Gear up for Growth - The Active or Passive Way

Posted On Friday, Jul 08, 2022

Are you worried about the current downturns in the equity market?

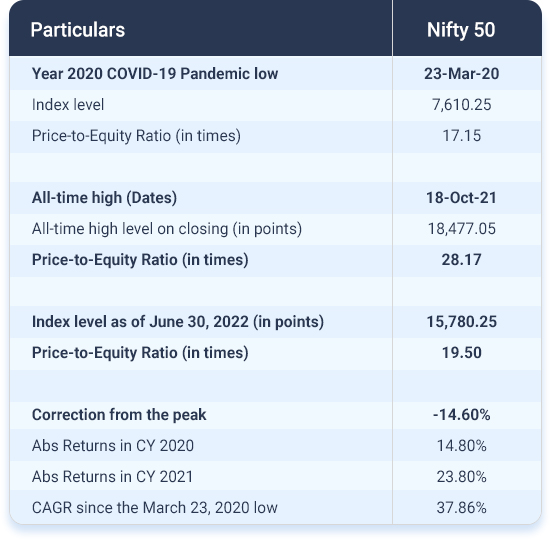

In times when the benchmark Nifty 50 Index has fallen significantly from its peak, investing in equity funds offers potential for growth. History reveals that despite all the odds or headwinds and interim market movements, the Indian equity markets have been able to compound hard-earned money for thoughtful investors.

Though inflationary pressures and interest rate hikes might weigh on demand and corporate margins in the near term, India’s long-term growth story remains intact. As we have witnessed in the past, Indian markets have bounced back after several such or even worse downcycles – be it during GFC (Global Financial Crisis – 2008), or the Covid-induced market crash in 2020, equity markets have stayed resilient.

Data as of June 30, 2022 Past performance may or may not be sustained in the future (Source: NSE)

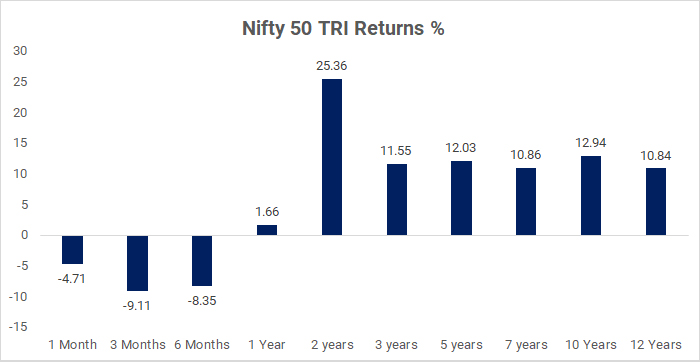

As you can also see in the chart below, while equity markets are prone to short-term fluctuations, over the long term, they give you the potential for risk-adjusted returns.

Data as of June 30, 2022 Past performance may or may not be sustained in the future.

Active or Passive Investing - Which One is Right for You?

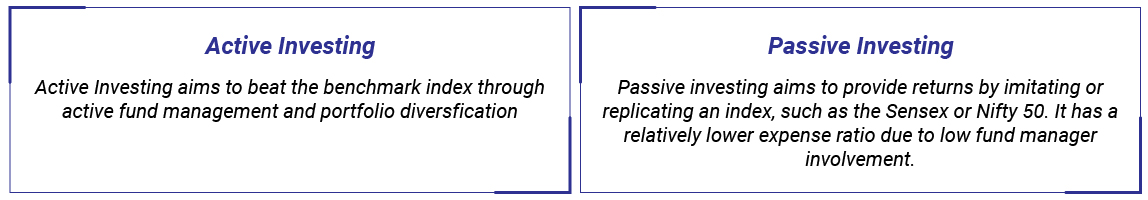

There are two styles of investing in equity mutual funds - Active or Passive.

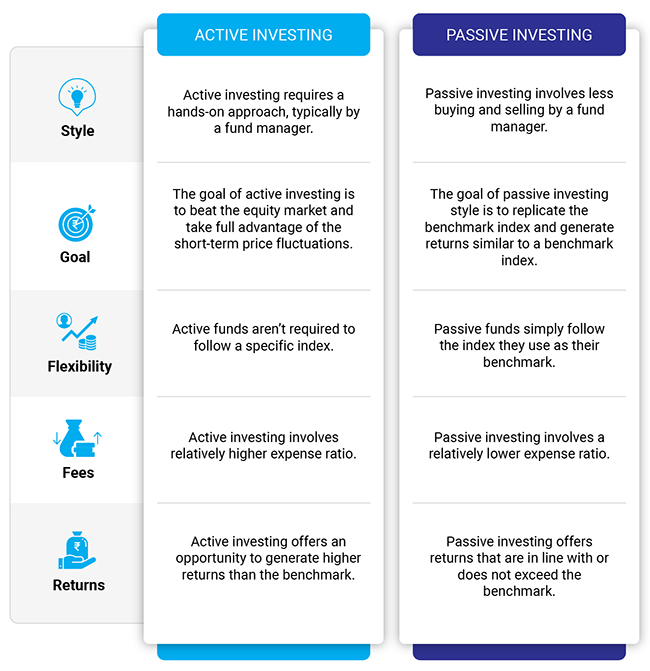

Let's understand the key differences between active and passive investing.

Fig 3: Difference between Active and Passive Investing

Consider the following factors to help you understand which approach is right for you:

Research: Investment in active investing needs an informed eye to help you decide the relevant mutual funds suited to your goals. While passive investments are a convenient option for those who are new to the market or are overwhelmed by the choices in the industry.

