Remain Positive but Turning Cautious

Posted On Thursday, Dec 19, 2024

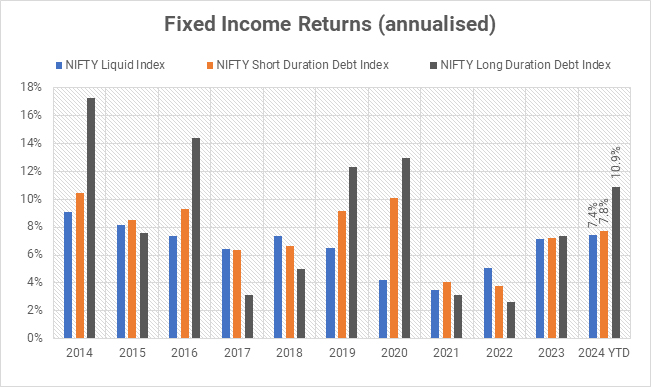

This was a good year for the fixed income investors. The key highlight of the year was India’s inclusion in the JP Morgan GBI EM Index, which led to foreign portfolio investors (FPIs) pouring in over USD 18 billion in Indian government bonds (IGBs) in 2024 so far.

Domestically, the government continued with the fiscal consolidation - pegging fiscal deficit at 4.9% of GDP in FY25 and limiting the new debt issuance. While demand from domestic insurance, pension and provident funds remained strong.

The RBI kept the policy repo rate unchanged at 6.50% throughout the year. The headline CPI inflation was volatile and elevated, mostly above 5%, while the Core-CPI fell well below the RBI’s 4% threshold.

Despite no rate cut from the RBI, bond yield fell between 35-45 basis points across the maturity curve driven by positive demand supply balance and easing inflation pressures. Decline in bond yields contributed positively to fixed income returns in the year with long term bonds benefiting the most.

Chart – I: Fall in bond yield boosted performance of long-term bonds

Source- AMFI Portal, Quantum Research; Data up to December 16, 2024

Past Performance may or may not be sustained in the Future

Looking Ahead

Some of the key market drivers of 2024 will continue to support the bond market in 2025. (Bull Case Revisited). The government is expected to lower the fiscal deficit to 4.5% of GDP in FY26. Consequently, the net borrowing through dated securities would remain almost same or lower in FY26 compared to Rs. 11.16 trillion planned for FY25.

On the other hand, demand for bonds is expected to grow by 10%-15% led by insurance companies, pension funds and banks.

RBI’s proposed changes to the liquidity coverage ratio (LCR) norms for banks (RBI Draft Guidelines) could boost the banks’ demand for government bonds even further.

Foreign inflows linked to the Index inclusion are also expected to continue in 2025. India will also be included in the Bloomberg EM Local Currency Government Index and FTSE EM Government Bond Index (EMGBI) starting January 2025 and September 2025 respectively.

Given the current trend and assuming no major weather shock, CPI inflation would align with the RBI’s 4% goal by mid-2025. We expect the RBI to embark on a rate cutting journey and cut the policy repo rate by cumulative 50-100 basis points in 2025 depending on the pace of growth recovery.

In addition to the aforementioned factors, India's strengthening credit profile and prospective sovereign rating upgrade will also support the bond market outlook in 2025. (India Poised for a Sovereign Rating Upgrade)

Growing Uncertainties

Although the overall macro backdrop remains supportive, we are watchful of some of the recent developments in that can add significant uncertainties in 2025.

