Why Quantum Remains Relevant

Posted On Tuesday, Feb 08, 2022

Amid the hawkish statement from the US Federal Reserve Chair Powell or the pro-growth Union Budget 2022-23, market levels have been experiencing wide swings. However, this is not new territory for us. Be it the 2000 tech bubble collapse, the 2008 GFC (Global Financial Crisis) or the Covid induced financial crisis, or the rally that followed, over the last 16 years, we have been with you through the ups and downs, offering you risk-adjusted returns in the long term.

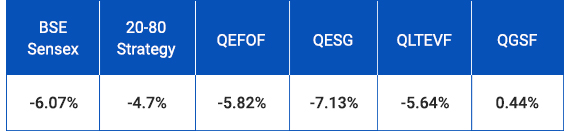

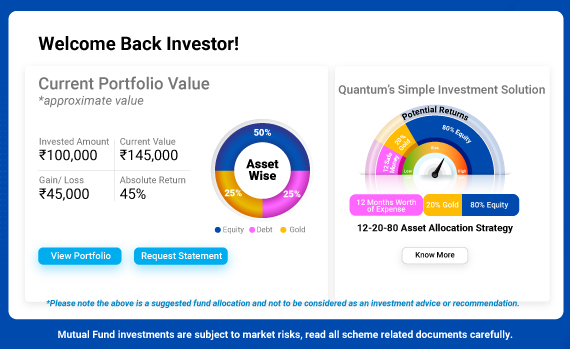

A recent case in point - since the Sensex attained all-time highs on Oct 18, 2021, markets have corrected close to 6% due to macro-economic challenges. However, investors who had diversified to the 12-20-80 asset allocation strategy would have seen lower downside risks.

*QEFOF – Quantum Equity Fund of Funds, QESG – Quantum India ESG Equity Fund,

QLTEVF – Quantum Long Term Equity Value Fund, QGSF – Quantum Gold Savings Fund

The above represent return of a 20-80 Gold- Equity portfolio for the period between 18th October, 2021 to 31st January, 2022. The Equity portfolio is split between QEFOF, QLEVF and QESG in the proportion of 70:15:15. Return on Investment in Quantum Liquid Fund (Emergency funds) is not included in the calculation. **Past performance may or may not be sustained in the future.

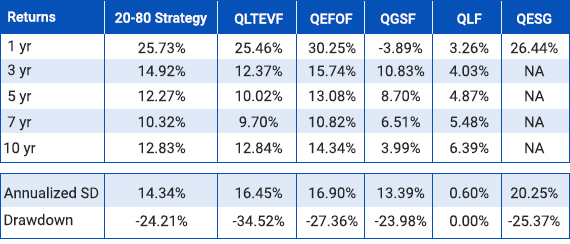

In addition, as can be seen in the table below, the drawdown or difference from peak to trough is lesser when investing using the 12-20-80 strategy.

**Past performance may or may not be sustained in the future.

The equity portfolio started on Jan 31st 2011. The Equity portfolio is split between QEFOF, QLEVF and QESG in the proportion of 70:15:15. Prior to the launch of ESG, the Equity portfolio was split in QEFOF and QLTEVF in a proportion of 80:20. Return on Investment in Quantum Liquid Fund (Emergency funds) is not included in the calculation. The performance shown in the table should be reviewed in conjunction with detailed performance of the scheme provided below.

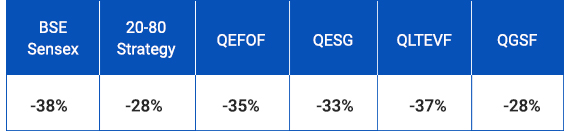

Similarly, when evaluating drawdown of the portfolio compared to the S & P BSE Sensex TRI from the pre-COVID peak (17th January 2020) to the COVID market crash bottom (23rd March 2020), you can see that the 12:20:80 asset allocation strategy limited the downside risk and provided stability in a highly volatile market.

**Past performance may or may not be sustained in the future.

Through our journey, we have always put you and your needs, our thoughtful investor, first and we have stayed true to the goal of delivering simple investment solutions with honesty, integrity and transparency. This focus has often come at the cost of our growing AUM and/ lower revenues.

Let’s take a trip down memory lane, and look at some of Quantum’s key milestones that have brought us to where we are today:

Building a Solution that makes investing easy and accessible to all

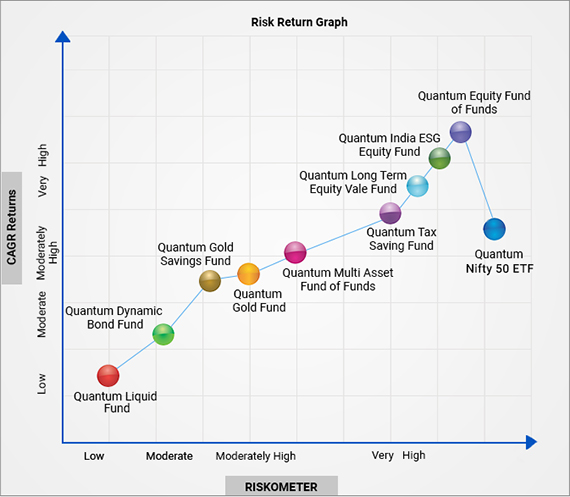

Since the launch of our flagship fund Quantum Long Term Equity Value Fund in 2006, we have followed the practice of having only one scheme per category. We have meticulously added diversified funds across the asset classes of Equity, Debt and Gold to create a one-stop-shop for all your mutual fund investment needs and objectives.

