Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

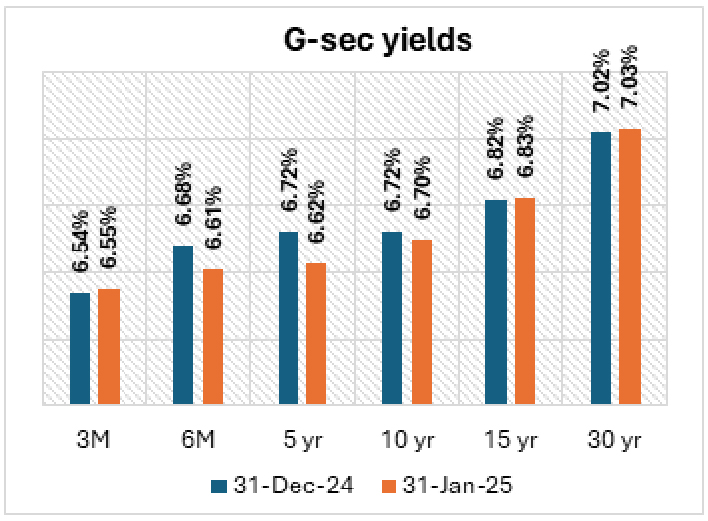

Bond markets witnessed increased volatility during the last month with the 10-year Government bond yield jumping from 6.76% to 6.87% in first half of the month followed by a bigger drop in the second half to close at 6.69%.

Indian yields tracked the US 10 -year Treasury yields which moved from 4.58% to 4.79% and then fell to 4.51% during the same period.

Markets were driven primarily by stronger jobs data and the Fed’s hawkish pause on rate cuts. The Fed signaled no immediate reductions due to ongoing inflation concerns and the impact of President Trump's policies. This suggests a cautious approach as the Fed monitors inflation and waits for clarity on Trump’s trade and immigration policies.

In the money market, T-bill rates for the 6-month and longer segments plunged, closing the month at 6.62%, while rates for the 3-month segment remained steady at 6.55% owing to the prevailing tight liquidity conditions. Meanwhile, the 3-month AAA PSU CP/CD rates ended the month higher in the 7.45%-7.55% range against 7.30% in the previous month.

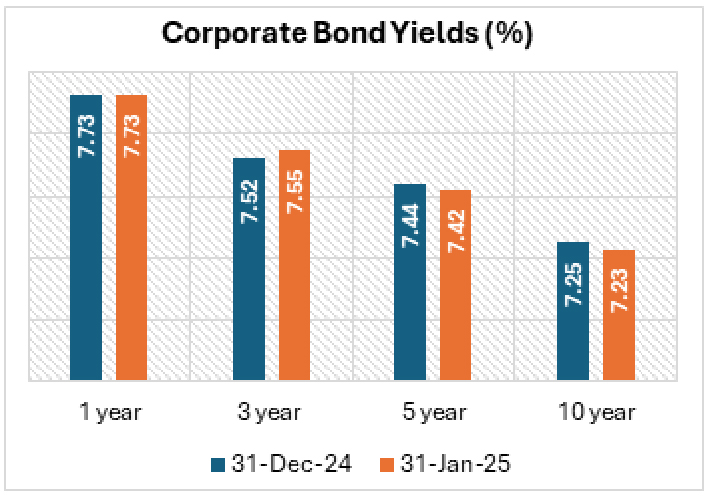

The Corporate bond yields remained broadly unchanged on monthly closing basis, maintaining a 40-50bps spread between G-sec and corporate bonds in the 10-year segment. The corporate yield curve continues to remain inverted.