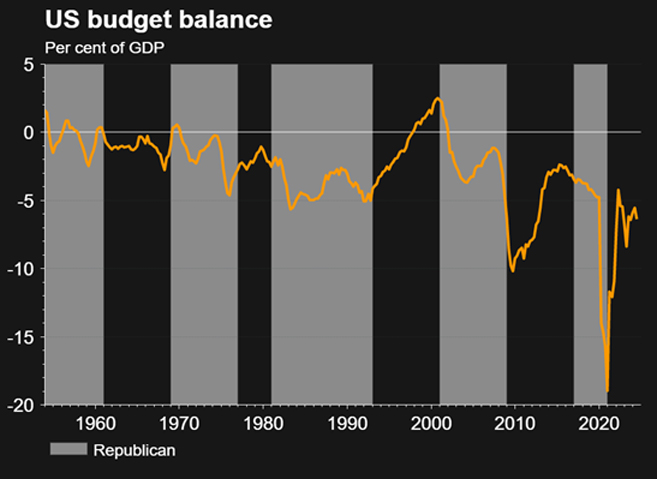

1. Tax Cut could push US deficit higher and limit room for rate cut: Among many election promises, the US president elect Donald Trump has promised sweeping tax cuts and new tariffs on most foreign goods.

How these policies will unfold and impact the markets is difficult to gauge at this point. However, there is a general sense that tax cuts will widen the US fiscal deficit and increase the US public debt as percentage of its GDP.

Chart II: High Fiscal Deficit: A Double-Edged Sword for U.S. Growth and Inflation Control

Source: LSEG Datastream, Data up to December 18, 2024

The US is already running a very high fiscal deficit at 6.4% of GDP. High fiscal deficit is good for the economic growth, but it could hamper the disinflationary process and limit the Fed’s ability to cut interest rates. To some extent, this is already reflected in the fed funds future rates that marched higher ahead of the Trump’s presidency.

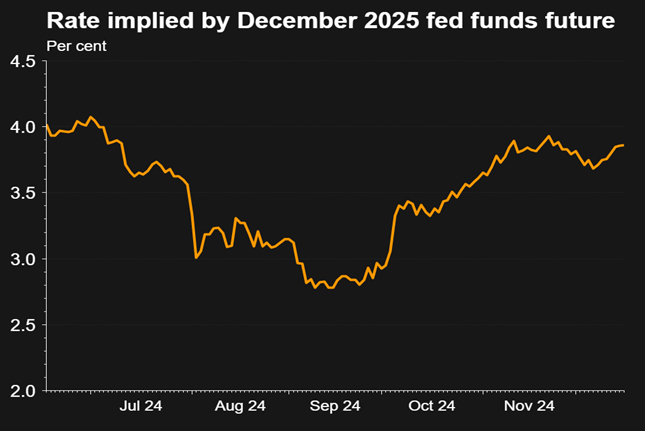

Now, the futures curve is pricing only two rate cuts of 25 basis points each in 2025 as against an expectation of cumulative 200 basis points cuts three months back.

Chart III: Shifting Expectations: Fed Funds Futures Reflect Diminished Rate Cut Outlook

Source: LSEG Datastream, Data up to December 18, 2024

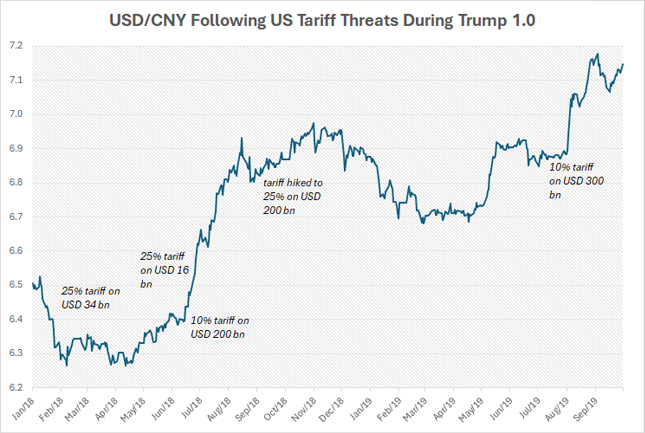

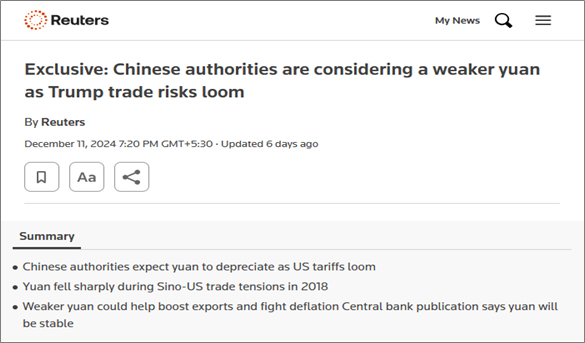

2. Trade war could trigger competitive currency devaluation: Trump's suggested trade policy is also seen as limiting the Fed's easing stance because tariffs may increase US inflation. It might, however, have a more detrimental effect on the emerging markets via the currency channel.

