Mix it Up! Style your Portfolio for a steady Financial Journey!

Posted On Wednesday, Dec 18, 2024

Fashion trends change with changing seasons. Bright colors and light weight fabrics are popular in Summer, floral prints are preferred in Spring, and warm fabrics and earthy tones are picked in Winter. Ditto for asset classes which go in and out of fashion based on the ever-changing economy.

But just like a typical wardrobe is a mix of clothes suited for each season, in the case of investing, asset allocation or a portfolio made up of different asset classes like equities, debt and gold is fundamental as one navigates the changing seasons of the economy.

Until recently Indian equities were the “can’t do no wrong” asset class. Equities had gained preference over other asset classes thanks to the multi-year bull run investors witnessed post the pandemic, resulting in lopsided portfolios. But leading equity indices are facing some turbulence since the start of October, and investors are starting to get uneasy.

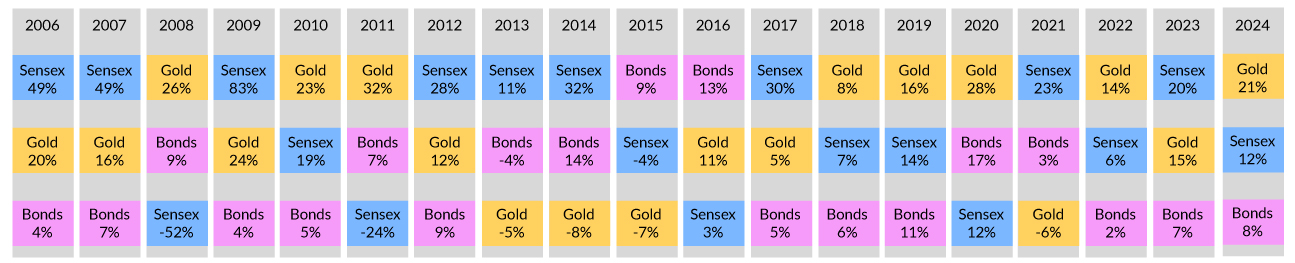

Asset allocation is often underappreciated in times of equity market outperformance. The attraction of potentially higher returns leads investors to discount the history of asset classes moving up and down in cycles, and the logic of the upturn in one asset class compensating for the downturn in the other.

Data as of 30th November 2024. The chart ranks the best to worst performing indexes per calendar yearfrom top to bottom

Past performance may or may not be sustained in future. Indices Used: BSE Sensex Total Return Index; MCX old Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

As equity markets move from strength to strength, complacency sets in and investors tend to assume that markets will continue to do well. They double down on their investments out of the fear of missing out on future gains. As more and more investors choose equities, investors tend to follow the crowds, whether or not a higher equity allocation aligns with their investment objectives and risk appetite.

While equities are an essential building block for long term wealth creation, they are prone to ups and downs coinciding with the good and bad times of the economy. Debt and gold have different drivers of performance and thus generally have a low correlation to equities, making them ideal portfolio diversifiers. A portfolio constructed using these three asset classes has potential to smoothen out market swings and generate better risk adjusted returns over the long term.

Some of the valuation excesses in Indian equity markets have been corrected off late, but further downside cannot be ruled out. Foreign investors have been on a selling spree as richly valued Indian businesses witnessed a second consecutive quarter of moderating earnings growth at the same time as prospects for more reasonably valued Chinese businesses improved on the back of government stimulus. A resurgence of price pressures and the Reserve Bank of India’s reluctance to cut rates are expected to further weigh on business margins, their cost of capital and business sentiment. With the Federal Reserve and other developed market central banks having embarked on an accommodative path to boost growth, investors are moving money back to foreign shores. Geopolitical tensions in the Middle East are also impacting risk averse flows to Indian equity markets.

At the same time as equity markets are turning volatile, the outlook for debt and gold is looking stable. Both debt and gold are set to benefit from the upcoming turn in interest rates. Exposure to debt can also be rewarding as Indian bonds get listed on foreign exchanges, attracting new flows even as government spending and thus issuances of bonds reduce in a bid to trim the fiscal deficit. Conditions for gold look conducive as macroeconomic and geopolitical uncertainty drives global flows to the precious metal.

