From Festivities to Financial Growth: Why Gold Mutual Funds are Modern Investors' Golden Ticket

Posted On Friday, Sep 20, 2024

Diwali, Dhanteras or Akshaya Tritiya - gold buying on these occasions has long held a special place in Indian culture as it symbolises welcoming prosperity, wealth, and good fortune.

But beyond its cultural significance, gold has proven to be a valuable investment during times of market instability and geopolitical tensions.

With an expected uptick in the recent festive demand and due to economic uncertainties, gold has become an important asset that holds cultural significance as well as acts as a financial safeguard.

Gold as an Investment Avenue: Beyond Physical Gold

Traditionally, Indians have purchased physical gold in the form of jewellery, coins, or bars, especially during festivals. However, the possession of physical gold comes with a set of challenges. It involves storage risks, lack of liquidity, and additional costs like making charges or theft protection.

In this digital age, gold can be purchased in smarter ways. Gold ETF and Gold Savings Fund (fund of fund scheme which invest in Gold ETF) are such investment vehicles, allowing you to invest in gold without the hassle of storing or securing it.

Should You Own Gold in Your Portfolio

As investors, there are various investment options available to us, like stocks, bonds, and real estate. But, why does gold still hold its allure? The U.S Fed has reduced its rate, creating a potential upside for gold prices. Any downsides in gold due to volatility in future rate expectations would be an opportunity for investors to build their gold allocation.

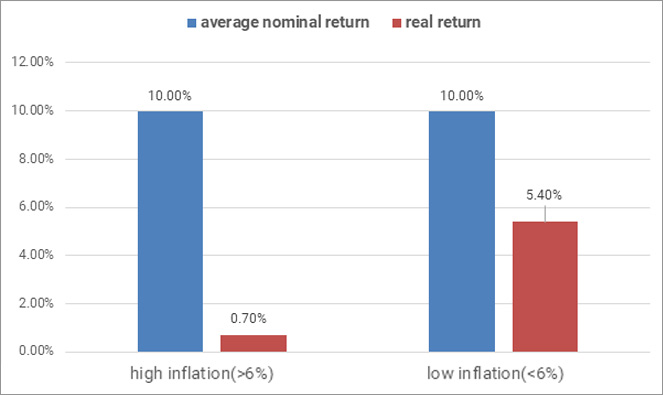

Gold has the potential to beat inflation over the long-run

In India, gold has historically beaten inflation, demonstrating development and resilience during periods of high inflation. It can be a valuable asset for long-term investment due to its capacity to preserve and potentially expand capital.

Gold has not just preserved capital, it has helped it grow in the long run!

Store of Value - Potential to beat inflation over the long term

Inflation is based on annual CPI y-o-y changes from June 1980 to Aug 2024

Gold Performance is based on MCX Spot 995 price from June 1980 to Aug 2024

Note: Past performance may or may not be sustained in the future

Real returns are nominal returns adjusted for inflation at 6% (Long term average inflation)

Gold generally has a low correlation to major asset classes

Gold's minimal correlation with equities and bonds aids in the diversification of portfolios. Historically, it has acted as a stabilising force during market downturns, generally providing positive returns when other asset classes falter.

| Year' | Gold INR | Sensex |

| 1981 | -23% | 54% |

| 1982 | 21% | 4% |

| 1983 | -9% | 7% |

| 1984 | -5% | 7% |

| 1985 | 3% | 94% |

| 1986 | 29% | -1% |

| 1987 | 22% | -16% |

| 1988 | -1% | 51% |

| 1989 | 10% | 17% |

| 1990 | 2% | 35% |

| 1991 | 31% | 82% |

| 1992 | 6% | 37% |

| 1993 | 27% | 28% |

| 1994 | -2% | 17% |

| 1995 | 13% | -21% |

| 1996 | -3% | -1% |

| 1997 | -14% | 10% |

| 1998 | 8% | -21% |

| 1999 | 2% | 64% |

| 2000 | 1% | -25% |

| 2001 | 6% | -18% |

| 2002 | 24% | 6% |

| 2003 | 14% | 86% |

| 2004 | 1% | 21% |

| 2005 | 22% | 40% |

| 2006 | 21% | 51% |

| 2007 | 17% | 67% |

| 2008 | 31% | -61% |

| 2009 | 19% | 92% |

| 2010 | 24% | 24% |

| 2011 | 31% | -36% |

| 2012 | 11% | 24% |

| 2013 | -19% | -2% |

| 2014 | 0% | 29% |

| 2015 | -6% | -8% |

| 2016 | 12% | 1% |

| 2017 | 2% | 38% |

| 2018 | 12% | 6% |

| 2019 | 24% | 14% |

| 2020 | 29% | 16% |

| 2021 | -5% | 22% |

| 2022 | 11% | 4% |

| 2023 | 12% | 19% |

| 2024 | 24% | 15% |

Total Return for Sensex since 1997 onwards as on 18 September, 2024.