In response to tariffs during the last Trump residency, China actively devalued its currency to remain competitive. That in turn put pressure on other EM currencies. We are again staring at this risk of competitive currency devaluation.

Chart IV/V – China had devalued its currency in response to trade tariffs during Trump 1.0

Source – LSEG Refinitiv, Quantum Research; Data as of December 18, 2024

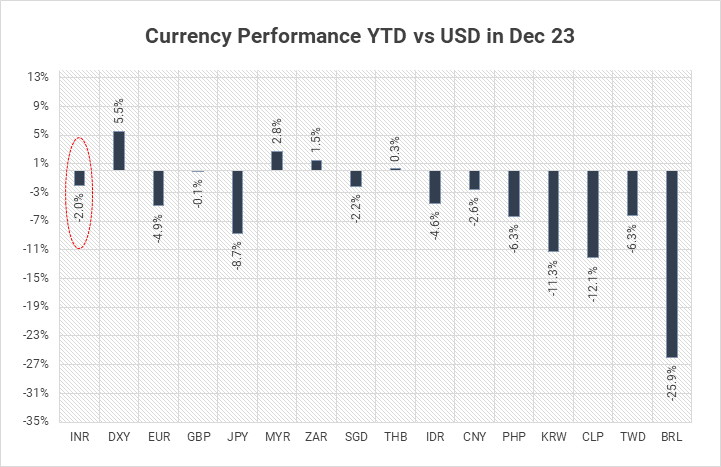

3) Falling INR and its Liquidity problem: Amidst growing global uncertainties and rising US Dollar, the INR is under pressure. It has lost nearly 1.3% against USD since September 30, 2024. Even though the INR's current movement appears to be limited, there is a risk of a significant depreciation ahead as global investors ramping up bets on further Dollar strength in 2025.

Chart VI – INR Faces Pressure Amid Rising US Dollar and Global Uncertainties

Source: Bloomberg. Data up to December 17, 2024

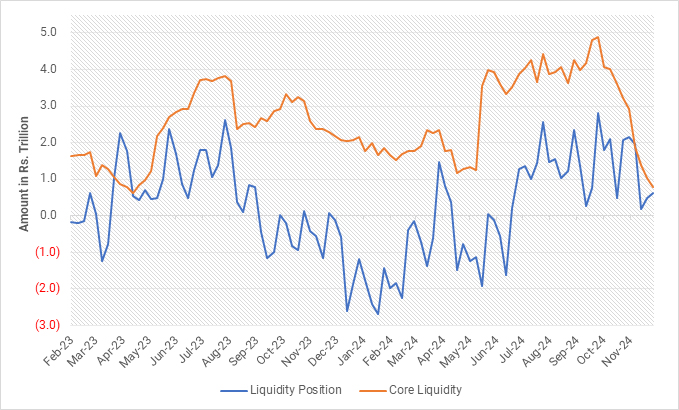

To curb the depreciation of the INR, the RBI has significantly increased its interventions in the forex market, selling an estimated USD 35 billion from its foreign exchange reserves over the past two months. When the RBI sells foreign currency or bonds, it effectively withdraws rupee liquidity from the banking system. As a result, the core liquidity-comprising banks' net borrowing/lending from the RBI and the government’s cash balance - dropped from Rs. 4.8 lakh crore at the end of September to around Rs. 75,000 crores as of December 6, 2024.

Chart VII - RBI’s CRR Cut Boosts Liquidity, but Forex Sales May Still Pose a Challenge

Source: RBI. Data up to December 06, 2024

The recent CRR (cash reserve ratio) cut by the RBI will add Rs. 1.16 lakh crore of durable liquidity over the next two weeks. But this might prove insufficient in the face of continued forex sales by the RBI.

