A Readymade Plug N Play - 3-in-1 Option

Posted On Friday, Sep 09, 2022

Markets are cyclical and different asset classes perform differently.

While it’s not easy for anyone to predict the next best-performing asset class, what most thoughtful investors do is stay invested for the long term with a balanced portfolio. Remember, a balanced portfolio helps you tackle fluctuating market cycles better and smoothens your investment journey.

At Quantum, we recommend the simple 12-20-80 (Baaraa, Bees, aur Assi) Asset Allocation Strategy to build a diversified portfolio. The strategy has three crucial building blocks comprising Equity, Debt and Gold. With our handy Asset Allocation Calculator, you can balance/rebalance your portfolio in just a few clicks to own a diversified basket of investments using actively or passively managed funds.

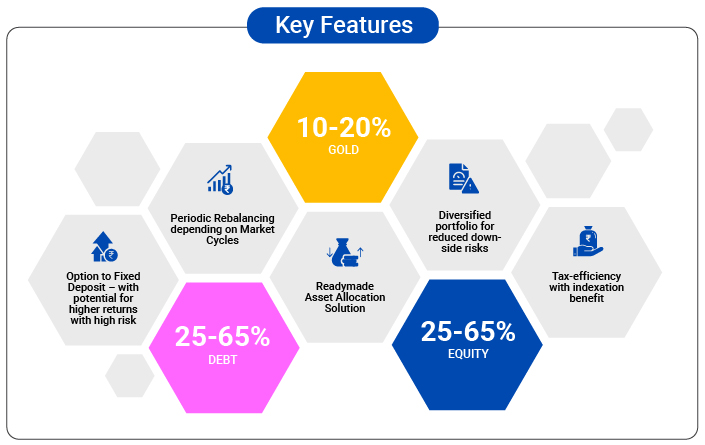

However, if you are unable to find the time to constantly balance your portfolio to suit the dynamic market movements, here is a convenient plug-and-play option to safeguard your future.

A Readymade Plug N Play - 3-in-1 Option

If you do not have the time to track/ balance your portfolio in many funds, you can consider investing in the Quantum Multi Asset Fund of Funds (QMAF). Launched in July 2012, this fund helps lower downside risk during market uncertainties through a balanced allocation. The Quantum Multi Asset Fund of Funds (QMAFOF) has a 10-year track record of navigating the market cycles. As the name suggests, this fund offers a dynamic portfolio that invests in not one, but THREE asset classes. QMAFOF is a Fund of Funds like a hybrid fund, offering investors exposure to three asset classes of equity, debt and gold in a single investment.

With QMAFOF, we allocate investments within three asset classes in the right proportion so that you can sail through any kind of changing market dynamics. The imperfect correlation between these asset classes will cut the impact of losses driven by falling markets.

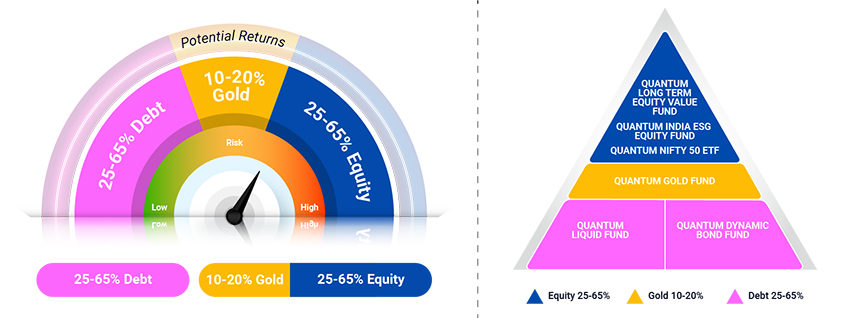

Fig 2: Indicative Allocation of QMAFOF

Fig 4: Key features of QMAFOF

Advantages of investing with QMAFOF

1. Balancing risk with reward: The scheme has a 10-year track record of balancing risk-reward across market cycles.

2. Potential to earn long term risk-adjusted returns:

This fund is especially for those who are looking for an option to FDs. This fund can give you a flavour of equity investing while limiting downside risks compared to a pure equity fund. The fund has historically given better returns than FDs over the long-term (3 years and above). As you can see below, the 3-year rolling return has been better than an FD, 86% of the times since inception*.

