Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one. Rankings and ratings are, of course, available today.

However, most ranking and ratings lay emphasis only on the quantitative parameters - mainly the returns. In such a case, what you are looking at is the historical returns, which are generally not indicative of how the mutual fund scheme will perform in the future. Particularly the short-term return cannot be the deciding factor to pick mutual fund schemes.

It is easy to get swept by the market noise and chase mutual funds that give you the highest returns. But remember that the top performing funds of today may not be among the top tomorrow. There’s more to the story behind a mutual fund. It is important to dig a little deeper and understand the qualitative parameters that will determine the fund's potential to meet your future goals.

Here are the aspects that are often overlooked but play a very important part in safeguarding your future goals.

1. Stay Put with Strategic Asset Allocation

There is no winning asset class. Different asset classes perform differently during different market cycles. Build investments by strategically diversifying your portfolio to help lower the risk of downside in the short term while offering the potential to reward you with decent risk-adjusted returns in the long term.

Asset Allocation offers your portfolio the correct mix of stability, growth and protection. An easy approach to adopt is Quantum Mutual Fund’s DIY 12-20-80 Asset Allocation Strategy:

**Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

✓ Set aside 12 months of regular monthly expenses (including EMIs on loans) into a pure liquid fund for a rainy day;

✓ Deploy 80% in equities (across market capitalisations and styles), provided you have an investment time horizon of at least 3 to 5 years and stomach for high risk,

✓ Invest the remaining 20% in gold ETFs and/or gold saving funds.

This time-tested approach can help you minimise downside risk, clock optimal risk-adjusted returns, provide the freedom of timing the market, help you stay focused in achieving your envisioned financial goals and sleep better at night (not having to worry about market uncertainty). Check out our Asset Allocator Tool to help allocate your investments across equity, fixed income and gold in just a few clicks.

2. Assess Returns Across Market Phases

The assessment of a mutual fund scheme must be made over longer time frames (3 years and more) and the bull, bear and corrective market phases.

The true test of a scheme is in how it fares during the corrective and bear market phases and this is what separates the men from the boys.

Markets, as you know, are prone to fluctuations and bouts of uncertainties. In unfavourable market conditions, if the performance of the scheme remarkably tumbles, that may be a cause of worry. The ranking or rating you once had confidence in, may prove you wrong; there may be divergence in the ranking.

3. Recognise the Style of Investing Followed

You see, each mutual fund follows a unique investment style based on its objective and pre-defined strategy. Not every scheme can consistently outperform in every market phase/cycle.

For instance, currently, amidst the uncertainty, value-style funds are coping well compared to growth-oriented funds. Value funds have the propensity to arrest the downside risk better in corrective and bear phases.

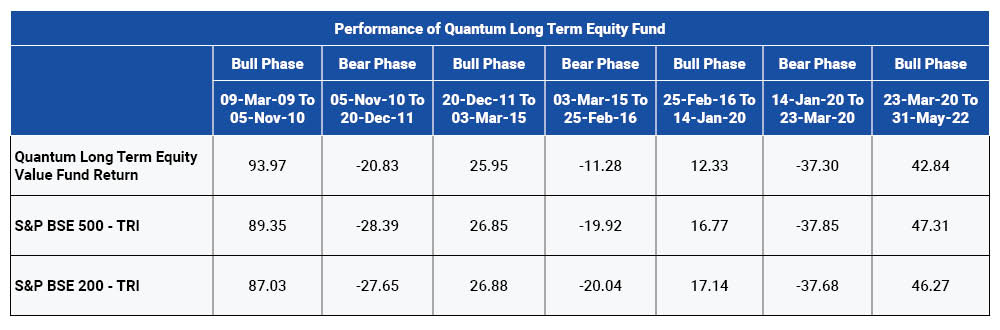

Source: ACE MF. Data as of May 31, 2022. Past performance is not an indicator of future returns. Absolute Returns. This should be read in conjunction with the complete fund performance below. Tier 1 - Benchmark S&P BSE 500 TRI and Tier 2 - Benchamrk S&P BSE 200 TRI. Bear market is when markets have corrected over 20% from the highs and remain so for a while while Bull markets are where the markets rise by 20%. The phases are selected to depict market cycles.

As seen in the table above, the Quantum Long Term Equity Value Fund has performed better during the bear market phases.

In the recent years, while the Quantum Long Term Equity Value Fund has lost some of its performance; over the long-term (with around 15% allocation out of the 80% total equity allocation), it has offered the potential to lower risk than its benchmark, the S&P BSE Sensex.