Moreover, RBI’s interventions are not limited to the spot market. Its net short position in the currency forwards including the forward leg of currency swaps has increased to USD 49 billion as on October 31, 2024. This means the RBI has contracted to sell USD 49 billion foreign currency on some predetermined future date.

Chart VIII – RBI’s forward short position suggest further FX in coming months

Source – RBI, Quantum Research; Data upto October 31, 2024

Based on the RBI’s International Reserves and Foreign Currency Liquidity Data Template, USD 28 billion of the total short position was due in November 2024, while the remaining USD 21 billion of forwards are due between December 2024 and January 2025. This could drain out nearly Rs. 1.8 lakh crore from the banking system by the end of next month, significantly more than liquidity infusion by the CRR cut.

The liquidity problem could get further complicated by the seasonal pick-up in cash withdrawals from banks during the January to March quarter due to wedding season and high rural activity. Based on the historical trend, Rs. 1.5 to 2 lakh crores could go out of the banking system from now till the March end due to cash withdrawals. Cash outgoes usually continue in April and May as well draining out the core liquidity further.

Continued depreciation pressure on the INR could delay the rate cutting cycle by the RBI. For now, there is a broad expectation that the RBI will start a rate cutting cycle in its next MPC meeting in February. Persistent INR depreciation and delay in the rate easing cycle would be a set back for the bond market in near term.

However, with liquidity situation getting tighter, there is a possibility of RBI conducting OMO (Open market operation) purchases of government bonds to provide durable liquidity in coming months. This would be supportive for the medium to long duration bonds.

Conclusion

We expect that structural shifts in the demand supply balance and internationalisation of the Indian market will continue support the bond market in 2025. Thus, we maintain our positive outlook on medium to long duration bonds and expect bond yields decline further over the next 12-24 months. (refer Bull Case Revisited)

However, we will remain watchful of the emerging risks and will not hesitate to change our view if conditions warrant that.

What should Investors do?

In our view, dynamic bond funds are the ideal choice for long-term investors who can tolerate occasional market volatility.

These funds offer the flexibility to adjust portfolio positioning in response to changing market conditions.

For investors with shorter investment horizons and a low risk tolerance, liquid funds remain the more suitable option.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of the assets in 10–40-year maturity bucket. However, given the recent build up of risks, we have reduced some of the long duration position and raised cash in the fund as a tactical positioning. |

Source – RBI, Blomberg, Refinitiv, MOSPI, IndianBudget.gov.in, CCIL, Quantum Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at Pankaj@QuantumAMC.com.

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at Neeraj@QuantumAMC.com / Insticare@QuantumAMC.com or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- India Poised for a Sovereign Rating Upgrade

