- Why Quantum

-

Investment Solutions

- Product Suite

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Active FOF

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Allocation Fund

- Partner Corner

- Learning Lab

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Allocation Fund

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Active FOF

Notice

Dear Investor,

Pursuant to SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings, irrespective of the amount of investment, under all mutual fund schemes.

1) To know more about payment modes available :

• Lump Sum Investments and their efficiency in the hierarchy of best to worst Click Here

• SIP Investments and their efficiency in the hierarchy of best to worst Click Here

2) Bank efficiencies in terms of providing credit to mutual funds on the same day before cut-off timings on which investors’ account is debited

i. NPCI (National Payments Corporation of India) Click Here

ii. Payment Aggregators (for e.g. Google Pay, Amazon Pay, PayTM)

We request Investors who have not submitted their PAN details and/or are Non KYC compliant to submit their PAN details & fulfill their KYC at the earliest. You may contact our [email protected] or call our toll free number 1800 - 209 - 3863 / 1800 - 22- 3863 for any queries or assistance.

Liquidity Window - Quantum Gold Fund (ETF): The Liquidity Window under Quantum Gold Fund is Open. Investors of Quantum Gold Fund can submit their redemption request upto Rs.25 Crores at the Official Point of Acceptance of the AMC. You may also redeem by sending the application via email from your registered Email Id to our Transact Id - [email protected].

SEBI’s Important Update on Folios without PAN / PEKRN: Click here for PAN / PEKRN related intimation.

Important Update on PAN & Aadhaar Seeding: As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 30th June 2023 failing which the unlinked PAN shall become inoperative. Please visit https://www.incometax.gov.in/iec/foportal/ and click on ‘Link Aadhaar option’ under the ‘Quick Links’ section to link your PAN with Aadhaar.

Equity Asset Class Outlook

Monthly Equity Outlook

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More

Equity Mutual Funds in India

heading

heading

heading

Quantum Value Fund

The investment objective of the scheme is to achieve long-term capital appreciation by investing primarily in shares of companies that will typically be included in the S&P BSE 200 Index and are in a position to benefit from the anticipated growth and development of the Indian economy and its markets.

Know More

heading

heading

heading

Quantum ELSS Tax Saver Fund

The investment objective of the scheme is to achieve long-term capital appreciation by investing primarily in shares of companies that will typically be included in the S&P BSE 200 Index and are in a position to benefit from the anticipated growth and development of the Indian economy and its markets.

Know More

heading

heading

heading

Quantum Nifty 50 ETF

The investment objective of the scheme is to invest in stocks of companies comprising CNX Nifty Index and endeavor to achieve returns equivalent to the Nifty by “passive” investment. The scheme will be managed by replicating the Index in the same weightage as in the CNX Nifty Index.....

Know More

heading

heading

heading

Quantum ESG Best In Class Strategy Fund

The Investment Objective of the scheme is to achieve long-term capital appreciation by investing in share of companies that meet Quantum’s Environment, Social and Governance (ESG) criteria.

Know More

heading

heading

heading

Quantum Small Cap Fund

An open Ended Equity Scheme predominantly investing In equity and equity-related instruments of small-cap companies. The investment objective of the Scheme to generate capital appreciation by investing predominantly in Small Cap Stocks.

Know More

heading

heading

heading

Quantum Multi Asset Allocation Fund

The investment objective of the Scheme is to generate long term capital appreciation/income by investing in a diversified portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments.

Know Moreheading

heading

heading

Quantum Ethical Fund

Related Webinars

-

From Fear to Fundamentals — Are Markets Turning a Corner?

Date & Time : 12th November, 2025 (04:30 PM)

Speaker : Ketan Gujarathi

Designation : Associate Fund Manager – Equity

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description :

Read MoreDecode the key market trends, macro indicators, and sectoral shifts shaping the investment opportunities

-

Cash, Courage, or Caution - What Works in EQUITY MARKETS Now?

