Debt monthly view for October 2021

Posted On Tuesday, Nov 09, 2021

The bond market selloff of late September continued in October. During the month, the 10-year benchmark government bond yield (Gsec) surged 17 basis points from 6.22% on September 30, 2021, to 6.39% on October 29, 2021.

Since September 20, 2021, the 10-year government bond yield has moved up by a cumulative 24 basis points. At the shorter end, the impact was even more pronounced as yields on 1-3 year maturity government bonds jumped by about 35-40 basis points during the same period.

Much of the selloff can be attributed to two developments – (1) a steep rise in crude oil price and (2) a normalization of liquidity operations by the RBI.

The crude oil price has been rising for the last two months due to the pick up in global demand and restricted supply by the oil producers’ cartel – the OPEC and Russia. The Brent oil price has jumped by ~18% in the last two months and currently hovering near its 2018 peak of USD 86/barrel.

If supply is not raised quickly, crude oil prices will remain under pressure which poses a risk for Indian bonds.

The RBI has been normalizing its liquidity operation since the start of this year with staggered re-introduction of variable-rate term reverse repos (VRRR). This was on expected lines and was more or less priced in the market.

However, total liquidity absorption under VRRRs increased significantly during the last month, which in turn led to a sharp reduction in the overnight surplus liquidity with banks. At the same time cutoff yields on the VRRR auctions also moved higher between 3.75%-3.99%.

The sharp jump in the money market rates inflicted to the front end of the bond curve and pushed yields higher. There is also an expectation of a hike in the reverse repo rate in the upcoming monetary policy review in December 2021.

Although the macro backdrop is unfavourable, valuations at both the short and long end of the curve have improved significantly after the sell-off. We particularly like the 3-5 year segment of the government bond market which in our opinion, is already pricing much of the liquidity normalisation and a start of rate hiking cycle by end of this year. Given the steep bond yield curve, 3-5 year bonds offer the best roll down potential as well.

At the longer maturity segment, current yield levels look good from a perspective that the terminal repo rate in this cycle may remain much below its pre-pandemic normal level. However, we are restricting exposure to the longer segment due to risk from the rising crude oil prices and the absence of assured RBI buying.

Currently, a bulk of the QDBF portfolio is positioned in the 2-5 year space which is reflective of our aforesaid view on the bond market.

In the current juncture, we believe a combination of liquid to money market funds to benefit from the increase in interest rates in the coming months; along with an allocation to short term debt funds and/or dynamic bond funds with low credit, risks should remain as the core fixed income allocation.

Source: Worldometer.info

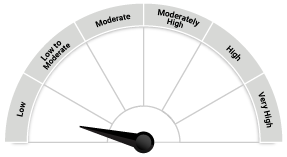

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on October 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly View for February 2025

Posted On Friday, Mar 07, 2025

February 2025 kicked off with two key events in Indian bond markets: the Union Budget and RBI's Monetary Policy.

Read More -

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Debt Monthly View for December 2024

Posted On Tuesday, Jan 07, 2025

The year 2024 has proven to be a strong one for fixed-income investors, marked by India's inclusion in the JP Morgan GBI EM Index.

Read More