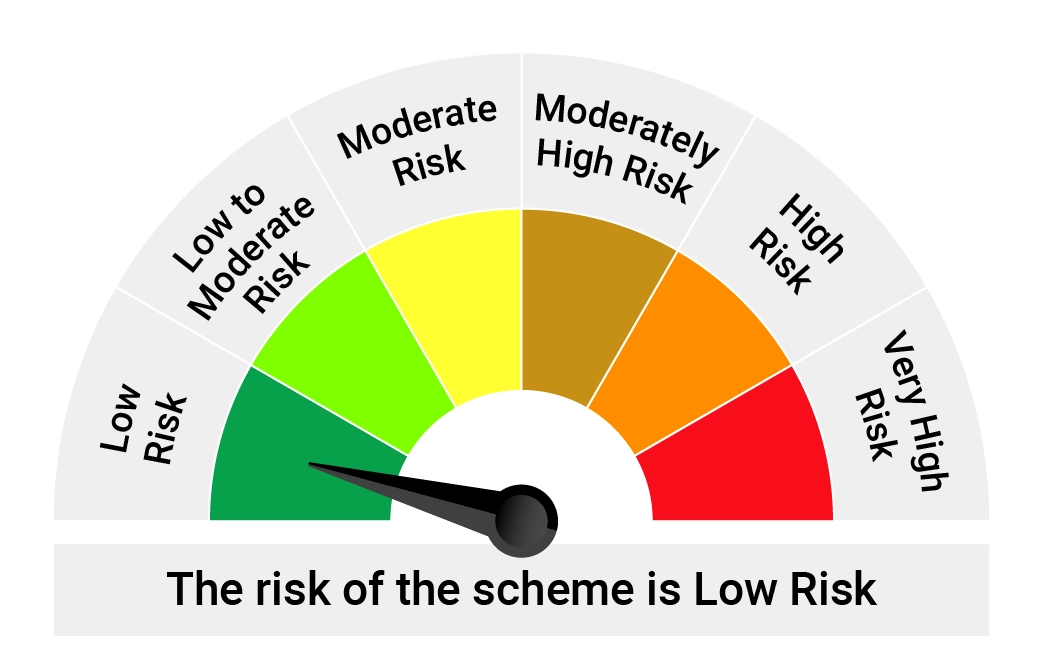

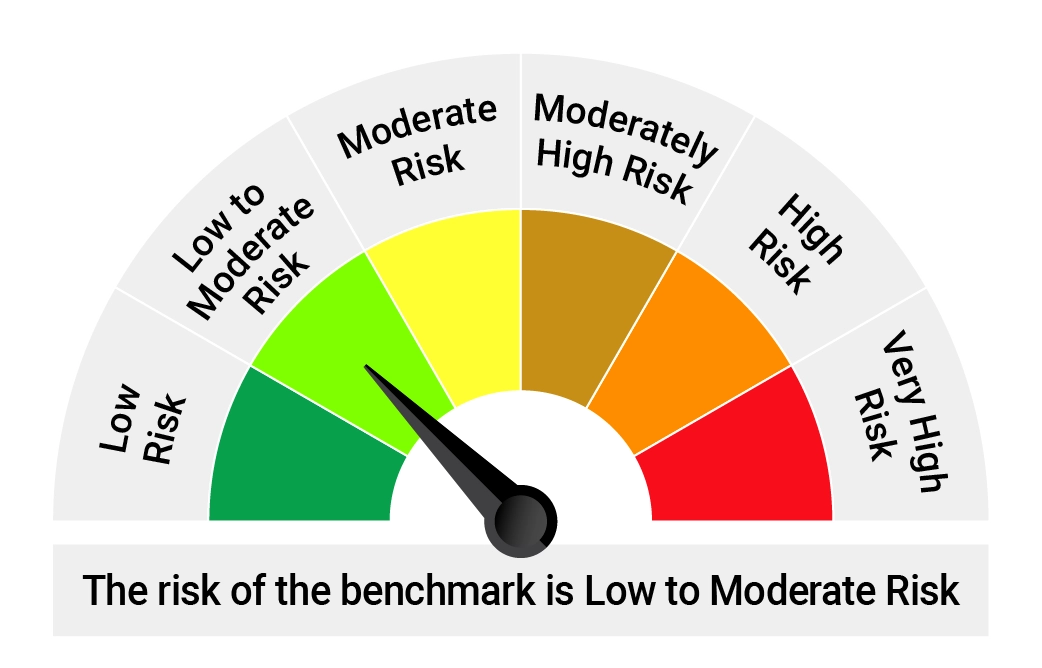

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme | Riskometer of Tier I Benchmark |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Liquid Debt A-I Index |

