Debt Monthly View for September 2024

Posted On Friday, Oct 04, 2024

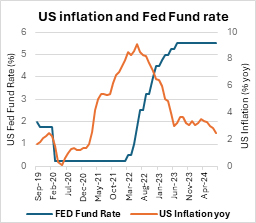

In September, the standout event was the US Federal Open Market Committee (FOMC) initiating an easing cycle with a significant 50 basis points (bps) rate cut. This led to a 12 bps drop in the US 10-year bond yield, ending at 3.787%. The European Central Bank (ECB) also cut its policy rate by 25 bps, highlighting a global trend of monetary policy easing.

Following the September rate cut, the Fed signaled two more cuts by year-end, totaling 50 bps. The Fed’s “dot plot” (a projections of the future interest rates by the members of the FOMC) also indicates further reductions in 2025 and 2026, with a total decrease of about 200 bps beyond the September cut.

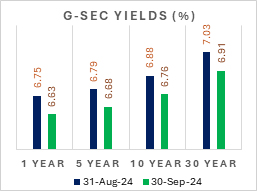

Indian bond yields continued to fall, influenced by falling global yields and crude oil prices. The 10-year benchmark yield dropped by approximately 13 bps.

Brent crude prices fell to a three-year low of $69.48 per barrel in September, driven by increased OPEC+ supply starting in December and reduced demand from China. The price ended the month $7 lower at $71.77 per barrel.

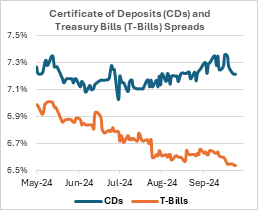

Divergence in the Money Markets: Three-month treasury bill (T-bill) rates dropped to ~ 6.40%-6.45% while, three-month Certificate of Deposit (CD) rates for AAA-rated banks traded between 7.1%-7.3%. This divergence in the Money Market has emerged mainly from the supply side wherein the government has cut down on its T-bill borrowings while banks ramped up its fund raising via CDs.

Liquidity tightened during the month: Banking system liquidity tightened this month, with the average daily surplus falling below Rs 1 trillion from Rs 1.5 trillion last month, primarily due to increased quarter-end tax flows.

Core liquidity (which excludes government balances) was ~Rs 4 trillion. We expect the excess liquidity to gradually decline in the second half of FY25 as cash withdrawals increase during the festive season.

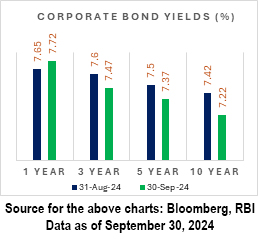

Corporate bond yield curve is inverted: The corporate bond yield curve is currently inverted, with 1-year rates higher than any other part of the curve. Overall, yields have declined across the curve, with a more pronounced drop at the longer end.

Positive long-term inflation outlook amid near term volatility: Headline inflation inched 3.65% in August 2024 from 3.50% in July, primarily due to a favorable base effect. As this effect diminishes, inflation is expected to exceed 4% into FY25. A spike in vegetable prices in September is likely to push the CPI higher. However, the overall inflation trend appears stable, with core inflation projected to be around 3.7% by the end of FY25. A favorable monsoon and healthy sowing trends should help reduce food inflation. Additionally, if the benefits of lower oil prices are passed on to consumers through reduced domestic fuel prices, it would further decrease inflation.

RBI Policy Expectations: As the US Fed begins its rate easing cycle, the RBI is anticipated to follow a similar path. Most major central banks have cut rates in 2024 (except Japan). The case for easing monetary policy in India is strengthening on the back of falling core inflation and anticipated post-monsoon food price declines. While the RBI may find some reassurance in the global rate easing trend, we believe the RBI will focus on sustaining the inflation moderation towards 4% target. Thus, a policy change in October is unlikely, though a shift to a neutral tone is possible. Consequently, we expect the RBI to begin rate cuts in February 2025.

Outlook

We maintain our positive outlook on long-term bonds considering

- Continued strengthening in demand from insurances companies, pension and provident funds

- India’s inclusion in the global bond indices to continue to add to the demand

- Potential Increase in demand from banks owing to RBI’s proposed LCR norms (Liquidity Coverage Ratio)

- Government’s fiscal consolidation

- Declining domestic inflation and anticipated rate cuts by the RBI

- Global Synchronized Rate Cutting Cycle

- Strong External Balances

Intensifying geopolitical tensions however could be a risk. This could lead to a surge in crude oil prices and prolonged disruptions in global supply chains.

Given the above factors, we expect the bond yields to go down (prices to go up). In this declining interest rate environment, investors with medium to long investment horizon, should consider dynamic bond funds. These funds can allocate to long-duration bonds while keeping flexibility to adjust portfolio position if market conditions change. This adaptability allows investors to remain invested for a longer period.

Investors with a short-term investment horizon and with little desire to take risks, can invest in liquid funds which invest in government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Source: RBI, MOSPI, Bloomberg

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly View for November 2024

Posted On Wednesday, Dec 04, 2024

In November the debt market was largely influenced by the US elections, which introduced considerable macroeconomic uncertainties.

Read More -

Debt Monthly View for October 2024

Posted On Wednesday, Nov 06, 2024

Indian bond yields moved up in October following sharp rise in the US treasury yields and spike in domestic CPI Inflation.

Read More -

Debt Monthly View for September 2024

Posted On Friday, Oct 04, 2024

In September, the standout event was the US Federal Open Market Committee (FOMC) initiating an easing cycle with a significant 50 basis points (bps) rate cut.

Read More