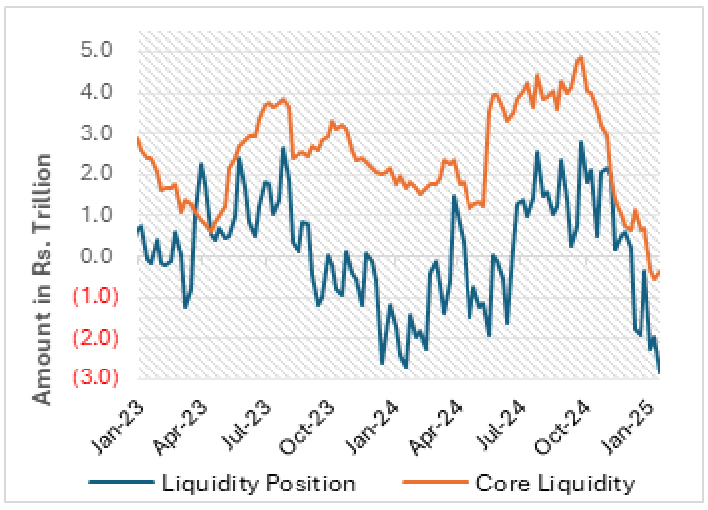

Banking system liquidity remained in deficit throughout the month, with the daily deficit reaching Rs 3.15 trillion. Additionally, by January 24, 2025, core liquidity (adjusted for government cash balance and RBI cash reserves) turned into a deficit of approximately Rs 0.3 trillion. This was mainly supported by month-end Government spending, Open Market Operations (OMO purchases) of approximately Rs 200 billion and a Rs 450 billion FX swap.

The decline in core liquidity surplus was primarily due to the RBI’s sales of foreign exchange and seasonal pick up in cash withdrawals.

Liquidity condition is expected to tighten further in coming months as cash withdrawals tend to pick up during the January to March quarter. FPI selling could further tighten the liquidity condition. We expect durable liquidity to be in a slight deficit by the end of March, warranting the need for further liquidity infusions in late February or early March. Core liquidity may turn into a surplus after the RBI dividend in May.

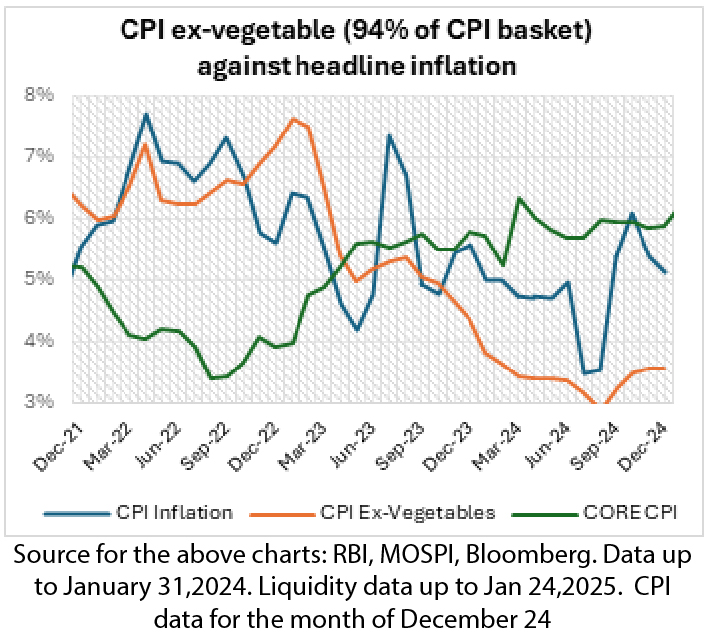

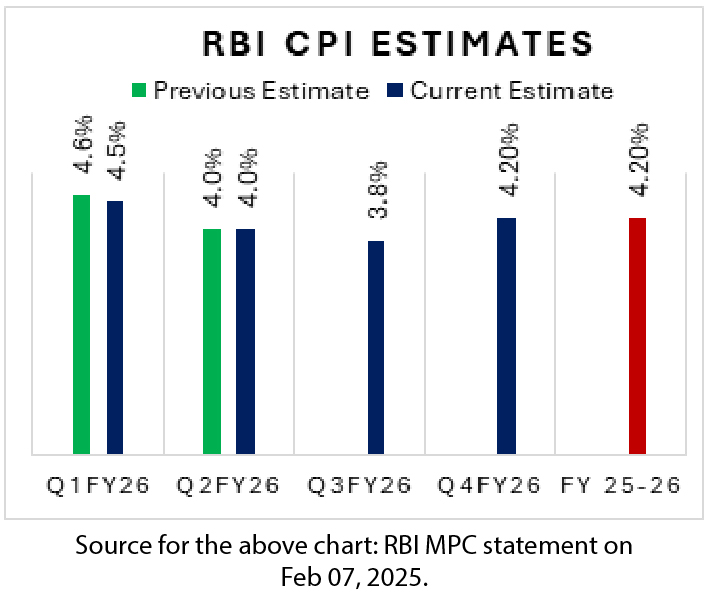

Headline CPI inflation eased to 5.2% y-o-y in December 2024, while the ex-vegetable CPI (which accounts for 94% of the basket), stood at 3.68% y-o-y (remaining below the RBI’s 4% target for nearly a year). January data shows significant softening in vegetable prices. We expect the headline inflation to be ~4.5% in Jan, with core inflation (inflation excluding food and fuel) inching up slightly to 3.8% y-o-y due to higher gold prices. Easing inflation will open room for rate cuts going ahead.