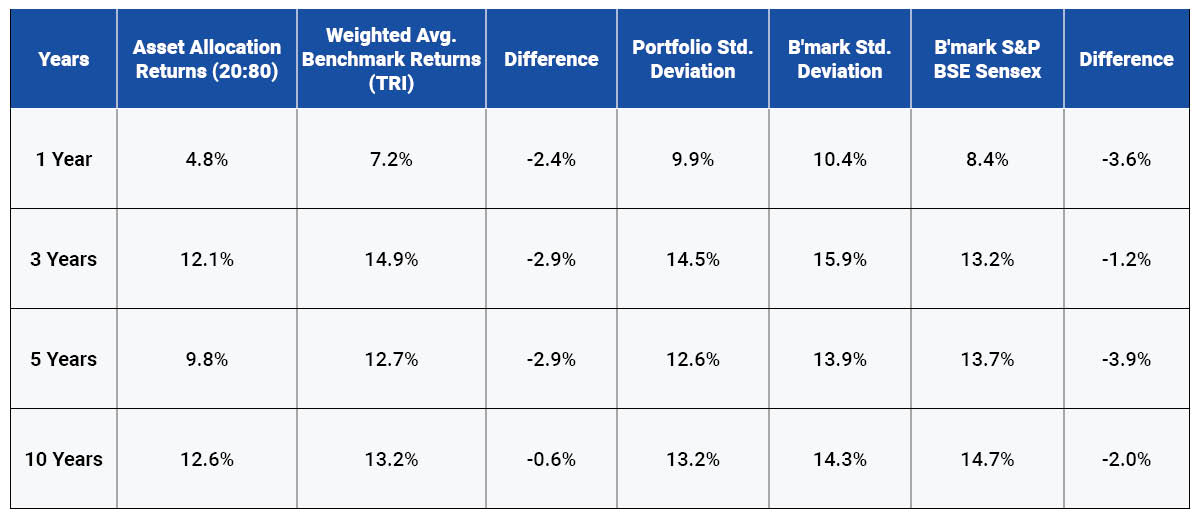

For 1 year: QLTEVF 12%, QEFOF 56%, QESG 12% (Total Equity 80%), QGSF 20% - Grand Total 100%

For 3 years: QLTEVF 16%, QEFOF 64%, QESG 0% (Total Equity 80%), QGSF 20% - Grand Total 100%

For 5 & 10 years: QLTEVF 16%, QEFOF 64%, QESG 0% (Total Equity 80%), QGSF 20% - Grand Total 100%

Data as of May 31, 2022. Returns are in Compounded Annual Growth Rate (CAGR). The allocation considers the equity-gold (20-80) portion of the 12:20:80 portfolio.

The above table is to be read in conjunction with the complete performance given below. Past performance may or may not be sustained in the future.

4. Evaluate the Portfolio Characteristics

This is necessary be it any mutual fund scheme. It shall introduce you to facts such as top-10 holdings, top-sector exposure, the market-cap allocation, the total number of stocks in the portfolio, the conviction with which the stocks are held (reflected by the portfolio turnover ratio) and the strategy followed, among other aspects that, all in all, tell you about the portfolio quality and how the scheme would perform in the future. If the portfolio characteristics are not in fine fettle, then it could weigh down on the scheme’s returns.

5. Assess if the Fund has Exposed You to an Extraordinary Level of Risk

While your objective may be clocking alpha returns, check at what level of risk it is coming at. Ideally, a fund/scheme with low Standard Deviation (a measure of risk), and a higher Sharpe Ratio (a measure of risk-adjusted returns) over a longer period is better than a fund/scheme that exposes you to a very high level of risk.

6. Understand Governance Practices Followed by the AMC

While it is worth knowing the credentials of the fund manager – his/her experience, the number of schemes managed, their performance etc. – don’t lay much emphasis on whether it is a star fund manager handling the fund/scheme. If in future, the star fund manager decides to move on, it could affect the scheme’s performance.

So when choosing mutual funds, while quantitative metrics such as returns assess the fund’s past performance, the qualitative aspects would help recognize the future potential.

Instead of wasting time chasing returns or the next winning mutual fund, choose a fund house with a thoughtful approach to help secure your future.

|

|

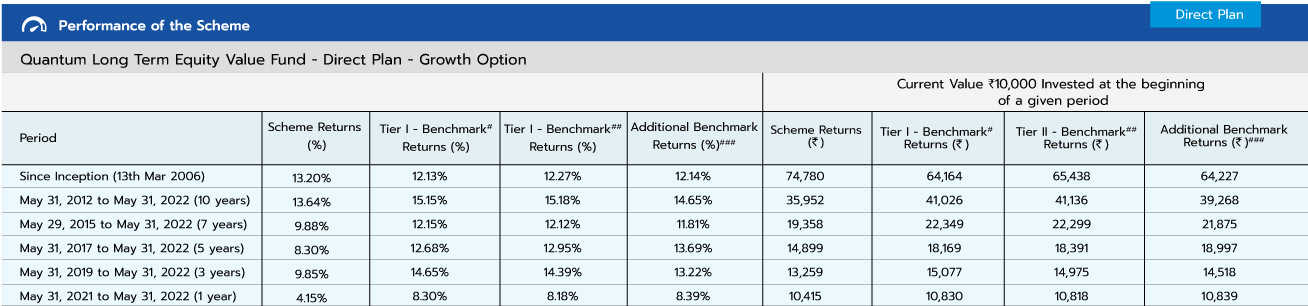

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of May 31, 2022.