|  |  |

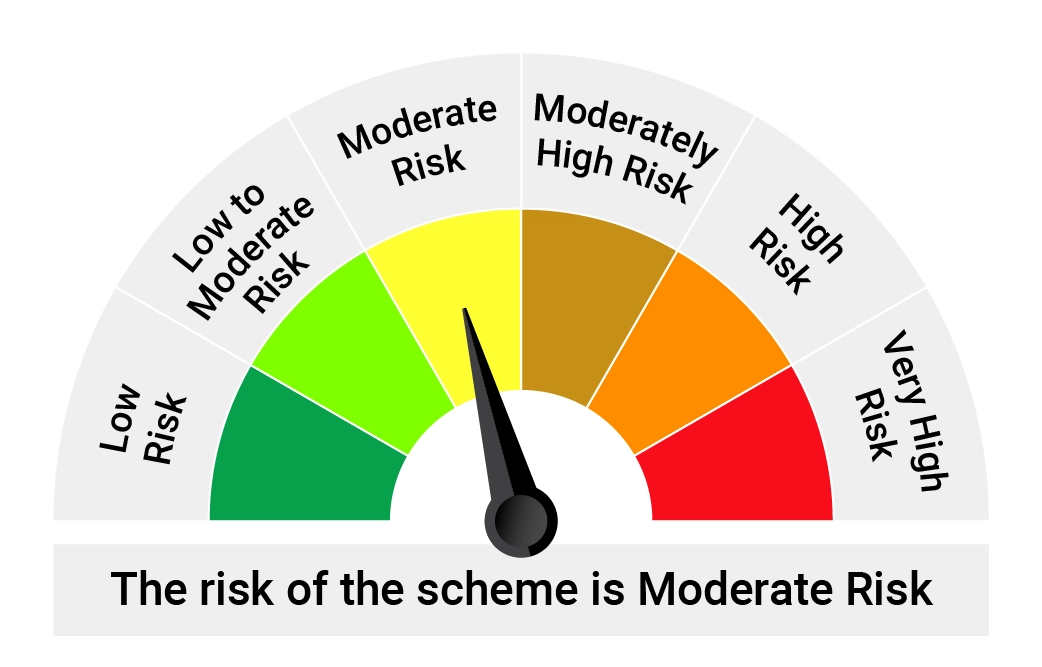

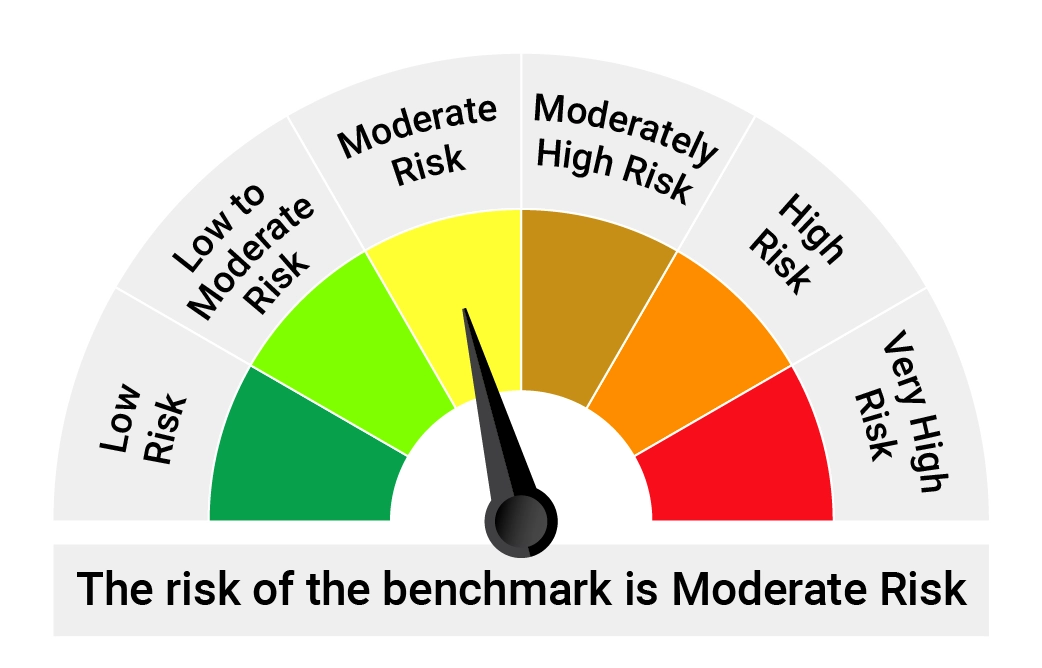

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Dynamic Bond A-III Index |

|  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More