Balance Hain toh Behtar hain - In Life and In Your Investments

Posted On Wednesday, May 25, 2022

| "When you are looking at an investment option to your bank deposits, you need to ensure you are selecting an option that is balanced and not biased to a particular asset class." |  |

| - Says Chirag Mehta, Chief Investment Officer |

A balanced meal or work-life balance is crucial for your long term physical and mental health. Similarly, when it comes to your investments, restricting your savings to Bank Deposits alone can prove to be less rewarding in achieving your long term goals.

To maintain your financial health, it is important to find that balance between risk and reward.

To explore more on why you need balance in your investments, we are in conversation with one of our youngest and dynamic thought leaders - Chirag Mehta, who has been recently elevated to the position of CIO (Chief Investment Officer) at Quantum Mutual Fund. Chirag has been managing the Quantum Gold Savings Fund, Quantum Equity Fund of Funds, Quantum India ESG Equity Fund and Quantum Multi Asset Fund of Funds.

In this interview, Chirag Mehta, shares thoughts on how you can improve your financial health with a balanced option that can potentially earn better returns than a Bank FD and help you ride market ups and downs with ease.

Q. Since equity markets are witnessing wide fluctuations, should investors take advantage of rising interest rates and invest / add money in Fixed Deposits (FDs)?

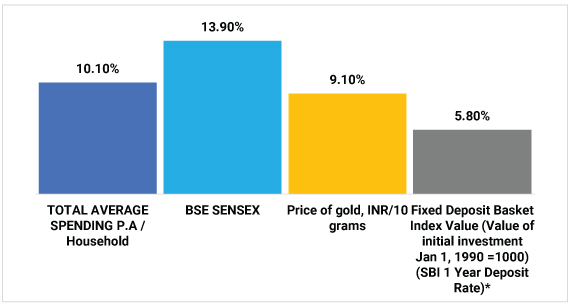

If we look at the increase in average consumer spending over the last two decades, returns from fixed deposits have not kept pace with the rate of inflation and in real terms, have returned negative.

On the other hand, Gold has kept pace with inflation and equities generally have offered the potential to exceed inflation rates but have been subject to drawdowns in the short term.

Thus, there is a need to move beyond FDs to achieve your long term goals.

Figure 1: Fixed Deposits not at par with the rate of inflation

Value of Initial Investment - Jan 01, 1990. Data as of 2021 Estimated. Given that 2020-21 were pandemic period, the actual data will be different from those of estimates but that would probably normalize going forward and hence we have used long term averages for calculation purposes. The Total Average spending is derived from Private Final consumption Expenditure data from CMIE using components that make a typical consumption basket and how average spending on such consumption basket has increased over time. 2021 Estimates of the consumption basket spending is derived using long term average over the 2020 data. For Fixed Deposit SBI 1 Year Fixed Deposit is taken into consideration.

