Markets Are Like A Cricket Pitch—Conditions Change, Approach Matters!

Posted On Wednesday, Mar 12, 2025

Cricket is a game of uncertainties. Some pitches allow for free-flowing stroke play, while others test a batter’s patience. A team that depends solely on aggressive batters might shine on a flat pitch but struggle on a turning track. As we just witnessed in India’s Champions Trophy triumph, it wasn’t one star performer but the balance of batters, bowlers, and all-rounders that helped cross the finishing line.

Championship-winning teams understand this-they balance their squad with batters, bowlers, and all-rounders, ensuring they’re prepared for any conditions.

Investing is no different. A well-balanced portfolio-one that strategically combines equity, debt, and gold-can help investors navigate different market conditions without relying on just one asset class. Asset allocation is the key to staying in the game, no matter how the market pitch plays out.

Markets = Cricket Pitch

Before every match, a cricket team studies the pitch. Is there early movement in the air? Is the surface dry and spin-friendly? A well-prepared team adapts its game plan accordingly. In India’s recent tournament journey, the team made these smart, tactical adjustments in every game-playing to the conditions.

Similarly, investors must recognize that market conditions are ever-changing-what works in one phase may not work in another.

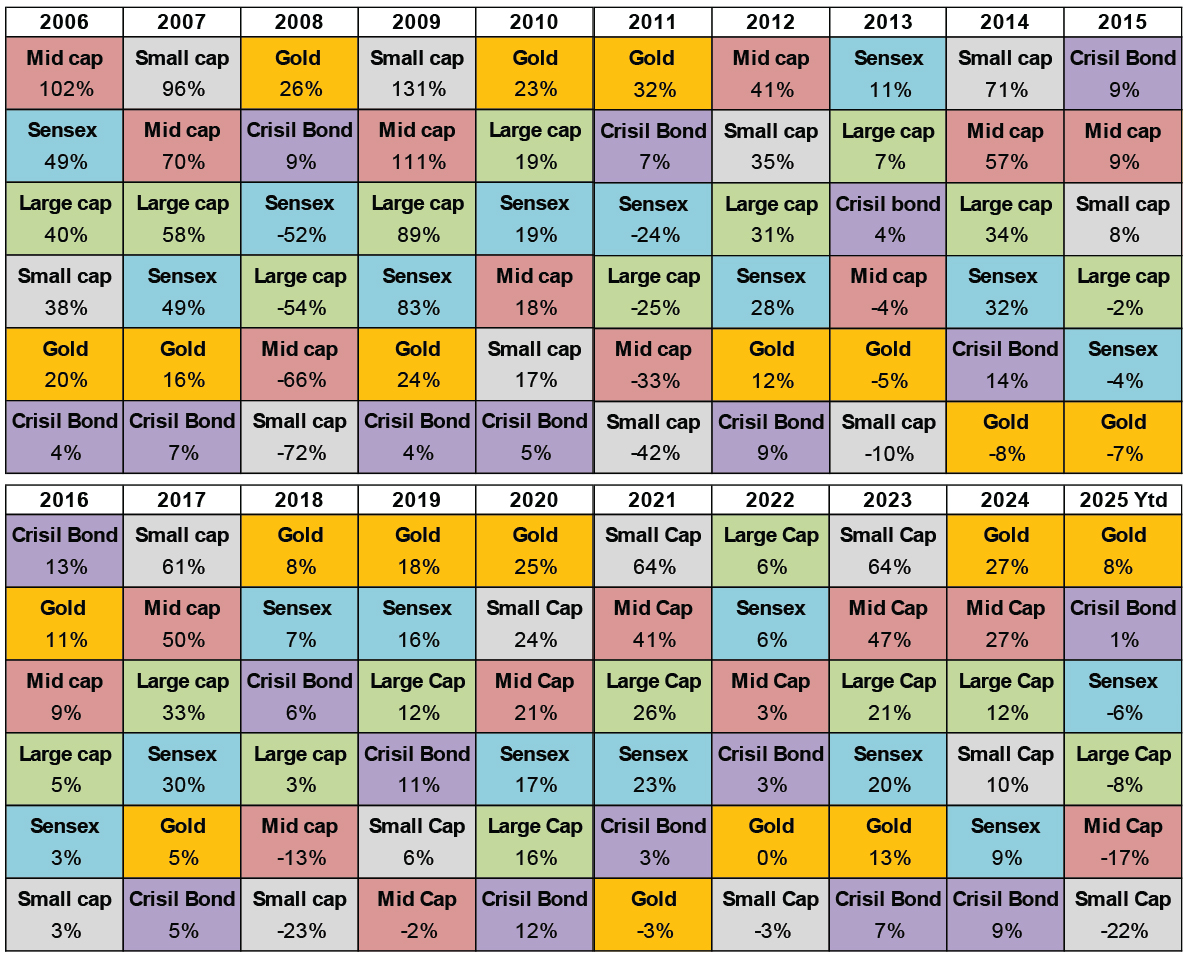

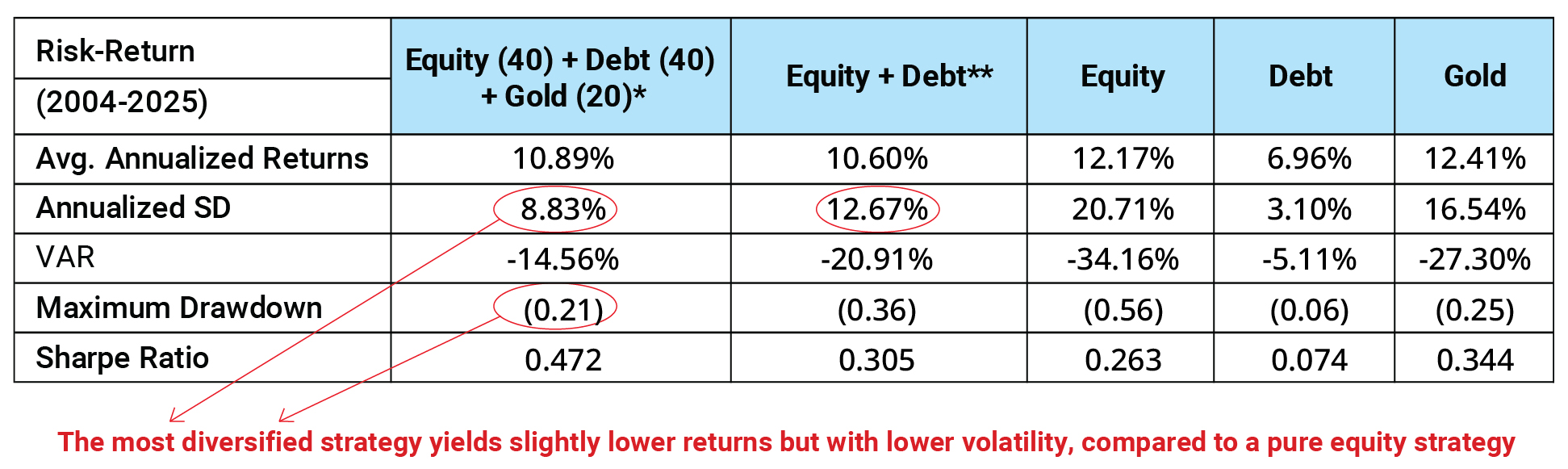

The chart ranks the best to worst performing indexes per calendar year from top to bottom. Past performance may or may not be sustained in the future. Indices Used: BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index. Source: Bloomberg

In strong bull markets, equity delivers high returns, much like a batter dominating on a perfect batting pitch. But when conditions shift, a portfolio heavily tilted toward equity may face sharp losses. This is where debt (stable, like a dependable bowler) and gold (the all-rounder that can shine in uncertainty) come into play, reducing downside risks and keeping the portfolio resilient.

A Winning Team Needs More Than Just High Scorers-So Does Your Portfolio

A winning cricket team wouldn’t rely solely on big hitters to pose high scores, they need defensive players to anchor the innings, bowlers to contain runs, and all-rounders to bring in versatility. India’s recent victory was a classic example of this balance-batsmen setting the tone, bowlers applying the pressure, and fielders holding their nerve in crunch moments.

In investing, this balance comes from asset allocation:

Equity - The High Scorers/Star Batter: Drives long-term wealth creation but needs the right environment to perform.

Debt - The Dependable Bowler: Provides stability and cushions against unpredictable market swings.

Gold - The All-Rounder: Brings balance to the portfolio, offering support when market conditions shift and other assets face challenges.