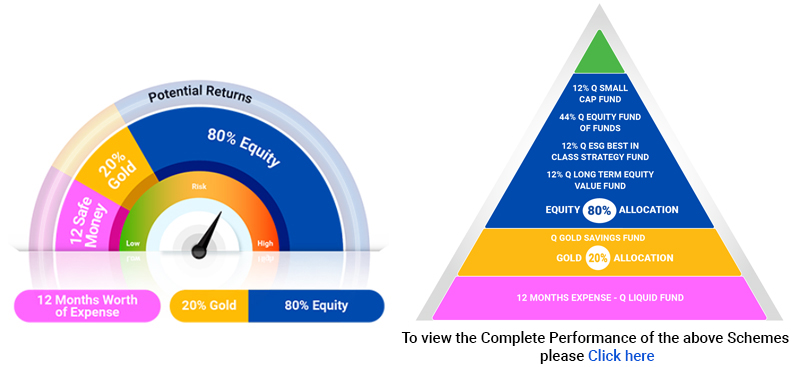

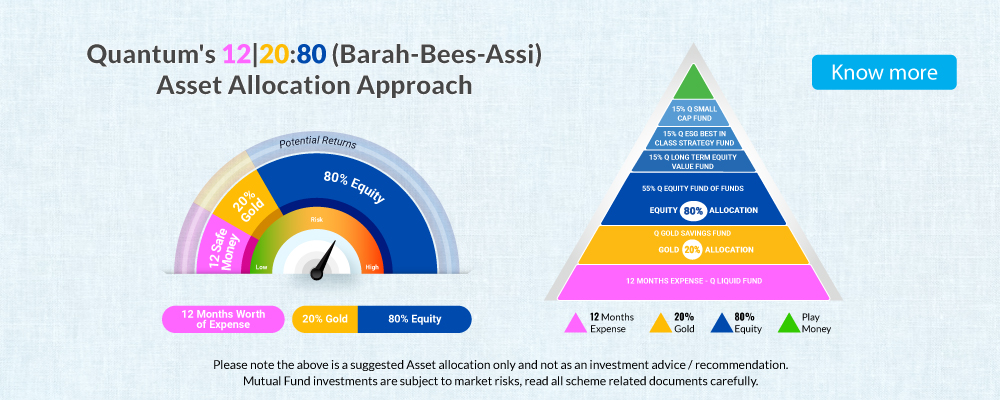

With Quantum’s 12|20:80 asset allocation approach, investors can style their portfolio for all seasons.

*Please note the above is a suggested Asset allocation and not to be considered as an investment advice / recommendation.

The investor can start by keeping aside 12 months of expenses in the debt-oriented Quantum Liquid Fund. This part of the portfolio can be counted on for fixed income returns and emergencies or unplanned expenses. Next, out of the balance investible amount the investor can divide the portfolio between equities and gold in an approximately 80: 20 proportion which can be structured based on investors investment objectives, investment horizon and risk-taking ability. Investors can consider diversifying the wealth creating equity component across the Quantum Equity Fund of Funds, the Quantum Long Term Equity Value Fund, the Quantum ESG Best In Class Strategy Fund and the Quantum Small Cap Fund to take exposure to various styles and scheme categories. The diversifying gold allocation can be taken through the Quantum Gold Savings Fund.

Just as a well-rounded wardrobe prepares us for any season, a balanced asset allocation ensures that we stay resilient through varying market conditions and economic shifts. By diversifying your portfolio with a strategic mix of equities, debt and gold you can navigate through market turbulence and position yourself for long-term growth. We reckon Quantum DIY Approach to Asset Allocation will stay in vogue through changing seasons, fashions, economic cycles and market moods.

Build a robust portfolio by exploring the 12|20:80 (Barah-Bees-Assi) Asset Allocation Calculator, here.

|

If you prefer a DIY (Do-It-Yourself) approach:

