Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

The strategy to build your Investment Portfolio is a lot like the strategies used in Chess. Sometimes you take a defensive position and other times, you may need to step out of your comfort zone. The objective being to safeguard you king (Your Portfolio).

The key is to be thoughtful of the strategy you are taking and stick with it. While constructing a portfolio using the simple tried and tested 12:20:80 (Baarah, Bees, aur Assi) Asset Allocation Strategy is one way secure your future, adopting an agile, dynamic and readymade Multi Asset Strategy is another.

A key question you should ask yourself – Is your investment beating inflation? Your money is worth less today than it was a few years ago, thanks to inflation. The Rs. 500 note in your pocket in 20 years will be worth Rs 150 at about 6% inflation each year. Inflation reduces to the purchasing power of your hard-earned money and portfolio.

Despite rising interest rates, traditional modes of investment such as Bank FDs are not able to keep up with inflation (Ref illustration).

Data as of Oct 31, 2022. SBI FD Data for 3 Year Tenure

It is therefore important to invest in avenues that has the potential to beat inflation.

Once such investment option is a diversified mutual fund

3 Asset Classes, 1 Fund

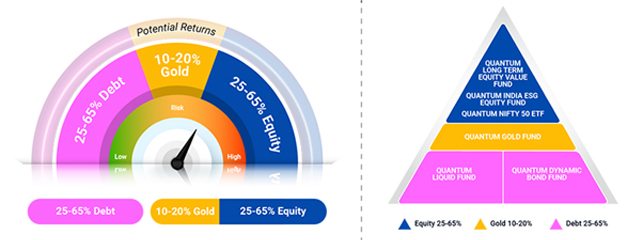

The Quantum Multi Asset Fund of Funds is designed to make life easy for you. It is a fund of funds that acts like a one-stop readymade portfolio, so you don't have to worry about picking multiple funds across multiple asset classes. The underlying funds and asset classes all form a pivotal role to complete the picture. For instance, equity funds help to build wealth over the long term, gold has the potential to cope with inflation, whereas debt adds liquidity to your investment portfolio. It is a curated Portfolio with 3 Asset Classes of Equity, Debt and Gold Combined, across 6 Quantum Mutual Funds.

Reasons to Invest in Quantum Multi Asset Fund of Funds

• Exposure to 3 Asset Classes in a single investment.

• 10 Year Track Record of Balancing Risk-Reward across Market Cycles

• Lesser risk due to the additional element of Gold

• Periodic Rebalancing Depending on the Market Cycles

• Forget about tracking multiple investments, the fund manager does the work for you.

• Option to a Bank Fixed Deposit with potential for higher returns

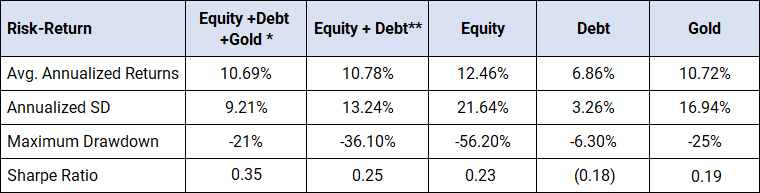

As you can see below, a diversified strategy (Equity + Debt + gold) yields similar returns with lower volatility and drawdowns, compared to a traditional 60-40 equity-debt portfolio or a pure equity strategy.

Time frame is November 2004 to October 2022. The period is taken from 2004 since the asset allocation weights are calculated based on normalizing the historical monthly equity and debt indicators. Given the normalization time frame used in the strategy, data availability for certain parameters beyond the time frame analyzed was a constraint. Compiled by Quantum AMC

*Equity-Debt-Gold in ratio of 40-40-20. **Equity-Debt allocated in 60-40 ratio Based on Sensex Index, Crisil Composite Bond Fund Index, and Domestic Gold Prices.

Note: Past performance may or may not be sustained in the future.

Just like in Chess, the right strategy can decide the outcome of the game, similarly, sticking to a well-diversified strategy can go a long way to securing your financial freedom. It’s time to choose the winning multi-asset approach by investing in the Quantum Multi Asset Fund of Funds today.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More