The Governance Feature in this ESG Fund

Posted On Friday, Jul 12, 2024

In the realm of sustainable investing, the governance aspect of an ESG (Environment, Social, and Governance) fund holds paramount importance. It encompasses the framework of rules, practices, and processes by which a company is directed. Effective governance ensures that companies operate transparently, aligning the interests of management with those of shareholders and other stakeholders.

This governance framework fosters accountability and potentially mitigates risks, thereby enhancing long-term financial performance and sustainability of the Company. As investors increasingly prioritise governance standards and corporate responsibility, the governance component is a critical criterion for evaluating the overall integrity and efficacy of the companies under consideration for investment.

Quantum ESG Best In Class Strategy Fund Turns 5

Quantum Mutual Fund's ESG (Environment, Social, and Governance) Best In Class Strategy Fund celebrates its fifth anniversary on July 12th 2024, marking a milestone in the investing realm. Over these past five years, the Fund has demonstrated a steadfast commitment to ESG principles, at the core of its investment strategy. This anniversary is a moment to reflect on the Fund's journey, and an opportunity to underscore the importance of ESG investing in today's financial landscape.

Back When

Nearly 25 years ago, Quantum at a group level embarked on a pioneering journey by implementing an 'integrity screen' to assess the trustworthiness of the management teams of potential investment targets. This innovative approach was designed to evaluate whether these management teams would prioritise the interests of minority investors or if their focus would solely remain on their promoters. This commitment to integrity has been a cornerstone of Quantum ESG Best In Class Strategy Fund's investment philosophy, reflecting a deep-seated belief in the importance of transparency and accountability in fostering sustainable, long-term growth.

In-house proprietary research to calculate the ESG Score

Quantum’s ESG portfolio holdings are based on an in-house proprietary research methodology on ESG. So, the ‘G’, the Governance aspect of ESG was always present at the core of Quantum’s investment philosophy. This depth of the research is a standout point in reflecting the characteristics of the Fund. Quantum goes beyond the publicly available disclosures and information through plant visits, stakeholder interactions, and more. To verify the authenticity and consistency of ESG compliance.

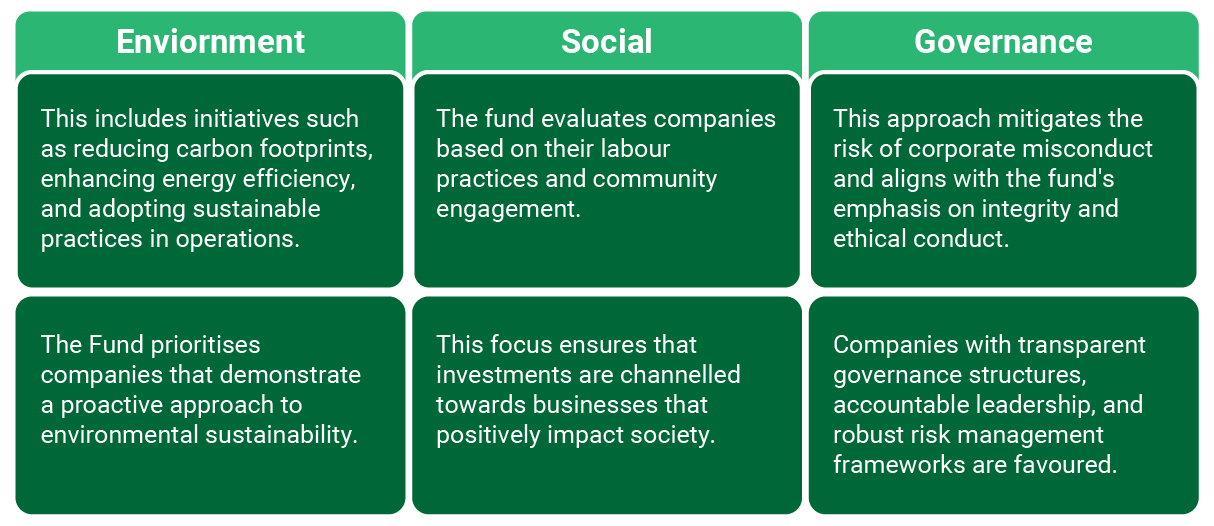

At the Core of ESG

A holistic perspective aligns investment strategies with broader societal goals, reflecting a growing recognition that financial performance and sustainable development are inextricably linked.

Quantum looks at the stock’s ESG score to determine its weightage in the Fund. Companies with a bad ESG score will never make it to the QESG portfolio.

While screening companies, Quantum subjectively evaluates more than 200 parameters across the Environment, Social, and Governance domains.

We have built a portfolio of 40-50 companies that have more than the minimum cut-off of our ESG score. Our fund portfolio is purely based on ESG principles, irrespective of the PE (Price to Equity) ratio, or any other factors.