Q. What are the ways in which one can balance their investments to strengthen their portfolio?

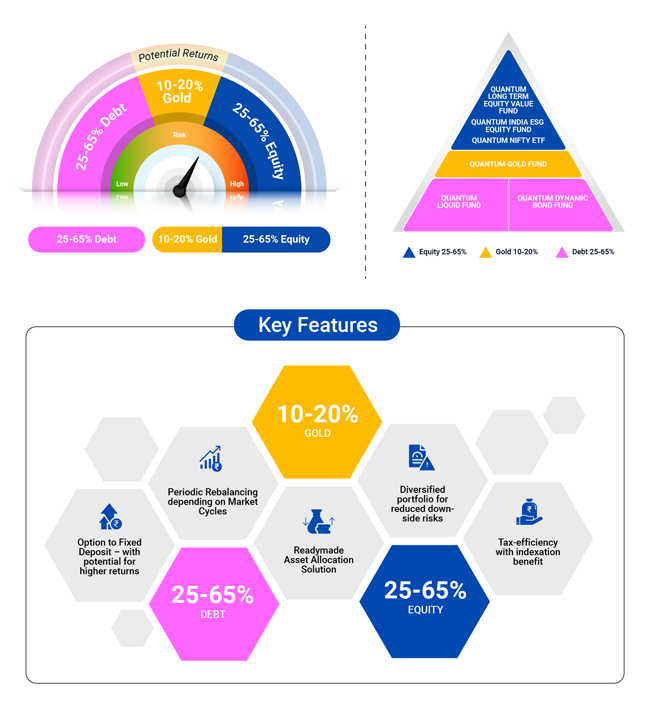

There are two ways to balance your portfolio. One is the DIY (Do-It-Yourself) Approach where you can do the asset allocation yourself using the Simple 12:20:80 Asset Allocation Solution with the underlying building blocks of equity, debt and gold.

And if you do not have the time or bandwidth to track multiple funds required in an DIY asset allocation, you can consider the option that offers a variety of asset classes in a single investment that is the Quantum Multi Asset Fund of Funds (QMAFOF).

Figure 2: Quantum Multi Asset Fund of Funds Portfolio

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

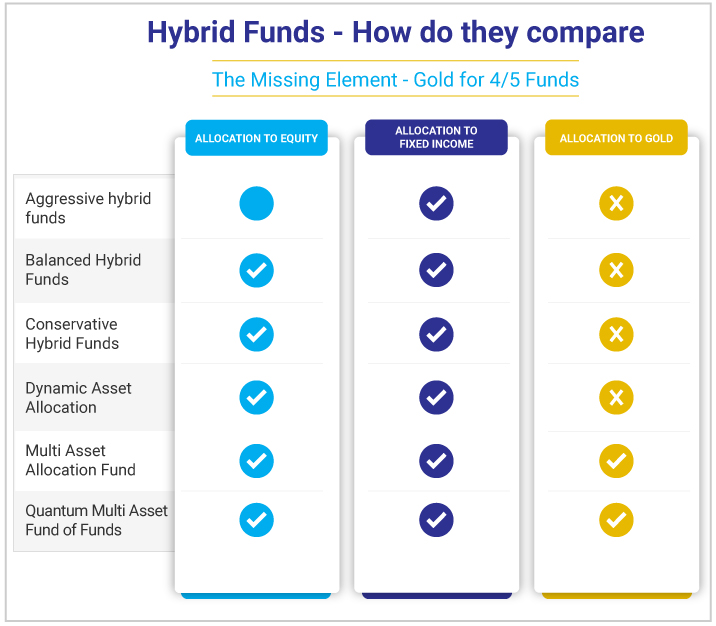

Q. How does this fund differ from other funds in the hybrid category?

When investing in hybrid funds, you need to exercise caution that your fund portfolio is not biased and not favoured to a particular asset class. If you are looking for reduced downside risks and at the same time potentially earn higher than the returns from Bank deposits, then Quantum Multi Asset Fund of Funds offers that balanced option.

QMAFOF is a Fund of Funds – that has characteristics of a hybrid fund and offers investors exposure to the missing element of Gold. The presence of gold in the equity-debt mix adds the third leg of the portfolio stool, thereby giving investors the potential to generate risk-adjusted returns through diversification of investments.

The underlying portfolio in our allocation is therefore a mix of all three asset classes in a proportion that will help you sail any kind of market environment.

If any one component of your portfolio is struggling, the other asset class steps in to reduce the fall. The imperfectly correlated underlying asset classes better position the fund to arrest portfolio drawdowns during periods of uncertainty.

Figure 3: Hybrid Funds - How do they compare

Q. How does this fund help lower downside risk than other funds in the hybrid category?

The fund has the potential to better arrest the risk of downside. If you compare the fund performance vs. the average of aggressive category of hybrid funds or multi asset allocation funds, it has registered a lower fall during the past three months amidst equity market correction, indicating a balanced allocation.

Figure 4: Category drawdowns comparison

| Hybrid Category | Average |

| Aggressive Hybrid | -1.95% |

| Multi Asset Allocation | 0.57% |

| Quantum Multi Asset Fund of Funds | 1.43% |

Source: Ace Application. YTD category average returns for the period ended April 30, 2022. Past Performance may or may not be sustained in future.

