heading

About The Fund

The Quantum Ethical Fund is an open-ended Equity Fund that invests in companies meeting an Ethical Set of Principles with the objective of achieving long-term capital appreciation. Our proprietary screening framework ensures that every portfolio investment stands high on Ethical & Integrity parameters. With Quantum Ethical Fund, you can invest responsibly, where moral principles and prosperity work together for a brighter future.

5 Reasons to Invest in the Quantum Ethical Fund

-

1. Ethical Compliance

Responsible investing with risk-adjusted returns

-

2. Proprietary Integrity Framework

Screened for Ethics, selected for growth

-

3. True to Label Fund, Always

Portfolio Investments stay Ethically Compliant or exit the stock

-

4. A Disciplined Investment and Research Process

30-50 Ethically curated stocks

-

5. Financially Sound Investments

Strong companies with sound growth potential

Portfolio

Investment Approach

+750 stocks

ADDRESSABLE

UNIVERSE*

- Addressable universe with avg daily traded value of > $1 mn

350 stocks

INITIAL ETHICAL

SCREENING

- Companies meeting Ethical Set of Principles

- Companies not part of our well-defined exclusion list

>150 stocks

INTEGRITY

COMPLIANCE CHECK

- Based on Quantum's proprietary research methodology

- The evaluation process consists of a blend of quantitative and qualitative factors. Assign scores -70 to +30

- Companies>INTEGRITY score of 0 qualify for inclusion in the portfolio

30 to 50 stocks

Q ETHICAL PORTFOLIO

- Allocation is based on the Integrity score of the company, with guardrails around Index sector ranges

- Investors get a Doing Good = Potentially Healthy Returns portfolio which in the long run is expected to outperform conventional market indices

The number of Stock in trading volume criteria, integrity criteria and in portfolio will be changed from time to time based on Investment Strategy of the scheme.

Ethical = Form part of the ethical frameworks Shariah Compliant Universe, Jainism and such other Ethical principles.

Please refer Scheme Information Document of the Scheme for complete Investment Strategy.

Fund Features

Investment Objective

The Investment Objective of the scheme is to achieve long-term capital appreciation by investing in Equity & Equity Related Instruments of companies following an Ethical Set of Principles. There is no assurance that the investment objective of the scheme will be achieved.

Benchmark

Tier I: NIFTY 500 Shariah Total Return Index (TRI)

Type of Scheme

An open-ended equity scheme following an Ethical Theme.

Plans Available

Direct Plan and Regular Plan with Growth option in both Plans.

-

Minimum Application Amount

Lumpsum - 500

SIP-100 (Daily) & 500 (Weekly,Fortnightly, Monthly & Quarterly)

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Ethical Fund

(An Open-Ended Equity Scheme following an Ethical Theme)Tier I Benchmark : NIFTY 500 Shariah TRI

-

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Investments in Equity & Equity Related Instruments of companies following an Ethical Set of Principles -

Risk-o-meter of Scheme

-

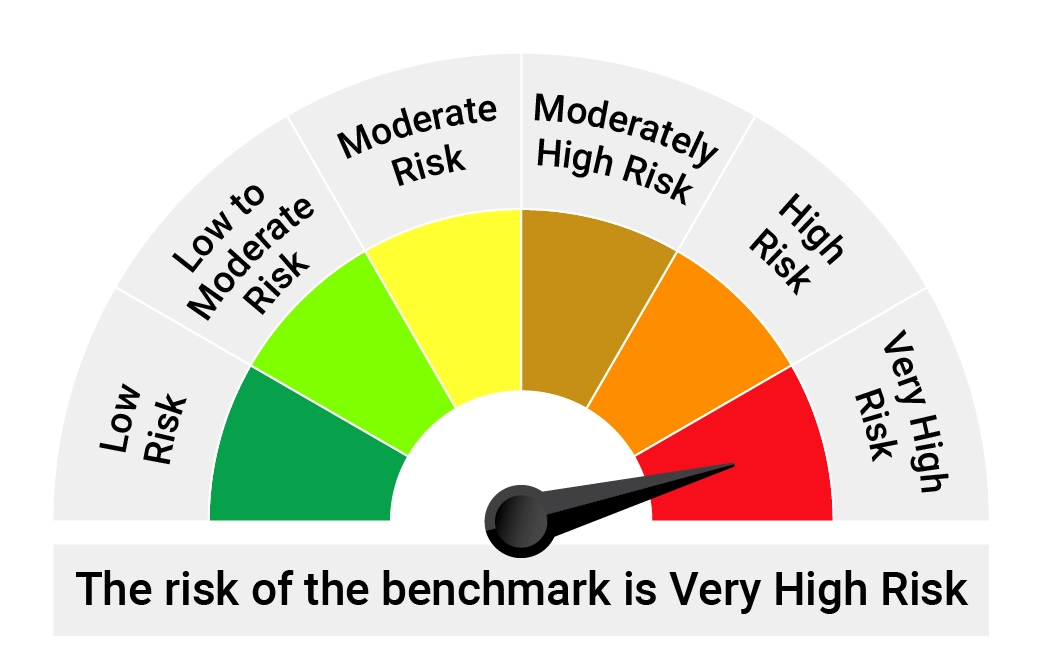

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.