Navigating Recent Global Developments and the Timeliness of Investing in Gold

Posted On Thursday, Aug 08, 2024

The global financial markets are in a state of flux, influenced by several factors ranging from geopolitical events to economic policies. Recently, these markets have experienced significant fluctuations, prompting investors to reassess their portfolios and consider alternative investments. Amidst this backdrop, gold has emerged as a particularly attractive option. We glance at the recent developments in the stock markets and outline why now might be an opportune time to invest in gold.

Recent Global Developments in Stock Markets

- Geopolitical Tensions: Ongoing geopolitical tensions between Russia, Ukraine, Israel and the West Bank, particularly between major economies, have led to heightened uncertainty in global stock markets. Issues such as trade disputes, political unrest, and international sanctions contribute to market fluctuations.

- Economic Uncertainty: The Fed's adjustments, often characterised by fluctuations in interest rates and quantitative easing measures, have generally led to increased market fluctuations and uncertainty as they try to maintain a delicate balance between growth and inflation. These conditions may reduce investor confidence in equities and fixed-income securities due to uncertainty created by the timing of changes to their policies, prompting for alternative investment avenue that are generally negatively correlated to traditional assets like gold. We have seen the ups and downs surrounding rate cuts expectations in the US before which led to volatility in gold prices and this time is no different. However, we are closing in on the beginning of rate cuts in the US, primarily driven by growth concerns and high interest costs impacting government balances. This would continue to support gold price

- Inflationary Pressures: The potential for inflationary pressures resulting from expansive monetary policies may enhance gold's appeal. Gold's intrinsic value, coupled with its historical resilience during economic slowdown makes it a viable alternative in the current scenario. Thus, amidst the current economic landscape shaped by potential Fed's policy shifts, gold stands out as a prudent choice for preserving wealth and ensuring portfolio diversification.

- Expensive Valuation Across Markets: Equity has been the best performing asset class in the recent past. As valuations have expanded in most markets in the recent market rally, the likely return in the medium term could be muted with a probable increase in volatility if the growth slows down materially going forward and we have seen the recent job numbers in the US provide a glimpse of what lies ahead. These factors could result in market swings and unpredictable returns for equity.

Should You Invest in Gold Now?

The price of gold has seen a decrease of custom duties from 15% to 6% as per announcement in the recent Budget 2024. This is a good time add gold to your investments as gold prices have reduced to give effect to lower customs duty as it forms part of the Indian gold price. Gold can be a useful asset for your portfolio due to the following reasons:

- NASDAQ’s Ripple Effect: Considering recent developments on the NASDAQ, these market dynamics have caused ripple effects globally, including in the Indian stock markets, where investor sentiment has been similarly affected by fluctuations and risk aversion. As equities may face increasing unpredictability, gold's role as a safe-haven asset becomes prominent. Investing in gold at this juncture provides a strategic means of preserving wealth, diversifying portfolios, and mitigating risks associated with ongoing market and economic uncertainties.

- Liquidity: An advantage of gold is its liquidity. Gold is universally recognised and can be easily traded across global markets, providing investors with quick access to cash when needed. This high liquidity ensures that gold can be readily converted to meet financial obligations. Incorporating gold into your investment portfolio can provide both security and liquidity, safeguarding your wealth while maintaining the ability to respond to changing financial needs.

- Customs Duty Cuts: Given the recent Union Budget announcement, there’s been a cut in customs duty from 15% to 6% on precious metals, leading to gold becoming cheaper to that extent given other prices have remained broadly steady. Over the years, gold has shown appreciation, giving investors the opportunity to realise profits.

- Favourable Tax Changes: Budget 2024 has also recommended reduction of long-term capital gains tax for gold from 20% with indexation to 12.5% without indexation. Thus investment in gold funds have another tipping point in their favour along with the price efficiency they offer.

Intrinsic value

Gold has long been considered a monetary asset. During times of economic and geopolitical uncertainty, investors often considered gold as a store of value. Its intrinsic value and historical stability make it an ideal asset during such times.

The key takeaway is that,

The recent global developments in the stock markets underscore the importance of diversifying investment portfolios and considering alternative assets. Gold, with its historical diversification and liquidity traits, stands out as a better investment option in the current economic landscape.

As investors navigate the uncertainties of today's markets, allocating a portion of their portfolios to gold can provide stability and resilience. Quantum 12|20:80 asset allocation strategy allocates suggests 20% of the investment in gold.

Wrapping up,

Incorporating gold into your investment strategy is not just a reaction to market volatility but a proactive step towards building a robust and diversified portfolio. If you’re considering If you’re considering Quantum Gold Savings Fund, now is an opportune time to explore the benefits of investing in this timeless asset.

|

|

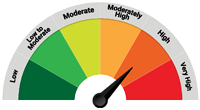

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Gold Savings Fund (An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund) | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Navigating Recent Global Developments and the Timeliness of Investing in Gold

Posted On Thursday, Aug 08, 2024

The global financial markets are in a state of flux, influenced by several factors ranging from geopolitical events to economic policies.

Read More