The difference in the market falls indicates that not all hybrid funds are created equally. The funds within the hybrid categories might have varying scales of exposure to high to very high risk assets such as equities. However, in QMAFOF, when the markets are experiencing a correction, the fund manager has the flexibility to respond tactfully to rebalance the underlying portfolio and reduce the risk of downside.

Q. Is this fund more tax efficient than a Fixed Deposit?

Unlike fixed deposit returns which are taxed as per the income tax slab of the investor, Quantum Multi Asset Fund of Funds’ long term capital gains are taxed at 20% with the benefits of indexation. This translates to a better return on investment, especially for investors in the highest income tax bracket.

Let’s understand the indexation benefit with an illustration. Suppose an investor invested Rs.1,00,000 in Jan 2018 and redeemed it in Jan 2021. For the sake of comparison, the rate of return on Quantum Multi Asset Fund of Funds has been assumed at the same rate as an FD at 5.1% for a period of 3 years.

Figure 5: Indexation Benefit Table

| Particulars | Quantum Multi Asset Fund of Funds | Fixed Deposits |

| Initial Investment Amount (Jan 1, 2018) | Rs. 100,000 | Rs. 100,000 |

| Redemption Amount (Jan 01, 2021) | Rs. 1,16,093.57 | Rs. 1,16,093.57 |

| Indexed Investment Amount | Rs. 110,661.8 | - |

| Capital gain | Rs. 5431 | Rs. 16,093.57 |

| Tax | 20% | 30% |

| Tax paid | Rs. 1086.35 | Rs. 4828.07 |

| Post Tax return | Rs. 15,007.22 | Rs. 11,265.50 |

| Actual Amount Received | Rs. 1,15,007.22 | Rs. 1,11,265.50 |

| Post Tax Return | 4.77% | 3.62% |

The above table is for illustration purposes only to explain the benefit of indexation. Past Performance may or may not be sustained in future.

Additionally, with this fund, you do not have to bear the taxation on capital gains arising out of rebalancing that you would have incurred had you performed the asset allocation yourself.

Q. What final takeaways should investors carry into their portfolio allocation for FY 23?

Market dynamics are changing. It is impractical to rely on low returns from your Bank Deposits or Invest in a mutual fund scheme that does not meet your investment objective / risk reward parameters.

If you do not have the time to track and rebalance multiple funds, Quantum Multi Asset Fund of Funds offers you a simple solution. The fund strategically positions its portfolio depending on the prevailing market conditions, thereby offering you a balanced allocation.

Choose an option that offers Balance in your investments, choose Quantum Multi Asset Fund of Funds today!

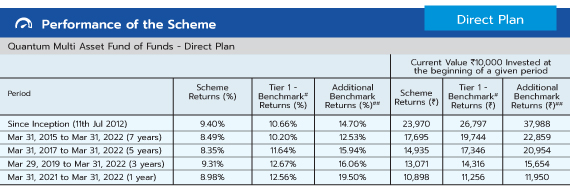

#CRISIL Composite Bond Fund Index (20%) + S&P BSE Total Return Index (40%) + CRISIL Liquid Index (25%) + Domestic Price of Gold (15%). It is a customized index and it is rebalanced daily.

##S&P BSE Sensex TRI

Data as of April 29, 2022. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The Fund is managed by Mr. Chirag Mehta. Mr. Chirag Mehta is managing the scheme since July 11, 2012. For other schemes managed by Mr. Chirag Mehta, please Click here.

Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Quantum Multi Asset Fund of Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on April 30, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund Tier I Benchmark: CRISIL Composite Bond Fund Index (20%) + S&P BSE Total Return Index (40%) + CRISIL Liquid Index(25%) + Domestic Price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on April 30, 2022.

The Risk Level of the Tier I Benchmark Index in the Risk O Meter is basis it's constituents as on April 30, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More