Figure 3: 3 year Rolling Returns: FD vs QMAFOF

Data as of Aug 31, 2022. The table above indicates the total number of days, the number of days it has underperformed compared

to an FD & percentage of outperformance. Note: The graph above has to be read in conjunction with the complete performance of the scheme provided

in the table below. *Note/ Disclaimer given below. Past Performance may or may not be sustained in the future.

4. Cope better with inflation: In current times, though FD interest rates are inching higher, they still fall behind the rate of inflation. With a diversified readymade portfolio using QMAFOF, you are better geared to earn a return that has the potential to beat inflation.

4. Flexibility to sit back and relax: You do not have to be worried about how the markets might move tomorrow. The Fund Managers constantly balances & tracks scheme investments and to save you any type of hassle.

5. Agile across market cycles: With QMAFoF, your portfolio stays agile across market cycles. The Fund Manager strategically positions the scheme portfolio depending on the prevailing market cycle. He has the flexibility to allocate anywhere between 25%-65% of the portfolio to equity or debt and the balance 10% - 20% to gold.

For example, during the Covid-19 market crash in Mar 2020, fund manager took the opportunity to increase equity allocation from 25% to 50% in a single month. They reallocate from one asset class to another while making sure not to take on undue risk in the process.

6. Unbiased allocation: The portfolio offers an unbiased allocation across equity, debt and gold.

Key Takeaways

- Now maybe a good time to relook at your investments, stay thoughtful and balance your portfolio. To safeguard your future, it is important to find that balance between risk and reward by either using the DIY 12:20:80 Asset Allocation Approach or if you prefer a readymade portfolio, switch to the plug and play convenient option with the Quantum Multu Asset Fund of Funds.

|

|

Period | Scheme Returns (%) | Tier 1 - Benchmark # Returns (%) | Tier 2 - Benchmark ## Returns (%) | Value of investment of Rs. 10,000@ | ||

Quantum Multi Asset Fund of Funds - Direct Plan - Growth Option |

|

|

| Scheme (Rs.) | Tier 1 - Benchmark # Returns (Rs.) | Tier 2 - Benchmark ## Returns (Rs.) |

Since Inception | 9.24% | 10.38% | 14.35% | 24,514 | 27,224 | 38,979 |

August 31, 2012 to August 30, 2022 | 9.28% | 10.38% | 14.57% | 24,292 | 26,843 | 38,982 |

August 31, 2015 to August 30, 2022 | 8.85% | 10.50% | 13.79% | 18,114 | 20,117 | 24,713 |

August 31, 2017 to August 30, 2022 | 8.05% | 10.87% | 14.75% | 14,727 | 16,751 | 19,899 |

August 30, 2019 to August 30, 2022 | 9.33% | 11.62% | 18.16% | 13,070 | 13,911 | 16,504 |

August 31, 2021 to August 30, 2022 | 5.14% | 5.25% | 4.82% | 10,513 | 10,524 | 10,480 |

#CRISIL Composite Bond Fund Index (20%) + S&P BSE Total Return Index (40%) + CRISIL Liquid Index (25%) + Domestic Price of Gold (15%). It is a customized index and it is rebalanced daily. ##S&P BSE Sensex TRI

Data as of Aug 31, 2022. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The Fund is managed by Mr. Chirag Mehta. Mr. Chirag Mehta is managing the scheme since July 11, 2012. For other schemes managed by Mr. Chirag Mehta, please Click here.

Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Mutual Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 31, 2022.

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More