Past performance may or may not be sustained in future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI.

As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from

March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from

March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Mr. Sorbh Gupta and Mr. George Thomas. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016.

Mr. George Thomas has been managing the fund since April 01, 2022 Click here to view other funds managed by Mr. Sorbh Gupta and Mr. George Thomas.

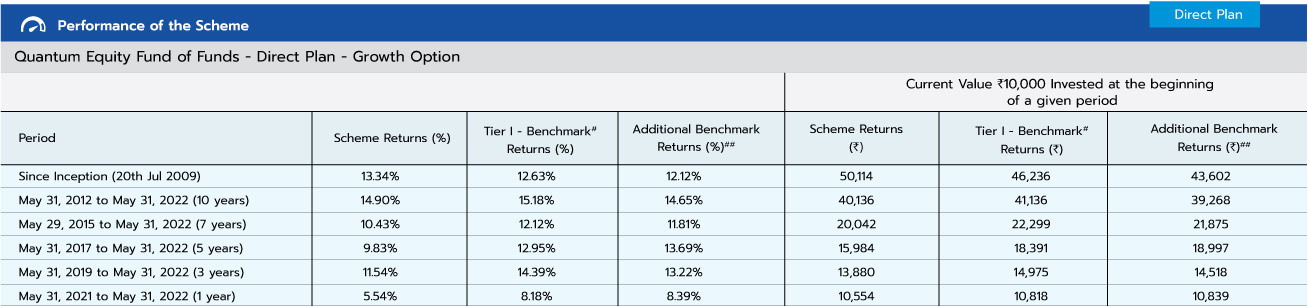

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as of May 31, 2022.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR).

The fund is managed by Mr. Chirag Mehta since Nov 1, 2013.

Mr. Chirag Mehta manages 4 Schemes of Quantum Mutual Fund. For other schemes managed by him, please Click here

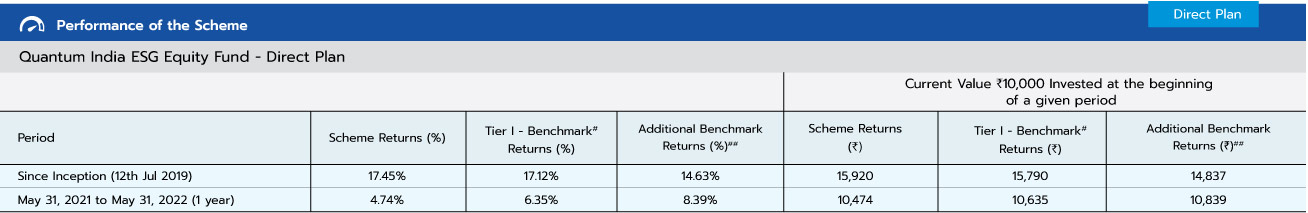

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as of May 31, 2022.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR).

The fund is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta and Ms. Sneha Joshi manage the fund since Jul 12, 2019.

Mr. Chirag Mehta manages 4 Schemes of Quantum Mutual Fund. For other schemes managed by them, please Click here

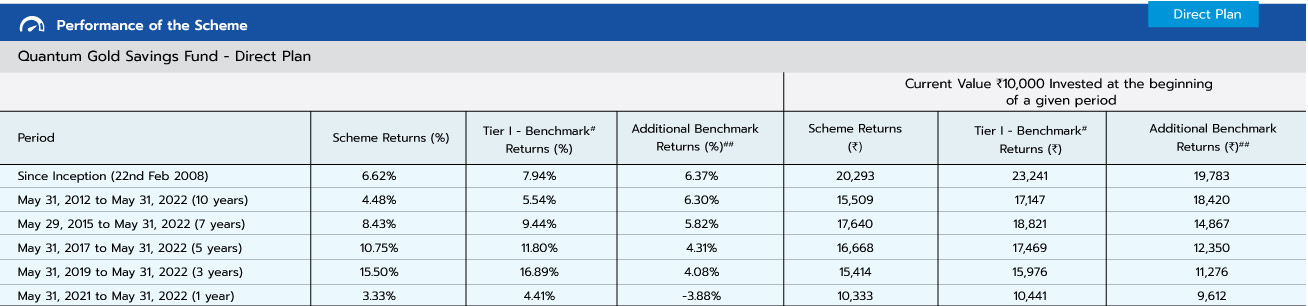

#Domestic Price of Physical Gold, ##CRISIL 10 Year Gilt Index.

Data as of May 31, 2022.

Past performance may or may not be sustained in the future. . Different Plans shall have a different expense structure.

The fund is managed by Mr. Chirag Mehta. Mr. Chirag Mehta is handing the fund since May 19, 2011.

For other funds managed by Mr. Chirag Mehta, please Click here

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Tier I Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |  |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme Tier I Benchmark: NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria |  Investors understand that their principal will be at Very High Risk |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier I Benchmark: Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |  |

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on May 31, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on May 31, 2022

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More