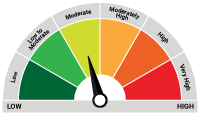

Illustrative View of the Risk-Return Graph of the Schemes of Quantum Mutual Fund

The above graph is for illustrative purpose to explain the concept of Risk and Returns in Quantum Mutual Fund schemes. Please review the actual returns and risk-o-meter of the respective schemes independently to make informed investment decision.

All our products have stayed true to label since inception and have not been repositioned to meet SEBI reclassification requirements. Each fund introduced forms a building block of the tried and tested '12-20-80' Asset Allocation Strategy that meets your long-term needs.

• The pandemic as previous black swan events has called for the need to have financial backup to meet unforeseen expenses. Therefore, Quantum Liquid Fund was launched to qualify as the Safety or the Foundation block of your portfolio. The fund offers a minimal credit risk and a portfolio of AAA/A1+ rated PSU / PFI securities of a duration not exceeding 91 days. It has a relatively low-Interest rate & Credit risk (classified as A-1 as per the PRC matrix) and is an option to your conventional fixed income instruments like a bank savings account.

• Understanding investor concerns regarding quality/purity of Gold, we then launched the Quantum Gold Fund ETF and are the only fund house that offers an independent test for all gold bars held under Quantum Gold Fund. We also launched the Quantum Gold Savings Fund of Fund to provide you with the flexibility to invest with an SIP. Generally, gold has an inverse relationship with equities and performs better when equity mutual fund performance is under stress and forms an ideal portfolio diversifier thus forming your Risk Diversifying Block.

• While Quantum Long Term Equity Value Fund offered the much-needed downside protection during times of uncertainty, we realized your need for diversification and simplifying fund selection from the 350+ mutual funds out there. Quantum Equity Fund of Funds was launched to meet this need. It consists of a bouquet of 5-10 well-researched third-party diversified equity funds of other fund houses with a proven track record. You get an actively well-researched portfolio (active qualitative + quantitative), with a minimal scheme expense ratio.

The Equity allocation of 80%, which qualifies as the Growth block has been divided among the three equity products — the Quantum Equity Fund of Funds, (70%) Quantum India ESG Equity Fund (15%) and the Quantum Long Term Equity Value Fund (15%).

Of the 80%, we insist that a majority of 70% should be invested into Quantum Equity Fund of Funds. The higher weightage gives your portfolio a mix of the different equity funds with underlying varying investment styles and market capitalization.

The last equity fund launched is Quantum India ESG Equity Fund, India’s one of the first true-to-label funds in the ESG thematic space created from scratch. The fund’s comprehensive and robust proprietary ESG scoring method can be attributed to the "Integrity Screen" introduced way back in 1996 at the Group Level. This answers questions like how founders treat minority shareholders, allocate capital and deal with environmental concerns? While the fund also considers environmental and social parameters, governance or integrity sits at the heart of our research.

This is the underlying essence of all our equity products, if the company/Board does not meet our integrity checks, it will not be included in the portfolio, irrespective of how large the company's weight is in the benchmark. We would rather miss a short-term opportunity than put your investment at risk in a company with low management integrity.

While the pandemic has undoubtedly presented unprecedented challenges, Quantum has been quick to accelerate the adoption of technology. Accordingly, as one step ahead, we have taken this asset allocation solution online to facilitate accessibility and ease of use.

Through our journey, we have strived to improve the ecosystem for investing. We have been an organization of firsts, especially when it comes to best practices. Many things which we introduced internally became industry practices and regulations.

1. Transparency on Distributor commissions

We believe that the distributor acts as the last mile touchpoint in an investment ecosystem. However, we were not comfortable with how distributor fees were never a part of the AMC annual report. We refused to be party to opaque practices and took a different path and work for our investors’ interest and launched direct investments, sans distributor commissions in 2006, even before SEBI introduced the concept. Even 12 years later when we launched regular plans, we insisted on ZERO upfront Distributor commission and maintained uniform trail commission across all partners.

2. Using Total Return Index (TRI) as a benchmark

In the spirit of upholding our principle of integrity and being honest to our investors, we were the first to use a total return as a scheme benchmark. The total return index includes the dividends reinvested back into the fund, thus offering a more transparent distinction of a funds’ performance versus the benchmark. This became a SEBI imposed rule almost 12 years later in 2018.