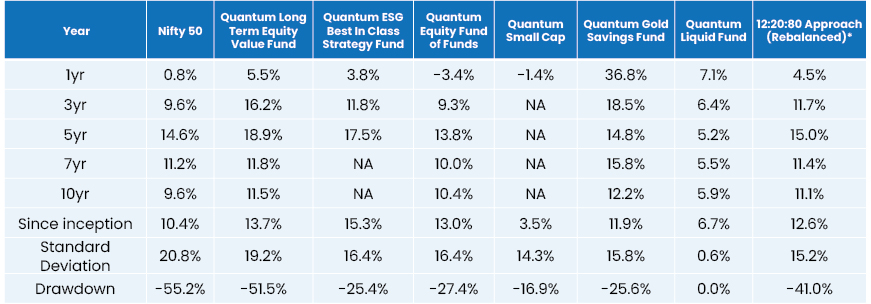

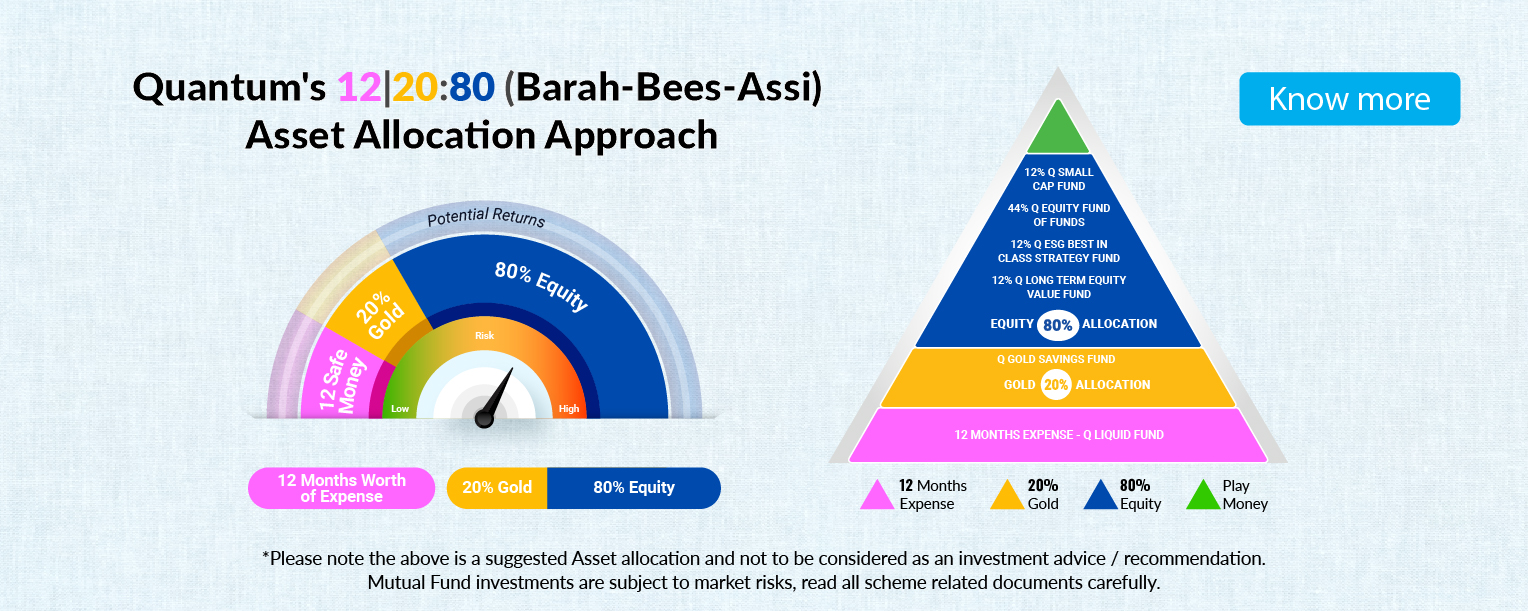

Performance of 12|20:80* DIY Approach

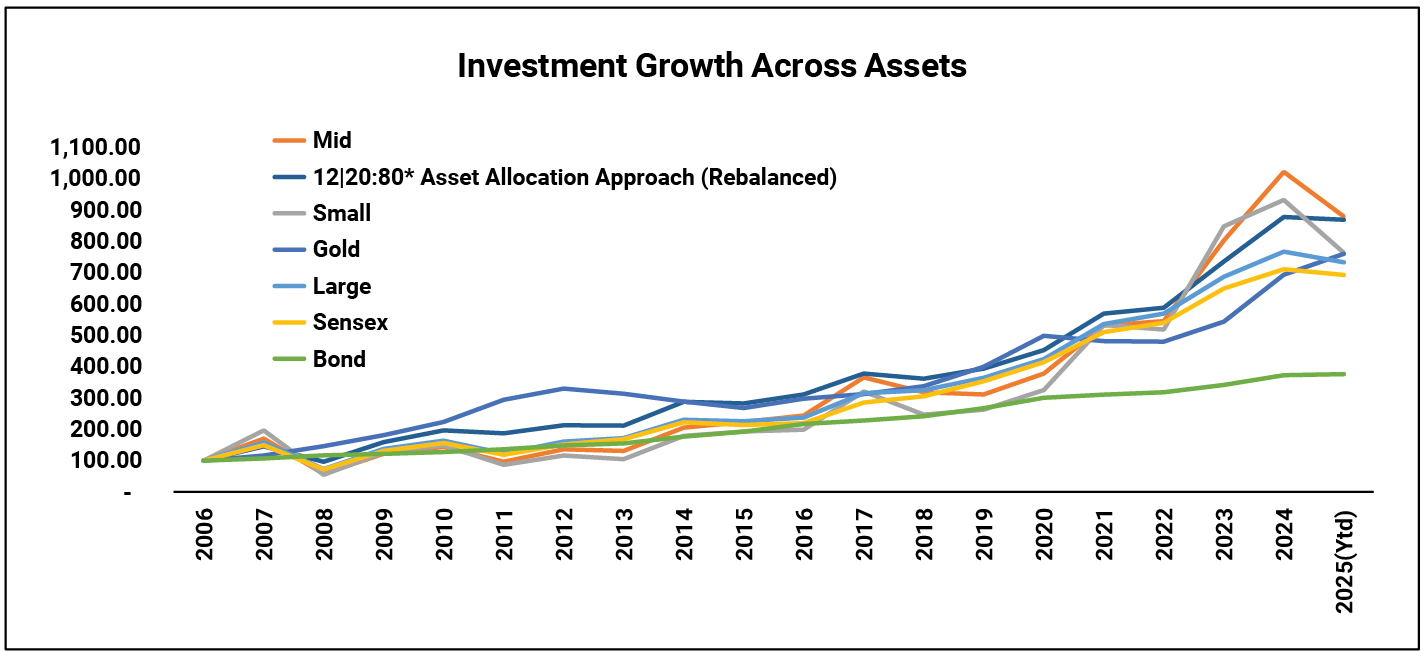

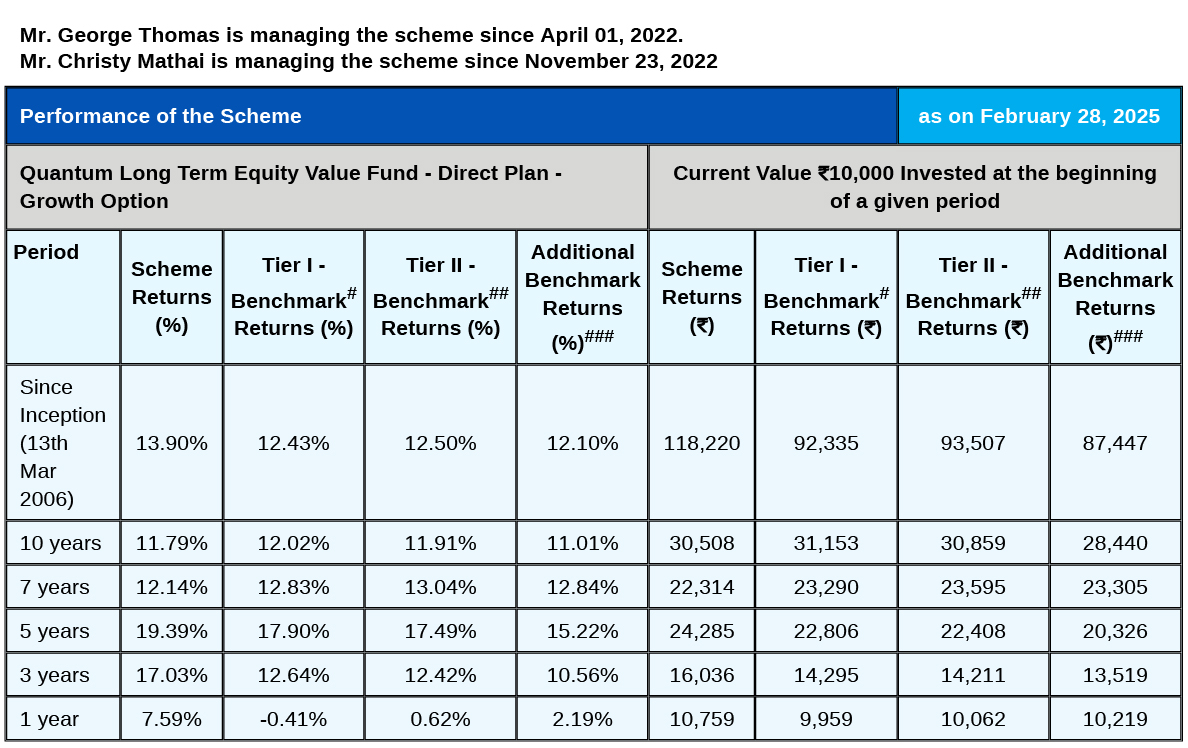

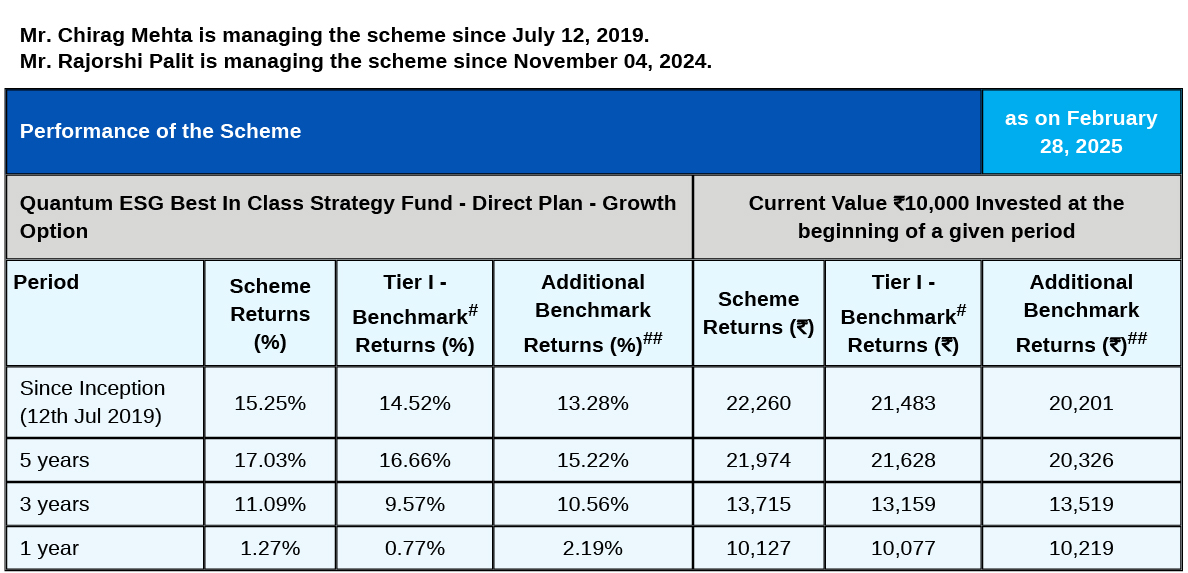

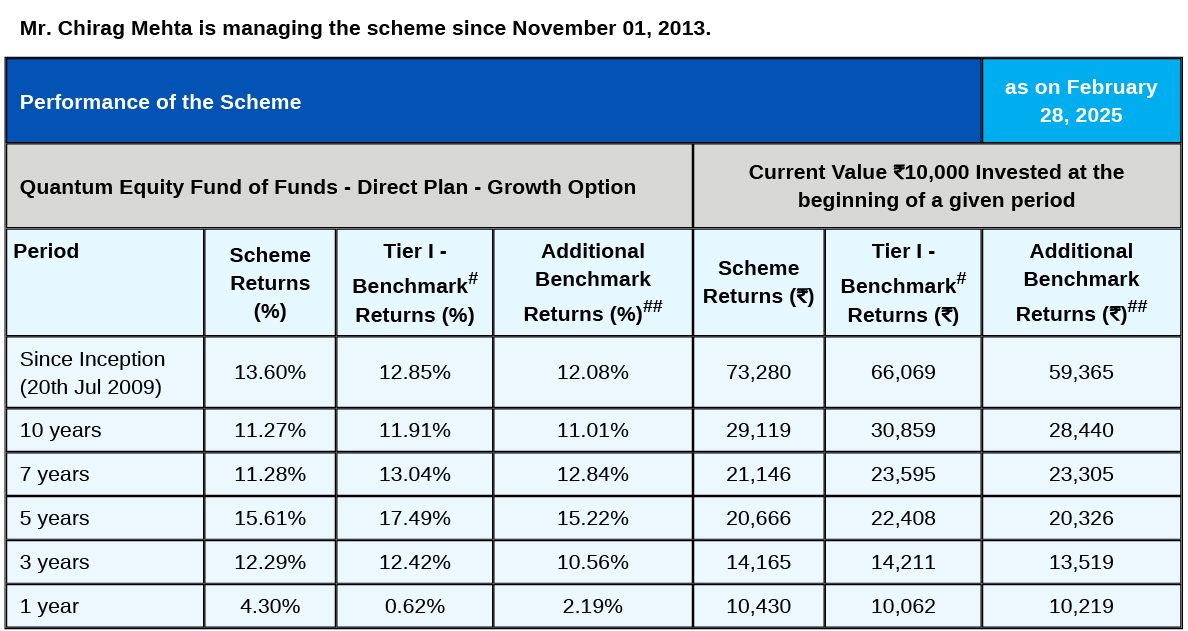

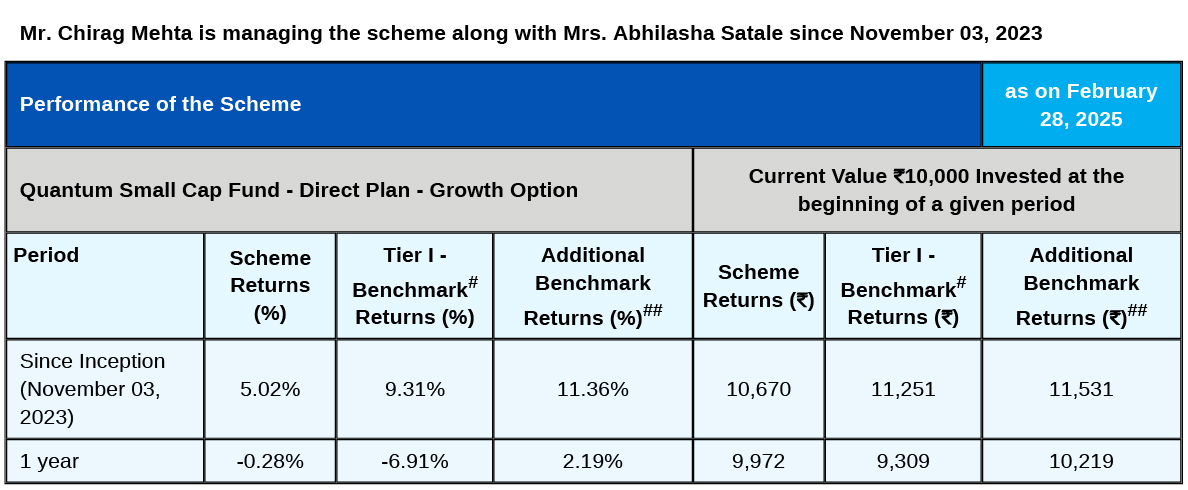

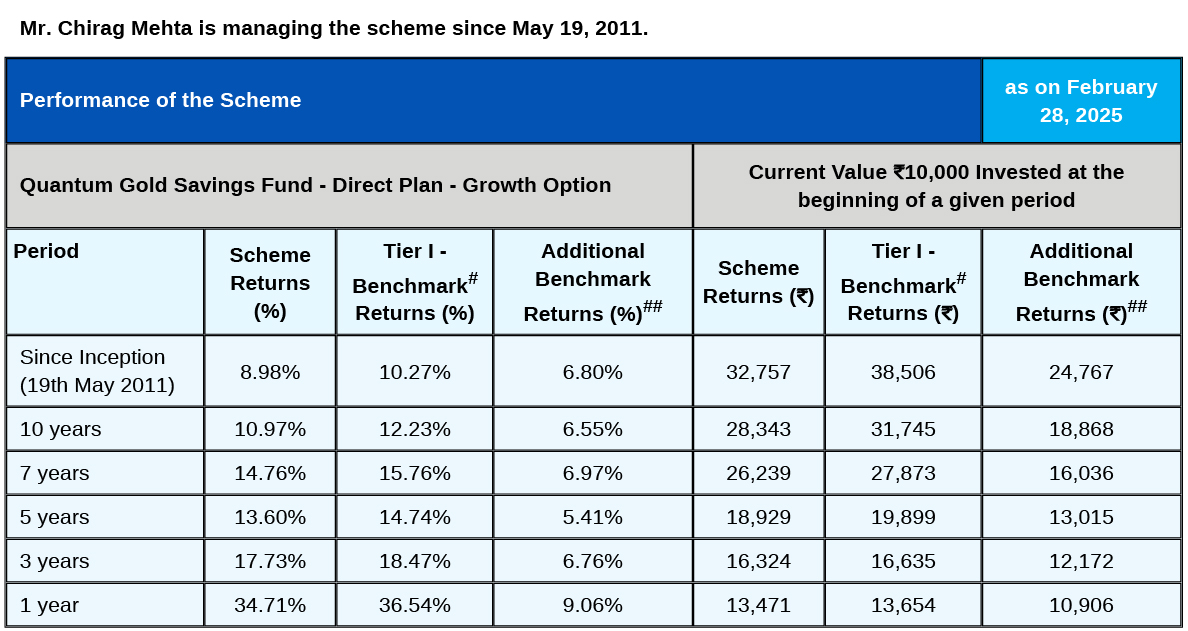

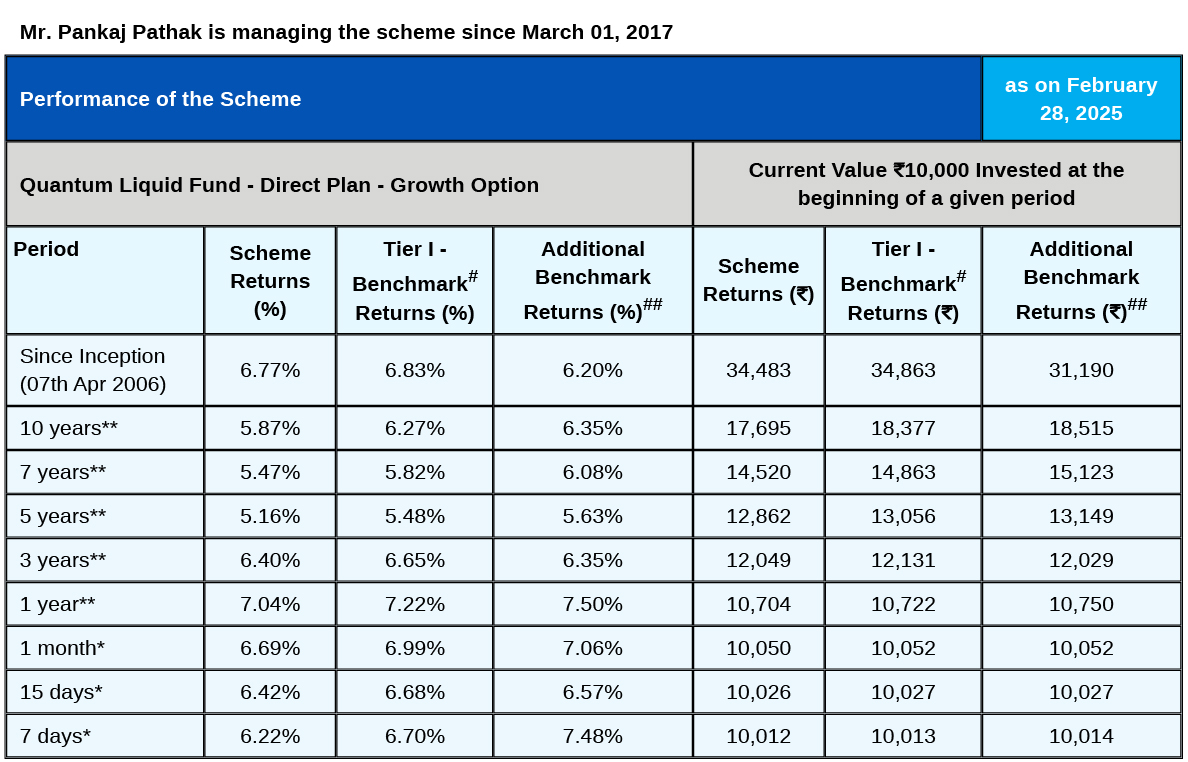

*The above represent hypothetical return of a 12-20-80* Liquid-Gold- Equity portfolio started on March 13th, 2006 which is rebalanced annually to the above-mentioned asset allocation. The Equity