Source: Bloomberg. Note: Past Performance may or may not be sustained in the future.

As seen in the table, the returns on gold and the Sensex generally do not move in the same direction. In years when the Sensex had negative returns, gold sometimes performed well and vice versa.

During a market crash, people often move to safe-haven assets like gold, which can be observed in 2008, when the stock market fell, and gold offered good returns.

Thus, adding gold to the portfolio could reduce the impact of losses during the market uncertainty.

Gold diversification helps generate Risk-adjusted Returns

Gold has been a safe parking spot for investments. As the below table shows, adding gold to your portfolio reduces the maximum drawdown during market uncertainty. This is in comparison to an Equity-only or debt-only portfolio. The maximum fall in a gold enabled portfolio has helped minimize downside risk.

| Risk-Return | *Equity (40) + Debt (40) + Gold (20) | **Equity + Debt | Equity | Debt | Gold |

| (2004-2024) | |||||

| Avg. Annualized Returns | 11.17% | 11.15% | 13.08% | 6.97% | 11.90% |

| Annualized SD | 8.88% | 12.75% | 20.83% | 3.13% | 16.60% |

| VAR | -14.66% | -21.03% | -34.37% | -5.16% | -27.39% |

| Maximum Drawdown | (0.21) | (0.36) | (0.56) | (0.06) | (0.25) |

| Sharpe Ratio | 0.484 | 0.337 | 0.299 | 0.033 | 0.304 |

Time frame is November 2004 to August 2024.The period is taken from 2004 since the asset allocation weights are calculated based on normalizing the historical monthly equity and debt indicators. Given the normalization time frame used in the strategy, data availability for certain parameters beyond the time frame analysed was a constraint. Compiled by Quantum AMC.

*Equity-Debt-Gold in ratio of 40-40-20. **Equity-Debt dynamically allocated in 80-20 range. Based on Sensex TRI, Crisil Composite Bond Fund Index, and Domestic Gold Prices.

Note: Past Performance may or may not be sustained in the future

Unlock the power of three in just a few clicks with our handy 12|20:80 (Barah-Bees-Assi) Asset Allocation Calculator and build a truly balanced portfolio.

However, to truly maximise its potential, it is important to explore modern investment avenues beyond just owning physical gold.

Quantum Gold Savings Fund and Quantum Gold ETF

Benefits of Investing in Gold Through Quantum Mutual Fund:

For those looking for added convenience and value, Gold Mutual Funds offers even more flexibility through a fund of funds (FoF) structure - Quantum Gold Savings Fund (QGSF).

QGSF invests in units of the Quantum Gold Fund (QGF), an Exchange Traded Fund (ETF) that directly invests in physical gold, with 0.995 finesse. The Quantum Gold Fund ETF is passively managed and the gold held is stored in secured vaults and is insured.

Unlike ETFs, which require a demat account for trading, QGSF allows investors to invest in Gold ETFs albeit indirectly without a demat account. Additionally, investors can invest by setting up SIPs (Systematic Investment Plans), enabling them to build their gold holdings gradually and systematically.

By combining the cost-efficiency and liquidity of ETFs with the added benefits of a fund of fund QGSF provides a value-added solution for investors seeking exposure to gold in a more flexible and accessible manner.

In Conclusion

This festive season expand your gold investment horizon with digital options. Choosing digital gold for your own self or loved ones can be responsible way of investing in gold with accountability for quality and ease of use. Reach out to Quantum Mutual Fund to know how to invest in gold through Mutual Funds.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-1 Benchmark |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold Tier I Benchmark : Domestic Price of physical gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier I Benchmark : Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 31, 2024

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on Aug 31, 2024

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

From Festivities to Financial Growth: Why Gold Mutual Funds are Modern Investors' Golden Ticket

Posted On Friday, Sep 20, 2024

Diwali, Dhanteras or Akshaya Tritiya - gold buying on these occasions has long held a special place in Indian culture as it symbolises welcoming prosperity, wealth, and good fortune.

Read More