Date & Time : 23rd May, 2025 (06:00 PM)

Speaker : Abhilasha Satale

Designation : Associate Fund Manager – Equity

Speaker : George Thomas

Designation : Fund Manager

Description :

Read MoreIn a world of shifting sentiment and mixed signals, equity investors face a pressing question—what really works?

-

FPI, Valuations & Markets: A Deep Dive

Date & Time : 28th February, 2025 (06:00 PM)

Speaker : George Thomas

Designation : Fund Manager

Speaker : Christy Mathai

Designation : Fund Manager

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description :

Read MoreGain insights from seasoned experts as they break down key investment themes. This session covers..

-

What Is the Status of Index Valuation in Relation to Its Long-Term Average & Its Way Ahead?

Date & Time : 06th December, 2023 (06:00 PM)

Speaker : George Thomas

Designation : Fund Manager

Description : Index valuation mostly moves around its long-term average. 🚀⚖️ Balancing act in the world of finance – where the present meets the past? Find out more on your equity investments & what should do you next to safeguard your investment portfolio?

Read More -

Changes in SEBI Guidelines – Impact on AMC's Explained by Christy

Date & Time : 08th June, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Fund Manager

Description : SEBI has changes the guidelines for Mutual Funds and Investors. Understand evolving guidelines & its impact on AMC’s, investments etc.

Read More -

Is India Amidst Rising Economic Boom or Is It Bubble?

Date & Time : 08th June, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Fund Manager

Description : Get answer to this key question about India‘s economy & more. If you have missed our #webinar, then view this snippet to resolve your doubts, from our investment experts.

Read More -

How Can Inflation Moderation Ease RBI Pressure and Impact Bond Risk Premiums?

Date & Time : 06th December, 2023 (06:00 PM)

Speaker : Pankaj Pathak

Designation : Fund Manager

Description : Unlocking a financial silver lining! 🌟 Moderating inflation not only eases the pressure on RBI but signals a potential shrink in risk premiums on bonds. 💹💼 Smart moves in finance pave the way for a brighter economic horizon.

Read More -

Elections Behind Us, Budget Ahead: The Way Forward for Investors

Date & Time : 21st June, 2024 (06:00 PM)

Speaker : Christy Mathai

Designation : Fund Manager

Speaker : Pankaj Pathak

Designation : Fund Manager

Description : Catch our recorded webinar on ‘Elections Behind Us, Budget Ahead: The Way Forward for Investors. 'Dive into the post-election analysis, expectations from the upcoming Budget and its potential impact on the markets.

Read More -

Is ESG true to its label

Date & Time : 13th July, 2023 (06:00 PM)

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : ind out what our investment expert Chirag Mehta speaks about India ‘s roadmap on #ESGinvesting, why are market leaders optimistic about India, #FPI’s outlook about top emerging countries etc.

Read More -

Webinar: Navigating Small-Cap Success: Market Insights & Strategies.

Date & Time : 16th October, 2023 (06:09 PM)

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : Given the flows small-cap funds have seen over the last year, the speakers share valuable insights into the growing opportunities in the Small Cap investing landscape & how to overcome the challenges.

Read More -

Webinar: Navigating Small-Cap Success: Market Insights & Strategies.

Date & Time : 16th October, 2023 (06:09 PM)

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : Given the flows small-cap funds have seen over the last year, the speakers share valuable insights into the growing opportunities in the Small Cap investing landscape & how to overcome the challenges.

Read More -

Webinar: Seize the Moment - Small Caps, Big Opportunities.

Date & Time : 18th October, 2023 (06:00 PM)

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : Get ready to dive into the world of Small Cap investments & opportunities, uncover the Quantum Small Cap NFO details, and learn how to address the challenges to build lasting Small Cap potential.