3. Walking the talk with a complete independent board

At Quantum, we walk the talk when it comes to integrity by being one of the few companies with a 100% independent board of trustees. This is something that needs to be adopted as an industry norm yet. It is the responsibility of the trustees to look after the investor’s interests. Hence, the trustee should not be someone from the AMC unlike the practice followed in the mutual fund industry. We believe this practice presents a conflict of interest as the trustee needs to represent the investors and not the AMC.

4. Mark-to-Market valuation in Liquid Funds since 2012

Quantum Liquid Fund (QLF) was the first and only fund to follow full Mark-To-Market valuation since July 2012. It was only in March 2019, that SEBI tightened norms for the valuation of debt instruments. As per the new rule, debt instruments of only less than 30 days can be amortized, all other instruments will have to be marked-to-market.

Through different phases of market ups and downs and complex macro-economic variables, you can rely on a fund house that will be one step ahead in excelling industry standards. A fund house that will always put your needs above all and provide simple solutions to all your investment needs.

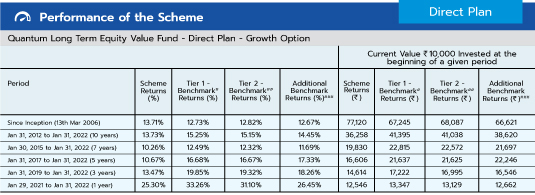

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of Jan 31, 2022.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Mr. Sorbh Gupta and Mr. Nilesh Shetty. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. Nilesh Shetty has been managing the fund since Mar 28, 2011.

Click here to view other funds managed by them.

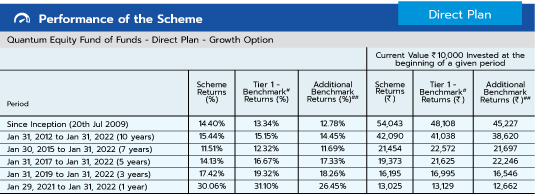

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as of Jan 31, 2022.

Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR). The fund is managed by Mr. Chirag Mehta since Nov 1, 2013. Mr. Chirag Mehta manages 5 Schemes of Quantum Mutual Fund.

For other schemes managed by him, please Click here.

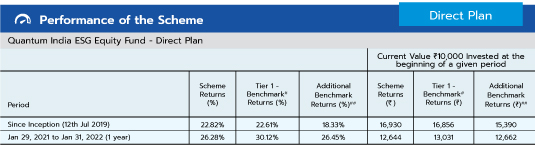

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as on Jan 31, 2022.

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Mr. Chirag Mehta manages 5 Schemes and Ms. Sneha Joshi manages 1 scheme of the Quantum Mutual Fund. For performance of other funds managed by Chirag Mehta, please Click here.

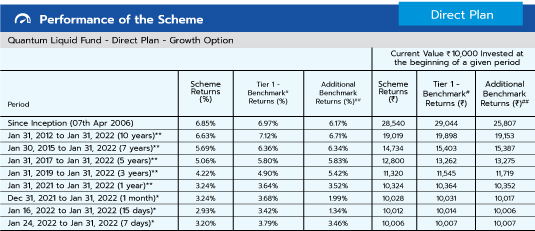

#CRISIL Liquid Fund Index, ##Crisil 1 year T-bill Index.

Data as of Jan 31, 2022.

Different Plans shall have a different expense structure.

*Simple Annualized. **Returns for 1 year and above period are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Returns are net of total expenses. The fund is managed by Mr. Pankaj Pathak since Mar 01, 2017. For other fund managed by him, please Click here.

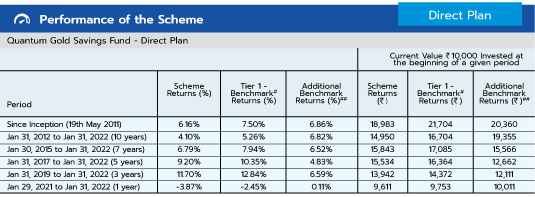

#Domestic Price of Gold.

Data as of Jan 31, 2022.

Different Plans shall have a different expense structure.

The fund is managed by Mr. Chirag Mehta and Ms. Ghazal Jain. Mr. Chirag Mehta is handing the fund since May 19, 2011. Ms. Ghazal Jain is co-managing the scheme since June 2, 2020. For other funds managed by Mr. Chirag Mehta, please Click here. For other fund managed by Ms. Ghazal Jain, please Click here.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on January 31, 2022.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on January 31, 2022.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Benchmark |

| Quantum Equity Fund of Funds An Open-ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Primary Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies. |  Investors understand that their principal will be at Very High Risk |  |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme Primary Benchmark: NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Primary Benchmark: Domestic Price of Gold | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |  |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.) Primary Benchmark: Crisil Liquid Fund Index | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on January 31, 2022.

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on January 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Very High Risk |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More