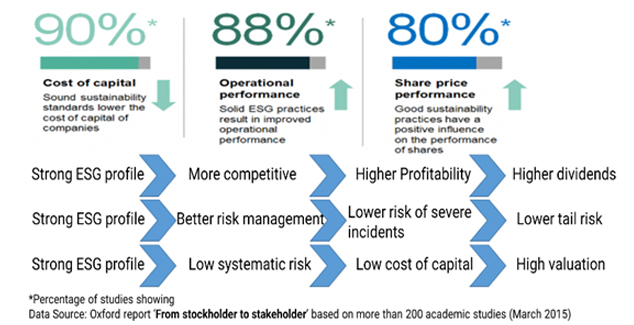

ESG – A Thoughtful Equity Investing Opportunity

Companies that are focused on environmental conservation, positively impacting the communities they operate in. These are the kind of companies that will find their way into the ESG Best In Class Strategy Fund. Historical trends show that a business that has good ESG practices has the potential to deliver good risk-adjusted returns in line with a lower cost of capital and improved operational performance.

These sustainable businesses are not only environmentally and socially responsible but also make great sense as investments as investors look to build wealth over the long term.

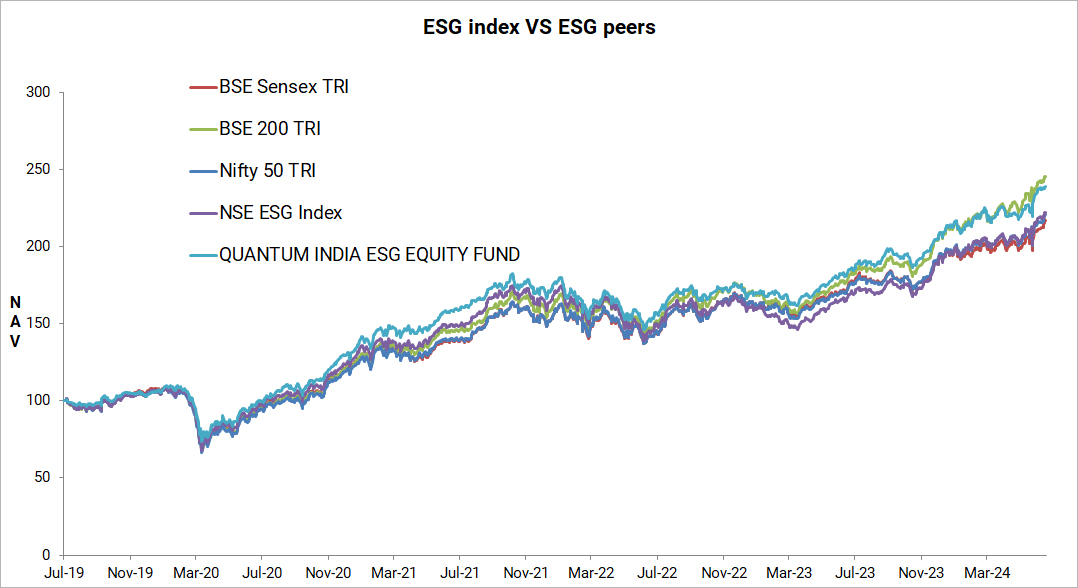

ESG Indices and Equity Indices

A chart showing the performance of the ESG Index against its peers.

Data as on June, 2024. Past performance may or may not be sustained in the future.

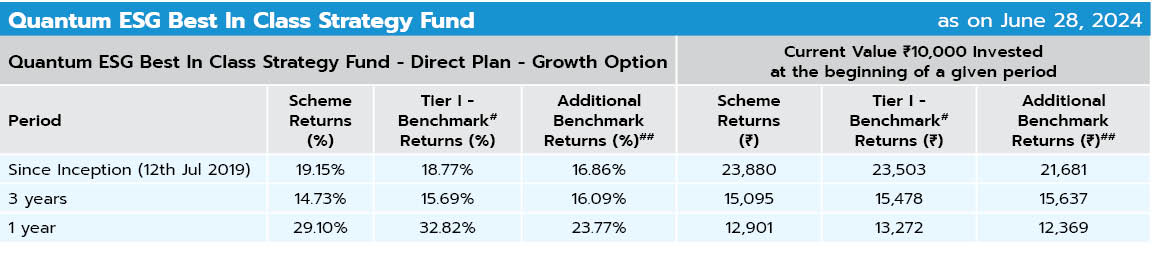

Scheme Performance

Past performance may or may not be sustained in the future. Load is not taken into consideration in Scheme returns calculation. Quantum ESG Best In Class Strategy Fund Performance as on Jun 28, 2024 Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The Fund is managed by Chirag Mehta and Sneha Joshi. Chirag Mehta is managing the fund since July 2019. Sneha Joshi is managing the fund since Jul 2019. Click here to view the performance details of other funds managed by Chirag Mehta.

Companies that align their goals with ESG as a prime focus have the potential to perform and/or deliver better.

The Next Five Years

The next five years promise to be as exciting as the fund continues its innovative approaches to ESG integration, expands its horizon, and delivers value to its investors. Quantum Mutual Fund's ESG Best In Class Strategy Fund is not just an investment; it is a testament to the power of aligning financial goals with a commitment to creating a better, more sustainable world. As it embarks on the next phase of its journey, Quantum Mutual Fund remains committed to driving positive change and delivering value to its investors, proving that returns and integrity can go hand in hand.

The key takeaway is that,

Take a step towards a better future by integrating ESG principles into your investment strategy, today. Join the positive impacting on the world. Start investing in the Quantum ESG Best In Class Strategy Fund now and be a part of the change we need for a sustainable tomorrow.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark |

Quantum ESG Best In Class Strategy Fund An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy Tier I Benchmark: NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum’s Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More