Read More -

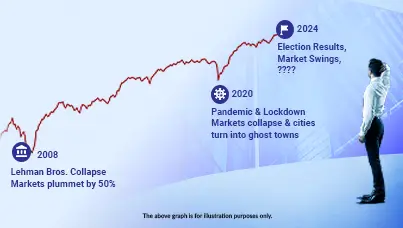

Certainty in an Uncertain World - Elections, Economy & Returns - Ajit Dayal Founder of QAMC

Date & Time : 26th March, 2024 (06:00 PM)

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Description : Ajit Dayal, founder of Quantum Asset Management Company, discusses the principles of value investing and Quantum's approach to predicting certainty in an unpredictable investment landscape. We have demonstrated our ability to navigate through turbulent market conditions, including crises like the collapse of Lehman Brothers, the challenges posed by the Covid pandemic and elections.

Read More -

Riding the Bull: Risk Management in Richly Valued Markets

Date & Time : 17th May, 2024 (06:00 PM)

Speaker : George Thomas

Designation : Fund Manager

Description : Introducing our monthly webinar series tailored to enhance investor learning in investments and financial planning.

Read More -

Small Caps, Big Opportunities: Navigating Obstacles

Date & Time : 19th April, 2024 (06:00 PM)

Speaker : Abhilasha Satale

Designation : Associate Fund Manager – Equity

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description :

Read MoreSmall cap investments offer tremendous growth potential, but they also come with their fair share of challenges...

-

Navigating Markets in 2024: Fund Managers' Year-End Perspective

Date & Time : 06th December, 2023 (06:00 PM)

Speaker : George Thomas

Designation : Fund Manager

Speaker : Pankaj Pathak

Designation : Fund Manager

Speaker : Chirag Mehta

Designation : Fixed Income (2013)

Description : Watch this mega webinar with our team of investment experts, where they decode the trends, unveil strategies, and chart the course for financial success.

Read More -

Navigating Small-Cap Success: Market Insights & Strategies.

Date & Time : 16th October, 2023 (04:30 PM)

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : Given the flows small-cap funds have seen over the last year, the speakers share valuable insights into the growing opportunities in the Small Cap investing landscape & how to overcome the challenges.

Read More -

Navigating the Path to Success with Small Cap Fund

Date & Time : 13th October, 2023 (06:00 PM)

Speaker : Abhilasha Satale

Designation : Associate Fund Manager – Equity

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : Given the inflows Small Cap Fund have seen over the last year, one should be mindful of the risks & challenges posed by investments in Small Cap Funds.

Read More -

Navigating the Market Rally: Strategies for Equity Investing.

Date & Time : 30th June, 2023 (06:00 PM)

Speaker : George Thomas

Designation : Fund Manager

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description : Discover winning strategies to thrive in the market rally! Learn how to navigate equity investing with expert insights and stay ahead. Don't miss out! Watch NOW.

Read More -

Riding the Big Wave - How to Build a Winning Investment Portfolio for India's Economic Boom

Date & Time : 26th May, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Fund Manager

Speaker : Pankaj Pathak

Designation : Fund Manager

Description : Did you miss tuning into our exclusive #webinar on “Riding The Big Wave” & creating an impactful portfolio? Hosted by our Fund Managers.

Read More

Watch the video to know more!

-

Are Market Dynamics Supporting Value Investing?

Date & Time : 12th April, 2023 (06:00 PM)

Speaker : Christy Mathai

Designation : Fund Manager

Description : In this video, we explore whether the current market dynamics are favorable for value investing, a long-term investment strategy that seeks to identify undervalued stocks and hold them until their true value is realized. We discuss the factors that influence market dynamics and how they impact the performance of value investing.

Read More -

Value investing in turbulent times

Date & Time : 18th April, 2020 (06:00 PM)

Speaker : Ajit Dayal

Designation : Founder – Quantum Advisors Pvt. Ltd. and Quantum Asset Management Company

Description :

Read MoreThe world seems to be experiencing an unprecedented event, as the COVID-19 pandemic is taking a toll on lives.

-

Mega Webinar: Equity Markets Poised For Growth - Is Your Portfolio?

