Indian Bonds Charting a Steady Course Through Volatility

Posted On Friday, Mar 28, 2025

In our previous edition of the Debt Market Observer (DMO) titled “The Road Ahead for Indian Bonds”, we explored the changing bond market landscape in detail, influenced by key economic events such as the FY 2025-26 Union Budget’s continued emphasis on fiscal consolidation and the RBI’s rate cut announcement.

Since then, India's growth and inflation dynamics have improved, creating new opportunities and challenges in the bond market that are worth exploring. Softer inflation and weaker growth leaves room for deeper than expected monetary policy easing by the RBI.

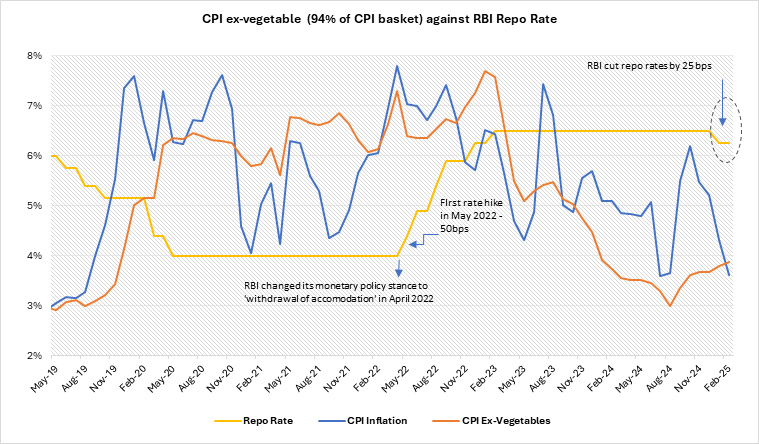

Softer inflation: Consumer Price Index (CPI) inflation fell to 3.6% in February 2025, the lowest in past seven months, driven by easing food prices. Food inflation dropped to 3.8%, the lowest since May 2023, with vegetables, pulses, and spices leading the decline. However, double-digit inflation in edible oils (16.4%) and fruits (14.8%) limited the overall moderation.

Chart – I: CPI inflation fell to a seven-month low on the back of lower food inflation

Source: MOSPI, RBI. Data on inflation for the month of February 2025.

Going forward, agricultural production is expected to reach a record high in 2024-25, supported by a strong Rabi harvest and healthy reservoir levels. While food inflation should stay mild, rising edible oil prices, driven by lower oilseed sowing and global price increases, could be a cause of concern.

Weather-related disruptions such as heat waves or untimely rainfall could also impact inflation trends. Global commodity prices, however, also remain a key concern due to uncertain trade policies and geopolitical tensions. Nonetheless, we believe that the CPI is moving in the comfortable zone.

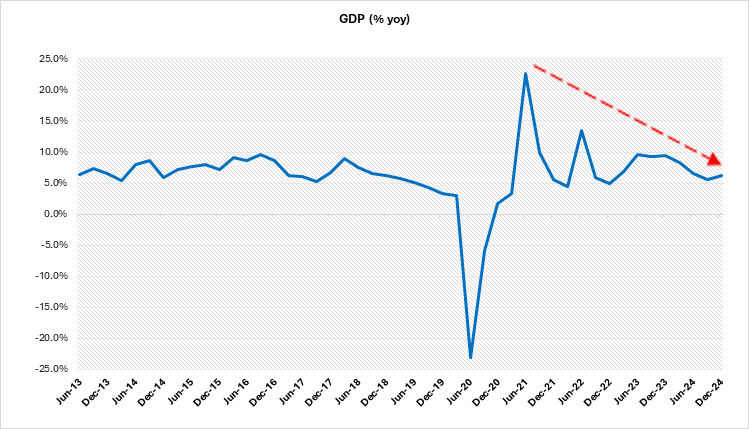

Growth rebounds but uncertainty hangs: GDP growth for Q3 FY25 was 6.2% y-o-y, slightly lower than market expectations, but an improvement from the 5.4% in Q2 FY25. The growth was supported by stronger private and government consumption, with government spending seeing notable acceleration. Rural growth was boosted by favourable weather and increased agricultural income, while urban consumption showed modest improvement.

Chart – II: GDP growth slowly recovering from Q2 slump, downside risks still linger

Source: RBI. Data on GDP growth up to the quarter ended December 2024.

