A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

“A strong portfolio, like a strong body, needs regular check-ups.”

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape. While we set new resolutions for our health and career, how often do we check on the health of our portfolio?

Just as an annual health check-up helps detect potential issues before they escalate, an annual portfolio review can prevent imbalances that may impact your long-term financial well-being.

• Are you overexposed to past trends that may no longer be relevant?

• Has your asset allocation drifted due to market movements?

• Are you investing in the right funds to achieve your goals?

Before you move ahead, take a step back. A financial health check today can set the foundation for a more resilient portfolio tomorrow.

Build a Strong Foundation – The Core of Your Portfolio

Strong buildings stand on strong foundations. The same goes for portfolios.

Every successful investment journey begins with a solid foundation. Whether you're constructing a skyscraper or structuring a portfolio, the base needs to be reliable, resilient, and built for the long run.

This is where Quantum Long Term Equity Value Fund (QLTEVF) can play a vital role. Instead of chasing short-term market trends, QLTEVF follows a value investing approach—identifying fundamentally strong businesses that are fairly valued.

Market sentiments fluctuates, but strong companies endure. With QLTEVF, investors get a research-driven portfolio designed to safeguard and grow wealth over time following value style of investment.

Is your portfolio built on a strong foundation, or is it swaying with market trends?

Small Caps in Focus – Finding the Right Fit

Not every investment is the right fit—just like not every exercise suits everyone.

Small Cap stocks have the potential to create wealth and generate alpha as these are under-researched, generally often mis-priced, innovative, or niche businesses with a long growth runway and scope to increase market share.

Small Cap funds can be rewarding, but they come with liquidity risks. Quantum Small Cap Fund (QSCF) follows a disciplined approach, selecting quality small-cap companies while maintaining adequate liquidity. QSCF remains mindful of its size, ensuring that every investor gets exposure to a portfolio that adheres to its investment mandate.

Don’t just pick any Small Cap fund—choose the one that prioritizes liquidity and does not stray from its investment mandate.

Is your Small Cap investment a right selection or just a leap of faith?

Approach for the Right Allocation – Is Your Portfolio Balanced?

A good portfolio, like a good workout plan, requires balance.

Investing in only one asset class is like only focusing on one muscle group—it may look good for a while, but it lacks long-term stability. Asset allocation is the compass that guides your portfolio in the right direction, ensuring that different market cycles don’t make your portfolio vulnerable.

Quantum Multi Asset Fund of Funds (QMAFOF) strategically invests across equity, debt and gold, helping investors diversify risk and limit downside through asset allocation across multiple asset classes. Just as a trainer structures workouts across different muscle groups, QMAFOF manages allocation, ensuring that no single asset class dominates the portfolio.

A well-diversified portfolio is not about maximizing returns in short term but optimizing risk-adjusted returns over time.

Are you over-relying on one asset class, or is your portfolio properly balanced?

Annual Reviews Ensure Financial Well-Being

What you don’t measure, you can’t improve.

Many investors set up their portfolios and forget about them, assuming that what worked last year will work again. But just as physical fitness declines without regular effort, financial health may deteriorate without regular monitoring.

Skipping a financial review is like neglecting an annual check-up—you might not notice an issue until it’s too late.

A new financial year is an opportunity to:

• Evaluate whether your portfolio still aligns with your financial goals.

• Rebalance where needed to stay on track.

• Reaffirm your investment choices to ensure you are not reacting to short-term trends.

Your investments should work for you—not the other way around. This financial year, prioritize your portfolio’s health just as you would your own.

The Bottom Line – Don’t Just Start the Year. Start Strong.

A well-maintained portfolio, like good health, is key to long-term success. The right funds, a disciplined approach, and an annual review can set you up for a financially secure future.

If you haven’t reviewed your portfolio yet, now is the time. A quick check today can help ensure that your investments remain aligned with your financial goals, no matter what the markets bring.

Because a financially fit future starts with a healthy portfolio.

|

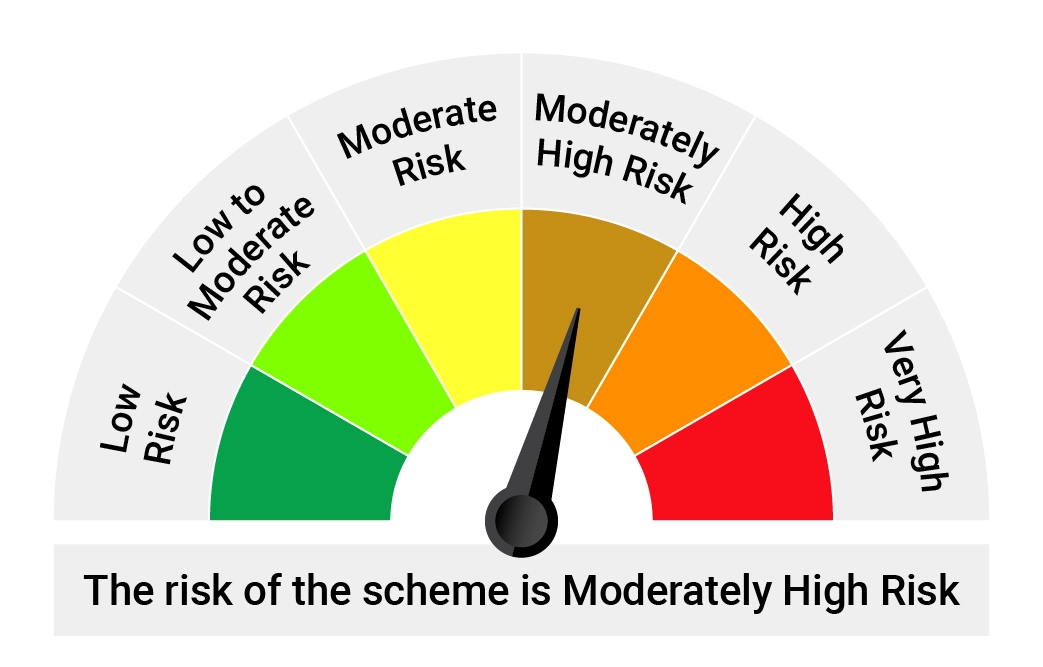

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks | • Long term capital appreciation • Investment in Small Cap Stock |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More