Date & Time : 22nd July, 2022 (06:00 PM)

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Speaker : Hitendra Parekh

Designation : Fund Manager – Equity

Description : In our mega webinar, our Fund Manager Hitendra Parekh and CIO Chirag Mehta discussed how you can ride the India growth story with ease.

Read More -

Webinar - How is India Placed Amidst Global Uncertainty?

Date & Time : 23rd September, 2022 (06:00 PM)

Speaker : George Thomas

Designation : Fund Manager

Description : In this webinar, our Fund Managers Ghazal Jain and George Thomas discussed how is India placed amidst Global Uncertainty.

Read More -

Could Equities be a Game Changer in 2021?

Date & Time : 23rd December, 2020 (12:00 AM)

Speaker : I.V.Subramaniam

Designation : Managing Director & Group Head – Equities

Description : Could Equities be a Game Changer in 2021?

Read More -

Investing in a Bull Run - Where to from here

Date & Time : 20th August, 2021 (06:00 PM)

Speaker : Nilesh Shetty

Designation : Co Fund Manager - Equity

Description : Watch Mr. Nilesh Shetty, Fund Manager - Equity, Quantum MF, share his insights on the recent bull run. He discusses whether reacting to this rally is the right move for long-term investors.

Read More -

Equity Investing Simplified

Date & Time : 06th November, 2020 (06:00 PM)

Speaker : Chirag Mehta

Designation : Chief Investment Officer & Fund Manager

Description :

Read MoreEquity Investing Simplified

Related Quantum Directs

Our weekly newsletter of curated content to keep you updated on industry trends

-

What ONDC Means for Mutual Funds?

Quantum AMC is pleased to announce its onboarding onto the Open Network for Digital Commerce (ONDC).

Read More -

Global Stewardship Certifications in Investment Management - and What Sets the UK Code Apart

At Quantum, responsible investing is not just a principle

Read More -

Guidelines on Non-Demat Unit Transfers and Tax Implications

A recent ruling by the Income Tax Appellate Tribunal (ITAT), Mumbai around capital gains arising out of redemption of mutual fund units by NRI investors are not taxable in India

Read More -

Navigating NRI Investments : Understanding Double Taxation Avoidance Agreement (DTAA)

A recent ruling by the Income Tax Appellate Tribunal (ITAT), Mumbai around capital gains arising out of redemption of mutual fund units by NRI investors are not taxable in India

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

QLTEVF – Your Partner in Both Good Times and Bad

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Quantum ELSS Tax Saver Fund: Solid, Stable and works 30 hours a week for you

Investors seek stability, consistency, and reliability in their financial journey.

Read More -

Choosing the Right Mutual Fund for your Client?

Choosing the right mutual fund can be a pivotal step towards building a secure financial future for your clients.

Read More -

The Importance of Regular Portfolio Reviews

While managing a portfolio involves what one thinks will be suitable investments...

Read More -

Resilience in Rough Markets - Invest the Quantum Way

It’s been a jolly good ride for Indian equity investors since 2020 with 5-year annualized return of frontline indices Nifty 50 and Nifty 500 at 15.5% and 19% respectively as per NSE data as on December 2024.

Read More -

Equity investments and Tax saving - Tick both boxes with ELSS funds

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Add the edge of Ethics to Equities with Quantum’s latest NFO: Closes Soon!

Business ethics are the moral principles that act as guidelines for the way a business conducts itself and its transactions.

Read More -

Quantum Ethical Fund: Your Path to Principled Returns

One does not have to choose between doing good and doing well. Rather than chasing fleeting returns, choose to invest in a way that offers consistent, responsible returns.

Read More -

Turn your Values into Wealth with our latest NFO

When the Greek king Midas was granted a wish, he got greedy and asked for everything he touched to turn to gold.