Budget highlights:

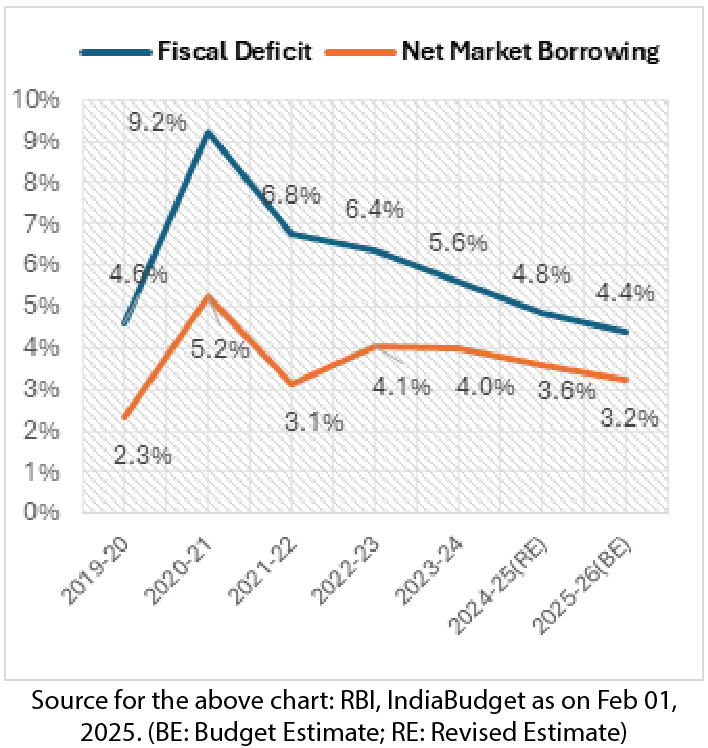

The fact that the government maintained fiscal prudence is fundamentally positive for the bond market. The central government's debt to GDP is expected to steadily decline from 57.1% in FY 2024–2025 to less than 50% by FY 2030–2031 according to the medium-term fiscal forecast. This suggests that the fiscal deficit be reduced by at least 0.2% of GDP annually after FY26.

Gross borrowing in FY26 is higher at Rs 14.84 tn against Rs 14 tn in FY25, while net borrowing remains similar at Rs 11.54 tn. Despite the fiscal deficit being lower at 4.4% for FY26, market borrowings as a percentage of the deficit are up, and reliance on small savings has decreased. Borrowing from small savings is projected at Rs 3.43 tn in FY26, down from Rs 4.12 tn in FY25. Additionally, Rs 2.5 tn of switches are budgeted for FY26, effectively increasing the supply of long-term bonds in the year.

Monetary policy highlights:

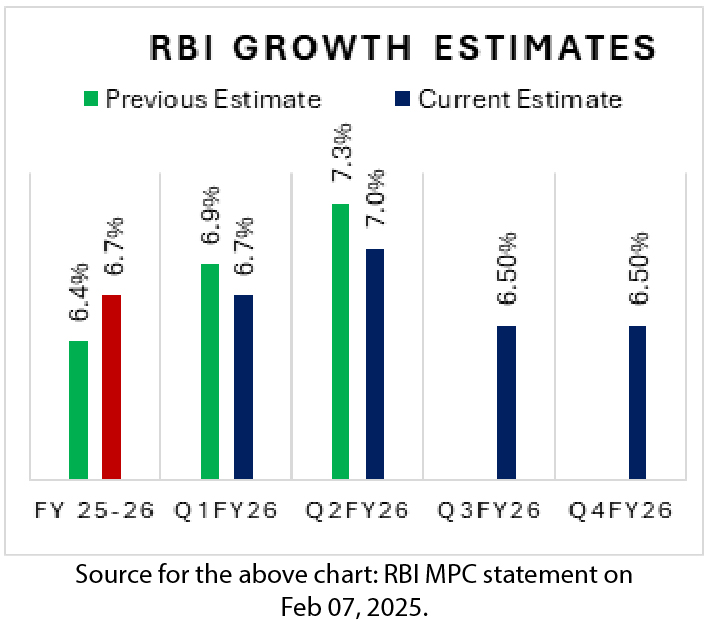

The RBI MPC unanimously decided to cut repo rate by 25 bps and keep the monetary policy stance unchanged to ‘Neutral’. Effectively, the repo rate is at 6.25%, the Marginal Standing Facility (MSF) and Standard Deposit Facility (SDF) rates lowered to 6.50% and 6.00%, respectively.

