QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times. Mutual funds are like our financial partners. And similar to life partners, a good mutual fund is one which has potential to perform well in both bull and bear markets.

Recently the mood on D-street has been sombre. Indian equities have had a rough six months since the last quarter of calendar year 2024. The BSE Sensex index closed at 73,253 on February 28, 2025, down approximately 14% from its peak on September 27, 2024 at 85,978. Foreign investors have also been moving out of domestic markets over concerns related to valuations, global uncertainty and loss of domestic earnings momentum.

What happened when markets corrected from the peak in September 2024?

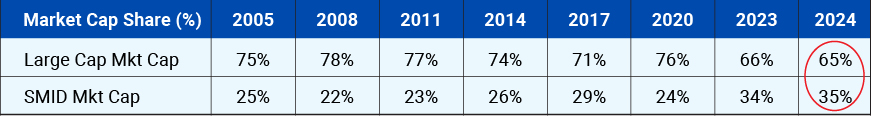

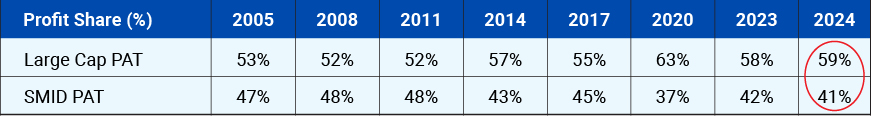

Let’s first look at the small & mid (SMID) vs large cap space, their share of market cap & share of profits. Comparing from 2005 till 2024, SMID market cap was at the highest level whereas their share of profits was at the lowest.

Source: ACE Equity.; Data as of Calendar Year End.

Source: ACE Equity.; Data as of Calendar Year End.

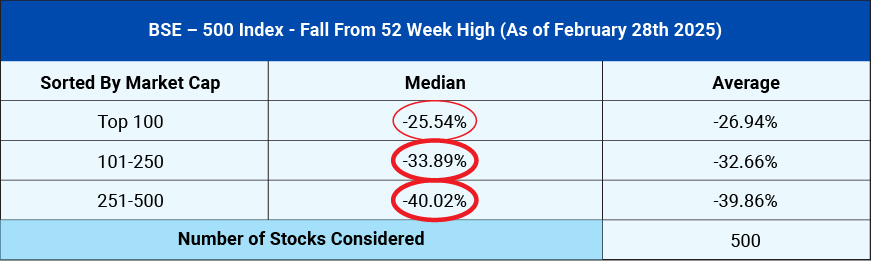

Also due to the market corrections, fairly valued larger businesses fell by 25% on an average compared to richly valued mid-cap stocks 33% and small cap stocks 40%.

Source: Ace Equity

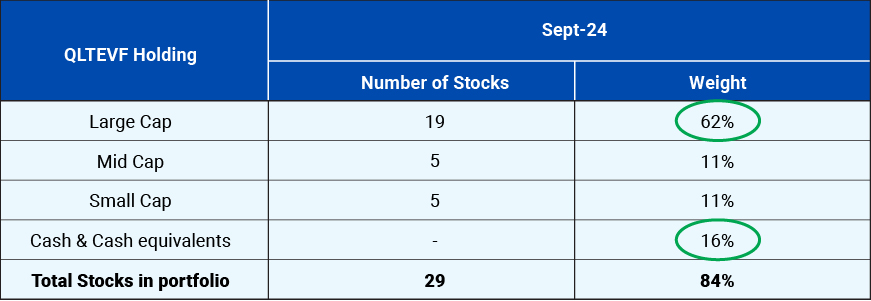

The Quantum Long Term Equity Value Fund fell by 12.93% during the same period (September 27th, 2024 to February 28th, 2025) as compared to its benchmark BSE 500TRI - 18.67% & Sensex TRI Index 14.19%. The fund follows value strategy to outperform the benchmark & index not only in good times but also bad. The fund’s strategy of owning undervalued stocks focus on liquidity, portfolio consisting of majority of large cap stocks and tactical use of cash has helped to protect the downside in an environment of elevated valuations.

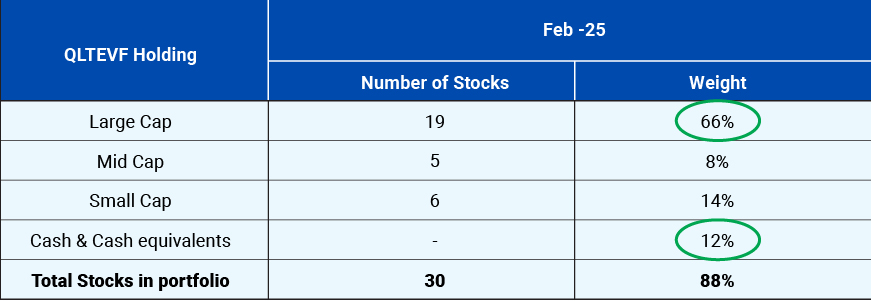

Quantum Long Term Equity Value Fund in September 2024 had 62% holdings in large cap stocks that helped soften the market crash. Also the fund was holding 16% of its portfolio in cash and this valuation cushion / cash buffer helped in lower drawdowns for the fund portfolio.

How is QLTEVF Portfolio Positioned?

Looking ahead, impact of tariffs imposed by President Trump on domestic and global growth, on US and domestic inflation and in turn on global and Indian monetary policies is set to weigh on near to medium term prospects of Indian businesses, and in turn of Indian stock markets. With pockets of the market still looking expensive, we could possibly be facing a prolonged phase of market uncertainty.

