Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities. But a rushed investment decision may lead to missed opportunities for long-term growth.

An Equity Linked Savings Scheme (ELSS) offers more than just a route to save tax under Section 80C of the Income Tax Act. The ELSS investment can contribute to building a resilient portfolio—one that stays focused on long-term value creation, across different market conditions.

Quantum’s Approach: Where Discipline Meets Dependability

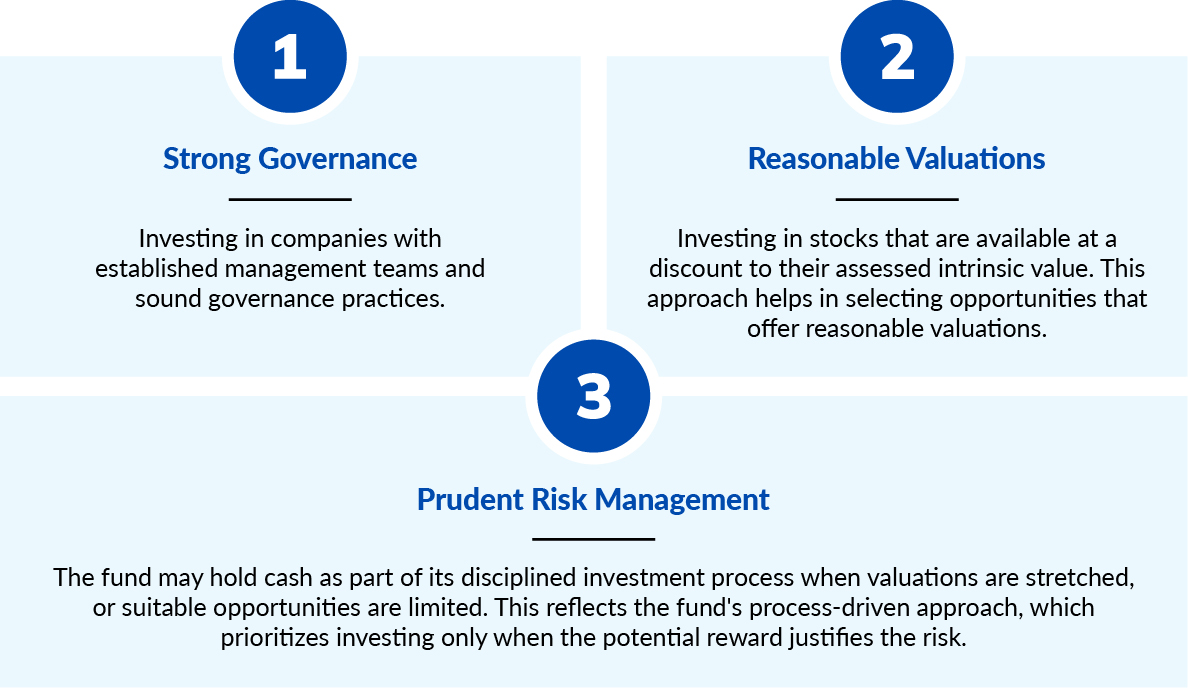

At Quantum, we believe tax-saving investments deserve the same thoughtful, disciplined approach as any long-term financial decisions. The Quantum ELSS Tax Saver Fund follows a value-investing strategy, anchored in:

This philosophy ensures we balance return potential with risk, aiming to deliver risk adjusted returns over the period, across the market cycles.

Risk-Return Balance: How Quantum ELSS Navigates Market Cycles

When evaluating an ELSS fund, it's important to look beyond returns alone and consider how much risk is being taken to achieve those returns. A fund that generates returns with reasonable risk management offers a more stable investment experience over time.

Here’s how Quantum ELSS Tax Saver Fund stands out, as on February 28, 2025

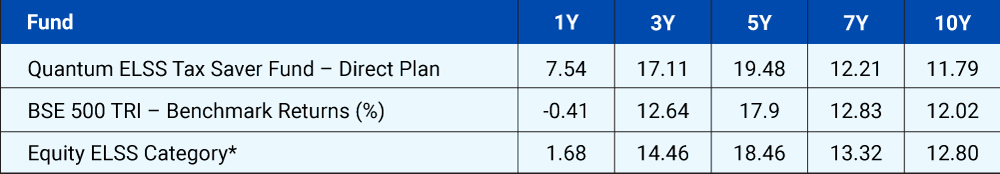

Return Over Time (%)

Data as on February 28,2025 *Value Research ELSS Equity Category, please refer returns methodology and other details https://www.valueresearchonline.com/funds/fund-category/. Past performance may or may not be sustained in the future. This table is to be read with complete performance provided in the article below.