The monetary policy met rate cut expectations, but the bond market was disappointed by its high expectations on liquidity and stance. We believe the RBI’s decision to maintain a ‘neutral’ stance is prudent, considering global uncertainties and currency volatility.

While no immediate liquidity measures were announced, the RBI reaffirmed its commitment to ensuring adequate system liquidity. An OMO purchase schedule is in place until Feb 20, with further purchases likely in March and April. However, with rising seasonal cash demand and a $24 billion FX forward maturity, durable liquidity could tighten in the coming months.

We maintain our medium-term positive outlook (refer Bull Case Revisited) on long-term bonds considering -

• Declining net supply of government bonds.

• Continued strengthening in demand from insurances companies, pension and provident funds

• India’s inclusion in the global bond indices to continue to add to the demand

• Potential rate cuts and OMO purchases by the RBI

What should Investors do?

Given the above factors, we expect the bond yields to go down (prices to go up). In this declining interest rate environment, investors with medium to long investment horizon, should consider dynamic bond funds. These funds can allocate to long-duration bonds while keeping flexibility to adjust portfolio position if market conditions change. This adaptability allows investors to remain invested for a longer period.

Investors with a short-term investment horizon and with little desire to take risks can invest in liquid funds which invest in government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Source: RBI, MOSPI, Bloomberg

|

| Name of the Scheme and Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier-I Benchmark |