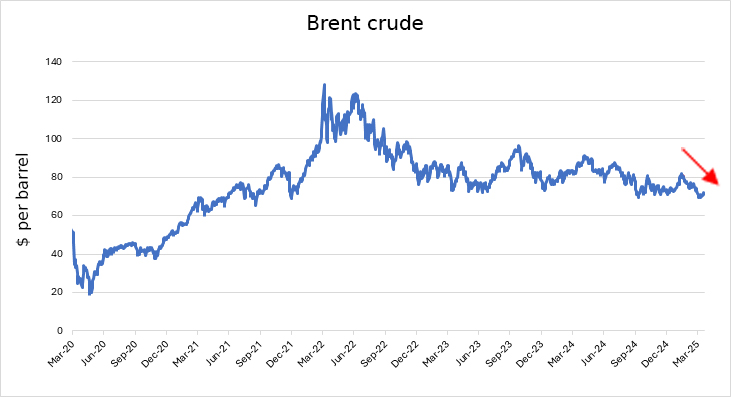

The outlook for consumption remains positive, supported by income tax cuts, falling inflation, and the RBI’s regulatory easing, which could encourage bank lending. Additionally, with crude prices moderating due to weakening demand and supply surplus, major shocks to India’s current account seem unlikely. Both the government and RBI are focused on supporting growth through tax cuts, liquidity injections, and reduced repo rates.

Chart – III: Stable Crude oil prices, supportive of external balances

Source: Bloomberg. Data up to March 21, 2025.

While the latest growth numbers indicate a revival and sequential pickup in activity, near-term prospects remain tied to ongoing geopolitical and economic challenges, including trade restrictions and tariff wars, which pose risks to growth.

Despite these challenges, India’s growth outlook remains moderately strong, with the International Monetary Fund (IMF) projecting 6.5% growth over the next two years. Lower borrowing costs from RBI rate cuts should also support the investment landscape. Increased public capex and a push for public-private partnerships as mentioned in the recent budget speech may likely help revive private investments.

A slower growth and softer inflation does make room for monetary policy easing, the extent of which is largely dependent on the evolving growth-inflation dynamics.

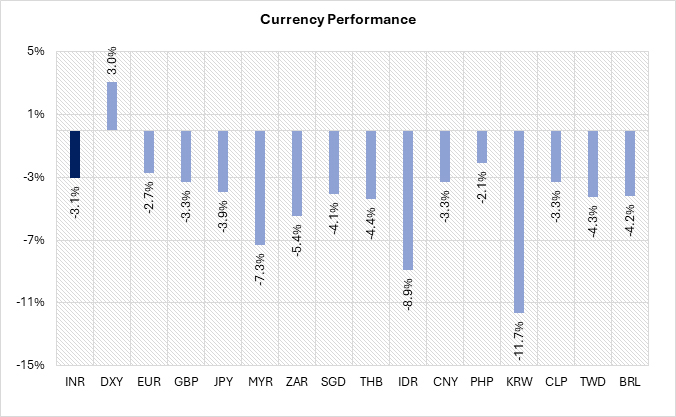

Rupee takes a breather: In the past quarter, the RBI allowed a gradual 3-4% depreciation of the INR, impacting Forex reserves and liquidity. However, global headwinds, dollar strengthening and capital outflows weighed on the INR, the dollar's retracement and the RBI's USD buy/sell swap have helped reduce volatility and improved the INR-USD outlook.

Chart – IV: The INR weakened less than other major currencies as the dollar strengthened.

Source: Bloomberg. Data up to March 20, 2025. Currency performance for the period September 30, 2024 - March 20, 2025

