Debt Monthly View for December 2024

Posted On Tuesday, Jan 07, 2025

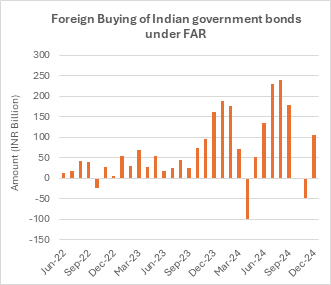

The year 2024 has proven to be a strong one for fixed-income investors, marked by India's inclusion in the JP Morgan GBI EM Index. This development led to over Rs 1.2 trillion in foreign investment flowing into Indian government bonds (IGBs) throughout the year.

Domestically, the government focused on fiscal consolidation, targeting a 4.9% fiscal deficit in FY25 and curbing new debt issuance, while demand from domestic insurance, pension, and provident funds remained robust.

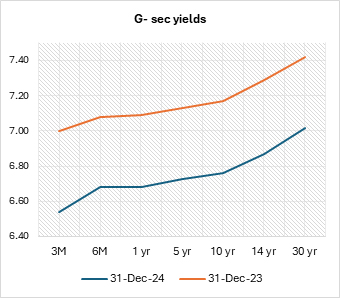

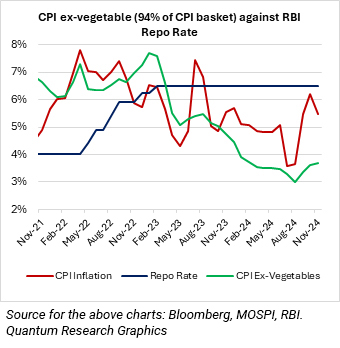

The RBI kept the policy repo rate steady at 6.5%, amid volatile CPI inflation above 5% and a Core-CPI below the 4% target. Despite no rate cuts, bond yields fell by 40-45 basis points during the year, driven by strong demand and easing inflation, benefitting long-term bond returns.

Bond Market Outlook 2025: A Promising Year Ahead

The key drivers shaping the bond market in 2024 are set to sustain its momentum into 2025. (Refer Bull case revisited)

The government aims to reduce the fiscal deficit to 4.5% of GDP by FY26, keeping net borrowing steady or lower than FY25's Rs 11.16 trillion.

Bond demand is set to rise by 10%-15%, driven by insurance firms, pension funds, and banks. RBI's draft LCR guidelines may further boost banks' appetite for government securities.

Foreign inflows likely to stay strong with India’s inclusion in Bloomberg and FTSE EM bond indices in 2025.

Additionally, CPI inflation is likely to align with RBI’s 4% target by mid-2025, paving the way for a 50-100 bps rate cut.

India’s strengthening credit profile and a potential sovereign rating upgrade add to the optimism for the bond market in 2025. (Refer India Poised for a sovereign rating upgrade)

What to watch out for? - While the macro backdrop remains broadly supportive, emerging developments could introduce significant uncertainties in 2025.

1) Tax Cut could push US deficit higher and limit room for rate cut:

The US president-elect Donald Trump’s pledge for sweeping tax cuts and tariffs on foreign goods - While specifics remain unclear, these measures could widen the already-high fiscal deficit (6.4% of GDP) and push public debt higher.

A higher fiscal deficit may fuel growth but could slow disinflation and limit the Fed’s room for rate cuts. Markets are already reacting, with Fed funds futures now pricing in fewer rate cuts for 2025.

2) Trade war could trigger competitive currency devaluation:

Trump's suggested trade policy is also seen as limiting the Fed's easing stance because tariffs may increase US inflation. It might, however, have a more detrimental effect on the emerging markets via the currency channel.

In response to tariffs during the last Trump residency, China actively devalued its currency to remain competitive. That in turn put pressure on other EM currencies.

3) INR Under Pressure: Rising Currency devaluation Risks Ahead:

The Indian Rupee has weakened by ~2.9% against the US Dollar since September 30, 2024, with risks of further depreciation as global bets on Dollar strength grow for 2025.

In response, the RBI has stepped up forex interventions, selling an estimated $35 billion in reserves over two months. This has sharply reduced core liquidity in the banking system, dropping from Rs 4.8 lakh crore in late September to just ~Rs 80,000 crore by the end of December 2024.

The RBI's recent CRR cut injected Rs1.16 lakh crore of liquidity over two weeks, but ongoing forex sales may outweigh this infusion. Seasonal cash withdrawals during the January-March quarter, typically Rs 1.5-2 lakh crore, could further tighten liquidity.

Depreciation pressure on the INR may delay the RBI's expected rate cuts, posing near-term challenges for the bond market. However, a tighter liquidity scenario increases the likelihood of RBI conducting OMO bond purchases, offering potential support for medium- to long-term bonds.

We expect that structural shifts in the demand supply balance and internationalisation of the Indian market will continue support the bond market in 2025. Thus, we maintain our positive outlook on medium to long duration bonds and expect bond yields decline further over the next 12-24 months.

(refer Bull Case Revisited)

However, we will remain watchful of the emerging risks and will not hesitate to change our view if conditions warrant that.

What should Investors do?

In our view, dynamic bond funds are the ideal choice for long-term investors who can tolerate occasional market volatility.

These funds offer the flexibility to adjust portfolio positioning in response to changing market conditions.

For investors with shorter investment horizons and a low risk tolerance, liquid funds remain the more suitable option.

Source: Bloomberg, MOSPI, RBI.

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly View for February 2025

Posted On Friday, Mar 07, 2025

February 2025 kicked off with two key events in Indian bond markets: the Union Budget and RBI's Monetary Policy.

Read More -

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Debt Monthly View for December 2024

Posted On Tuesday, Jan 07, 2025

The year 2024 has proven to be a strong one for fixed-income investors, marked by India's inclusion in the JP Morgan GBI EM Index.

Read More