Quantum Budget View: Fiscal Prudence over Populist Spending

Posted On Friday, Feb 02, 2024

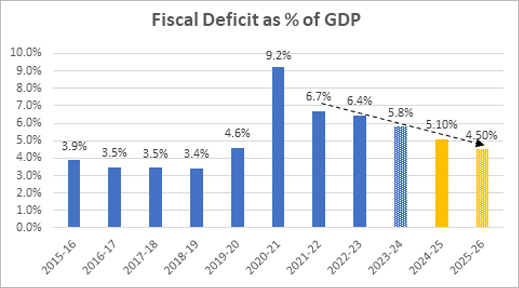

The key highlight of this budget was the government’s commitment to fiscal consolidation. In the budget 2021, the government had set a target to reduce fiscal deficit/GDP to 4.5% by FY 2025-26 from 6.8% in FY 2021-22.

Following this glide path, the government lowered the fiscal deficit/GDP to 5.8% in FY2023-24, below the budget estimate of 5.9%. For the fiscal year 2024-25, the fiscal deficit is pegged at 5.1%, lower than broader expectation of about 5.3%.

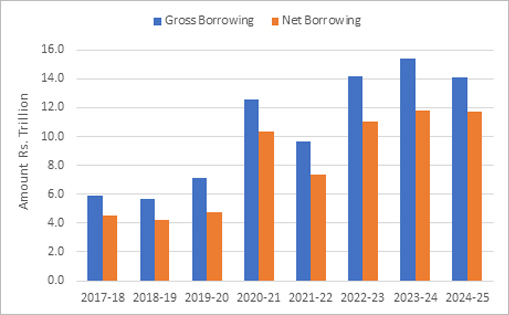

Chart – I: Government Sticking to the Fiscal glide path

Fiscal deficit target for FY 24-25 and FY 25-26 are estimated

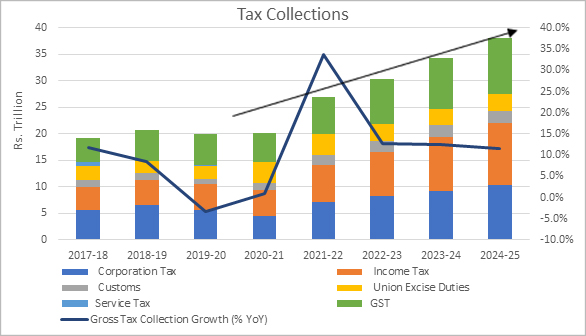

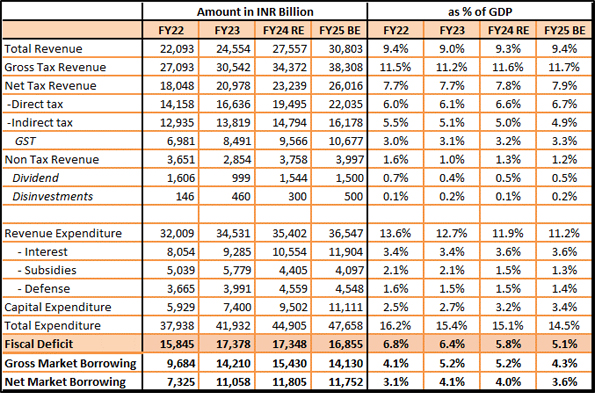

Government revenue assumptions seem reasonable as the gross tax collection budgeted to grow by only 11.5% YoY in FY25 as against growth of over 12.5% in the last two financial years.

Chart – II: Increased formalisation and improving compliance are supporting Tax Collection

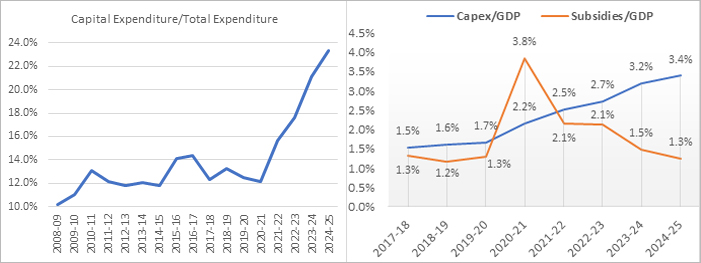

On the expenditure side, the government continues to favor capital spending over revenue expenditure. The proportion of capital expenditure to total increased further to 23.3% in FY25 vs 21.2% in FY24.

Chart – III: Improving expenditure quality with capex boost should enhance growth Multiplier of Government Spending

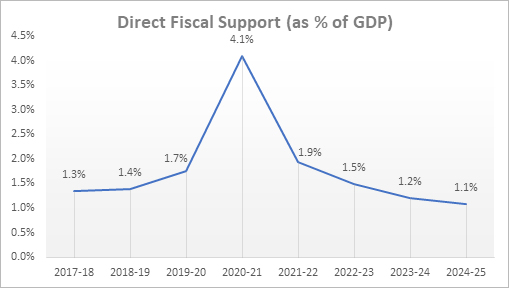

Compression of revenue expenditure was largely contributed by reduction in fiscal support to low-income groups. Expenditure on subsidies has been coming down consistently over the last 4 years along with expenditure on Income and employment guarantee schemes.

Lower direct fiscal support is bad for consumption especially at the low-income segment. This should ease inflation pressures further and provide enough headroom to RBI to ease monetary policy.

Direct Fiscal Support = Food Subsidy+ Employment Guarantee+ Income Guarantee

Increased government capex along with recent pickup in private sector investments should lead to a multiplier effect in the economy and boost growth over the medium term. However, the sluggish demand recovery and the lack of demand stimulus remain headwinds to the near term growth outlook.

With faster fiscal consolidation, government market borrowing is also budgeted to decrease in FY25. The gross market borrowing is budgeted at Rs. 14.13 trillion in FY25 against Rs. 15.4 trillion in FY24. Given the rising demand for bonds from domestic investors like pension, PF, insurance etc. and India’s inclusion in the global bond index, supply of government bonds in FY25 might fall short of total demand. This will put downward pressure on interest rates going forward.

Bond Market View:

Government’s push for fiscal consolidation and below expectation fiscal deficit and borrowing estimates were cheered by the bond market.

We hold a positive outlook on the fixed income market based on following:

- Favourable demand supply mix in government bonds

- Increasing participation by foreign investors with index inclusion

- Declining Inflation trend

- Possibility of rate cuts by the RBI

- Softening global environment with declining global growth and expectation of rate cuts by major central banks

We expect bond yields to decline over the coming months. With higher starting yield and possibility of decline in bond yields over medium term, return potential of fixed-income funds investing in long duration bonds look good.

Investors can capture this opportunity with dynamic bond funds which are invested in long term bonds.

Fiscal Snapshot

Source – Budget Documents, QuantumInternal Research

Portfolio Positioning

Scheme Name | Strategy |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of the assets in 10-14 year maturity bucket. |

Source – RBI, Quantum Mutual Fund

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Good Time to Be Bond Investor

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More