Take the Early Ride to Maximize Your Tax Saving & Wealth Building Potential with an SIP in ELSS

Posted On Tuesday, May 09, 2023

Generally, many of us start scrambling toward the end of the financial year to make last-minute tax-saving investments. It's a stressful process that can leave us feeling overwhelmed and unsure if we have made the right decision. But what if this time you can do things differently - what if there was a way to say goodbye to the last-minute tax-saving hassles and hello to planned investments? Through this article explore how you can take control of your financial future and start planning early for your tax planning needs with an SIP in ELSS investments.

Tax planning is the analysis of a financial plan to ensure that all elements work together to allow you to pay the lowest taxes possible. Reduction of tax liability and maximizing the ability to contribute to achieving long-term goals are crucial for success of Tax Planning.

ELSS vs other 80C investments?

Investing in ELSS mutual funds is a smart way to get the best of both worlds - save tax while safeguarding your future goals at the same time!

| Tax benefit u/s 80 C | Investments made in ELSS up to Rs. 1.5 lakh per annum are eligible for tax deduction, which can significantly reduce your tax liability. |

| Get the most out of your money | An ELSS has 80% of the portfolio invested in equity and equity-linked instruments, which allows you the potential to generate higher returns over the long term while also benefiting from tax savings. |

| Lowest lock-in | Flexibility of the lowest lock-in period among other tax saving investments. |

| Weathers against Market Volatility | Potential to weather the volatility that may come with investing in stock markets. The scheme not only benefits from the market highs but also has provisions to lessen the impact of the lows. |

Despite all these benefits, you might be wondering whether an equity-linked savings scheme is the answer during these times when the future of the equity market is uncertain.

Equity markets have been experiencing tumultuous swings due to global policy changes and the prolonged Russia-Ukraine conflict. On a YTD basis, Nifty 50 Index has given negative returns and lacklustre returns on a 1 year basis. However, over 5 years or longer, Nifty 50 TRI has returned over 12% returns.^

^Source: ind_nifty50.pdf (niftyindices.com)

While it's difficult to predict market movements, use the 12 | 20: 80 Asset Allocation approach to start your journey toward long-term wealth creation. As part of Quantum’s Asset Allocation Strategy, equity forms the largest building block of your portfolio occupying 80% of your investable surplus. As ELSS invests primarily in equity and equity linked instruments, it forms an integral part of your diversified equity portfolio.

Visit Quantum’s 12|20:80 Asset Allocation Calculator to add ELSS as part of your diversified equity bouquet.

Waiting for the last minute may not always be a good idea, especially with your Tax Saving Investments. Start with an SIP in ELSS, as this can play a crucial role in helping you to plan early for your financial future & tax planning needs. Here are additional reasons why SIP in ELSS is important:

• No need for timing markets - With an SIP, you invest regularly and in a disciplined manner, that can help you avoid the temptation to time the market and make impulsive investment decisions that can prove to be costly to your wealth creation journey.

• Rupee-cost averaging - Benefit from rupee-cost averaging, which means you will buy more units when the markets are down and fewer units when the markets are up, thereby reducing the overall cost of investment.

• Grow wealth - You can benefit from the power of compounding and create significant wealth over the long term.

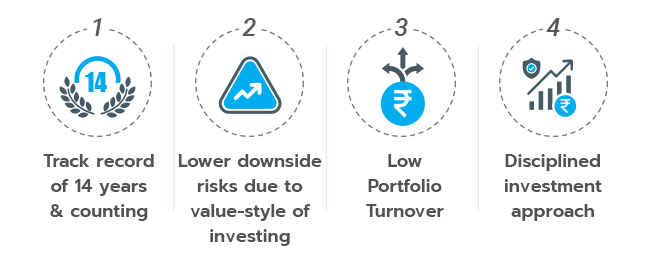

The fund has outperformed its benchmark on a since inception basis, making it a reliable investment option for investors who are looking to build wealth over the long term.^

Overall, the Quantum Tax Saving Fund is a good investment option if you are looking for consistent long-term returns and a disciplined investment approach. Invest wisely with Quantum Tax Saving Fund to plan your future tax saving and wealth creation goals. if you are looking for consistent long-term returns and a disciplined investment approach. Invest wisely with Quantum Tax Saving Fund to plan your future tax saving and wealth creation goals.

|

|

Related Articles

Your Anchor in a Storm - Grow your Wealth with a Value + Tax Advantage

Here’s Why Invest in ELSS for Tax Benefit

What is a Tax-Saving Fund And Why Does It Make Sense for the Risk-takers to Invest in It?

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Tax Saving Fund - Direct Plan - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark # Returns (%) | Tier 2 - Benchmark ## Returns (%) | Additional Benchmark ### Returns (%) | Scheme (₹) | Tier 2 - Benchmark ## Returns (₹) | Additional Benchmark ### Returns (₹) | Additional Benchmark ### Returns (₹) |

| Since Inception (23rd Dec 2008) | 15.64% | 15.78% | 15.71% | 15.22% | 80,550 | 81,931 | 81,251 | 76,398 |

| April 30, 2013 to April 28, 2023 (10 years) | 12.45% | 14.11% | 13.96% | 13.58% | 32,331 | 37,420 | 36,941 | 35,737 |

| April 29, 2016 to April 28, 2023 (7 years) | 10.93% | 14.24% | 14.24% | 14.61% | 20,670 | 25,387 | 25,387 | 25,975 |

| April 30, 2018 to April 28, 2023 (5 years) | 8.70% | 11.38% | 11.72% | 13.02% | 15,175 | 17,133 | 17,400 | 18,434 |

| April 30, 2020 to April 28, 2023 (3 years) | 23.74% | 25.50% | 24.63% | 23.36% | 18,926 | 19,743 | 19,335 | 18,753 |

| April 29, 2022 to April 28, 2023 (1 year) | 7.15% | 4.24% | 4.49% | 8.51% | 10,713 | 10,423 | 10,448 | 10,848 |

Data as of April 30, 2023

# S&P BSE 500 TRI ## S&P BSE 200 TRI ### S&P BSE Sensex TRI

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). #with effect from February 01, 2020 benchmark has been changed from S&P Sensex TRI to S&P BSE 200 TRI.

The Scheme is co-managed by Mr. George Thomas & Mr. Christy Mathai. Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022. Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022. For other Schemes Managed by Mr. George Thomas & Mr. Christy Mathai please Click here.

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Riskometer of scheme | Tier I Benchmark | Tier II Benchmark |

Quantum Tax Saving Fund (An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit) Tier I Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More