Read More -

From Piggy Banks to Portfolios: Mutual Fund Investments for Growing Kids

Our children are the joy of our lives. We chuckle as they naively talk about being a doctor one day and an astronaut the other, while we work hard at our jobs

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Quantum Mutual Fund - Riding the Market Rollercoaster? Strap in with Downside Protection

India with impressive economic growth, demographic dividend, and increasing influence on the political scale, the world’s hope remains with India.

Read More -

Invest in Financial Freedom with This Multi Asset Fund

Just as India’s freedom was marked by resilience, strategic planning, and unity, the journey to financial independence requires thoughtful investment choices that secure long-term prosperity.

Read More -

Be Good. Do Good: The Quantum Way

In the business environment, good corporate governance is paramount to the success and sustainability of organisations.

Read More -

Navigating the New Taxation Rules for Quantum Investors

The Union Budget announced on 24 July, 2024 brought in controversial changes such as removal of indexation benefits and changes in tax rates.

Read More -

Ballots Cast, Budgets Await: Market Reactions in the Post-Election Economy

As India emerges from a dynamic election cycle, the investing landscape finds itself at a crossroads. While the newly formed Coalition government settles in, pre-budget expectations are shaping market sentiment.

Read More -

The Governance Feature in this ESG Fund

In the realm of sustainable investing, the governance aspect of an ESG (Environment, Social, and Governance) fund holds paramount importance.

Read More -

Experience the Quantum Difference: Investor Success with Integrity

In the evolving landscape of mutual funds, Quantum stands out as a beacon of integrity, transparency, and investor-centric operations.

Read More -

Skip the Coffee, SIP It Instead

We all know the joy of starting the day with a cup of our favourite coffee brew. But what if we told you that your daily Rs. 300 coffee habit

Read More -

Balancing Act: The Coalition Government and Markets in India

Let's explore how the current coalition government may impact your investments. The Indian stock market is a barometer of the country's economic health and is shaped by the prevailing political environment.

Read More -

Polls to Portfolios: A Robust Portfolio with Quantum in Post-Election India

The election season may be over, but the journey for your investments is ongoing.

Read More -

Are You Looking for Stability and Growth in Your Portfolio? Read This

Although the Indian equity markets have scaled new highs, the last couple of months have been rather volatile.

Read More -

World Health Day: Build a Healthier Portfolio with Quantum ESG Best-in Class Strategy Fund

As we celebrate World Health Day on April 7th, it's a timely reminder of the importance of wellness in all spheres of our lives.

Read More -

Worried How the Indian Equity Markets Would Do Around Elections?

In the last couple of months of the calendar year 2024, the Indian equity market has been on a rollercoaster ride or rather volatile.

Read More -

Did Your New Car Come Without a Steering Wheel?

Everything that is produced, as you know, follows a particular process and has certain capacity constraints.

Read More -

Small Cap, Big Difference: Staying Ahead with Liquidity & other Risk Controls

Amid a build-up of “froth” in the small cap and midcap space in terms of valuation

Read More -

-

Valentine’s Day Special: A Perfect Match for Certainty in an Uncertain world

As Valentine's Day approaches, it is a great time for creating and nurturing relationships.

Read More -

Interim Budget 2024-25: A Quantum Perspective

Fiscal prudence, continued capex spending, green growth and status quo on direct and indirect taxes were the key highlights of the Interim Budget FY 2024.

Read More -

This Republic Day, build a Strong Foundation for your Equity Portfolio

India will be celebrating its 75th Republic Day tomorrow.

Read More -

Dynamic Bond Fund stands to benefit from Fiscal Consolidation: Fixed Income Perspective from Pankaj Pathak

The interim union budget for 2024-25 will be presented on February 1, 2024 As has been the custom, the government may not announce any major policy changes in the interim budget ahead of Union elections.

Read More -

Tax Saving Season with a Predictable Approach

Instead of a short-term tax-saving exercise, take a holistic approach - a new lens of building wealth alongside tax saving by knowing what you can expect from your investments.

