Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt. A disciplined investor on the other hand, like a responsible driver, understands that while speed (high returns) is tempting, safety (risk control) and protection (capital preservation) is crucial for a long and successful journey.

Safeguard from downside

Just like a seat belt can safeguard you from severe injury in case of an accident, prudent risk management can safeguard your portfolio from financial loss.

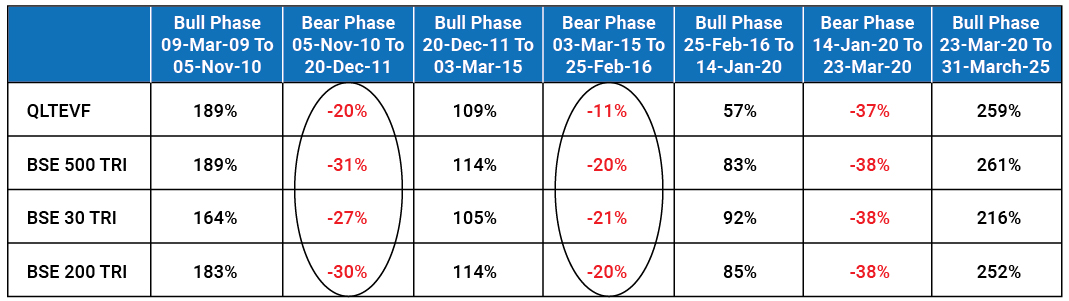

Quantum Long Term Equity Value Fund’s investment framework has built-in risk management process in its investment strategy which has resulted in better downside protection for its investors during market downturns. The fund’s preference for fairly valued, liquid and well governed businesses have acted as the seat belt when it really mattered.

Source: ACE MF, Past performance may or may not be sustained in the future. This table should be reviewed in conjunction with detailed performance of the scheme provided at end of the article. Tier I benchmark is BSE 500 TRI and Tier II benchmark is BSE 200 TRI. The above performance is of the Direct Plan. Data as on 31st March 2025.

For instance, in 2010-2011, concerns over tapering of the 2008 era stimulus and the sovereign debt crisis in several European states led to capital outflows from emerging markets like India. Markets fell with the BSE 500 TRI correcting by 31%. In comparison, the Quantum Long Term Equity Value Fund portfolio corrected by 20% during this period. Then the Non-Performing Asset crisis in Indian Banking system in 2015-2016 resulted in BSE 500 TRI correcting by 20%. The Quantum Long Term Equity Value Fund’s correction was 11% in the same period.

Driving without a seat belt might feel fine—until an accident happens. Similarly, ignoring risk mitigation might seem fine in a bull market—until a downturn hits. Markets had rewarded investors in the run-up to the 2010 and 2015 crashes, making investors chase returns without acknowledging risks.

Aids the journey

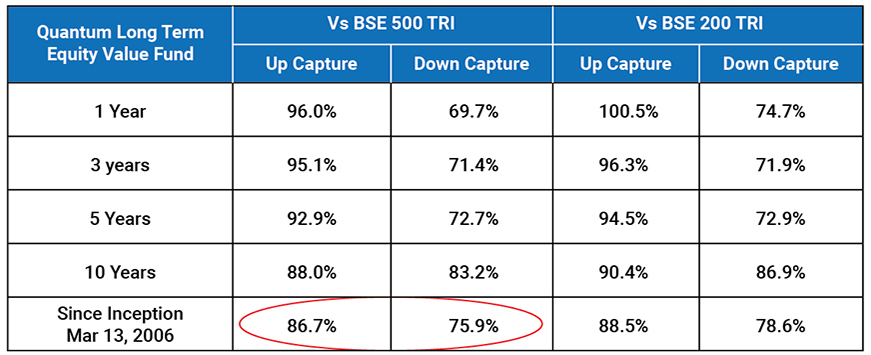

A seat belt doesn’t stop you from driving fast, but it safeguards from the danger. Risk management practices do not hinder the investment journey, instead they make the ride smoother. A simple metric to evaluate a fund is to see how the fund behaves in a market upcycle and market downcycle. Up capture is the monthly average of the ratio of fund’s performance in up markets relative to it’s benchmark performance. Similarly, Down capture is the monthly average of the ratio of fund’s performance in down markets relative to it’s benchmark performance. Since inception, the Quantum Long Term Equity Value Fund has an Up Capture and Down Capture ratio of 87% and 76% respectively against it’s primary benchmark – BSE 500 TRI. In simple language, fund captured a larger share when market went up Vs how much it lost in a falling market.

Upside capture ratio measures a strategy’s performance in up markets relative to an index. A value over 100 indicates that an investment has outperformed the benchmark during periods of positive returns for the benchmark. It is calculated by taking average of the strategy's monthly return during months when the benchmark had positive returns and dividing it by the average of the benchmark return during months when the benchmark had positive returns.

Downside capture ratio measures a strategy’s performance in down markets relative to the index. A value of less than 100 indicates that an investment has lost less than its benchmark during periods of negative returns for the benchmark. It is calculated by taking average of the strategy's monthly return during months when the benchmark had negative returns and dividing it by the average of the benchmark return during months when the benchmark had negative returns.

Monthly returns are considered to compute the ratios. Performance data considered as on 31st March 2025. Past performance may or may not be sustained in the future. This table should be reviewed in conjunction with detailed performance of the scheme provided at end of the article. Source: Quantum, Bloomberg

Enables Long-Term Existence Path

A road accident can have adverse consequences on our health or life, potentially hurting our ability to drive in the future. Similarly, large market drawdowns can be hard to recover from – for instance a 50% drop in investment value needs a 100% gain just to breakeven.