Returns that Outpace the Benchmark and Category Average (3-Year Data – since ELSS Funds are subject to a 3-year lock-in period):

- Quantum ELSS Tax Saver Fund (3Y Return): 17.11%

- BSE 500 TRI (Benchmark, 3Y Return): 12.64%

- ELSS Category Average (3Y Return): 14.46%

➔ The fund has delivered higher returns over a 3-year period, outperforming both its benchmark and category peers.

Data Source: Value Research. Data as on February 28,2025. please refer methodology and other details https://www.valueresearchonline.com/funds/fund-category/. Past performance may or may not be sustained in the future. This table is to be read with complete performance provided in the article below.

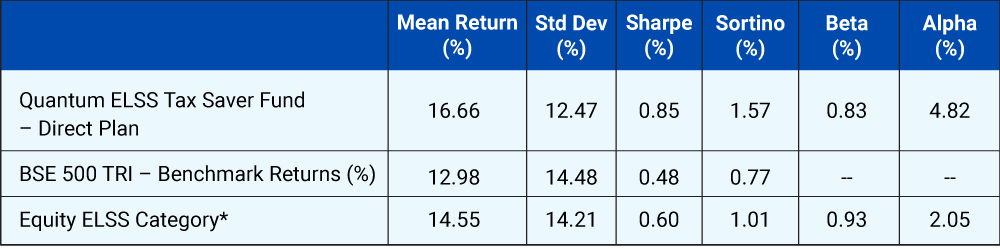

Lower Standard Deviation Indicates Relatively Lower Fluctuation (3-Year Data – since ELSS Funds are subject to a 3-year lock-in period):

- Quantum ELSS Std Dev (3Y): 12.47%

- BSE 500 TRI Std Dev (3Y): 14.48%

- ELSS Category Average Std Dev (3Y): 14.21%

➔ A lower standard deviation suggests that the fund has exhibited less variability in returns, offering a smoother experience through different market phases.

Sharpe Ratio Reflects Better Risk-Adjusted Returns (3-Year Data – since ELSS Funds are subject to a 3-year lock-in period):

- Quantum ELSS Sharpe Ratio (3Y): 0.85

- BSE 500 TRI Sharpe Ratio (3Y): 0.48

- ELSS Category Average Sharpe Ratio (3Y): 0.60

➔ A higher Sharpe Ratio means that for every unit of risk taken, Quantum ELSS has historically delivered better risk-adjusted returns compared to its benchmark and category.

Why does this Risk-Return Profile matter to you?

When evaluating a fund, returns are important—but so is understanding how those returns are generated. A fund’s risk-return profile helps investors gauge whether the potential returns are appropriate for the level of risk taken.

A fund with sound risk-return metrics like the Quantum ELSS Tax Saver Fund may offer a more balanced investment experience. It follows Value investing style to deliver growth potential by prioritizing downside protection and aims to deliver reliable and dependable long-term returns during dynamic markets.

Who may opt for this?

Quantum ELSS Tax Saver Fund’s balanced risk-return approach makes it a preferred choice for investors who:

- Seek tax-saving benefits under Section 80C of the Income Tax Act without exposing their investments to excessive market swings.

- Prefer stability and consistency as they work toward long-term wealth creation.

- Value a fund that focuses on capital preservation, even as it aims to deliver reasonable, risk-adjusted returns.

- Look for a disciplined investment process backed by research and a clearly defined stock selection framework.

March 31st Is a Deadline—But Long-Term Growth Is an Ongoing Goal

As the financial year closes, investors often hurry to meet their Section 80C requirements. However, this is also an opportunity to bring discipline and balance to your investment decisions.

A fund like Quantum ELSS Tax Saver Fund offers:

- Tax Savings Today

- Long-Term Wealth Creation for Tomorrow

- A Structured, Value Style Prudent Investment Approach Throughout

By investing in this fund, you’re choosing a strategy designed to ride through market cycles—not just react to them.

