Ballots Cast, Budgets Await: Market Reactions in the Post-Election Economy

Posted On Thursday, Jul 18, 2024

As India emerges from a dynamic election cycle, the investing landscape finds itself at a crossroads. While the newly formed Coalition government settles in, pre-budget expectations are shaping market sentiment. Additionally, the upcoming monsoon season remains a crucial factor, with its potential impact on agricultural output and broader economic activity demanding close attention. This confluence of political, fiscal, and environmental considerations presents a unique and intriguing environment for investors navigating the Indian market.

An Overview of Political Stability and Budget Announcements

Political stability ensures a conducive environment for investment and economic activities by fostering confidence among investors and businesses about the continuity and reliability of policies. Budget announcements, being annual fiscal blueprints, outline the government's economic priorities, allocation of resources, and strategies to stimulate growth and manage public finances. These announcements can impact market sentiment and investment decisions.

Monsoon Predications

The monsoon season has far-reaching implications for the broader economy. Good monsoon predictions typically enhance market optimism, as they promise robust agricultural output, lower food prices, and increased rural incomes. This, in turn, can boost demand for consumer goods, automobiles, and other sectors dependent on rural consumption. Conversely, forecasts of deficient rainfall can raise concerns about agricultural distress, food inflation, and overall economic slowdown, prompting cautious market behavior.

Together, these factors shape the economic environment in the near term, influencing growth trajectories, market dynamics, and policy formulation in India.

The Market Environment

In the lead-up to the Union Budget, market participants closely monitor the government's fiscal policies and economic priorities. Expectations regarding tax reforms, infrastructure spending, social welfare programs, and regulatory changes significantly influence market sentiment. A budget perceived as pro-growth, with measures aimed at stimulating investment and consumption, generally leads to positive market reactions. On the other hand, a budget focusing on fiscal consolidation without adequate growth incentives might dampen market enthusiasm.

Expected Focus Areas of the Upcoming Union Budget

The upcoming Union Budget is anticipated to prioritise several key sectors crucial for India's economic growth and development. Infrastructure development is expected to be at the forefront, with significant allocations aimed at enhancing the country's transportation, logistics, and urban infrastructure. Investments in highways, railways, ports, rural boost are likely to be substantial, aiming to create a robust framework that supports economic activities.

Anticipated Changes in Tax Policies Affecting Individuals

Tax policies are a critical component of the Union Budget. The government can use these changes to boost consumption. For individuals, there may be revisions in income tax slabs and exemption limits aimed at increasing disposable incomes and stimulating consumption. Enhancements in standard deductions, higher exemption limits for savings and investments, and potential tax reliefs for middle-income groups could be part of the budget proposals.

Anticipated Changes in Tax Policies Affecting Corporations

For corporations, the budget may introduce measures to simplify the tax regime and encourage business investments. Potential tweaks in the PLI schemes and incentives for startups and small and medium enterprises (SMEs), including tax provisions to enhance ease of doing business are expected. Additionally, tax incentives for research and development, innovation, and sustainable practices may be introduced to promote long-term growth and competitiveness.

Identifying Emerging Opportunities Based on Pre-Budget Announcements

Pre-budget announcements and speculations often highlight emerging opportunities for investors. Sectors such as renewable energy, digital infrastructure, and healthcare technology are poised for significant growth, driven by government initiatives and incentives. Renewable energy projects, including solar and wind power, may receive support, aligning with global sustainability goals and reducing dependence on fossil fuels.

Strategies for Investors to Position Their Portfolios Ahead of the Budget

In the yesteryears, there were many taxation changes in the budget but since GST implementation, the importance from equity markets perspective has reduced. Broader market expectation is that government is well placed to pursue pro-consumption measures without disrupting the fiscal consolidation path. Any surprises on this front can dampen otherwise buoyant market sentiment. Hence, diversification remains a fundamental strategy, ensuring a balanced exposure across various sectors poised for growth, such as infrastructure, healthcare, and technology.

The Importance of Thoughtful Asset Allocation as an Investment Strategy

Thoughtful asset allocation emerges as a cornerstone strategy for achieving long-term financial goals while managing risk. Asset allocation involves distributing investments across various asset classes, such as equities, debt, and gold. This approach is grounded in the principle of diversification, which aims to reduce the impact of volatility and enhance the potential for risk adjusted returns. By thoughtfully diversifying their portfolios, investors can navigate market fluctuations more effectively and position themselves for sustainable growth.

Since no two asset classes always perform the same, it’s advisable to rely on more than one asset class. A sound financial plan diversifies across asset classes, which helps optimise the risk and return of the overall portfolio. This is available for a investor with Quantum’s Multi-Asset Allocation Fund or a DIY 12|20:80 Asset Allocation here.

The key takeaway is that,

Thoughtful asset allocation is a vital investment strategy that provides robust risk management, aligns investments with financial goals, and enhances long-term portfolio performance. By diversifying across asset classes and regularly rebalancing their portfolios, investors can navigate market uncertainties with greater confidence and achieve sustainable growth.

|

|

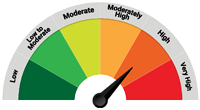

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Multi Asset Allocation Fund (An Open-Ended Scheme Investing in Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments) | • Long term capital appreciation and current income • Investment in a Diversified Portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments |  Investors understand that their principal will be at High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Ballots Cast, Budgets Await: Market Reactions in the Post-Election Economy

Posted On Thursday, Jul 18, 2024

As India emerges from a dynamic election cycle, the investing landscape finds itself at a crossroads. While the newly formed Coalition government settles in, pre-budget expectations are shaping market sentiment.

Read More