How Can ESG Investing Safeguard Your Future?

Posted On Thursday, Aug 11, 2022

Over the past few years, people around the globe have been making more sustainable choices in their lives, changing simple things like recycling household waste, or going for greener ways to travel wherever possible. It’s not surprising that the demand for Environmental, Social, and Governance (ESG) investing has increased substantially

But the question is, how can ESG investing safeguard your future?

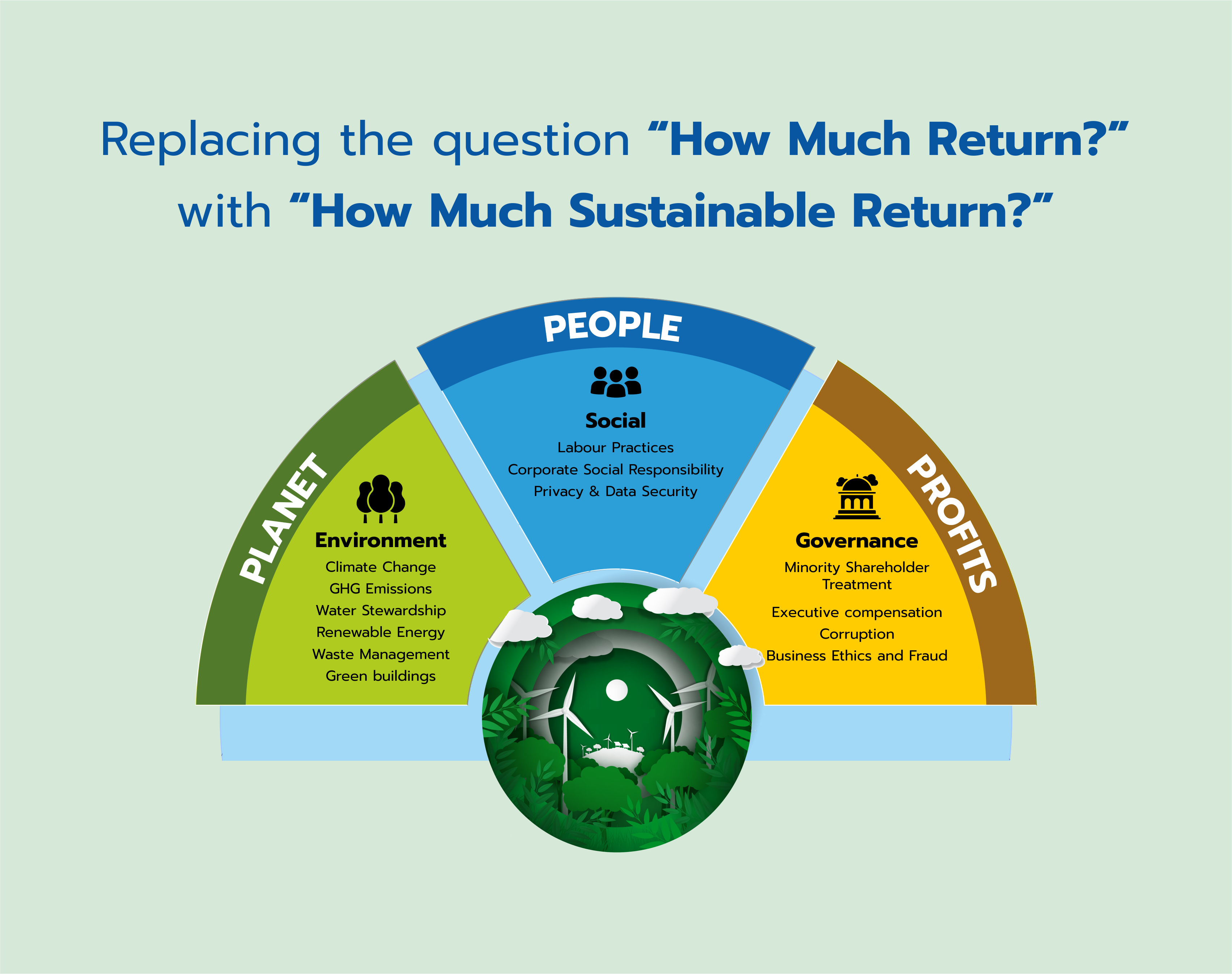

For the uninitiated, ESG mutual funds invest in securities of companies that are evaluated based on the non-financial factors of Environmental, Social and Governance. ESG aims to achieve a triple bottom line that is good for the people, planet and profits.

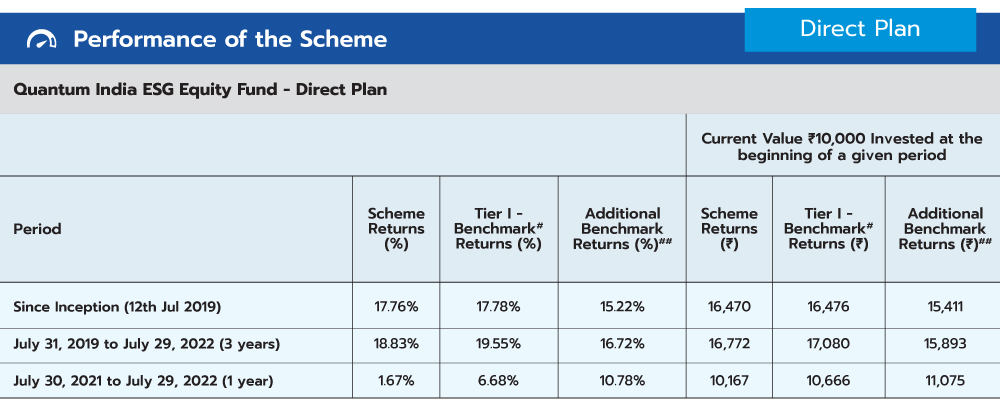

Quantum was one of the first funds to launch an ESG fund in India in 2019. Since its inception, the fund goes beyond traditional valuation metrics and uses a proprietary ESG scoring methodology to shortlist companies based on environmental, social and governance parameters. Over the past three years and counting, it has been adding resilience to your portfolio during uncertain times – be it during the pandemic, Russia-Ukraine war, record high inflation and subsequent rising interest rate scenario.