You work hard to secure your future—let your ELSS work just as hard, with measured risk and disciplined strategy.

|

Mr. George Thomas is managing the scheme since April 01, 2022. Mr. Christy Mathai is managing the scheme since November 23, 2022. Mr. Ketan Gujarathi is managing the scheme since February 01, 2025

| Performance of the Scheme | Direct Plan | |||||||

| Quantum ELSS Tax Saver Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Tier II - Benchmark## Returns (%) | Additional Benchmark Returns (%)### | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Tier II - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)### |

| Since Inception (23rd Dec 2008) | 16.45% | 15.86% | 15.76% | 14.82% | 117,790 | 108,419 | 106,924 | 93,807 |

| 10 years | 11.79% | 12.02% | 11.91% | 11.01% | 30,516 | 31,153 | 30,859 | 28,440 |

| 7 years | 12.21% | 12.83% | 13.04% | 12.84% | 22,406 | 23,290 | 23,595 | 23,305 |

| 5 years | 19.48% | 17.90% | 17.49% | 15.22% | 24,377 | 22,806 | 22,408 | 20,326 |

| 3 years | 17.11% | 12.64% | 12.42% | 10.56% | 16,067 | 14,295 | 14,211 | 13,519 |

| 1 year | 7.54% | -0.41% | 0.62% | 2.19% | 10,754 | 9,959 | 10,062 | 10,219 |

#BSE 500 TRI, ##BSE 200 TRI, ###BSE Sensex TRI. Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). ##with effect from February 01, 2020 benchmark has been changed from BSE Sensex TRI to BSE 200 TRI. Regular Plan was launched on 1st April 2017. Mr. Ketan Gujarathi (Associate Fund Manager w.e.f 1st February 2025). Click here for other schemes managed by the Fund Managers.

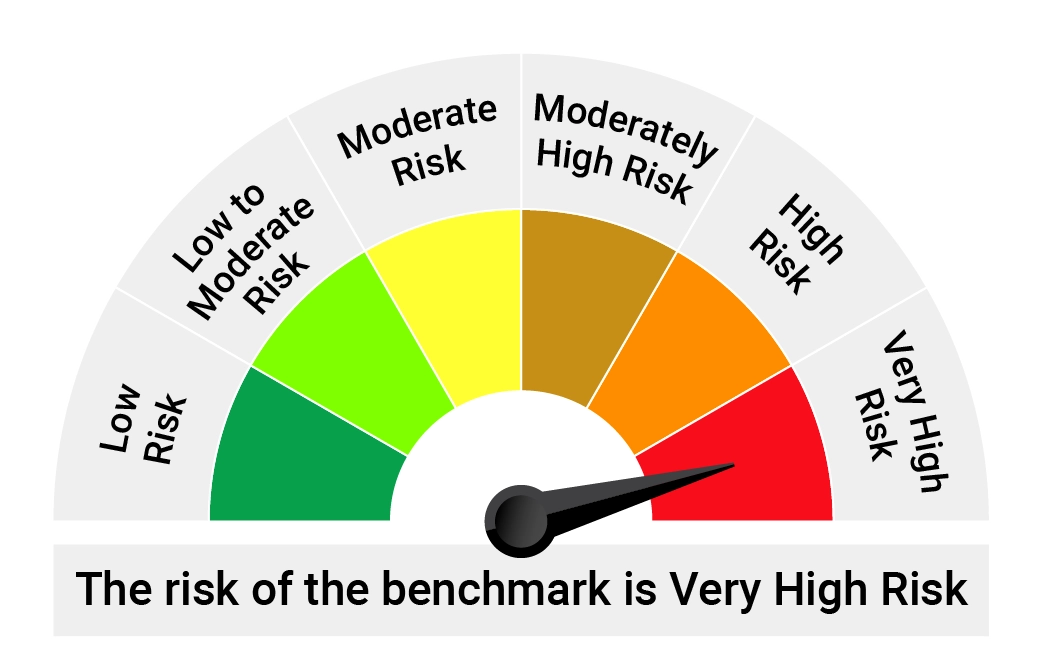

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier I & II Benchmark |

Quantum ELSS Tax Saver Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More