From Piggy Banks to Portfolios: Mutual Fund Investments for Growing Kids

Posted On Thursday, Nov 14, 2024

Our children are the joy of our lives. We chuckle as they naively talk about being a doctor one day and an astronaut the other, while we work hard at our jobs to fulfil their dreams and aspirations. We enroll them in the best of schools and extracurriculars, limit their screen time, keep them away from processed food, teach them good manners and inculcate in them a habit of saving a part of their pocket money - all to prepare them for a successful, well-rounded life.

But just like that one missing piece in your child’s jigsaw puzzle can prevent him or her from completing it, working hard and simply saving for your child’s future may not be enough to accomplish all your child’s dreams. Diversifying your income with investments is a must in the competitive, inflationary and uncertain times that we live in. This is why the savings you are putting away for your child’s future goals to be smartly invested.

Income from investments, unlike regular/periodic income, does not require much effort or labor and can supplement your efforts to offer your child a head start in life. As you save for your child’s education, marriage or financial security, those savings can be put to work in a way that they grow over and above inflation. Only this will ensure that the savings are adequate to meet the goals after all those years. For instance, if higher education today costs Rs 20 lacs, 15 years from now it will cost you Rs 59 lacs assuming a 7.5% annual inflation. Income earned from investments in equity-oriented mutual funds is a type of income earned from investments that holds potential to keep up with this inflation.

Equity investing 101

• Start early

• Save regularly

• Be diversified

• Have a long-term horizon

Investing for children comes with the advantage of starting at a young age and a long runway for investing as most of the expenses related to higher education or marriage are years away. The sooner you start investing, the lesser you will need to save to reach your goals.

| Target / Goal | *Rate of Return | No of Years | Monthly Contribution required |

| ₹12,50,000 | 12% | 15 | ₹2,500 |

| ₹12,50,000 | 12% | 5 | ₹15,500 |

*Assuming @12% XIRR in investments through SIP route in a Mutual Fund made at the beginning of the month. The above chart is for illustrative purpose only. The information is not to be considered as investment advice/ recommendation. Investment through SIP does not guarantee any return or protection of capital. Investments through SIP is subject to market risk and do not assure a profit or returns or protection against a loss in downturn market.

The longer the savings are invested, the more they grow. Also, the probability of incurring a loss in equity investing may go down as the investment horizon increases.

Investing for children through equity mutual funds can limit investment risks as these funds invest in multiple, well-researched businesses across market caps, styles and sectors. Mutual funds also offer Systematic Investment Plans or SIPs which can help to regularly save towards children’s goals in a disciplined and consistent manner. This way of saving can be less stressful as it requires smaller amounts to be put away instead of larger, intimidating sums. With dedicated investments for children, we are less likely to divert funds to other goals and expenses. In addition, having a separate investment account in the name of the child can make them feel more financially responsible and can inculcate a saving habit from an early age.

This Children’s Day can be a good opportunity to help your child move from a piggy bank to a mutual fund portfolio and have the ability to be whatever he or she chooses to be – doctor or astronaut. Here’s what you need to do:

1) Prepare and submit documents establishing the child’s age and identity, your relationship with the child and proof of the child’s bank account for investment purposes

2) Ascertain the goals you wish to fulfil for your child, time to achieve those goals and required goal amounts after taking into account inflation

3) Use Quantum’s SIP calculator (https://www.quantumamc.com/tools-and-calculator/sip-calculator) to determine monthly savings required to reach goal amounts

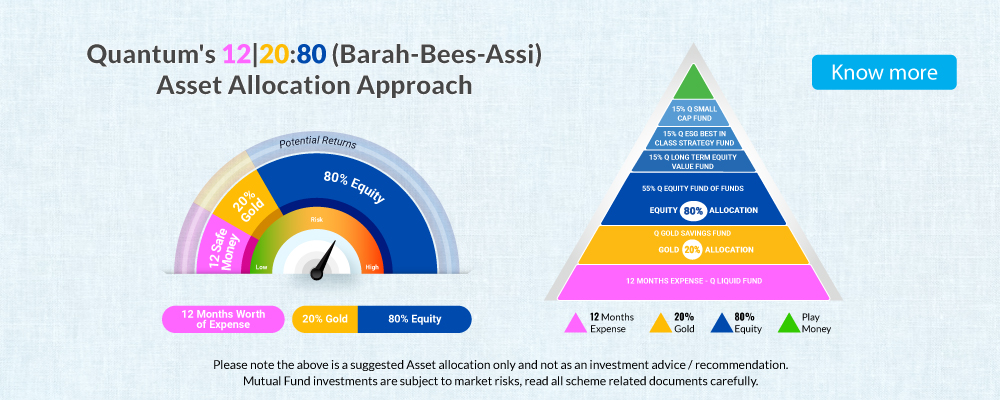

4) Start a monthly SIP in your child’s name in 2-4 diversified equity funds. You can consider investing in the Quantum Equity Fund of Funds which invests in a basket of diversified equity funds of other fund houses, Quantum Long Term Equity Value Fund which follows a value style of investing, Quantum ESG Best In Class Strategy Fund which invests in businesses where sustainable practices drive long term performance and the Quantum Small Cap Fund which invests in small cap stocks, to own a comprehensive equity portfolio.

5) Periodically monitor and review your investments.

6) When the goal nears, gradually transfer the investments to a short-term debt fund like Quantum Liquid Fund to avoid any fluctuations in market value.

As parents, we wouldn’t want our children to miss out on or give up on any of their dreams. Well-planned and timely investments in mutual funds can ensure that.

|

If you prefer a DIY (Do-It-Yourself) approach:

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk |

Quantum ESG Best In Class Strategy Fund An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy Tier I Benchmark : NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Tier I Benchmark : BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk Tier I Benchmark : CRISIL Liquid Debt A-I Index | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier I Benchmark : Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Add the edge of Ethics to Equities with Quantum’s latest NFO: Closes Soon!

Posted On Thursday, Dec 12, 2024

Business ethics are the moral principles that act as guidelines for the way a business conducts itself and its transactions.

Read More -

From Piggy Banks to Portfolios: Mutual Fund Investments for Growing Kids

Posted On Thursday, Nov 14, 2024

Our children are the joy of our lives. We chuckle as they naively talk about being a doctor one day and an astronaut the other, while we work hard at our jobs

Read More