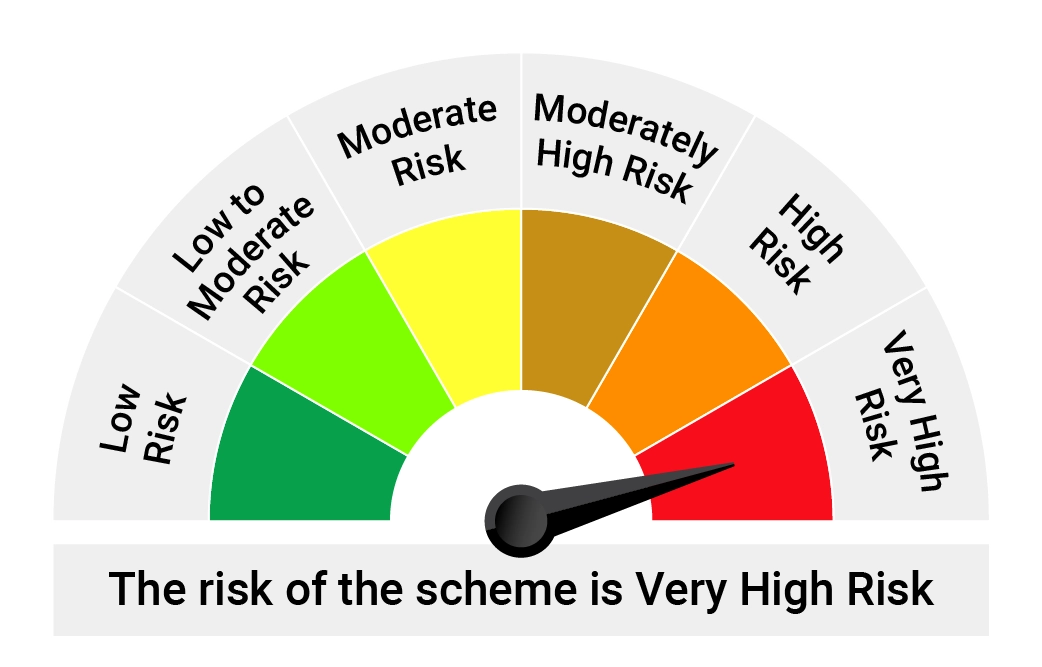

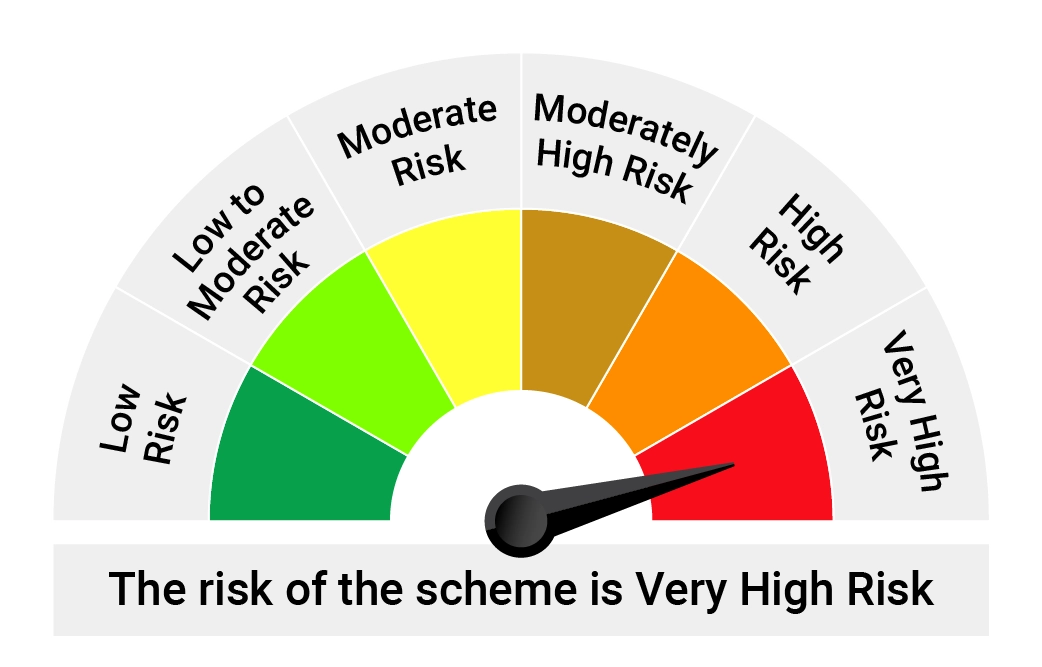

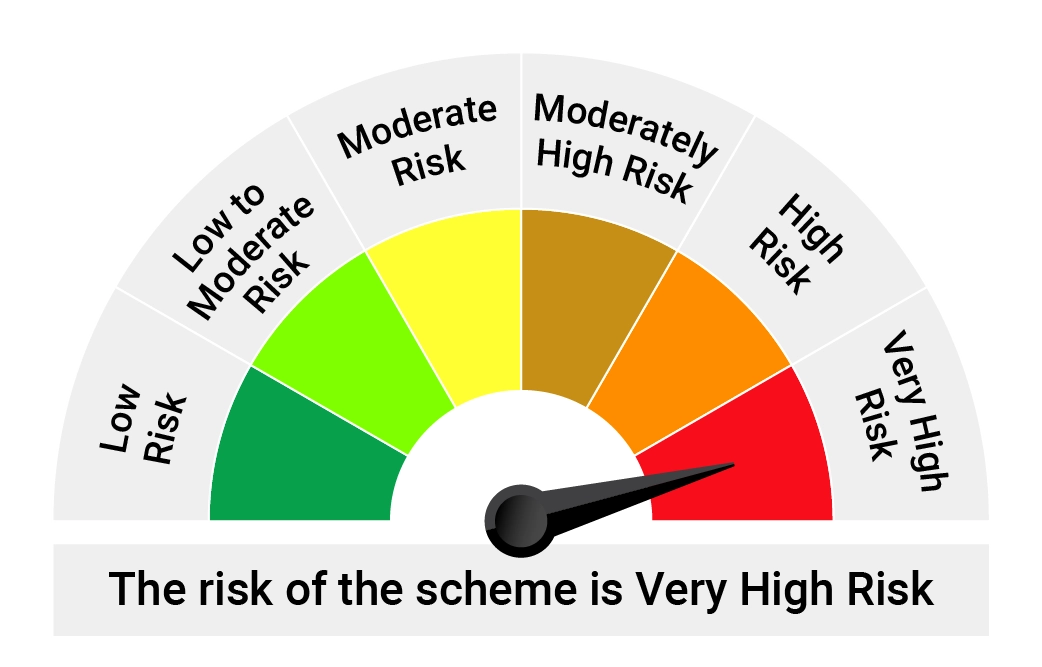

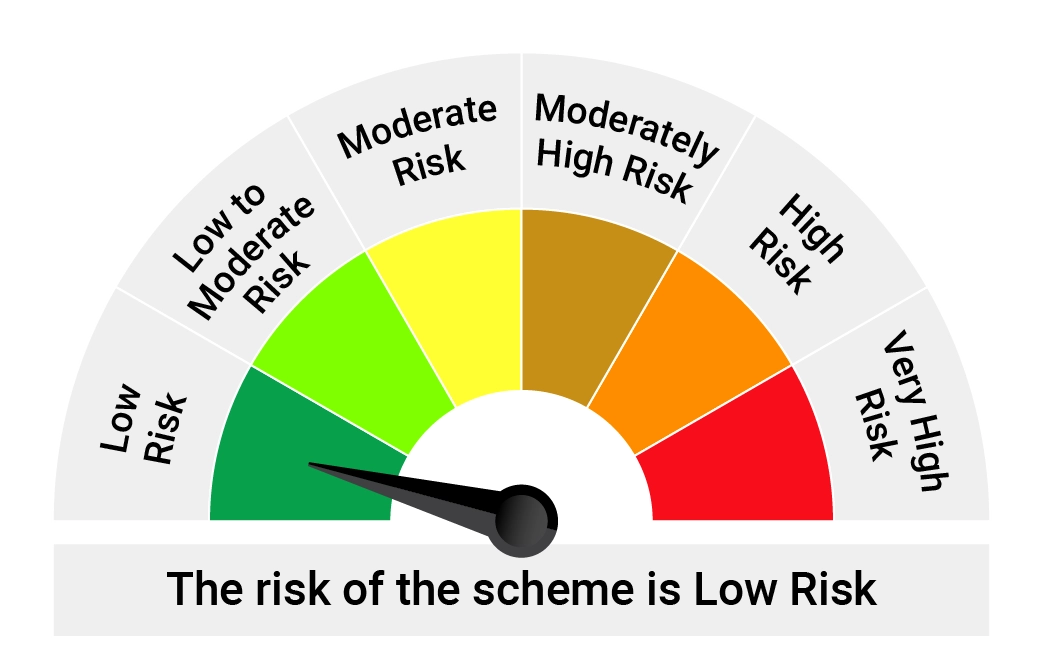

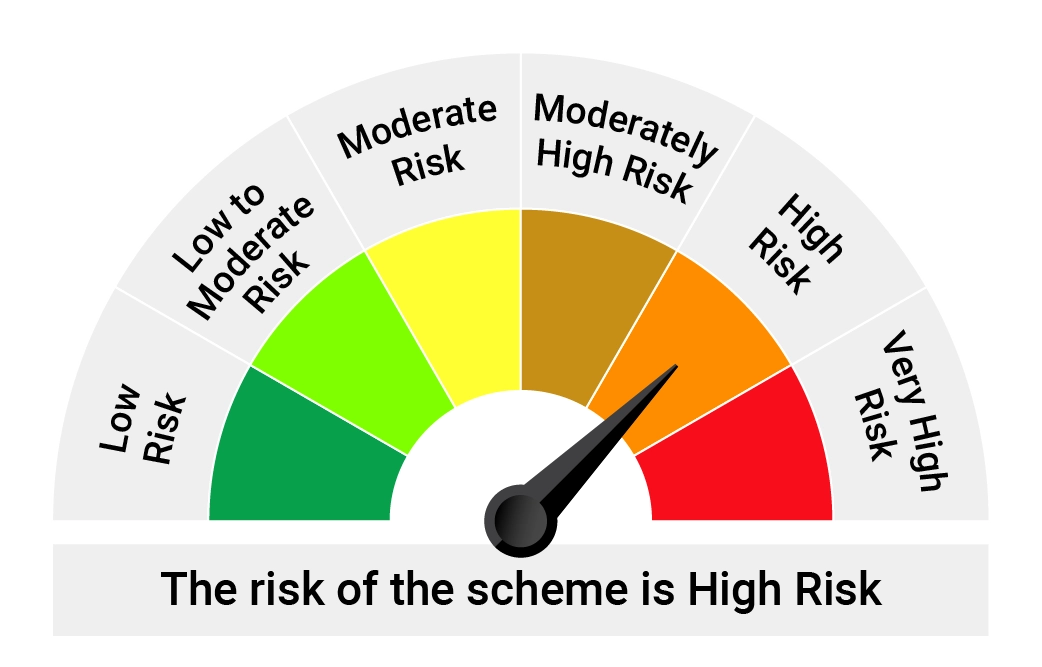

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

