Guessing The Next-Best Asset Class

Posted On Wednesday, Apr 29, 2020

Indeed these are nerve-racking times. Things on the health and economic front are changing so fast that it isn't easy to keep up. Investors can merely sit at home (courtesy, lockdowns), scan headlines and anxiously witness the massive swings in the financial markets and unfortunately, even in their portfolio values. There is no way of knowing what the future holds let alone guessing how financial markets and individual asset classes are set to perform. No one, not even the so-called experts, can accurately know what the best performing asset class or investment idea over the next few months/years will be.

But the good news is that they’ve never known. The simple reason for this is that the best performing asset class is dependent on the state of the economy, which with its booms and busts keeps changing continuously. Assets, due to their differing risk and return characteristics, respond differently to these booms and busts, thus going through cycles of optimism (price increases) and pessimism (price falls). Typically, when interest rates are low, debt gives lower returns but equity will be outperforming; when the equity markets are down, debt would be a source of stable returns; in times of uncertainty, cash and gold will rule and so on.

But don’t just take our word for it. Let’s dig into the asset class returns history in India.

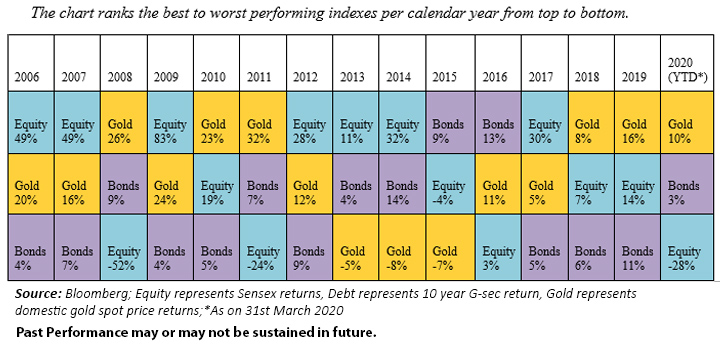

This snapshot of historical asset returns highlights how asset classes grow and contract in cycles. To put it simply, there will be periods when equity markets will have a brilliant run, periods when only bonds will be dependable, and periods when gold will shine the brightest, and these periods will not typically overlap.

Similarly, each of these asset classes is expected to respond differently to the Covid-19 pandemic and the developing macroeconomic situation.

Hence it is important to not get anxious about what you can't control i.e. guessing the next best-performing asset class through this current crisis, and instead focus on what you can. And what you can control is ensuring all your money eggs aren't in one asset basket i.e asset allocation.

Asset allocation or holding a diversified portfolio with multiple imperfectly correlated asset classes (equity, debt, gold) can prove to be the easiest, smartest way to make risk adjusted returns through the ups and downs of the economy, and especially through this health cum economic crisis that we are currently facing. This is simply because historically when one asset type has average or poor returns; the other usually does well, thus limiting downside and compensating your portfolio for the poor returns or losses of the former. This significantly reduces the risk of losing money and overall portfolio volatility.

To put things in perspective, if you had an all-equity portfolio worth Rs 1,00,000 at the start of the new decade, you're probably down a painful 28% to 72,000 as of March end, which means you'll need a whopping 39% gain to recover from the recent carnage. And based on how unpredictable and bearish things are at the moment, you'd agree that those kinds of spectacular gains are pretty far out in the future. On the flip side, if your portfolio at the start of 2020 was divided between equities, debt and gold in 40:40:20 ratio, the current value would stand at 92k requiring a much lesser 8.7% gain to be whole again. The results would be even better if the portfolio tactically had an even lower allocation of 30% to overpriced equities, with the portfolio losing only 4.9% of its value in this crisis and rebounding to the original value with a mere 5.2% return.

Multi asset portfolios

An ideal way to use this asset cyclicality to your advantage and ensure a risk adjusted rate of return with limited volatility is to be invested in a multi asset portfolio.

The Multi Asset Mutual Fund category is one such avenue. This category of funds invests in equity, debt and gold creating a balanced risk and return profile. It thus offers investors exposure to various asset classes in a single investment.

The manager strategically moves in and out of these asset classes capitalizing on their up and down cycles, thus relieving the investor from monitoring asset markets. The portfolio strives to optimize gains and minimize downside and is ideal for the diversification and asset allocation needs of investors with low and medium risk appetite.

So don’t lose sleep over the current ups and downs of the financial markets, diversify through multi asset funds and have a relatively steady ride towards long term wealth creation.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk< |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More