India Story Turns Positive Again: How to Position Your Portfolio

Posted On Tuesday, Jul 04, 2023

In recent times, the Indian economy has shown promising signs of a positive turnaround. Moreover, the Indian financial markets have defied all odds and broke previous records with the Nifty 50 crossing 19000 levels and Sensex crossing 64500 as of June 30, 2023. As the nation emerges from a period of challenges, the mid-year is a good time to assess how best to position your equity portfolio to capitalise on the new opportunities that lie ahead.

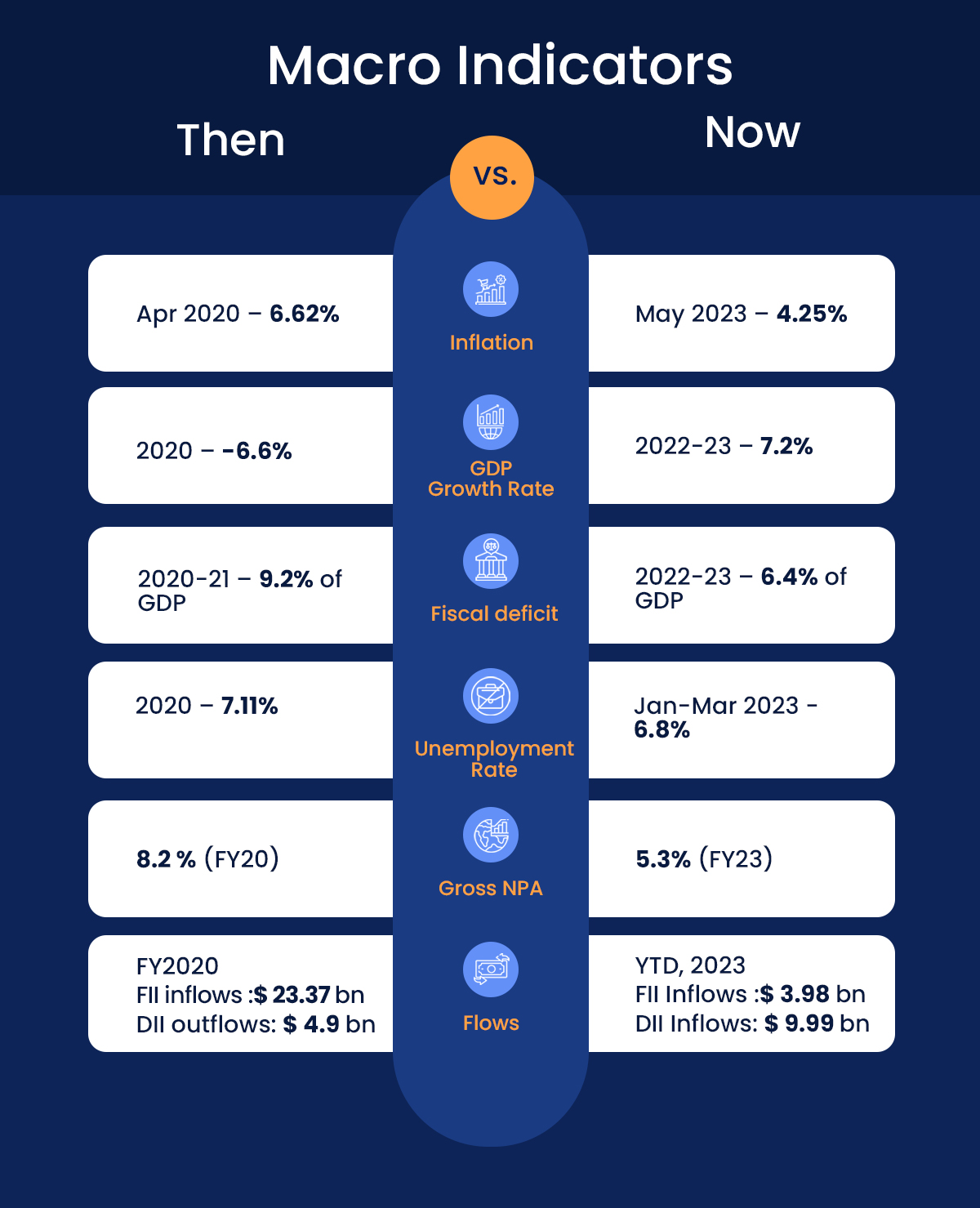

Indian Economy Then & Now

Source: NSE, MOPSI, CMIE, pib.gov.in

India’s economy has turned around for the better as the macro data becomes favorable despite economic and geopolitical uncertainties. India’s earnings growth looks promising fueled by robust corporate balance sheet & favourable economic environment.

S&P assessments indicate increase of approximately 50% in aggregate EBIDTA during FY 24. Brent Crude oil prices have settled at comfort zone at $71.63 per barrel. This is good news, especially when it comes to long term investors.

Though much is depended on how things progress from here on considering El Nino’s impact on monsoon and the presence of global uncertainties. Here’s how you can avoid negative impact of any market or macroeconomic uncertainty by strengthening your equity investments.

In this blog post, we will delve into the current state of the Indian economy and discuss how you can strategically position your portfolio to take advantage of the evolving landscape.

Economic Recovery:

After the unprecedented impact of the COVID-19 pandemic, India's economy has witnessed a robust recovery. The government's efforts to accelerate vaccination campaigns, coupled with policy reforms to stimulate growth, have contributed to a positive turnaround.

Key sectors such as manufacturing, infrastructure, and services have been showing signs of revival, attracting domestic and foreign investments. India clocked in GDP growth rate of 7.2% in FY 2023. As a matter of fact, global credit rating agency – Standard & Poor has retained India’s GDP growth at 6% for FY 2023-24, maintaining India as one of the fastest growing economy among Asian emerging market economies.