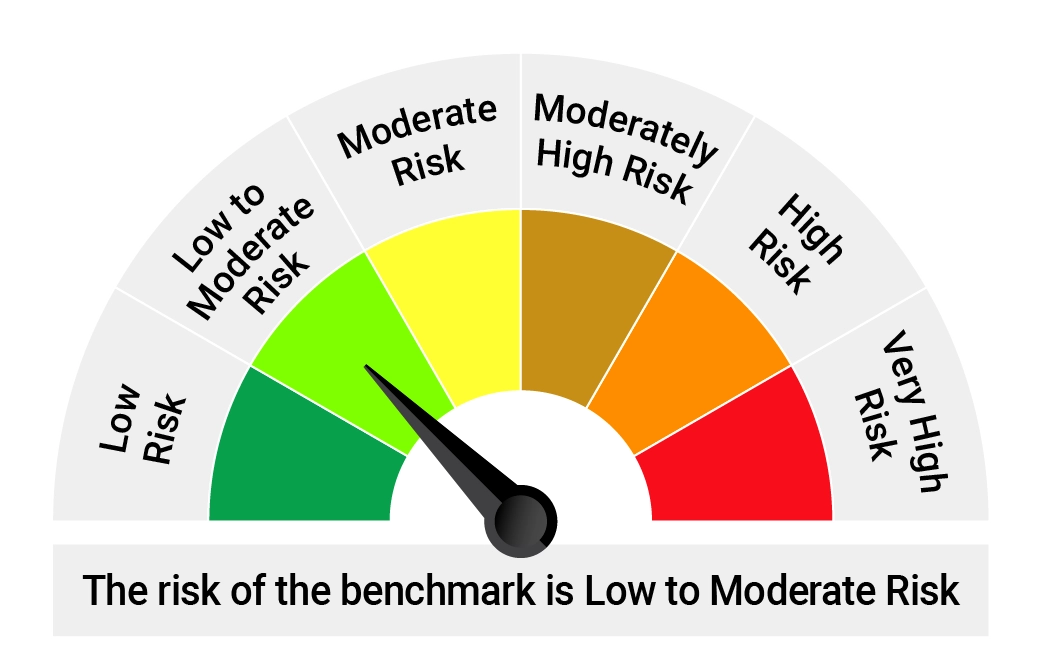

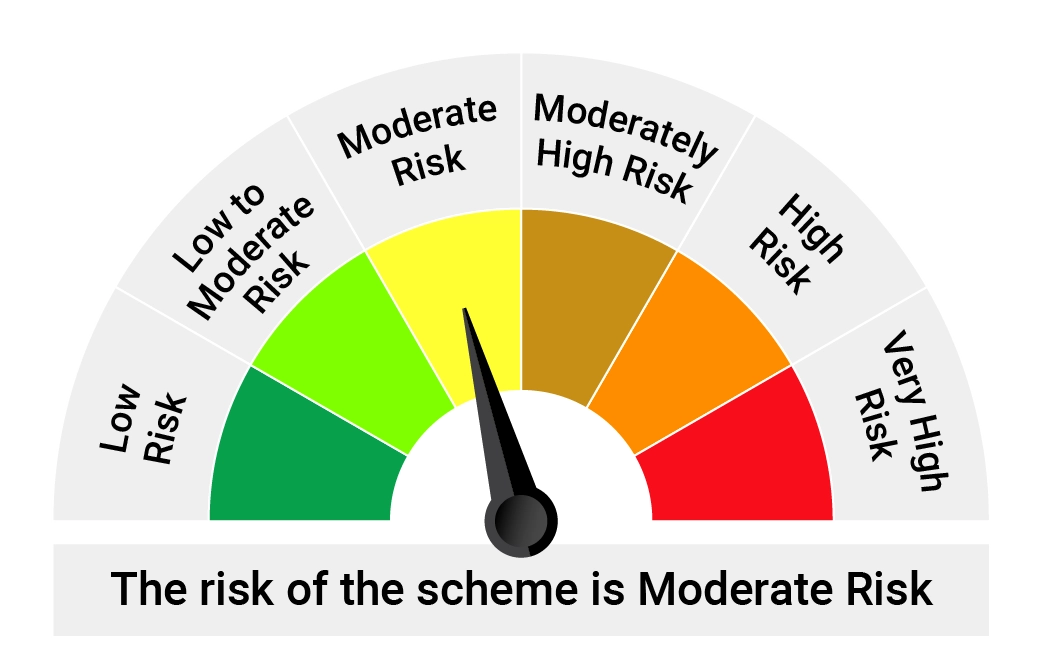

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk Tier I Benchmark : CRISIL Liquid Debt A-I Index | • Income over the short term • Investments in debt / money market instruments |  |  |

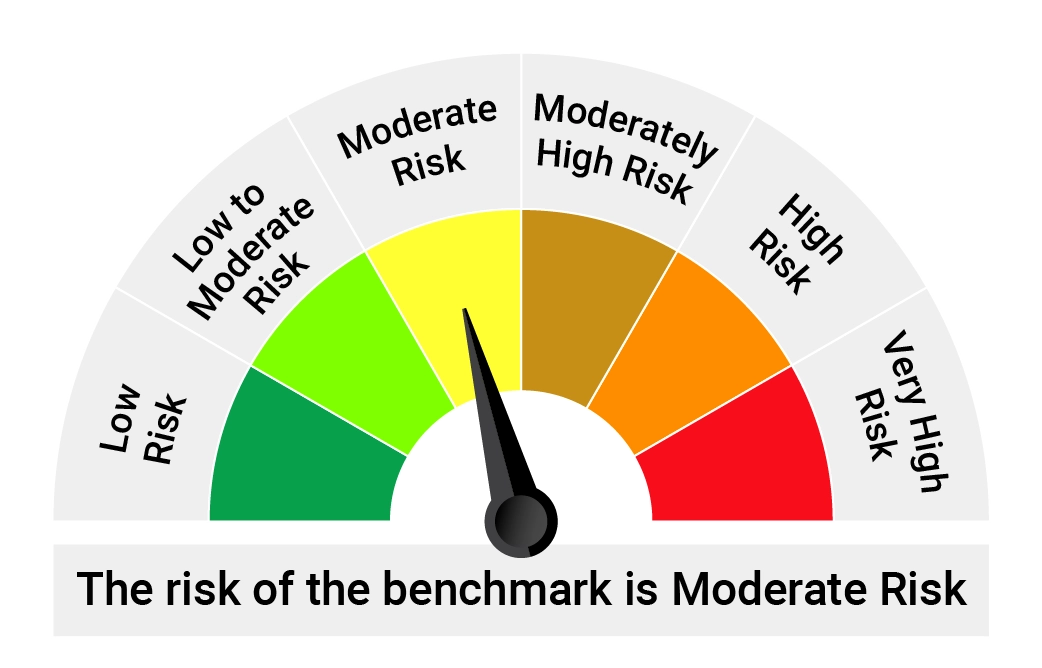

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Dynamic Bond A-III Index | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |  |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly View for March 2025

Posted On Monday, Apr 07, 2025

In March 2025, both U.S. Treasury and Indian Government Bond yields cooled off

Read More -

Debt Monthly View for February 2025

Posted On Friday, Mar 07, 2025

February 2025 kicked off with two key events in Indian bond markets: the Union Budget and RBI's Monetary Policy.

Read More -

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More