Investors can consider investing in the Quantum Long Term Equity Value Fund to navigate this challenging market phase as it well positioned to tackle the uncertainty.

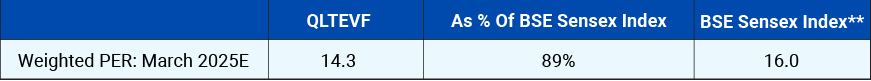

Based on the weighted average Price to Earnings ratios, the fund is currently 11% less expensive than the BSE Sensex. In this environment where stock prices are losing froth and returning back to fundamentals, the fund has a lesser chance of price declines as it owns stocks that are reasonably valued to begin with.

Source: Internal Research; As of February 28th, 2025, | cash weight excluded | **BSE Sensex Index weight is based on free-float. % BSE Sensex Index column depicts the Fund fundamentals as a percentage of BSE Sensex Index fundamentals. The figures mentioned in WTD PER ratio are calculated on the basis of Bloomberg consensus estimates for companies owned by the Fund as well as the companies in the BSE Sensex Index as of the reporting date i.e. February 28th, 2025.

66% of the fund’s portfolio consist of fairly valued large cap stocks, which may potentially limit portfolio downside in the event of further correction. Fund’s exposure to mid-cap stocks and small cap stocks, which are trading at premium to their larger peers is limited and higher stock holding in large, liquid (trading volumes of over US $1 million/day) stocks would ensure that low secondary market liquidity does not have an adverse impact on prices of the fund’s holdings during market corrections like the current one which was more unpleasant for small and mid-sized businesses.

The fund is also holding 12% cash to take advantage of market corrections and deploy funds at attractive valuations.

It’s easy to do well when markets are doing well. But the mettle of a mutual fund is known when the tide turns and markets falter. Instead of chasing the highest returns, Quantum Long Term Equity Value Fund like a true financial partner has always prioritized downside protection and aims to deliver risk adjusted returns.

Quantum Long Term Equity Value Fund

With You, For You, Forever

|

Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022.

Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022.

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Tier II - Benchmark## Returns (%) | Additional Benchmark Returns (%)### | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Tier II - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)### |

| Since Inception (13th Mar 2006) | 13.90% | 12.43% | 12.50% | 12.10% | 118,220 | 92,335 | 93,507 | 87,447 |

| 10 years | 11.79% | 12.02% | 11.91% | 11.01% | 30,508 | 31,153 | 30,859 | 28,440 |

| 7 years | 12.14% | 12.83% | 13.04% | 12.84% | 22,314 | 23,290 | 23,595 | 23,305 |

| 5 years | 19.39% | 17.90% | 17.49% | 15.22% | 24,285 | 22,806 | 22,408 | 20,326 |

| 3 years | 17.03% | 12.64% | 12.42% | 10.56% | 16,036 | 14,295 | 14,211 | 13,519 |

| 1 year | 7.59% | -0.41% | 0.62% | 2.19% | 10,759 | 9,959 | 10,062 | 10,219 |

#BSE 500 TRI, ##BSE 200 TRI, ###BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). ##with effect from December 01, 2021 Tier I benchmark has been updated as BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite. CAGR BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006. ##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value. since August 1, 2006. Click here for other schemes managed by Fund Managers.

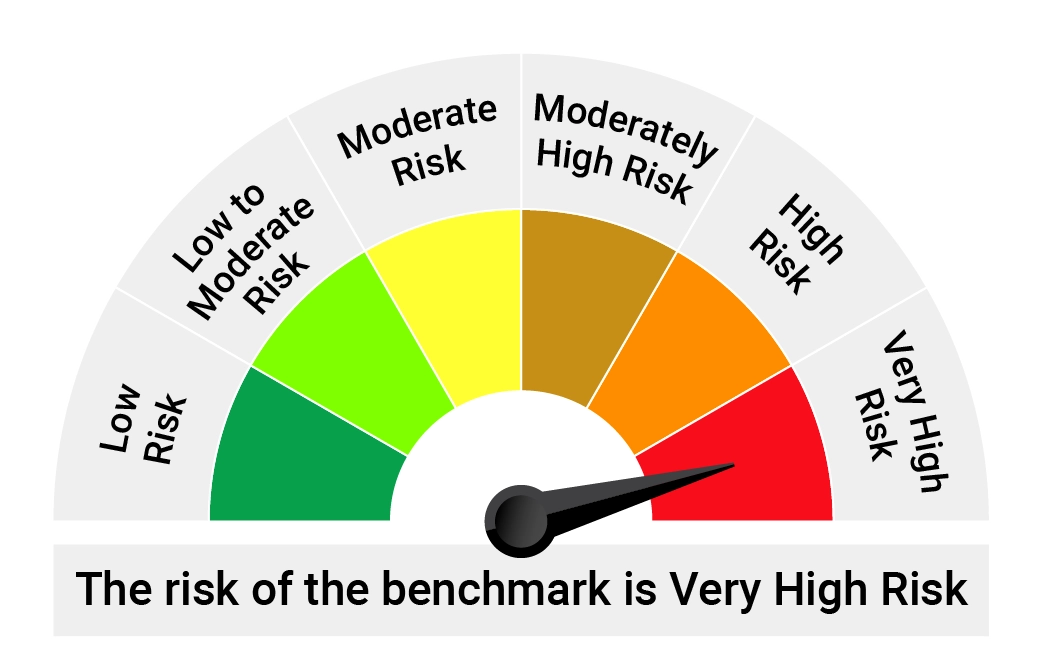

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier I & II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More