Read More -

Planning your Taxes with ELSS? Choose a Predictable Approach to Navigate High Valuations

We are in tax planning season. It is also a time when your employer asks you to submit investment

Read More -

Target Equity Growth with a more Predictable Approach

While markets will always remain uncertain and unpredictable, what if we told you could rely on a fund that offers you more predictability?

Read More -

Portfolio Released: A Sneak Peek into Our Small Cap Portfolio!

We believe that within the realm of small caps lie opportunities that can generate remarkable returns

Read More -

Look Beyond Ratings and Returns - Think S.M.A.R.T.

Investment decisions based on past returns may not be prudent as it may not be indicative of the potential or future

Read More -

Decoding the Intersection of Elections, Economy & Equity Investments

Elections tend to create short-term volatility and uncertainty in the financial space where it becomes difficult to predict market movements.

Read More -

Sail through Market Cycles with a Diversified Equity Portfolio

Mutual Funds needs close observation, realistic assessment and an open mind...

Read More -

Usher in Wealth & Good Fortune This Dhanteras with a Smart Gold Investment

Dhanteras, is fast approaching on the 10th of November and it marks the first day of the grand Diwali celebration, a time when homes across India are lit up with the warm glow of diyas.

Read More -

Opportunities & Challenges in the Small Cap Space: Interview with Chirag Mehta, CIO & Fund Manager

The Small Cap universe is very vast and has showcased good growth potential.

Read More -

Small-Caps, Big Difference: The Unexplored Opportunity Amid Sensex Rise

Worried that the Indian equity markets are near the peak?

Read More -

Small Cap, Big Difference to your Portfolio - NFO Launched Today on Oct 16!

Equity market goes through cycles. If you were to see the relative valuation of small caps vs Sensex, it is trading close to long term averages.

Read More -

Small-Caps Still Hold Potential but be Cognizant of Risks for a Rewarding Experience

The Indian equity market has had a run in the last couple of years, driven by a broad-based market rally. In the last one year, the S&P BSE Sensex generated an absolute return of 13% (as of October 05, 2023).

Read More -

Exploring the Shared Principles of Classrooms and Markets

From imparting knowledge, instilling good values and guiding you towards the right path, a teacher's contribution to one’s life is unmatched.

Read More -

Raksha Bandhan: Karo #PlanetKiRaksha with this Mutual Fund

Just as you've vowed to protect your sister, it's time to make a commitment to act towards #PlanetKiRaksha.

Read More -

India's True Independence Shines Amid Global Economic Shifts

In today's rapidly evolving world, where economic dynamics are constantly undergoing seismic changes, India emerges as a resolute beacon of resilience and growth.

Read More -

Sustainable Growth or Bubble? What Sets the Current Equity Rally Apart from the Pre-Covid Rally?

The Indian equity market has witnessed several upswings in recent years, but the current rally is particularly noteworthy for its strength and breadth.

Read More -

While Chasing Market Rally, Take Cognizance of Risks

We are halfway through 2023 and after overcoming challenges such as skyrocketing inflation and aggressive rate hikes in the initial part of this year, Nifty 50 & Sensex broke into new lifetime highs in June (19000 & 64500 levels respectively).

Read More -

India Story Turns Positive Again: How to Position Your Portfolio

In recent times, the Indian economy has shown promising signs of a positive turnaround.

Read More -

Market Fundamentals in Favour of Value

Value investing is a proven equity investing strategy propagated by legendary investors like Warren Buffett and Benjamin Graham that focuses on investing in undervalued stocks that are priced lower than their intrinsic value.

Read More -

Is there a link between green investing & long-term returns?

ESG investing refers to the integration of Environmental, Social, and Governance factors into investment decision-making processes.

Read More -

Take the Early Ride to Maximize Your Tax Saving & Wealth Building Potential with an SIP in ELSS

Generally, many of us start scrambling toward the end of the financial year to make last-minute tax-saving investments.

