Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022. That said, the Indian equity markets were rather volatile in the calendar year gone by.

This is mainly because of a variety of challenges, such as:

• The third wave of COVID-19

• Russia’s invasion of Ukraine

• China-Taiwan strained relations

• North Korea being provocative with nuclear activity build-up

• The supply chain disruptions

• Spiralling inflation

• And central banks indulging in monetary tightening.

Now due to synchronous policy interest rate hikes to tame inflation, the World Bank and the International Monetary Fund (IMF) foresee the risk of a global recession in 2023 and a string of financial crises in Emerging Markets and Developing Economies (EMDEs).

As you know, in the U.S. and parts of Europe, certain macroeconomic indicators are already pointing at early signs of a recession.

Relatively, the Indian economy is in a better position as of today -- one of the fastest-growing major economies with a demographic dividend. But if the global macroeconomic conditions deteriorate, we may not remain fully insulated.

India too has border disputes at the Line of Actual Control (LAC) with China and the Line of Control (LOC) with Pakistan. In the gulf, there are regional conflicts.

In such times, as the challenges in global financial markets persist, Indian equity markets may remain vulnerable..

Currently, Indian equities seem to be relatively expensive compared to many of its global peers and the downside risks remain. So, as thoughtful investors, it's time to follow a balanced approach with a multi asset strategy.

2023: A Ready-made Asset Allocation Solution with Quantum Multi Asset Fund of Fund

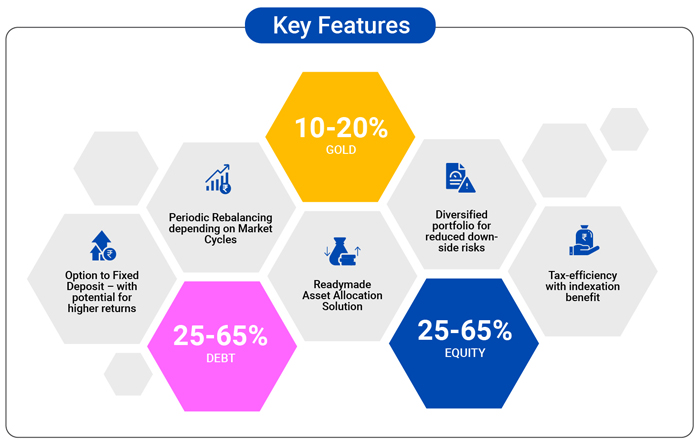

If you are looking to simplify portfolio diversification and reduce the downside risk arising from a pure equity fund, you can look at the readymade Asset Allocation Solution with Quantum Multi Asset Fund of Funds. The Quantum Multi-Asset Fund of Fund (QMAFOF) provides exposure to three asset classes: equity, debt and gold in 1 Fund.

QMAFOF follows a proprietary approach and is backed by an astute investment strategy.

It takes into consideration:

• The outlook for every asset class based on global and domestic macroeconomic data

• Assesses the relative valuations between asset classes considering price-to-earnings relative to historical averages

• The relationship between earning yield to bond yield relative to historical averages,

And more!

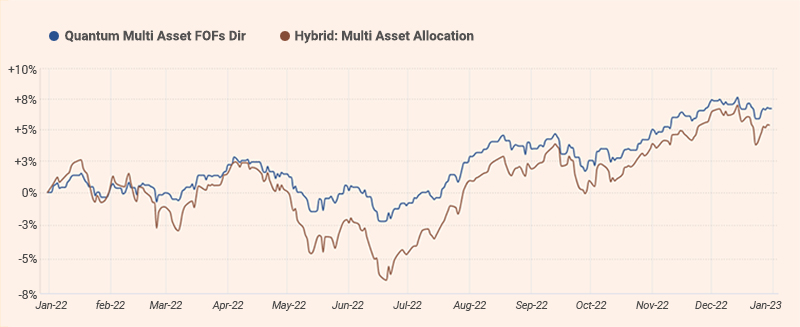

The Quantum Multi Asset Fund of Funds has showcased resilience during periods of market correction. The portfolio is not heavily biased to equities which means that this fund has the potential to minimize downside better during a market fall.

| Aggressive Hybrid | Multi Asset | Quantum Multi Asset Fund of Funds |

Average | 0.30% | 4.89% | 6.35% |

Min | -9.31% | -7.62% | -4.92% |

Max | 11.44% | 13.32% | 7.83% |

Source: Value Research. Data for the period between Dec 31, 2021 to Dec 31, 2022. Past performance may or may not be sustained in the future.

