Quantum Mutual Fund - Riding the Market Rollercoaster? Strap in with Downside Protection

Posted On Wednesday, Aug 21, 2024

India with impressive economic growth, demographic dividend, and increasing influence on the political scale, the world’s hope remains with India.

The recent surge in optimism led to peaks in the Indian stock markets.

However, this euphoria over rising prices needs to be navigated with caution. Rich valuations and increasingly uncertain global prospects make for a watchful eye. Surviving such complex circumstances necessitates understanding both macroeconomic indicators and company fundamentals. Although long-term prospects look good, the near-term trajectory is uncertain.

This makes downside protection crucial in euphoric markets.

Downside Protection: An Anchor in Euphoric Markets

During market euphoria, when stocks are rising and investor’s sentiments are high on sunshine, many investors concentrate only on returns without regard to associated risks.

Still, it doesn’t have to ignore the fact that, during euphoric markets downside protection is paramount. It is essential to evaluate how much risk a fund takes to generate its returns because portfolio-specific risks like liquidity issues, governance problems facing the companies being invested in, and overvalued stock prices can affect long-term returns of the fund when the markets correct.

Investors often overlook that outsized returns in bullish markets may come from taking on higher risks, which can lead to losses when the market turns. This is why it’s essential to prioritise factors such as liquidity, valuations, governance, and sustainable growth for downside protection.

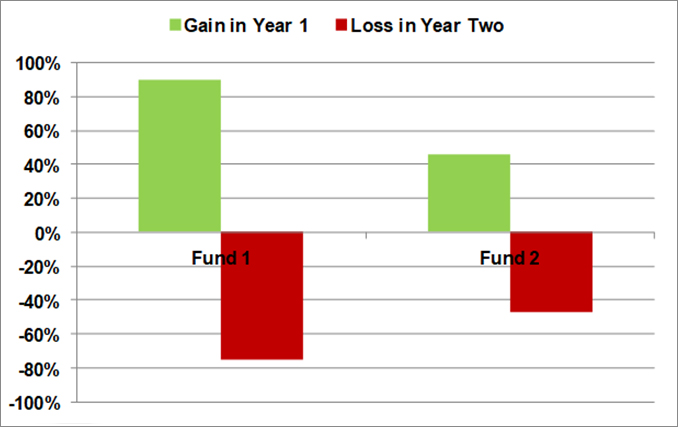

Consider the example of two funds: Fund 1 and Fund 2.

Fund 1 thrives in euphoric environments, investing on thematic moves such as technology stocks in 1999 or real estate and infrastructure in 2007. On the other hand, Fund 2 takes a more conservative approach, focusing on liquidity, reasonable valuations, strong governance, and sustainable growth. While Fund 2 might not outperform during the market’s peak, it is better equipped to help withstand a downturn.

When the market corrected after the global financial crisis, Fund 2’s prudent approach proved to be effective. An initial investment of Rs 10,000 in Fund 1 would have reduced to Rs 4,750 (-53% 2-year absolute returns), while for Fund 2 it was Rs 7,730 (- 23%).

Fund 1 would need to outperform Fund 2 by 63% to recover from its underperformance. The difference serves as a revelation on how much downside protection matters during periods of euphoric optimism, where the temptation to chase higher returns can lead to financial setbacks.

| Calculations | Fund 1 | Fund 2 |

| Gain in Year 1 | 90% | 46% |

| Loss in Year 2 | -75% | -47% |

| An initial investment of Rs.10,000 would be worth | Rs.4,750 | Rs.7,738 |

The above chart & table is for explanation purpose only.

This is where a well-balanced investment strategy can make all the difference.

Quantum AMC’s Proven Strategy: Balancing Growth with Prudence

Quantum AMC’s investment philosophy is based on a strategy that considers long-term stability and growth potential of its investors’ wealth. Liquidity, prudent valuations, strong governance, and sustainable growth are among the basic principles that Quantum focuses on to ensure its portfolios are well-positioned to help weather market swings.

This careful but strategic method helps protect Quantum’s downside risk while at the same time allowing it to capture upside potential.