Read More -

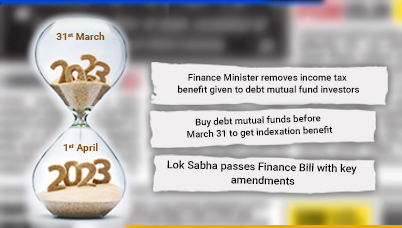

How do you Benefit from Indexation before Mar 31

What is the impact of indexation benefit withdrawal & how do you respond?

Read More -

India is Gearing Towards Sustainability. Is your Portfolio?

The Government has identified Green growth as one of the seven top priorities of the Union Budget this year.

Read More -

How to Structure Your Portfolio Given an Imminent Global Economic Slowdown

The Indian equity markets, as you may have experienced, have been quite volatile of late.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More -

Planning your taxes? Consider an option that can Save Tax AND Grow Wealth

It’s February and we are pretty much in the tax planning season. If you are a high-risk taker, looking to get two birds with one stone

Read More -

Here’s Why Invest in ELSS for Tax Benefit

‘A penny saved is a penny earned’, so goes a famous saying.

Read More -

Top 10 Highlights of the Indian Union Budget 2023-24 and Takeaways

Union Finance Minister Nirmala Sitharaman has presented the Union Budget 2023 heralded as the first budget in Amrit Kaal.

Read More -

What is a Tax-Saving Fund And Why Does It Make Sense for the Risk-takers to Invest in It?

We all aim to maximise our savings, isn’t it? In this respect, along with prudent budgeting and wise use of hard-earned money, saving tax is important.

Read More

Our Fund Managers

Have Questions? Reach out directly to our experienced fund managers and start a conversation today!

-

heading

heading

Chirag Mehta

Chief Investment Officer & Fund Manager

Chirag Mehta has over 18 years of experience in managing commodities and developing alternative investment strategies.

He is the Chief Investment Officer and Fund Manager at Quantum Asset Management Company. He joined Quantum in 2006 and assumed the CIO role in April 2022.

He holds a Master’s in Management Studies (Finance) and is a Chartered Alternative Investment Analyst (CAIA). His areas of expertise include precious metals, asset allocation, ESG investing, and multi-asset strategies.

Chirag manages multiple funds including the Quantum Gold Savings Fund, Quantum Gold Fund, Quantum Equity Fund of Funds, Quantum Multi Asset Fund of Funds, Quantum India ESG Equity Fund, Quantum Ethical Fund, Quantum Small Cap Fund & Quantum Multi Asset Allocation Fund.

He was ranked 4th among the world’s best Fund Managers under 40 by Citywire in 2017. -

heading

heading

George Thomas

Fund Manager

George Thomas has over 12 years of experience, including 9 years of experience in equity research covering multiple sectors.

He is a Fund Manager – Equity at Quantum Asset Management Company, a role he took on in 2022. He joined Quantum in 2016. He holds a Post Graduate Diploma in Management (Finance) from the Institute of Management Technology (IMT) and is a CFA Charterholder (CFA Institute, USA).

His expertise includes value investing, bottom-up stock picking, and sector analysis.

George currently manages the Quantum Value Fund and the Quantum ELSS Tax Saver Fund.

Prior to Quantum, he worked at Wipro Technologies and Robert Bosch Engineering & Business Solutions. -

heading

heading

Hitendra Parekh

Fund Manager – Equity

Hitendra Parekh has over 30 years of experience in the financial services industry.

He is a Fund Manager – Equity at Quantum Asset Management Company, having joined the firm in 2004. He holds a Bachelor's degree in Commerce and a Master’s degree in Financial Management from Narsee Monjee Institute of Management Studies.

His domain expertise includes index-based investing, fund management, and financial analysis.

Hitendra manages the Quantum Nifty 50 ETF and the Quantum Nifty 50 Fund of Fund.

Before joining Quantum, he was associated with Unit Trust of India and UTI Securities Ltd.

Reach out directly to our experienced fund managers and start a conversation today!