portfolio is split between Quantum Equity Fund of Funds, Quantum Long Term Equity Value Fund, Quantum Small Cap Fund and Quantum ESG Best In Class Strategy Fund in the proportion of 44:12:12:12. If the funds were non-existent it was proportionately allocated to the funds in existence on a pro rata basis. Since inception returns pertains to each fund’s inception date. The above performance is of the Direct Plan. Past performance may or may not be sustained in the future. Source: Quantum MF, Data as on 28th February 2025. The performance shown in the table should be reviewed in conjunction with detailed performance of the scheme provided below. Since Inception Date (Direct Plan): QLTEVF (March 13, 2006) QEFOF (July 20, 2009) QESG (July 12, 2019) QSCF (November 3, 2023) QGSF (May 19, 2011) QLF (April 7, 2006)

Past performance may or may not be sustained in the future. Source: Quantum MF, Data as on 28th February 2025.

The Resilience Edge: Playing the Long Game

Cricket teams are not built overnight. They follow a disciplined approach, stick to their game plan, and focus on long-term. India’s Champions Trophy win was a result of years of preparation, consistent strategies, and belief in their process. The same principle applies to investing.

A sudden market drop may tempt investors to exit equity completely—just like a batter might panic and start playing rash shots on a tricky pitch. But just as experienced players weather the tough overs and wait for scoring opportunities, a well-allocated portfolio helps investors ride out market downturns and capture long-term gains.

Time frame is November 2004 to February 2025. The period is taken from 2004 since the asset allocation weights are calculated based on normalizing the historical monthly equity and debt indicators. Given the normalization time frame used in the strategy, data availability for certain parameters beyond the time frame analyzed was a constraint. Compiled by Quantum AMC. *Equity-Debt-Gold in ratio of 40-40-20. **Equity-Debt dynamically allocated in 80-20 range Based on Sensex TRI, CrisilComposite Bond fund index, and Domestic Gold Prices. Note: Past performance may or may not be sustained in the future.

The 12|20:80 Asset Allocation approach* ensures that allocation is made for all market conditions-balancing equity, debt, and gold in a way that provides stability while allowing growth. Use our Asset Allocation Calculator to see how it works for you.

