Multi Asset Funds To The Rescue...

Posted On Saturday, Oct 24, 2020

We know times are bad!

What economies across the globe are witnessing, is something that no one ever saw coming.

The future is unpredictable.

Imagine, if you had invested all your money in just one asset class.

Say, Equities (hypothetically).

The stock market crash would have left you with nothing but money in a bank account!

That is why, having all your eggs in one basket is never a good idea.

If only more investors were informed enough to diversify in such a way that there was no need to time the markets or be deterred by any volatility.

Simply put, it is always advisable to have a balanced portfolio.

The difficult part here is, how does one know if their investments are balanced enough to give them risk adjusted returns?

The Quantum Multi Asset Fund of Funds (QMAFOF) aims to achieve just that.

It diversifies across asset classes - which mitigates risk of a particular asset class and provides risk adjusted returns.

One of its core aims is to reduce the volatility of returns, by reducing dependency on a single asset class for the same.

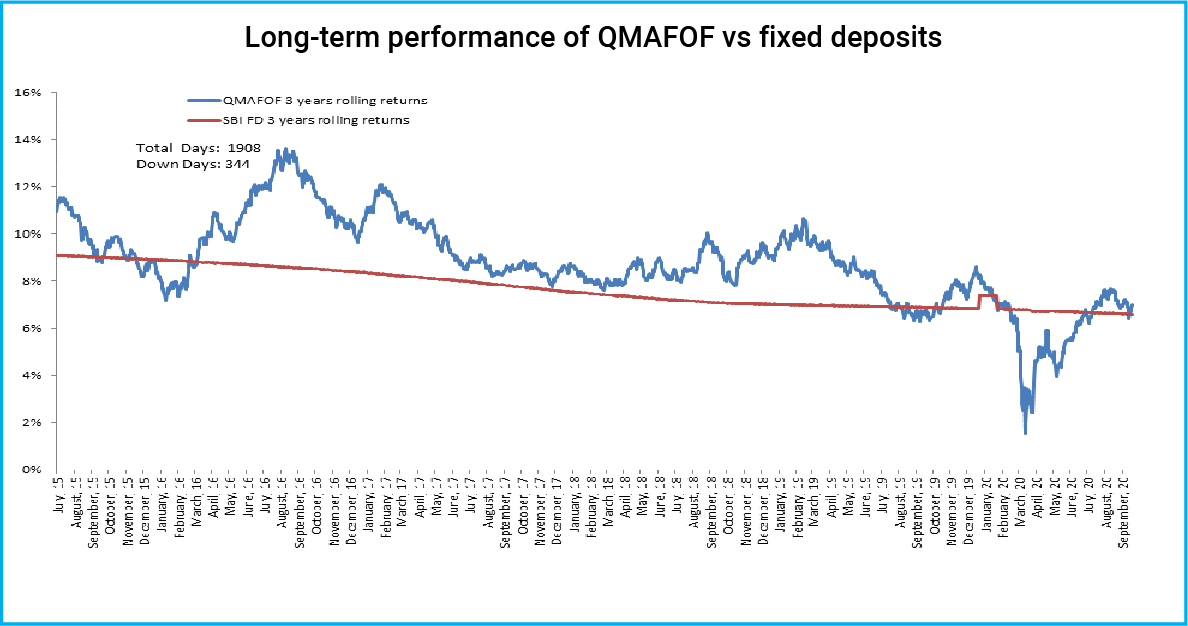

The Quantum Multi Asset Fund of Funds has been achieving all of this for years now. Here is a glimpse of the fund pitted against a Fixed Deposit since its inception. This has to be read in conjunction with performance of the scheme provided in the table below*.

Source – Bloomberg, Quantum AMC

*Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Quantum Multi Asset Fund of Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor.

Performance of Quantum Multi Asset Fund of Funds, Direct Plan – Growth Option

The scheme is co-managed by Mr. Chirag Mehta and Mr. Nilesh Shetty since July 11, 2012**.

| Period | Current Value of 10,000 Invested at the beginning of a given period | |||

| Scheme Returns (%) 0 | Benchmark Returns (%)# | Scheme (Rs) | Benchmark (Rs)# | |

| 1 year | 8.84% | 11.69% | 10,887 | 11,172 |

| 3 years | 6.98% | 11.01% | 12,247 | 13,688 |

| 5 years | 8.44% | 10.54% | 15,001 | 16,513 |

| 7 years | 9.46% | 10.62% | 18,841 | 20,279 |

| Since Inception (11th July 2012) | 9.07% | 10.09% | 20,428 | 22,051 |

**Note: Past performance may or may not be sustained in the future. Data as of 30th September 2020. Load is not taken into consideration in scheme returns calculation. Different Plans shall have different expense structure. Returns are calculated on the basis of Compounded Annualized Growth Rate (CAGR). # Indicates CRISIL Composite Bond Fund Index (40%) + S&P BSE SENSEX Total Return Index (40%) + Domestic price of Gold (20%). With effect from January 1st 2020, the name of the fund has been changed from Quantum Multi Asset Fund to Quantum Multi Asset Fund of Funds.

For performance of other Schemes Managed by Mr. Chirag Mehta please click here and for performance of other Schemes Managed by Mr. Nilesh Shetty please click here.

You see, the Quantum Multi Asset Fund of Funds follows a regular rebalancing approach within each asset class, which allows investors to generate good risk adjusted returns through diversification of investments.

This makes it a better and a more tax efficient option for investors who park their money in long term FDs (3 years and above). That’s because unlike fixed deposit returns which are taxed as per the income tax slab of the investor, Quantum Multi Asset Fund of Fund’s long term capital gains are taxed at 20% with the benefits of indexation. If the investment is withdrawn within 3 years short term capital gains are taxed as per the investors income tax slab.

To make things clearer, please have a look at the asset allocation strategy the fund follows:

| Asset Class | Range of Exposure | Fund |

| Equity | 25-65% | Quantum Long Term Equity Value Fund, Quantum Nifty ETF |

| Debt | 25-65% | Quantum Liquid Fund, Quantum Dynamic Bond Fund |

| Gold | 10-20% | Quantum Gold Fund |

Ideal asset allocation is not static. Asset allocation needs to change depending on an asset class’s relative performance vis-à-vis other asset class.

The Quantum Multi Asset Fund of Funds follows such a dynamic portfolio allocation technique, which makes it unique.

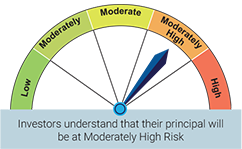

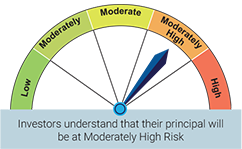

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  |

| Quantum Nifty ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More