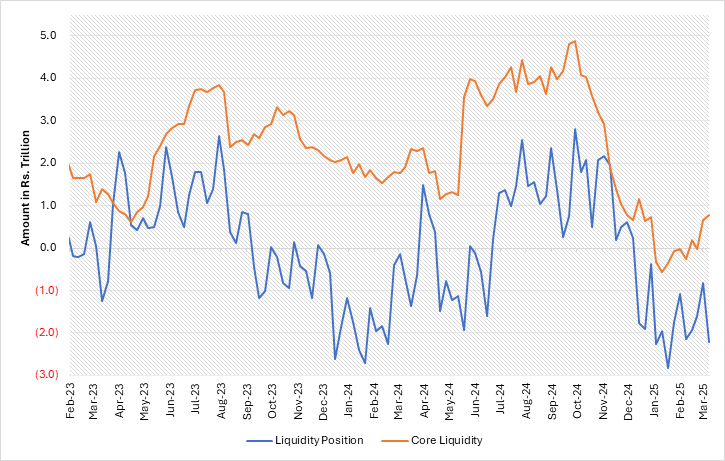

Liquidity turning in surplus, supportive of rate cut transmission: In addition to a 25bps rate cut, the RBI infused over Rs 6.3 trillion in liquidity over the last few months. Core/durable liquidity has moved from Rs 1 trillion deficit in December 2024 to an estimated Rs 1.5 trillion surplus by March 2025. We believe this infusion is sufficient to maintain a surplus in core liquidity in the near term. Besides, the RBI's dividend, which is estimated to be ~ Rs 2.5 trillion will significantly boost core/durable liquidity by May-June 2025, keeping it in surplus from April 2025 through H1 FY 2025-26.

Chart – V: Core Liquidity moving in the surplus territory

Source: RBI. Data up to week ended March 14, 2025

Following the 25bps rate cut in the February 2025 monetary policy meet, we expect another 25bps cut in coming April. While the market broadly anticipates a shift in the policy stance from 'neutral' to 'accommodative' due to growth concerns, we believe that any additional rate cuts beyond April 2025 will largely depend on the RBI's assessment of the current growth situation and its willingness to provide further support.

Given the surplus liquidity in the system, the pass-through effect of the rate cut is expected to be smoother and more effective. With coordinated efforts from both the RBI and the Government to bolster growth, we expect a gradual rate cut cycle, with an additional 25-50bps reduction by December 2025.

OUTLOOK:

Throughout CY 2024, we maintained a positive outlook on long-term government bonds, supported by favourable demand-supply dynamics and a broader environment conducive to a bond market rally.

The inclusion of government bonds in JP Morgan indices resulted in an influx of USD 20 billion in FPI flows. Fiscal consolidation efforts have successfully reduced the deficit from 5.4% to 4.4% of GDP, while the RBI's OMO purchases (Open Market Operations), exceeding Rs 2.5 trillion in Q1 CY 2025, have effectively addressed the core liquidity deficit.

However, we see a more data-dependent landscape with a slight bullish bias in the near term, influenced by:

- A potentially shallow rate cut cycle could be driven by a recovery in growth, external uncertainties, such as tariffs and currency fluctuations. However, if these external factors cause a slowdown in growth, deeper rate cuts than currently anticipated might become a possibility. As a result, the magnitude of rate cuts remains uncertain due to the impact of unpredictable trade policies, geopolitical tensions, and shifting growth-inflation dynamics.

- A reduction in OMO purchases in the second half of the year and limited fiscal consolidation as the government's focus shifts from fiscal deficit targets to managing the debt-to-GDP ratio.

While a degree of caution is necessary, the medium to long-term outlook for bonds remains positive. In line with our expectation of a shallow rate cut cycle, a surplus liquidity environment, and ongoing uncertainty surrounding growth and external shocks, we are adopting a more vigilant stance in the near term.

Despite global volatility, the Indian bond market has shown impressive resilience, with yields staying within a tight range. This stability highlights the robustness of the Indian bond market amidst broader global market fluctuations. Refer Indian Bonds in a Volatile Global Landscape.

With fiscal balances improving and monetary policy easing, the Indian bond market's resilience is likely to persist throughout CY 2025. We maintain a positive outlook for medium to long-duration bonds, expecting further declines in bond yields over the next 12 to 24 months (refer to "Bull Case Revisited"). However, we will remain vigilant to emerging risks and are prepared to adjust our outlook, if circumstances require it.

What should Investors do?

In our view, dynamic bond funds are an ideal choice for long-term investors who can tolerate occasional market volatility. These funds offer the flexibility to adjust portfolio positioning in response to changing market conditions.

For investors with shorter investment horizons and a low risk tolerance, liquid funds remain the more suitable option.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities with maturity up to 91 days, issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are currently maintaining reasonably high duration in the scheme with bulk of the assets in 10–40-year maturity bucket. |

Source - RBI, Blomberg, Refinitiv, MOSPI, CCIL, Quantum Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Pankaj Pathak, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian - Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- The Road Ahead for Indian Bonds

- Indian Bonds in a Volatile Global Landscape

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More