For example:

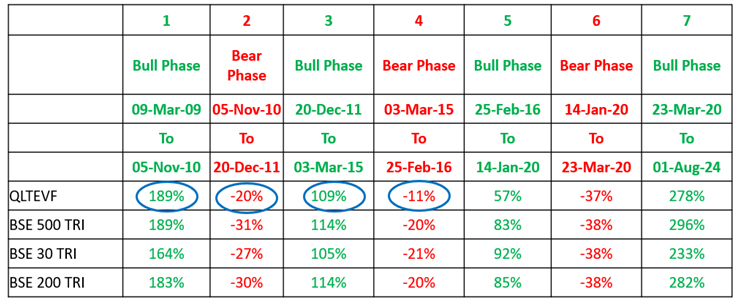

One of our funds, the Quantum Long Term Equity Value Fund, has captured upside potential while managing to protect against downside risk. In the bull phase, spanning between March 2009-November 2010 (Bull Phase), Quantum Long Term Equity Value Fund delivered a return of 189%, keeping pace with other major indices.

However, the true strength of Quantum’s strategy was showcased during the subsequent bear phase from November 2010 to December 2011. While markets experienced downturns, the Quantum Long Term Equity Value Fund managed to limit its negative returns, outperforming major indices by preserving more of its value.

Source: Quantum. Past performance may or may not be sustained in future. This table should be reviewed in conjunction with detailed performance of the scheme provided towards the end of this article. Tier I benchmark is BSE 500 TRI, Tier II benchmark is BSE 200 TRI.

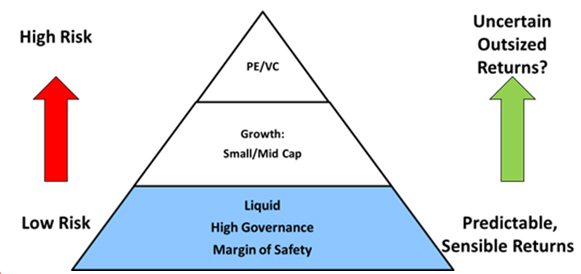

Remember that taking on higher risk can lead to the expectation of higher returns, but these returns are not guaranteed. For any investor, equity allocation should have a higher portion at the base of the pyramid, invested in fund that prioritises liquidity, governance and valuations based on investor’s risk appetite. As you move up the pyramid, return expectations may increase, but so do the associated risks.

When navigating the complexities of the market, Quantum AMC can be your trusted partner, seeking both growth and safety in the long run.

Grow Wealth with an Established 4Ps System with Quantum Mutual Fund

When selecting a mutual fund house, look beyond brand name or short-term performance and evaluate the 4 Ps.

People: What is the background? What is the experience?

Philosophy: Is there a clearly defined investment philosophy across all market situations, or is this an opportunistic collect AuM and ride-the-wave, “sell-what-is-hot” manager?

Process: What is the research and investment process, and how reliable is it?

Predictability of Performance: Given the process, is the performance as predictable as it should be?

At Quantum Mutual Fund, we put you-the thoughtful investor—at the centre of everything we do. When you choose Quantum Mutual Fund, you choose a fund house that always puts your needs and goals first, ensuring your financial journey is secure, sustainable, and successful.

Choose downside protection with Quantum Mutual Funds

| Quantum Long Term Equity Value Fund | as on July 31, 2024 | |||||||

| Quantum Long Term Equity Value Fund - Direct Plan - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Tier II - Benchmark## Returns (%) | Additional Benchmark Returns (%)### | Scheme Returns (₹) | Tier 1 - Benchmark# Returns (₹) | Tier II - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)### |

| Since Inception (13th Mar 2006) | 14.95% | 13.87% | 13.85% | 13.16% | 1,29,750 | 1,09,055 | 1,08,724 | 97,164 |

| 10 years | 14.01% | 15.65% | 15.39% | 13.58% | 37,156 | 42,867 | 41,889 | 35,777 |

| 7 years | 14.13% | 16.51% | 16.35% | 15.43% | 25,238 | 29,176 | 28,889 | 27,327 |

| 5 years | 19.62% | 22.51% | 21.62% | 18.26% | 24,518 | 27,632 | 26,641 | 23,147 |

| 3 years | 20.54% | 21.04% | 20.50% | 17.24% | 17,534 | 17,753 | 17,513 | 16,131 |

| 1 year | 41.44% | 38.82% | 36.87% | 24.38% | 14,157 | 13,894 | 13,699 | 12,445 |

#BSE 500 TRI, ##BSE 200 TRI, ###BSE Sensex TRI.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier I benchmark has been updated as BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

Regular Plan was launched on 1st April 2017.

Click here for other schemes managed by George Thomas & Christy Mathai Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-1 Benchmark and Tier-2 Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Quantum Mutual Fund - Riding the Market Rollercoaster? Strap in with Downside Protection

Posted On Wednesday, Aug 21, 2024

India with impressive economic growth, demographic dividend, and increasing influence on the political scale, the world’s hope remains with India.

Read More