Risk appetite: If you are someone who has a relatively lower risk appetite or prefers a relatively predictable outcome, you can opt for an index fund or ETF which replicates the benchmark index. However, if you wish to take a higher risk for a potential for higher reward, then you can opt for active investments.

Financial goal: If your focus is building wealth with the potential to beat the index, you may opt for actively managed mutual funds. On the other hand, if you are looking not looking to beat the market and achieve returns in line with the benchmark, you can opt for a passive fund.

Building a Weather-Proof Portfolio

While it is a good time to invest in equity, do not forget the importance of asset allocation in building a weather-proof portfolio.

Remember that all asset classes do not move in the same direction. They move in cycles – when your equity investments are under stress, gold generally performs relatively better and vice versa. The presence of Debt gives stability to your portfolio. That’s why it’s essential to have a mix of all asset classes – Equity, Debt in the right proportion. If any one component of your portfolio is struggling, the other asset class steps in to reduce the fall. These imperfectly correlated asset classes help to safeguard your investments during periods of uncertainty. This is asset allocation.

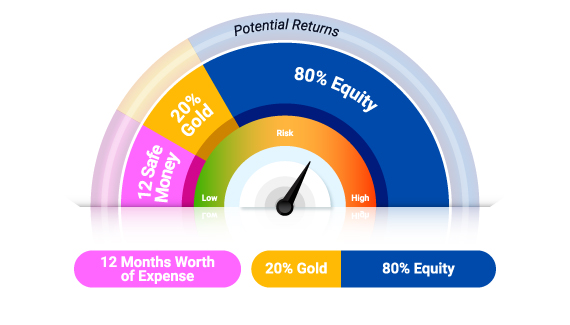

At Quantum, we have time and again advocated the importance of building your portfolio with the 12-20-80 portfolio that will help you brace for any uncertainty. Each fund introduced forms a building block of this Asset Allocation Strategy to create a one stop shop for all your mutual fund investment needs and objectives.

Fig 4: Quantum’s 12-20-80 Proprietary Asset Allocation Strategy

Please note that the above is a suggested fund allocation and is not to be considered as an investment advice/recommendation.

With this strategy, there are three crucial building blocks:

✓ Set Aside Safety Block in Liquid Fund: Begin by deploying 12 months of regular and unavoidable expenses in the Quantum Liquid Fund or a savings bank account (which may help you handle any exigencies),

✓ Portfolio-Diversifying Block: Invest 20% of your investable surplus into gold via efficient financial forms such as the Quantum Gold Fund or Quantum Gold Savings Fund (which could serve as a portfolio diversifier, and

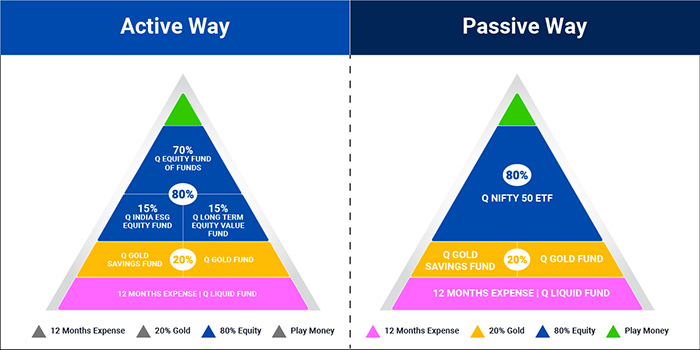

✓ Growth Block: Allocate the balance 80% of your total investment in a diversified equity portfolio, that is free from style or market cap bias. For those of you that wish to build your portfolio in Actively Managed Funds, you can invest in just three funds: Quantum Long Term Equity Value Fund (15%), Quantum India ESG Equity Fund (15%) and Quantum Equity Fund of Fund (70%).

If you rather opt for Passively Managed Funds, you can invest in the Quantum Nifty 50 ETF – an equity fund that forms part of your core portfolio.

In our continuous endeavour to make investing simple, and offer you a one stop shop for all your solutions, we are also launching the Quantum Nifty 50 ETF Fund of Fund – a first of its kind Nifty ETF Fund of Fund on July 18, 2022

This fund will invest in units of Quantum Nifty 50 ETF Fund that in turn replicates the benchmark Nifty 50 Index. It combines the efficiency of the Nifty 50 ETF with the convenience and flexibility of an index fund. This offers you a simple and straightforward way to invest in equity mutual funds and achieve your wealth creation goals without having to stress about timing markets or worry about unforeseen circumstances.

You can visit our Asset Allocator Tool to choose between active and passive approach to build your portfolio and help allocate your investments across equity, fixed income and gold in just a few clicks.

*Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

In summary, as markets have corrected, this is a good time to build or rebalance your equity investments for your long-term goals. Gear up for India’s long term growth story and choose an active or passive way to build your investment portfolio.

|

|

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF Fund of Fund** An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on June 30, 2022.

**Investors will bear the recurring expenses of the Scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Gear up for Growth - The Active or Passive Way

Posted On Friday, Jul 08, 2022

If you are worried about the present downturns in the equity market and are looking for ease of investing, here’s a new opportunity for you.

Read More -

The SIP Investment Way To Build Wealth

Posted On Monday, Oct 25, 2021

If you are an investor – New or seasoned, there is no way you have not come across the term SIP Investment.

Read More -

Why Are Investors Coming Back To Equity Mutual Funds Through SIPs

Posted On Wednesday, Apr 28, 2021

SIP or systematic investment plan is a mode of investing in mutual funds and investors are coming back to SIPs.

Read More