Sustainability -A Vital Part of Your Portfolio

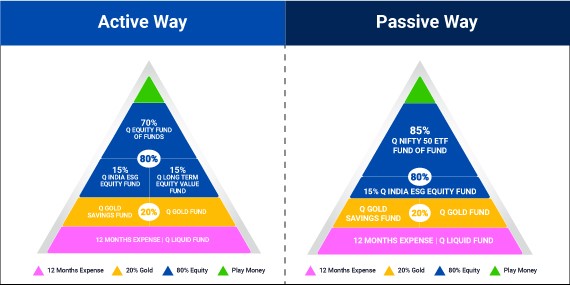

Sustainability is becoming an integral part of life, and companies that adopt the triple bottom line will be the future. Given its importance and to provide diversification to your portfolio, we have included Quantum India ESG Equity Fund as a key component of your equity portfolio in our 12:20:80 asset allocation strategy for both – active or passive investing.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

After setting aside 12 months of your monthly expenses to the Quantum Liquid Fund as a foundation block of your portfolio, allocate the balance into Gold (Diversifying Block) and Equity (Growth Block) in the ratio of 20-80. Your Growth Block i.e 80% then gets divided using a diversified equity bucket. The funds get allocated across three different equity funds - Quantum Equity Fund of Funds, (70%) Quantum Long Term Equity Value Fund (15%) and Quantum India ESG Equity Fund (15%).

If you choose a passive allocation, you can diversify your growth block by investing 85% in the Quantum Nifty 50 ETF Fund of Fund and the balance of 15% in Quantum India ESG Equity Fund.

You can also check out our handy 12:20: 80 asset allocator tool – to see how much you should invest responsibly in ESG as part of your overall diversified portfolio.

ESG is Good for the Planet & For Your Pocket

For years, people used to think that ESG investing may lead to weaker returns. But that is not true. In fact, studies from the past few years show that ESG investing achieves similar or even has the potential to generate higher returns than traditional equity funds.

If you see the performance of the Quantum India ESG Equity Fund (QESG), it has showcased resilience since its inception. The fund can help you with risk adjusted returns over the long term. It helps achieve long-term wealth creation by investing in shares of companies that meet Quantum's Environment, Social and Governance (ESG) criteria.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as of July 31 2022.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR). The fund is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta and Ms. Sneha Joshi manage the fund since Jul 12, 2019. Mr. Chirag Mehta manages 4 Schemes of Quantum Mutual Fund. For other schemes managed by them, please Click here.

ESG Funds Lower the Downside Risk

Another significant reason why ESG investing is important is that ESG investing not only performs well over time but also minimizes downside risk for investors. If you can evaluate a true to label ESG fund, it will have the potential to reduce the impact of market downturns on your portfolio. Since ESG focused businesses are committed to adhering to government regulations, governance and following a fair ESG framework, they tend to be less volatile and have stronger reputations.

| As of July 31, 2022 | Quantum India ESG Equity Fund |

| Annual Standard Deviation | 19.60% |

| Beta | 0.89% |

| Sharpe Ratio | 0.72% |

Data as of July 31, 2022. Risk Free Rate assumed to be 5.25% (FBIL Overnight MIBOR for 29th July 2022) for calculating Sharpe Ratio. Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns.

Past performance may or may not be sustained in the future.

Risk return is also favourable in case of ESG. As you can see in the figure above, the fund has a low volatility and a high sharpe ratio. Therefore, you need not worry about the impact of market uncertainties on your investment.

A Win-Win Situation to Safeguard Your Future

Investing in QESG is a win-win situation for investors as it not only has the potential to provide better risk adjusted returns but also serves as a route to contribute to the environment and society positively. QESG is a great way of complementing your portfolio with a fund that showcases your ethics and standards while delivering risk adjusted returns.

Move from investing in a Single Bottom Line to the Triple Bottom Line – People, Planet and Profits by diversifying your portfolio to include a ESG Fund like the QESG today .

|

|

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low to Moderate Risk |

Quantum Nifty 50 ETF Fund of Fund** An Open-ended fund of fund scheme investing in Quantum Nifty ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria |  Investors understand that their principal will be at Very High Risk |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on July 31, 2022.

**The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 05, 2022.

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Tax Planning Season is Coming - Don’t Wait Till the Last Moment

Posted On Tuesday, Nov 15, 2022

It is around the time when companies start requesting investment proofs for tax planning.

Read More -

How Can ESG Investing Safeguard Your Future?

Posted On Thursday, Aug 11, 2022

Three waves of the pandemic, the Russia-Ukraine war, record-high inflation - the last three years have been challenging...

Read More -

Balancing Emotions While Investing

Posted On Monday, Jun 20, 2022

Emotions are an essential part of what makes us human but when it comes to investing, emotions can either make or break your goals.

Read More