Even the equity mutual funds within Quantum Mutual Fund are positioned to benefit from this broad-based economic growth. We believe 6.5% real GDP growth is a realistic long term assumption for India. Exports, credit growth and real estate revival are some of the other tailwinds of the economy and equity markets.

Rising Consumer Demand:

Consumer demand is likely to be the key driver of India’s growth trajectory. India has a demographic dividend comprising of one of the largest young populations with a median age of 28.2 years according to data from World Population Prospects (WPP).

This creates a large workforce which will further continue to drive India’s consumption story. Quantum’s equity investments are carefully crafted to tap into the evolving needs and preferences of the Indian consumer.

One another economic trend that is evolving and also saw increased weightage in the Union Budget 2023-24 is green growth or green initiatives.

Green Initiatives

India has made substantial commitments towards renewable energy and environmental sustainability as outlined in the Union Budget 2023-24. The push for clean energy sources and reducing carbon emissions presents opportunities in ESG (Environmental, Social & Governance) or responsible investments.

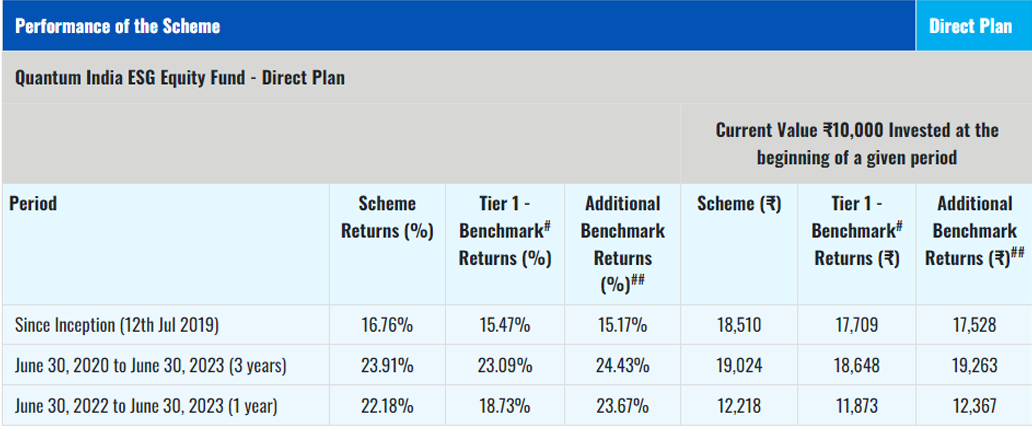

Within Quantum, we have been quick to adapt to the evolving equity landscape and were one of the first ESG themed funds with Quantum India ESG Equity Fund delivering a since inception return of 16.76% as of Jun 30, 2023, outperforming the benchmark Nifty 100 ESG TRI (15.47%) & BSE Sensex TRI(15.17%).

This fund filters companies based on our proprietary ESG scoring model – evolved from the integrity filter which is the underlying methodology of all our equity funds.

Amid a high growth environment, one key takeaway is to try and keep your investments simple. One way to simplify your investments is through diversification. Let’s understand the two parameters that you can use to structure your portfolio to benefit from the equity rally.

Diversification:

A diversified portfolio is essential for managing risks and capitalising on emerging opportunities. Even within your equity basket, it is important to diversify your equity portfolio across different market caps, themes, and investment styles. Even within Quantum, we have a value-oriented fund with Quantum Long Term Equity Value Fund and an ESG fund with the Quantum India ESG Equity Fund.

This reinforces our belief that a well-diversified mix of value & growth funds can help balance the risk-reward dynamics of your equity portfolio. For those preferring a passive style of investing, you can consider investing in the Quantum Nifty 50 ETF Fund of Fund that is a wrapper fund of the Quantum Nifty 50 ETF which aims to mirror the Nifty 50 Index.

Focus on fundamentals:

When investing in equities, focus on a portfolio of quality stocks with strong fundamentals, sustainable business models, and a proven track record. Even within Quantum equity investments, we look for companies that have strong liquidity – with daily active trading volume of $1 million or more. Wetake a long term view on businesses rather than focusing on short term noise.

These guiding principles help investors to better handle downturns. This means that even if the market does not perform as expected, the portfolio stands resilient to weather the turbulence.For instance, for Quantum Long Term Equity Value Fund, our portfolio has a low churn ratio and an average holding period of approximately 5-6 yrs.

Since equity forms the largest building block of your portfolio, care must be taken to not skew your portfolio to any particular market capitalization or sector. Find out how best to craft your portfolio with the Asset Allocation Calculator.

Conclusion:

As the India story turns positive once again, you have an opportunity to position your portfolios strategically for long-term growth. The country's economic recovery and market resilience provide a favourable environment for investment. By diversifying your portfolio, focusing on quality stocks, & maintaining a long-term perspective, you can navigate the evolving Indian economy and potentially benefit from its growth trajectory. Take the opportunity of the equity market rally to strengthen your equity investments and benefit from India’s growth.

|

|

^The statement to be read in conjunction with the complete fund performance below:

Data as on June 30, 2023.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI. Past performance may or may not be sustained in the future.

Load is not taken into consideration in Scheme returns calculation. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The Scheme is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta is the Fund Manager and Ms. Sneha Joshi is the Associate Fund Manager managing the scheme since July 12, 2019.

For other Schemes Managed by Mr. Chirag Mehta please click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Benchmark |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open ended Fund of Fund Scheme investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF - Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More