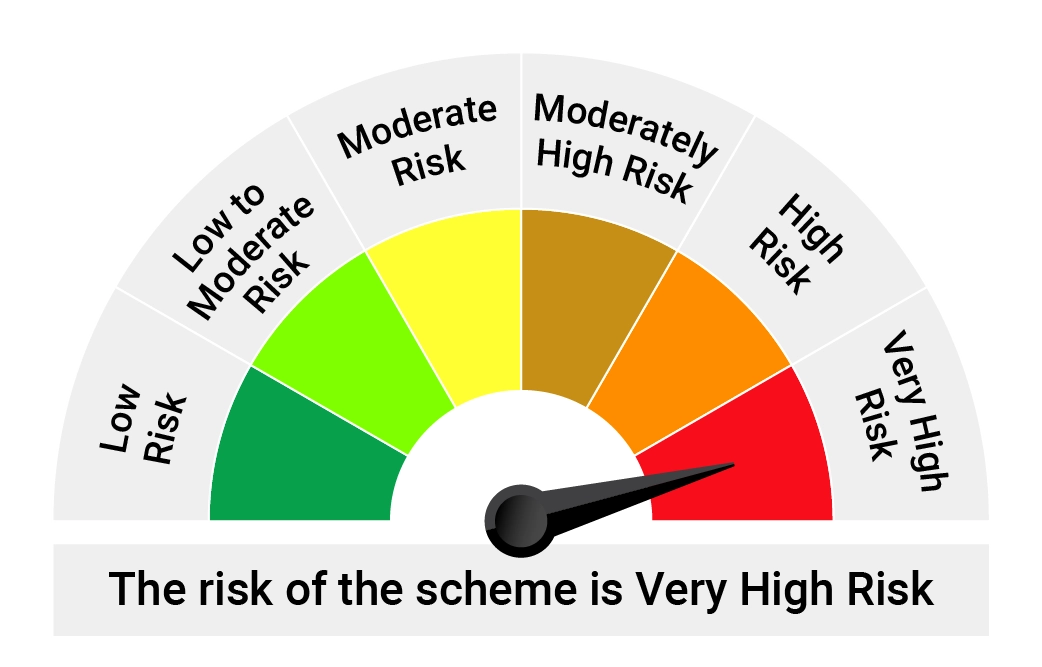

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  |

Quantum ESG Best In Class Strategy Fund An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy | • Long term capital appreciation • Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy |  |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk | • Income over the short term • Investments in debt / money market instruments |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More