Tax Planning Season is Coming - Don’t Wait Till the Last Moment

Posted On Tuesday, Nov 15, 2022

2022 is close to an end and as you start charting out plans to welcome the new year we suggest you do not lose sight of the fact that it is also the time when companies start requesting investment proofs for tax planning. Planning your taxes at the last moment leaves little time for you to study different investment options. It also becomes a burden to invest a lumpsum amount just to save tax. Alternatively, you can invest small amounts regularly through SIPs all through the year, thereby not eating into a chunk of your savings at the last moment.

“Next to being shot at and missed, nothing is quite as satisfying as an income tax refund.” – F.J. Raymond

You generally invest money to achieve your financial goals then why not invest to save tax, as money saved is money earned. Thoughtful investors do not wait for the tax season and start planning & take advantage of the various exemptions and deductions using simple methods to minimize tax liability during a financial year. Financial planning for them is not just about saving taxes but also maximizing returns from those investments.

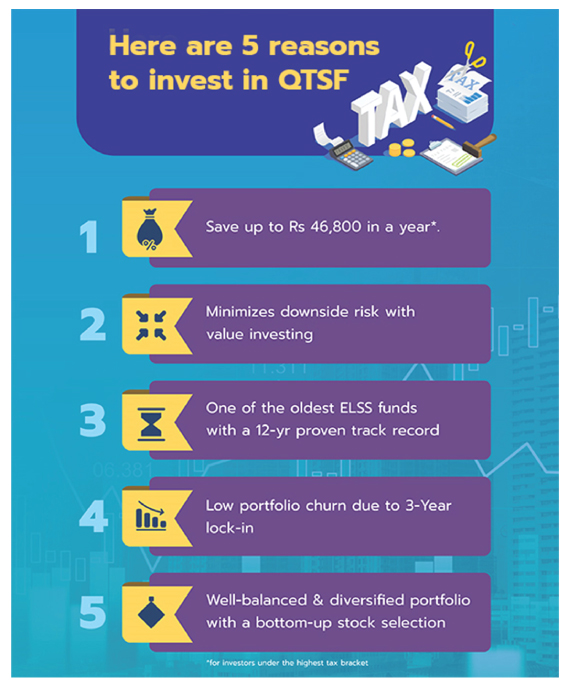

One such avenue that is widely popular among investors is an Equity Linked Savings Scheme (ELSS). It gives you the dual benefit of tax saving and building wealth due to its investment in equity and equity-related instruments. More importantly, it is a type of mutual fund that gives you the flexibility of liquidity when you need it due to the lowest lock-in of 3 years as compared to other Tax saving investment options u/s 80C.

Find answers to all your questions on ELSS from George Thomas, Associate Fund Manager, Quantum Tax Saving Fund.

What are the different tax-saving instruments?

Investors in India can claim tax deduction up to INR 1.5 lakh under 80C. Popular tax saving instruments include Provident Fund, Tax Saving Fixed Deposit (5 year lock-in), PPF (Public Provident Fund) and ELSS Schemes (Equity Mutual Fund).

How is ELSS different from other tax-saving investments?

Unlike other options mentioned previously, Mutual Funds under ELSS scheme have an underlying investment in Equity. Equity remains as an optimal asset class that has potential beat inflation over the long term. The lock-in for ELSS schemes is relatively lower at 3 years compared to 5 years in the case of Tax Saving FD and 15-year lock-in for PPF with the potential for relatively higher risk-adjusted returns over the long term.

What are the tax benefits for ELSS investors?

Since the investment in ELSS is locked in for 3 years, investors cannot withdraw from the scheme before 3 years. So, only a long-term capital gain tax is applicable instead of a short-term capital gain tax. ELSS remains as an optimal choice for an investor looking at the combination of tax rate and lower holding period mandate compared to other available options.

The tax savings would improve the long-term returns on a tax-adjusted basis.

Why add Quantum Tax Saving Fund (QTSF) to your portfolio?

Since investment under ELSS has a lock-in period of 3 years, it is important to make sure that the Fund Manager invests with a long-term perspective and the Fund Manager doesn’t deviate from the stated style. A long-term track record would enable investors to gauge the performance of fund under different circumstances.

The low turnover ratio of QTSF indicates that it invests with a long-term perspective. QTSF has a portfolio turnover ratio of 18.48% as of September 30, 2022 translating to an average holding period of 5.4 years. QTSF has a long-term track record of ~14 years and the fund follows a value style (PE ratio 12.2x FY 24E consensus earnings Vs. the S&P BSE Sensex valuations of 17.0x based on FY24E consensus earnings as of Oct 31, 2022.

How does QTSF complement an investor’s portfolio?

Different styles come in favour in the market depending on the economic environment. Value style tends to do well during times of a rising investment and credit cycle. In a normalized interest rate environment, value style tends to outperform as investors start questioning the high valuation multiples assigned during the low interest rate environment.

QTSF follows a value style and invests with a long-term perspective. Investors may consider the fund for their value allocation. We believe a diversified basket of funds managed under different styles would aid investors in constructing a portfolio that can deliver risk adjusted returns across market cycles. Investors can follow Quantum’s tried and tested 12:20:80 strategy (Baarah, Bees Aur Assi) that helps them achieve risk-adjusted returns and fulfil their financial goals. Investors can explore our Asset Allocator Calculator online to understand how best to build their portfolio.

When it comes to tax saving investments, think beyond traditional avenues. It’s not a year-end activity so avoid hasty decisions of investing in tax-saving schemes that don’t give you benefits in the future. Simple management and strategic decisions at the right time facilitate Smart Tax Planning in order to optimize tax saving u/s 80C of the Income Tax Act.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on October 31, 2022

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Tax Planning Season is Coming - Don’t Wait Till the Last Moment

Posted On Tuesday, Nov 15, 2022

It is around the time when companies start requesting investment proofs for tax planning.

Read More -

How Can ESG Investing Safeguard Your Future?

Posted On Thursday, Aug 11, 2022

Three waves of the pandemic, the Russia-Ukraine war, record-high inflation - the last three years have been challenging...

Read More -

Balancing Emotions While Investing

Posted On Monday, Jun 20, 2022

Emotions are an essential part of what makes us human but when it comes to investing, emotions can either make or break your goals.

Read More