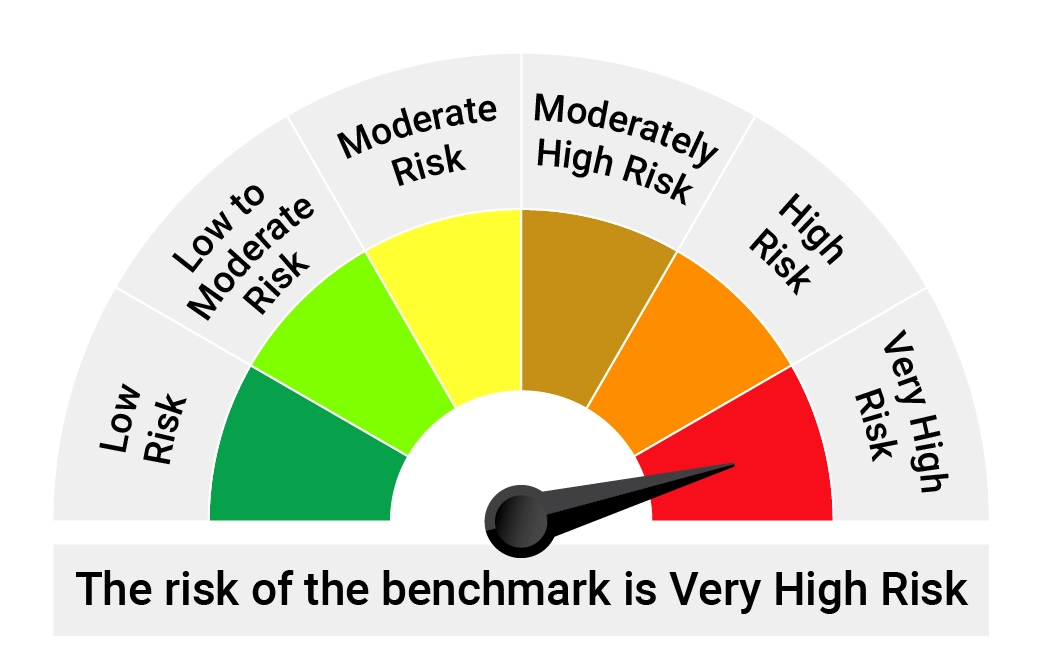

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Frequently Asked Questions

Generally, when selecting an equity fund, investors tend to browse ranking websites to assess the best equity funds to invest in. While this can be a starting point for evaluating mutual funds, it does not give you the complete picture.

You can consider the following parameters to evaluate the best mutual equity fund.

Track Record: There’s more than the recent performance of a fund, what is important is the potential for it to perform consistently across market cycles. Evaluate the scheme’s track record over a 1 year, 3 years, 5 years, 7 years and from inception basis in comparison to its benchmark. Evaluate the rolling returns of the mutual fund over a period which help offer a more holistic view of an investment's performance.

Diversification: Check the portfolio composition and the level of diversification it offers. Assess whether it diversifies across market caps, investment styles or sectors.

Financial ratios: Assess risk measures such as standard deviation which helps measure the sensitivity of the equity fund concerning the benchmark index or Sharpe ratio which is a measure of risk- adjusted returns. Choose an equity fund with a lower standard deviation and a higher Sharpe ratio.

You also need to consider your risk appetite, investment horizon and financial goals, etc, when investing. Remember, your goals are different than other investors and hence what may be the best equity fund for your friend may not be the best equity fund for you.

An Equity Fund invests a majority of its underlying portfolio in equity and equity related investments across different companies, market cap and sectors.

There are various types of equity funds including large-cap fund, mid-cap, large & mid-cap fund, small-cap fund, value fund, focused funds, sector & thematic funds, and so on. Broadly, equity funds can be categorized as actively managed and passively managed funds.

Actively managed funds require active fund management and is ideal for those who want the potential to beat the market. Whereas passively managed funds replicate the index in composition and generate returns in line with the benchmark index. It does not require active fund management.

Generally, equity funds have the potential to create risk-adjusted returns over a long period, but at the same time, they tend to be riskier as they can be volatile in the short-term depending on market fluctuations. It is important to diversify your equity portfolio across various stocks and market cap, depending on your investment objective.

Starting from August 2009, SEBI has mandated that mutual funds cannot charge entry load to investors. So currently, there is only an exit load charged to investors. Exit Load is the fee collected from investors when exiting from an equity fund scheme partially or fully within a predetermined period from the date of investment.

If you have an investment horizon of 5 years or longer and have a risk appetite, then you can consider investing in an equity fund. It is suitable for long-term goals such as buying a house or retirement.

If you choose to invest passively, you can invest in 3 ways in the Nifty 50 Index:

1) Index Fund 2) ETF 3) Fund of Fund investing in ETF

Nifty 50 ETF Fund of Fund invests in units of the Nifty 50 ETF, offering the efficiency of an ETF with the convenience of an Index Fund. The underlying Quantum Nifty 50 ETF tracks/ replicates India’s Nifty 50 companies. In other words, this fund provides exposure to the Nifty 50 Index through an SIP option.

ETF and index ETF funds are two ways of investing in the Nifty Index. An index fund aims to build wealth by imitating or replicating the Nifty 50 Index. While ETFs (exchange traded funds) are traded like stocks and are a low cost way to replicate the index. There is also another type of mutual fund that involves a passive investing strategy i.e., a Fund of Fund scheme. An index ‘Fund of Fund’ (FOFs) or ETF index Fund of Fund passively invests in another mutual fund(s) or ETF rather than investing directly in stocks, bonds or other securities.

You can invest in a Nifty 50 index mutual fund or the Nifty 50 ETF Fund of Fund in the same way as that in any other mutual fund scheme. You can invest using an SIP of Rs. 500 or a lumpsum mode of investment. A Systematic Investment Plan (SIP) is a disciplined way to gradually invest in mutual funds at predetermined intervals (weekly, monthly, quarterly, or semi-annually), to help you in your wealth creation journey.

On the other hand, if you prefer investing in the Nifty 50 Index ETF, you need to have a minimum investment of 1 Unit. 1 Unit is equivalent to the Fund NAV. The NAV is arrived at after deducting expenses and tracking error.

Although Nifty Index Funds or ETFs can offer risk-adjusted returns over the long term, they do not offer flexibility to the Fund Manager in managing market downsides. If the fund is generating negative returns due to unfavourable economic conditions, the active Fund Manager has the flexibility to modify the portfolio composition to lower the downside risks. For instance, you can consider the Quantum Nifty 50 ETF Fund of Fund as a core component of your portfolio using a passive approach. You can consider diversifying your equity basket using actively managed equity mutual funds such as theQuantum ESG Best In Class Strategy Fund. You can make use of the Asset Allocator Calculator to rebalance between funds as per the tried and tested 12|20:80 Asset Allocation Strategy.

Yes, you can redeem units from your Nifty 50 ETF Fund of Fund that invests in the underlying ETF. For redeeming from Equity Funds and getting money to your account generally takes 3 working days.