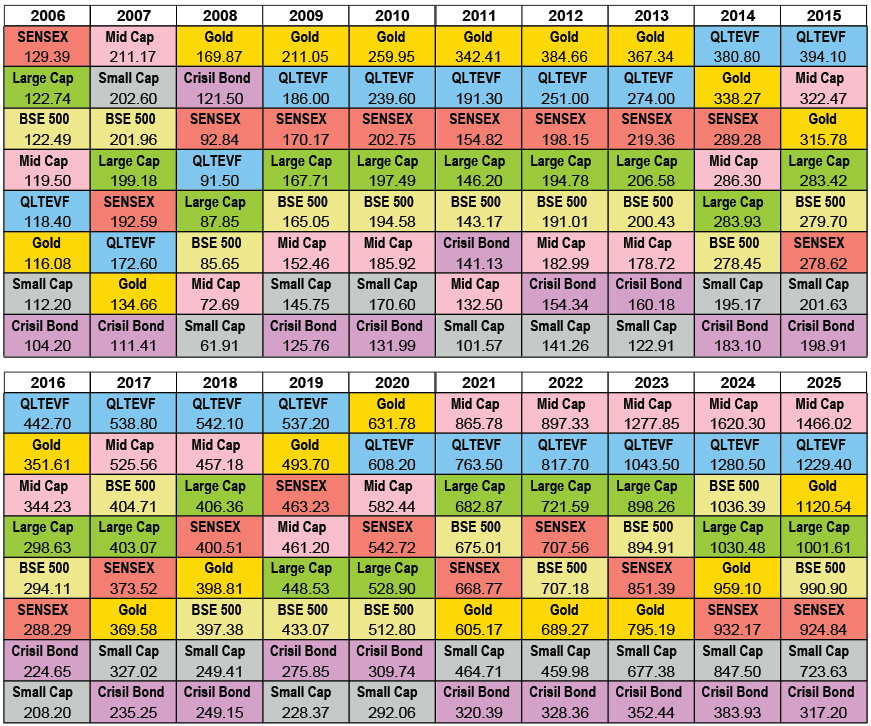

Let’s examine the performance of QLTEVF relative to various asset classes and indices over the last 20 years. During market corrections in 2008, 2011, and 2015, Quantum Long Term Equity Value Fund (QLTEVF) had fallen less compared to few large-cap indices.

QLTEVF’s relative outperformance during market down turns has enabled it to perform reasonably well over long term. As can be seen in the table below, the cumulative value of QLTEVF since it’s inception has exceeded large cap tilted indices over long term. While the fund may not have been exciting during bull markets, it’s performance during down markets has led to a reasonable long-term performance.

All asset class returns and QLTEVF Returns data starting from same date i.e. 13th March 2006. The chart ranks the best to worst performing indexes per calendar year from top to bottom. Past performance may or may not be sustained in the future. Indices Used: BSE Sensex TRI , BSE 500 TRI , BSE 200 TRI , BSE 150 MidCap TRI, BSE 250 Small Cap TRI , MCX Gold Commodity Index , CRISIL Composite Bond Fund Index. Source: Bloomberg Data updated as on 31st March 2025.

Detailed methodology for the working of rebased value Rs.100. Base Date Selection: Choose a base date and assign a value of 100 to the index on that date. Formula for Rebasing: Rebased Index = (Index level at Ending date)/(Index level at beginning Date)*100

If an investor suffers losses, they may exit the market entirely, missing long-term gains. By limiting downside risk, Quantum Long Term Equity Value Fund ensures investors stay invested and benefit from long-term market growth. Fewer losses also mean less emotional stress and fewer rash decisions such as selling at market lows.

Stock markets are full of ups and downs as they reflect the good and bad times of the underlying economy. Sustained periods of strong returns can feel like a long, comfortable drive with beautiful views - making investors complacent, and unappreciative of risks. A sharp turn of the road often catches them off guard – their portfolios unprepared to deal with the market correction.

Whether on the road or in the markets, the key to reaching your destination safely is not just how fast you go, but how well-prepared you are for the bumps along the way. Quantum Long Term Equity Value Fund’s focus on risk management can be a smarter and safer way to reach your long-term financial goals.

|

Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022.

Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022.

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Tier II - Benchmark## Returns (%) | Additional Benchmark Returns (%)### | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Tier II - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)### |

| Since Inception (13th Mar 2006) | 14.07% | 12.78% | 12.85% | 12.38%% | 122,940 | 99,090 | 100,161 | 92,573 |

| 10 years | 12.32% | 13.16% | 13.05% | 12.11% | 31,991 | 34,471 | 34,122 | 31,389 |

| 7 years | 13.45% | 14.55% | 14.68% | 14.30% | 24,229 | 25,922 | 26,139 | 25,530 |

| 5 years | 27.18% | 26.29% | 25.59% | 22.73% | 33,290 | 32,140 | 31,264 | 27,864 |

| 3 years | 17.32% | 13.73% | 13.50% | 11.14% | 16,155 | 14,717 | 14,627 | 13,731 |

| 1 year | 11.57% | 5.96% | 6.22% | 6.39% | 11,157 | 10,596 | 10,622 | 10,639 |

#BSE 500 TRI, ##BSE 200 TRI, ###BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). ##with effect from December 01, 2021 Tier I benchmark has been updated as BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006. ##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006. Regular Plan was launched on 1st April 2017. Click here for other scheme managed by the Fund Managers.

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier I & II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More