At Quantum, we believe that just like India’s champion cricket team, a well-structured portfolio isn’t built on one strength alone-it’s about balance, adaptability, and the ability to stand strong in any market condition. So, is your asset allocation prepared to play the long game? Because whether on the field or in the markets, success comes to those who plan wisely, stay disciplined, and make every move count.

|

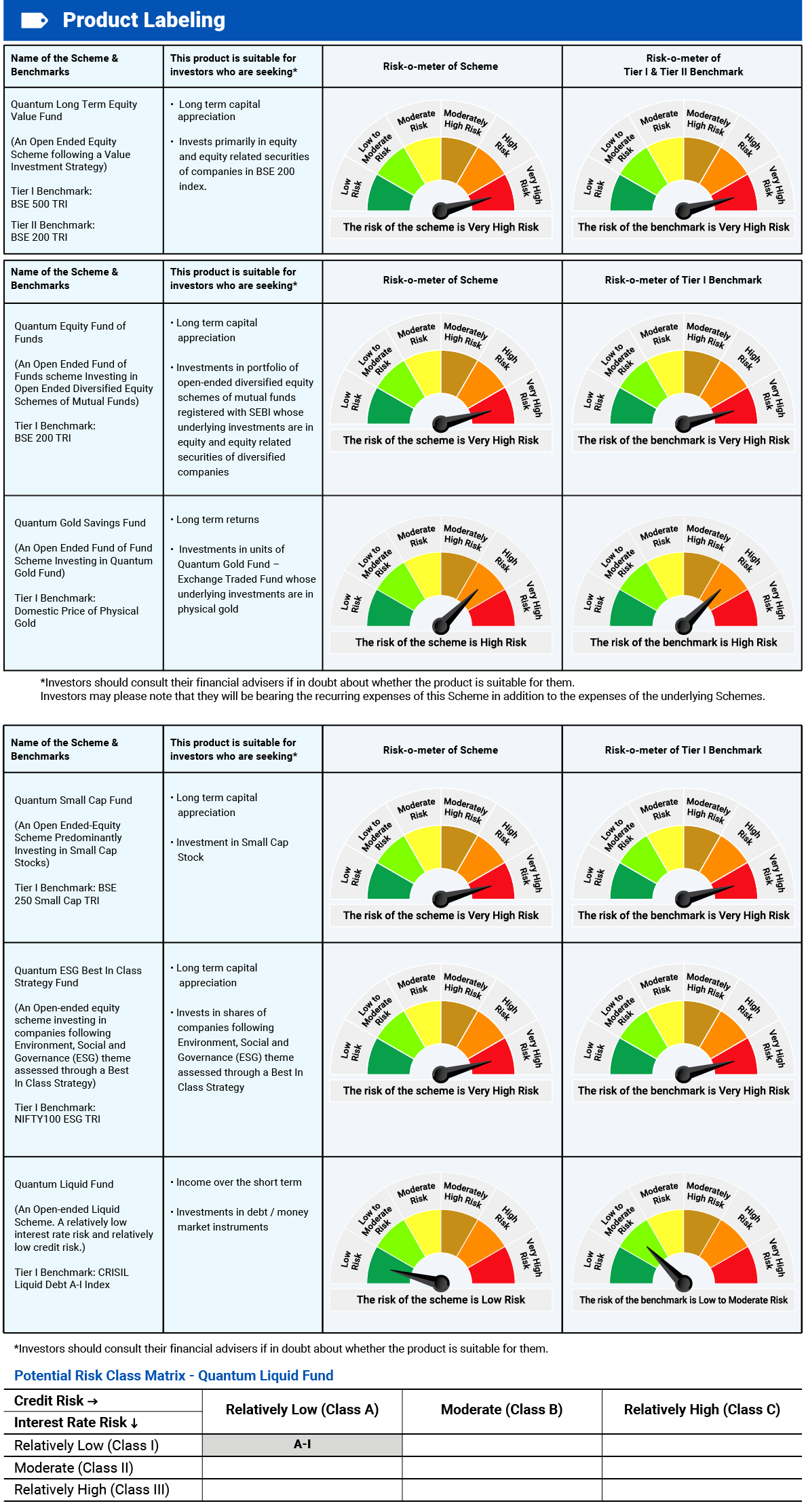

#BSE 500 TRI, ##BSE 200 TRI, ###BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). #with effect from December 01, 2021 Tier I benchmark has been updated as BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite. CAGR BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006. ##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value. since August 1, 2006. Regular Plan was launched on 1st April 2017. Click here for other schemes managed by Fund Manager.

#NIFTY100 ESG TRI, ##BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in Scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR) Click here for other schemes managed by Fund Manager.

#BSE 200 TRI, ##BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Regular Plan was launched on 1st April 2017. Click here for other schemes managed by Fund Manager.

#BSE 250 Small Cap TRI; ## BSE Sensex TRI Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR) Click here for other schemes managed by Fund Manager.

#Domestic Price of Physical Gold, ##CRISIL 10 Year Gilt Index. Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Click here for other schemes managed by Fund Manager.

#CRISIL Liquid Debt A-I Index; ## CRISIL 1 year T-bill Index. Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure. *Simple Annualized. **Returns for 1 year and above period are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Returns are net of total expenses. Click here for other schemes managed by Fund Manager.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. *Please note the above is a suggested Asset allocation and not to be considered as an investment advice / recommendation. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More