Data as of 31st December 2022

(Source: Value Research). Past performance may or may not be sustained in the future.

As seen in the chart above, QMAFOF in the challenging condition of 2022 hasn’t fallen much. This is due to the sensible portfolio allocation between equity, debt, and gold and the dexterity with which the fund has been managed.

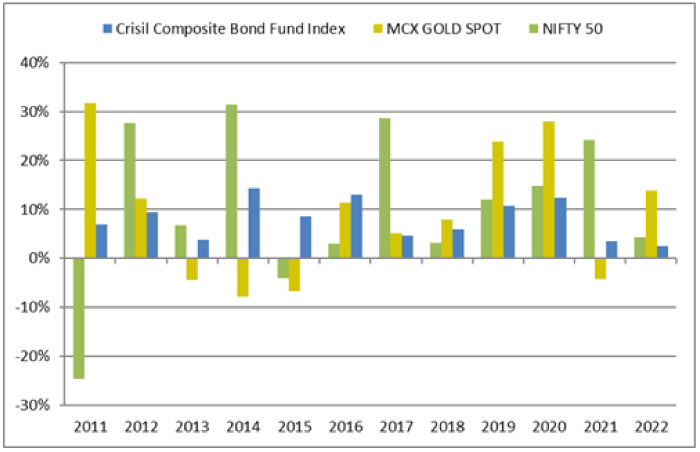

Graph: Performance of equity, debt, and gold in the respective calendar years

Data as of 31st December 2022

MCX spot price of gold used.

(Source: MCX, ACE MF). Past performance may or may not be sustained in the future.

The graph above indicates that not all assets move in the same direction always. There have been years when equities have rewarded investors with stellar returns and, at times disappointed investors (like in the years 2011, 2015, and 2018). During periods where equities have generated negative or lacklustre returns, it is usually debt and gold that have done well and added stability to the portfolio. Hence, it makes sense to follow a multi-asset approach.

If you are an investor seeking long-term capital appreciation by taking a moderately high risk and an investment time horizon of 3 to 5 years, QMAFOF is possibly the best fit for you.

Five Key Reasons to Invest in QMAFOF are:

With tactical asset allocation (which is the cornerstone of investing) handled by the fund manager, you will be able to balance the risk-reward in the journey of wealth creation. Further, it will save you the trouble of rebalancing at your end and makes portfolio tracking easy.

Quantum Multi Asset Fund of Fund allows strategic allocation between equity, debt, and gold at all times, which is necessary to sensibly generate wealth without being subject to a shrieking rollercoaster ride. Thus, be a thoughtful investor and consider investing in Quantum Multi Asset Fund of Funds .

Happy Investing!

|

|

If you prefer a DIY (Do-It-Yourself) approach:

| Performance of the Scheme | Direct Plan | |||||

| Quantum Multi Asset Fund of Funds - Direct Plan | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (11th Jul 2012) | 9.20% | 10.23% | 14.12% | 25,162 | 27,749 | 39,907 |

| Dec 31, 2012 to Dec 30, 2022 (10 years) | 8.91% | 9.94% | 13.57% | 23,483 | 25,807 | 35,708 |

| Dec 31, 2015 to Dec 30, 2022 (7 years) | 8.92% | 10.76% | 14.23% | 18,196 | 20,462 | 25,395 |

| Dec 29, 2017 to Dec 30, 2022 (5 years) | 8.05% | 10.45% | 13.61% | 14,731 | 16,448 | 18,943 |

| Dec 31, 2019 to Dec 30, 2022 (3 years) | 9.26% | 11.03% | 15.17% | 13,044 | 13,686 | 15,274 |

| Dec 31, 2021 to Dec 30, 2022 (1 year) | 6.71% | 6.67% | 5.82% | 10,669 | 10,665 | 10,580 |

# CRISIL Dynamic Bond Fund AIII Index (20%) + CRISIL Liquid Fund AI Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%).

Data as of Dec 31, 2022.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure.

The fund is managed by Mr. Chirag Mehta. Chirag Mehta is handing the fund since July 11, 2012. For other funds managed by Chirag Mehta, please Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier I Benchmark |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund Tier I Benchmark: CRISIL Dynamic Bond Fund AIII Index (20%) + CRISIL Liquid Fund AI Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |  |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Investors in the Quantum Multi Asset Fund of Funds Scheme shall bear the recurring expenses of the Scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment (subject to regulatory limits).

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More